Answered step by step

Verified Expert Solution

Question

1 Approved Answer

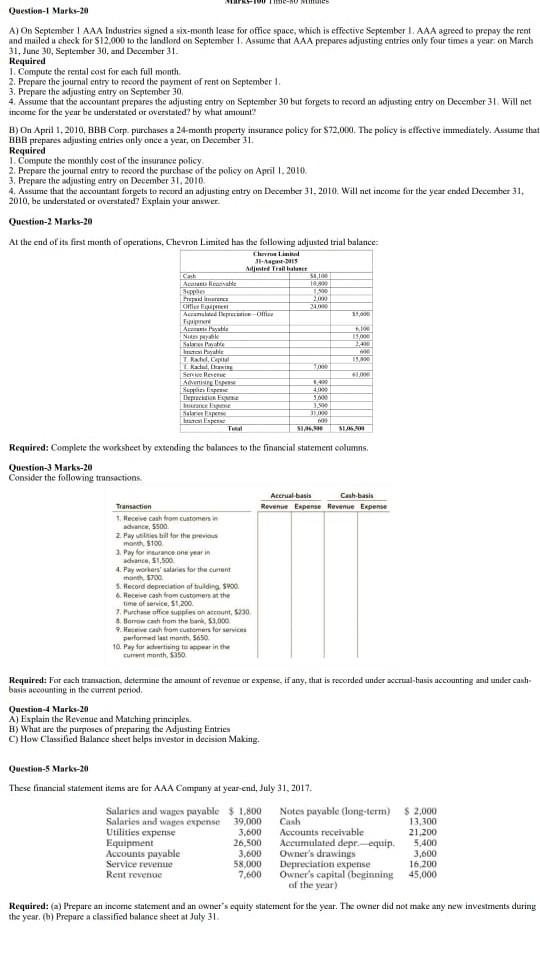

please ans 1 (B), 2, 3 and 5 - ICS Question-1 Marks-20 A) On September 1 AAA Industries signed a six- month lease for office

please ans 1 (B), 2, 3 and 5

- ICS Question-1 Marks-20 A) On September 1 AAA Industries signed a six- month lease for office space, which is effective September I. AAA agreed to prepay the rent and miled u check for $12,000 to the landlord on September 1. Assume that AAA prepares adjusting entries only four times a year on March 31, June 30, September 30, and December 31. Required 1. Compute the rental cost for each full month 2. Prepare the journal entry to record the payment of reist on September 1 3. Prepare the adjusting entry on September 30 4. Assume that the accountant prepares the adjusting entry on September 30 but forgets to record an adjusting entry on December 31 Will net income for the yent be understated or overstated by what amount? B) On April 1, 2010, BBB Corp. purchases a 24-month property insurance policy for $72,000. The policy is effective immediately. Assume that BBB prepares adjusting entries only once a year, an December 31 Required 1. Compute the monthly cost of the instimme policy 2. Prepare the journal entry to record the purchase of the policy on April 1, 2010 3. Prepare the adjusting entry on December 31, 2010, 4. Assume that the accountant forgets to record an adjusting entry on December 31, 2016. Will net income for the year ended December 31, 2010, be undenitated or overstated? Explain your answer. Question-2 Marks-20 At the end of its first month of operatiotis, Chevron Limited to the following adjusted trial balance che HIS A Trabant ARE T. 1900 20 Rio IS 1 61.0 10 J. Cit! Acreme pre- 10 F Ae Nike Salware IT RMC Ser elevene Sipas spente Depec EUR Berat pole Sale Tal SA Required: Complete the worksheet by extending the balances to the financial statement columns Question- Mark -20 Consider the following transactions Accrual basis Cashbasis Transaction Revenue Expense Hovenie Expense Heceve cash from customer chance, 5500 2. Fayl til for the previo month $100 3. Pay force one year in chance, $1.500 4. Fay workers are for the current 5700 Hecord depreciation of tulding 40 Receive cash from customen the time of service, 51,200 7. Purchase af supplen truun, 5330 llow cash from the bank 53,000 9. Hevesh from customers for service performed last month 5650 10. Pay for dette er in the current month $350 Required: For each transaction determine the amount of revenue dir expense, if any, that is recorded under accrual basis accounting and under canh basis accounting in the current period. Question-4 Marks-20 A) Explain the Revence and Matching principles B) What are the purposes of preparing the Adjusting Entries C) How Classified Balance sheet helps investor in decision Making Question 5 Markr-20 These financial statement items are for AAA Company at year-end, July 31, 2017 Salaries and waren payable $1,800 Notes payable (long-term) $2.000 Salaries and wipes expense 39,000 Cash 13.300 Utilities expense 3,600 Accounts receivable 21,200 Equipment 26,500 Accumulated depr.-equip 5.400 Accounts payable 3,600 Owner's drawings 3,000 Service revenue 58.000 Depreciation expense 16,200 Rent revenge 7,600 Owner's capital (betinning 45,000 of the year) Required: (a) Prepare an income statement and an owner's equity statemest for the year. The owner did not make any new investments during the year. (h) Prepare a classified balance sheet at July 31Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started