Answered step by step

Verified Expert Solution

Question

1 Approved Answer

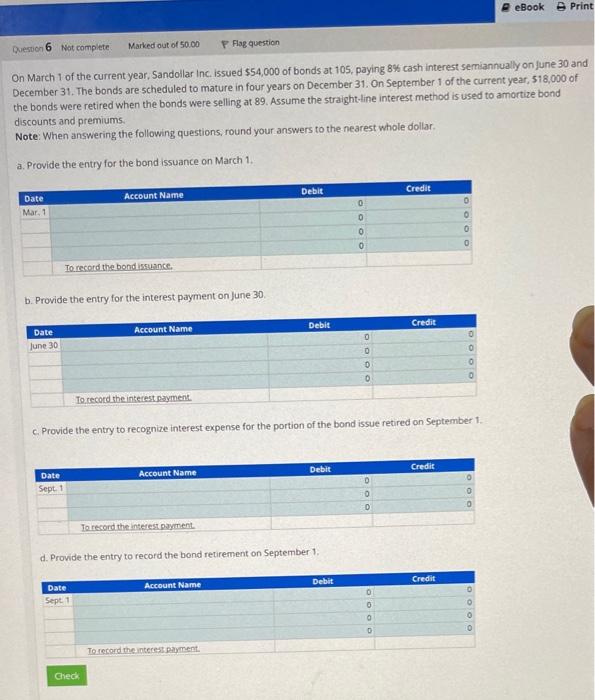

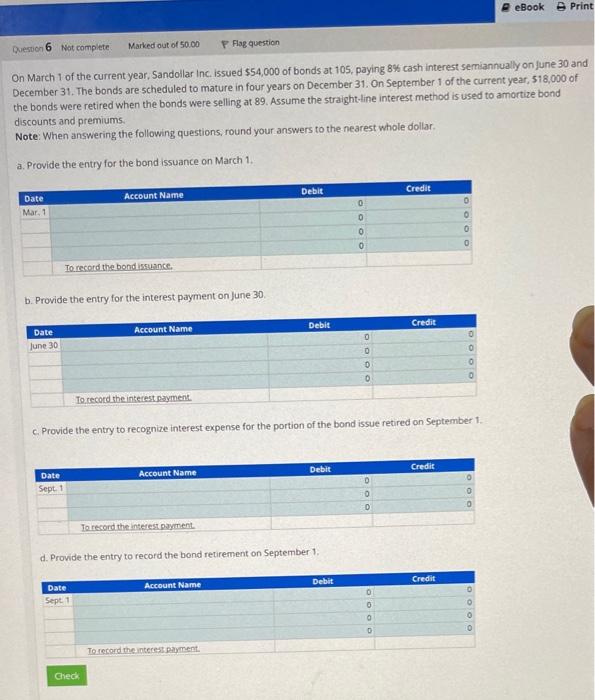

please ans both questions..thank you eBook Print Question 6 Not complete Marked out of 50.00 P Flag question On March 1 of the current year,

