Answered step by step

Verified Expert Solution

Question

1 Approved Answer

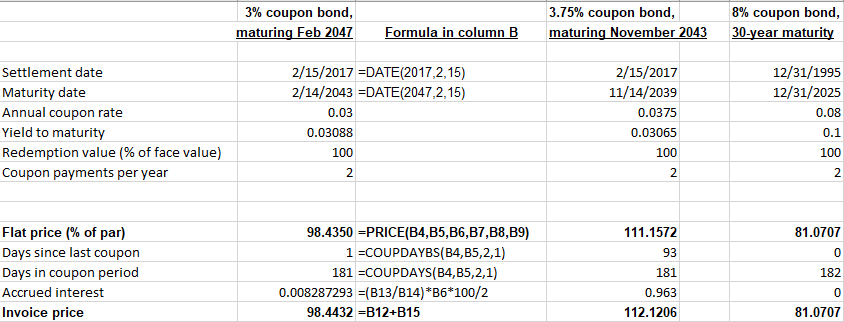

Please analyze the data in the Spreadsheet 10.1 provided below and change the relevant selected input variables of bond characteristics (including annual coupon rate) but

Please analyze the data in the Spreadsheet 10.1 provided below and change the relevant selected input variables of bond characteristics (including annual coupon rate) but realistically, and following the market conventions for quoting bonds) for each bond separately to get the Invoice price of 77, 97 and 146 respectively for the first, the second and the third bond in the table (as close as possible due to implied limitations).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started