please analyze data

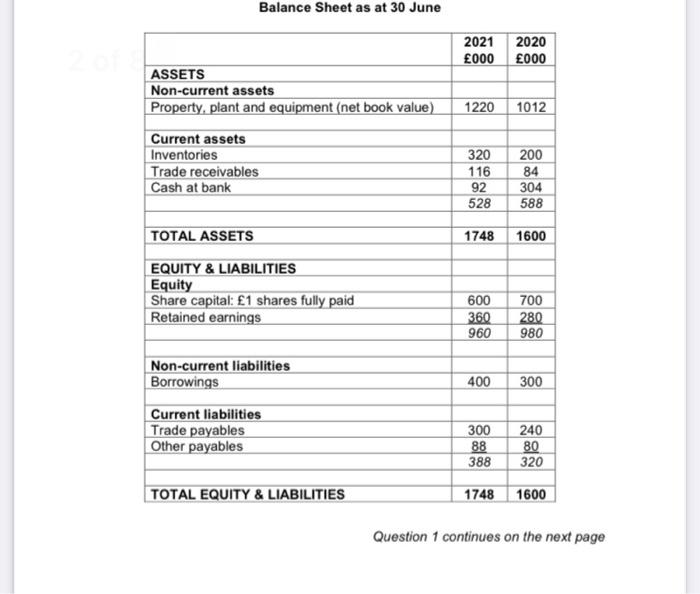

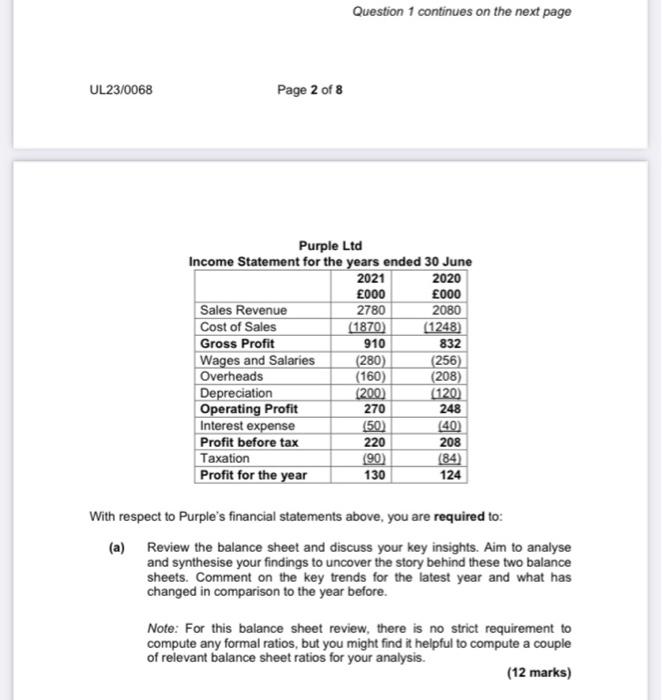

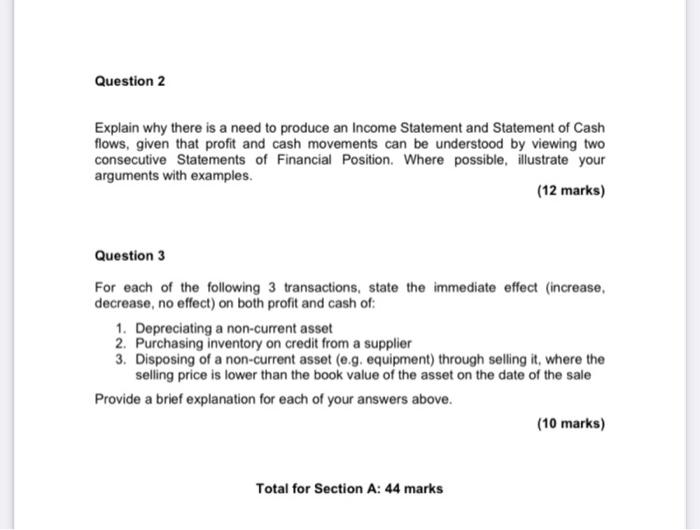

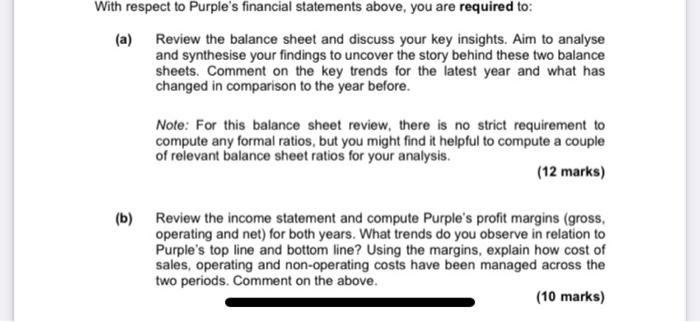

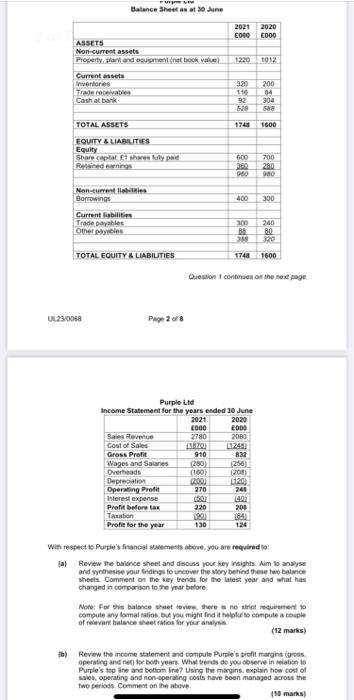

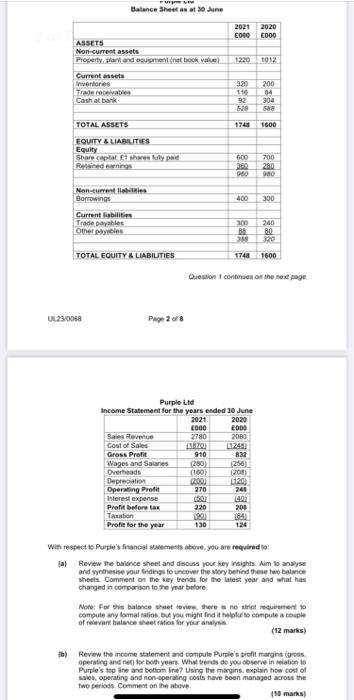

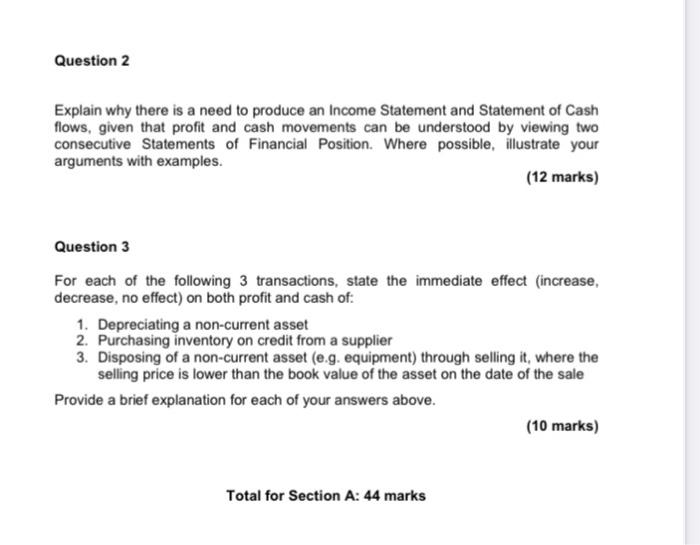

Balance Sheet as at 30 June Question 1 continues on the next page Purple Ltd With respect to Purple's financial statements above, you are required to: (a) Review the balance sheet and discuss your key insights. Aim to analyse and synthesise your findings to uncover the story behind these two balance sheets. Comment on the key trends for the latest year and what has changed in comparison to the year before. Note: For this balance sheet review, there is no strict requirement to compute any formal ratios, but you might find it helpful to compute a couple of relevant balance sheet ratios for your analysis. (12 marks) Explain why there is a need to produce an Income Statement and Statement of Cash flows, given that profit and cash movements can be understood by viewing two consecutive Statements of Financial Position. Where possible, illustrate your arguments with examples. (12 marks) Question 3 For each of the following 3 transactions, state the immediate effect (increase, decrease, no effect) on both profit and cash of: 1. Depreciating a non-current asset 2. Purchasing inventory on credit from a supplier 3. Disposing of a non-current asset (e.g. equipment) through selling it, where the selling price is lower than the book value of the asset on the date of the sale Provide a brief explanation for each of your answers above. With respect to Purple's financial statements above, you are required to: (a) Review the balance sheet and discuss your key insights. Aim to analyse and synthesise your findings to uncover the story behind these two balance sheets. Comment on the key trends for the latest year and what has changed in comparison to the year before. Note: For this balance sheet review, there is no strict requirement to compute any formal ratios, but you might find it