Answered step by step

Verified Expert Solution

Question

1 Approved Answer

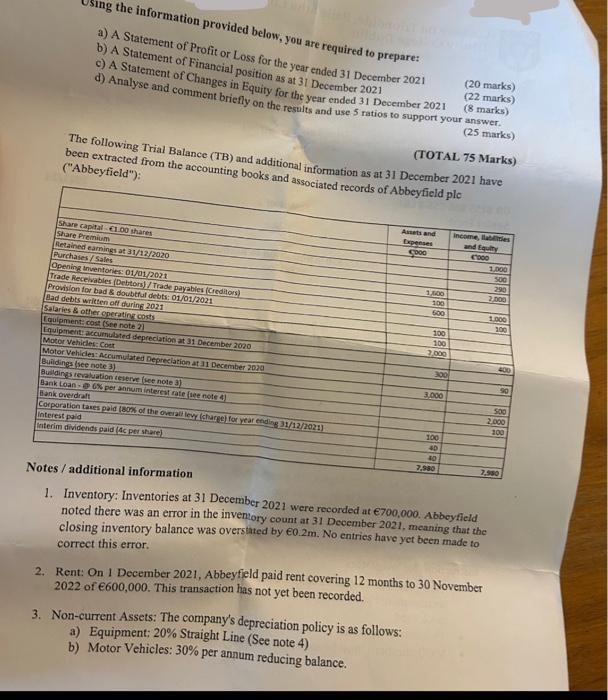

Sing the information provided below, you are required to prepare: a) A Statement of Profit or Loss for the year ended 31 December 2021

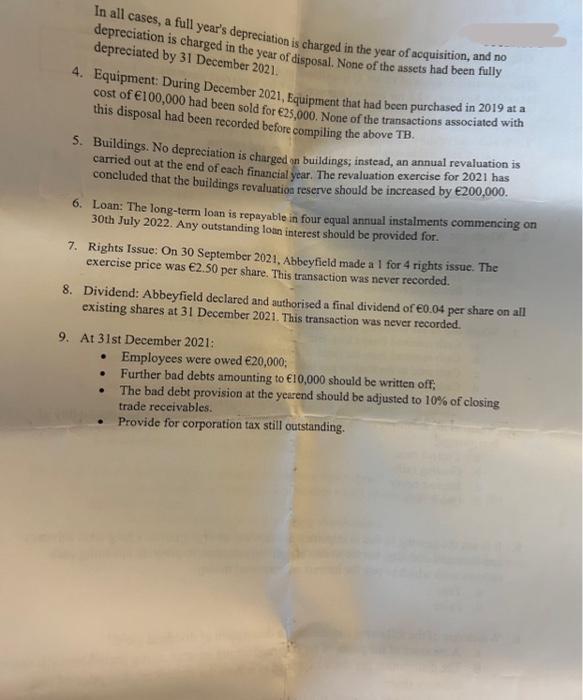

Sing the information provided below, you are required to prepare: a) A Statement of Profit or Loss for the year ended 31 December 2021 b) A Statement of Financial position as at 31 December 2021 c) A Statement of Changes in Equity for the year ended 31 December 2021 d) Analyse and comment briefly on the results and use 5 ratios to support your answer. (25 marks) (TOTAL 75 Marks) The following Trial Balance (TB) and additional information as at 31 December 2021 have been extracted from the accounting books and associated records of Abbeyfield ple ("Abbeyfield"): Share capital 1.00 shares Share Premium Retained earnings at 31/12/2020 Purchases/Sales Opening inventories: 01/01/2021 Trade Receivables (Debtors)/Trade payables (Creditors) Provision for bad & doubtful debts: 01/01/2021 Bad debts written off during 2021 Salaries & other operating costs Equipment: cost (See note 2) Equipment accumulated depreciation at 31 December 2020 Motor Vehicles: Cost Motor Vehicles: Accumulated Depreciation at 31 December 2020 Buildings (see note 3) Buildings revaluation reserve (see note 3) Bank Loan-6% per annum interest rate (see note 4) Bank overdraft Corporation taxes paid (80% of the overall levy (charge) for year ending 31/12/2021) Interest paid Interim dividends paid (4c per share) Assets and Expenses COOD 1,500 100 500 100 100 3,000 3. Non-current Assets: The company's depreciation policy is as follows: a) Equipment: 20% Straight Line (See note 4) b) Motor Vehicles: 30% per annum reducing balance. 300 3,000 (20 marks) (22 marks) (8 marks) 100 40 40 7,980 Income, labies and Equity 1000 1,000 500 290 2,000 2. Rent: On 1 December 2021, Abbeyfield paid rent covering 12 months to 30 November 2022 of 600,000. This transaction has not yet been recorded. 1.000 100 Notes / additional information 1. Inventory: Inventories at 31 December 2021 were recorded at 700,000. Abbeyfield noted there was an error in the inventory count at 31 December 2021, meaning that the closing inventory balance was overstated by 0.2m. No entries have yet been made to correct this error. 400 90 500 2,000 100 7,900 In all cases, a full year's depreciation is charged in the year of acquisition, and no depreciation is charged in the year of disposal. None of the assets had been fully depreciated by 31 December 2021. 4. Equipment: During December 2021, Equipment that had been purchased in 2019 at a cost of 100,000 had been sold for 25,000. None of the transactions associated with this disposal had been recorded before compiling the above TB. 5. Buildings. No depreciation is charged on buildings; instead, an annual revaluation is carried out at the end of each financial year. The revaluation exercise for 2021 has concluded that the buildings revaluation reserve should be increased by 200,000. 6. Loan: The long-term loan is repayable in four equal annual instalments commencing on 30th July 2022. Any outstanding loan interest should be provided for. 7. Rights Issue: On 30 September 2021, Abbeyfield made a 1 for 4 rights issue. The exercise price was 2.50 per share. This transaction was never recorded. 8. Dividend: Abbeyfield declared and authorised a final dividend of 0.04 per share on all existing shares at 31 December 2021. This transaction was never recorded. 9. At 31st December 2021: . Employees were owed 20,000; Further bad debts amounting to 10,000 should be written off, The bad debt provision at the yearend should be adjusted to 10% of closing trade receivables. Provide for corporation tax still outstanding.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started