Please and please l need help with this questions as soon as possible this second time to send the same questions thanks!

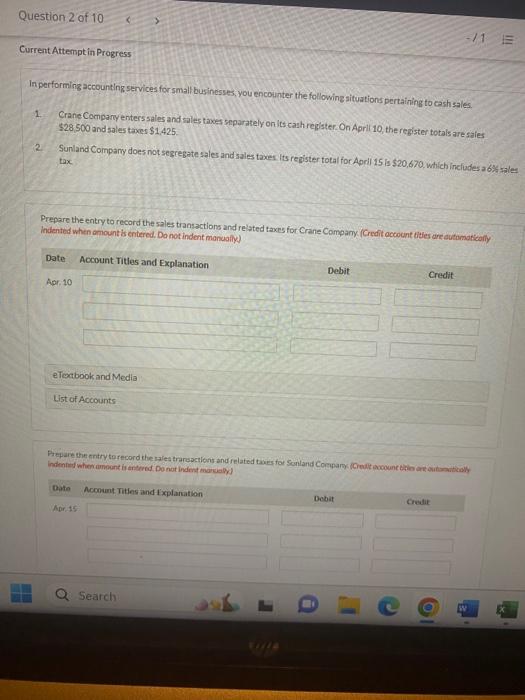

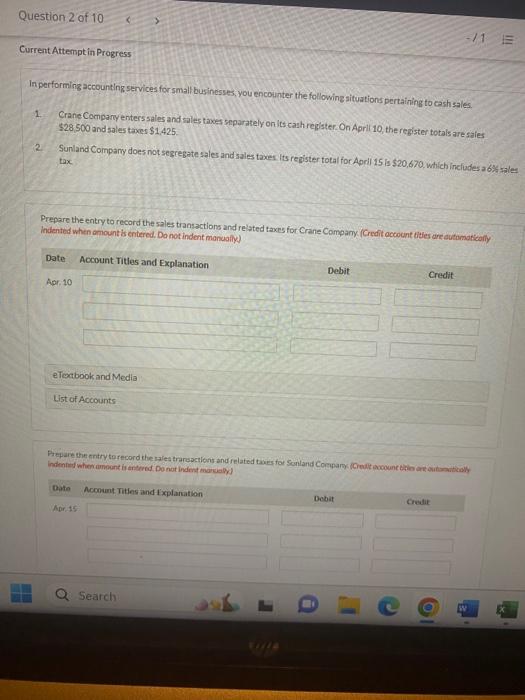

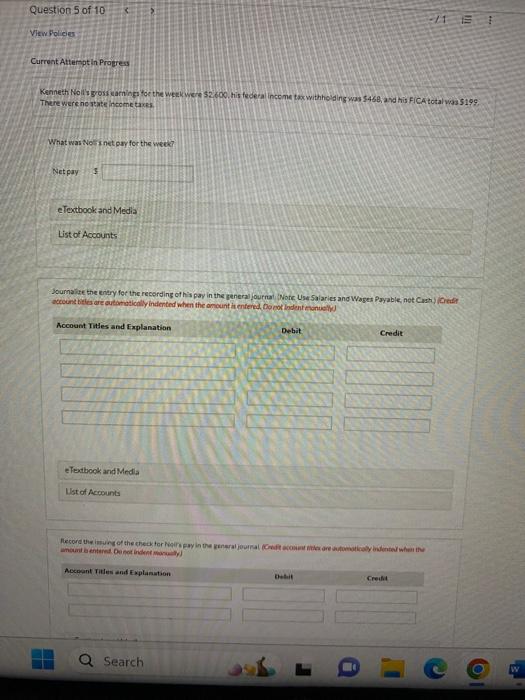

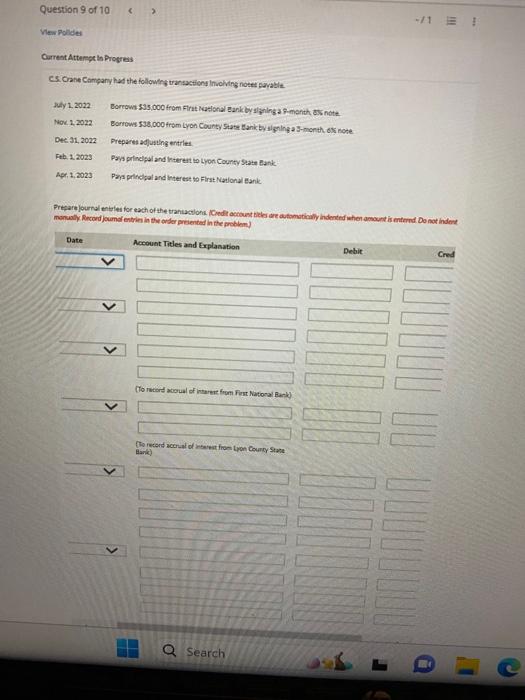

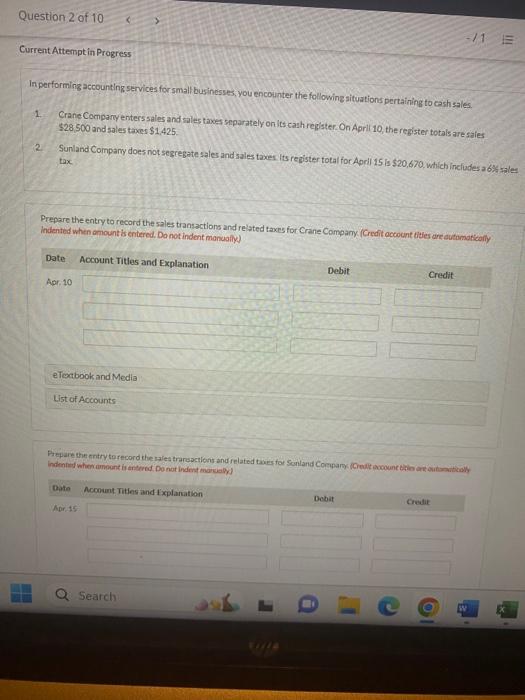

In performing accounting services for small businesses, you encounter the following situations pertaining to cash sales. 1. Crane Company enters sales and males taxes separately on its cash register. On April 10 , the register totals are sales $28,500 and 50 ies taxes $1,425 2. Sunland Coinpany does not segregate saler and sales tabes its register total for April 15 is 520,670 . Which incluades a 68 saled tax Prepare the entry to record the sales transactions and related taxes for Crane Company (Credit occocint tates aredutumoticolly indented when omount is entered. Do not indent manuaily) eferbook and Media List of Accounts indenter wher amount berstered Do not indent mavealys? Keneth Noll' gross earnings foe the weekyere 52600 . his federal inceme twx withholding was 5468 a avd his FiCA total was 5199. There wierene state income taxes. What was we is int pay for the weck? Net pay Soumalite the every foe the recording of his pay in the generaj journat, Wiote Use saiaries and Wages Payable, net Cuah) (Chetif acecons bitis are suthtatically indented when the onount it entered, bo oot indent enonuelly ancuni b enternd. Gaifot indent mosuily) Frecare lournal entrfiei for each of the