helpful to compute a couple of relevant balance sheet ratios for your analysis. (12 marks) (b) Review the income statement and compute Purple's profit margins (gross, operating and net) for both years. What trends do you observe in relation to Purple's top line and bottom line? Using the margins, explain how cost of sales, operating and non-operating costs have been managed across the two periods. Comment on the above. (10 marks) Dalance Sheot as ot 39 dune Question 1 continses on the sext page Wen respect is Purie's financial stskenests abeve, you are required to: (a) Review the balonce sheel and decuss your key insights. Aim io anslyse and yynowesise cour tnding to yncover the mory behind these two balmoe sheets. Comment on the key trendy for the latest year and what has changed in cemparisen to the ynar before Note: For this balance sheet tovies. there in no thict wequitemert is compule any lomal ratiok. bet you might fnd it hebfuc to compute a couple of felevart baience sheet ration for your andyss. (12 marks) (b) Review the income statement and compule Purple's troft margns (jross. operating and nef) lot both year. Why tersts de you doberve in telatish to Purple's tap ane and bothem Ine? Using the margins. explain how cost of sales, operating and non-eperating costs have been mansyed across the two periods Comment on the abeve Explain why there is a need to produce an Income Statement and Statement of Cash flows, given that profit and cash movements can be understood by viewing two consecutive Statements of Financial Position. Where possible, illustrate your arguments with examples. (12 marks) Question 3 For each of the following 3 transactions, state the immediate effect (increase, decrease, no effect) on both profit and cash of: 1. Depreciating a non-current asset 2. Purchasing inventory on credit from a supplier 3. Disposing of a non-current asset (e.g. equipment) through selling it, where the selling price is lower than the book value of the asset on the date of the sale Provide a brief explanation for each of your answers above. (10 marks) Total for Section A: 44 marks