Answered step by step

Verified Expert Solution

Question

1 Approved Answer

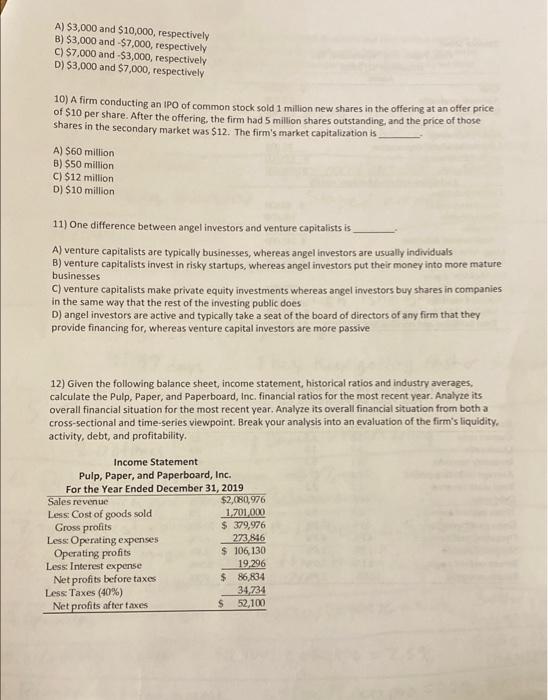

Please and thank you A) $3,000 and $10,000, respectively B) $3,000 and $7,000, respectively C) $7,000 and $3,000, respectively D) $3,000 and $7,000, respectively 10)

Please and thank you

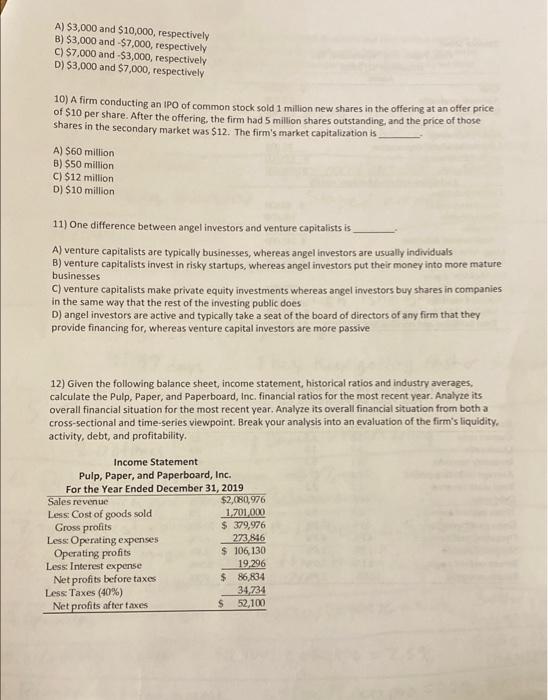

A) $3,000 and $10,000, respectively B) $3,000 and $7,000, respectively C) $7,000 and $3,000, respectively D) $3,000 and $7,000, respectively 10) A firm conducting an IPO of common stock sold 1 million new shares in the offering at an offer price of $10 per share. After the offering the firm had 5 million shares outstanding, and the price of those shares in the secondary market was $12. The firm's market capitalization is A) $60 million B) $50 million C) $12 million D) $10 million 11) One difference between angel investors and venture capitalists is A) venture capitalists are typically businesses, whereas angel investors are usually individuals B) venture capitalists invest in risky startups, whereas angel investors put their money into more mature businesses C) venture capitalists make private equity inwestments whereas angel investors buy shares in companies in the same way that the rest of the investing public does D) angel investors are active and typically take a seat of the board of directors of any firm that they provide financing for, whereas venture capital investors are more passive 12) Given the following balance sheet, income statement, historical ratios and industry averages, calculate the Pulp, Paper, and Paperboard, Inc. financial ratios for the most recent year. Analyze its overall financial situation for the most recent year. Analyze its overall financial situation from both a cross-sectional and time-series viewpoint. Break your analysis into an evaluation of the firm's liquidity. activity, debt, and profitability. Income Statement Pulp, Paper, and Paperboard, Inc. For the Year Ended December 31, 2019 Sales revenue $2,080.976 Less Cost of goods sold 1.701,000 Gross profits $ 379,976 Less Operating expenses 273 816 Operating profits $ 106, 130 Less: Interest expense 19.296 Net profits before taxes $ 86,834 Less Taxes (40%) 34,734 Net profits after taxes $ 52,100

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started