trantastloni. ICindit account bicles de aytomstimily indented when amount is enternd Do not indent monvilly Record joumd entrien in the ovider prientad in the problent. In performing accounting services for small businesses, you encounter the following situations pertaining to cash sales. 1. Crane Company enters sales and males taxes separately on its cash register. On April 10 , the register totals are sales $28,500 and 50 ies taxes $1,425 2. Sunland Coinpany does not segregate saler and sales tabes its register total for April 15 is 520,670 . Which incluades a 68 saled tax Prepare the entry to record the sales transactions and related taxes for Crane Company (Credit occocint tates aredutumoticolly indented when omount is entered. Do not indent manuaily) eferbook and Media List of Accounts indenter wher amount berstered Do not indent mavealys? Keneth Noll' gross earnings foe the weekyere 52600 . his federal inceme twx withholding was 5468 a avd his FiCA total was 5199. There wierene state income taxes. What was we is int pay for the weck? Net pay Soumalite the every foe the recording of his pay in the generaj journat, Wiote Use saiaries and Wages Payable, net Cuah) (Chetif acecons bitis are suthtatically indented when the onount it entered, bo oot indent enonuelly ancuni b enternd. Gaifot indent mosuily) Frecare lournal entrfiei for each of the trantastloni. ICindit account bicles de aytomstimily indented when amount is enternd Do not indent monvilly Record joumd entrien in the ovider prientad in the problent