Question

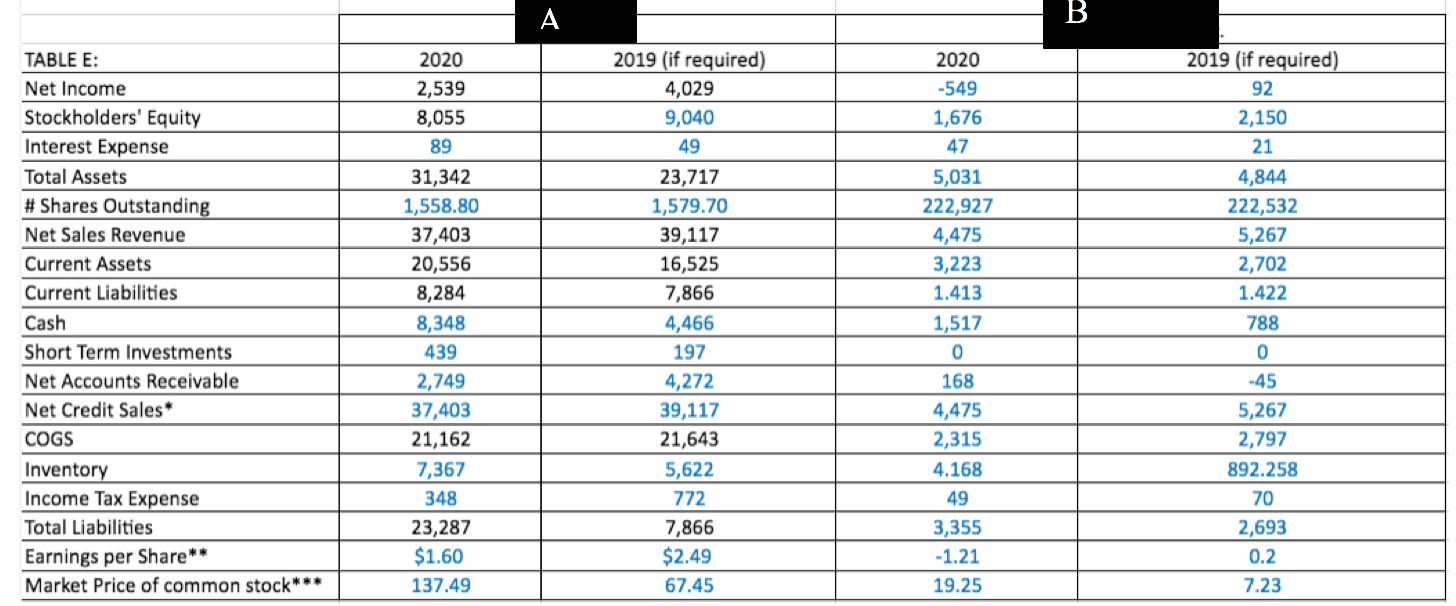

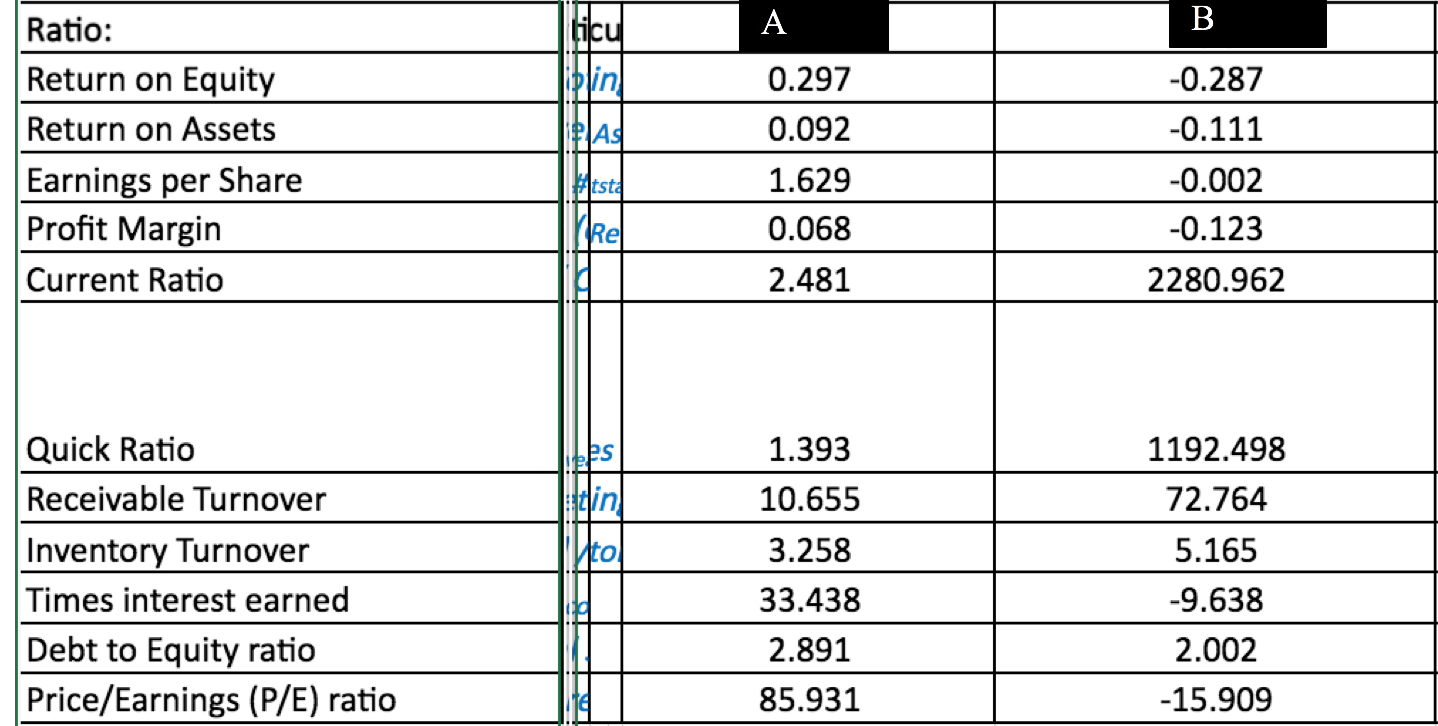

Please analyze the company in terms of its profitability, solvency, and liquidity, provide your investment and credit recommendations. Use the results of your ratio and

Please analyze the company in terms of its profitability, solvency, and liquidity, provide your investment and credit recommendations. Use the results of your ratio and other analyses on Excel sheet to support your answers: state what each ratio tells us in general (but no need to define the ratio), summarize how your company is performing in these categories, and then analyze your companys performance compared company A to its competitor company B.

Select at least two ratios from each category:

(i)Profitability (e.g. net profit margin)

(ii)Turnover (e.g. inventory turnover)

(iii)Liquidity (e.g. current ratio)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started