please ans both questions..thank you

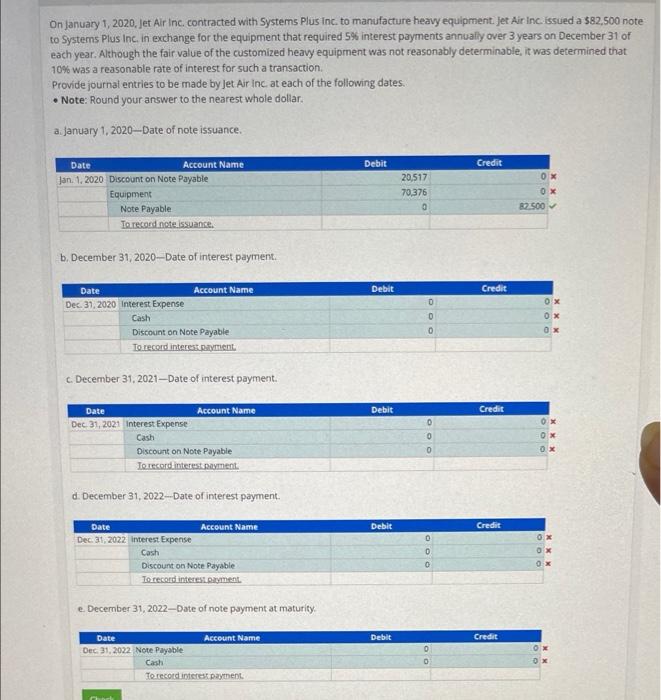

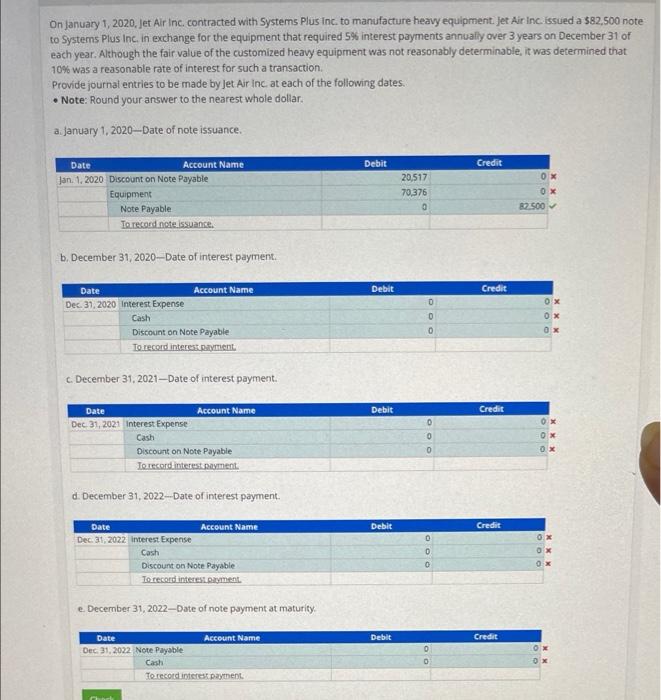

eBook Print Question 6 Not complete Marked out of 50.00 P Flag question On March 1 of the current year, Sandollar Inc. issued $54,000 of bonds at 105, paying 8% cash interest semiannually on June 30 and December 31. The bonds are scheduled to mature in four years on December 31. on September 1 of the current year, 518,000 of the bonds were retired when the bonds were selling at 89. Assume the straight-line interest method is used to amortize bond discounts and premiums Note: When answering the following questions, round your answers to the nearest whole dollar a. Provide the entry for the bond issuance on March 1. Debit Credit Account Name 0 Date Mar. 1 OOOO O 0 0 To record the bond issuance. b. Provide the entry for the interest payment on June 30 Debit Credit Account Name Date June 30 0 OOO To record the interest payment c. Provide the entry to recognize interest expense for the portion of the bond issue retired on September 1, Date Credit Debit Account Name 0 0 Sept. 1 0 0 0 0 To record the interest payment d. Provide the entry to record the bond retirement on September 1 Debit Credit Account Name Date Sept. 1 0 0 To record the interest payment. Gred On January 1, 2020, jet Air Inc. contracted with Systems Plus Inc. to manufacture heavy equipment, jet Air Inc. issued a $82,500 note to Systems Plus Inc. in exchange for the equipment that required 5% interest payments annually over 3 years on December 31 of each year. Although the fair value of the customized heavy equipment was not reasonably determinable, it was determined that 10% was a reasonable rate of interest for such a transaction Provide journal entries to be made by Jet Air Inc at each of the following dates. Note: Round your answer to the nearest whole dollar. a. January 1, 2020-Date of note issuance. Debit Credit Date Account Name Jan. 1.2020 Discount on Note Payable Equipment Note Payable To record note issuance. 20,517 70,376 0 x OX 82.500 b. December 31, 2020-Date of interest payment. Debit Credit 0 OX Date Account Name Dec 31, 2020 Interest Expense Cash Discount on Note Payable To record interesent 0X 0 c. December 31, 2021-Date of interest payment. Account Name Debit Credit Date Dec 31, 2021 Interest Expense 0 0 Ox OX Ox 0 Discount on Note Payable Te record interest payment d. December 31, 2022--Date of interest payment. Debit Credit O Date Account Name Dec 31, 2022 Interest Expense Cash Discount on Note Payable To record interestment 0.X OX 0 0 e December 31, 2022-Date of note payment at maturity Debit Credit Date Account Name Dec 31, 2022 Note Payable Cash To record interest payment

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started