please answer 1-3

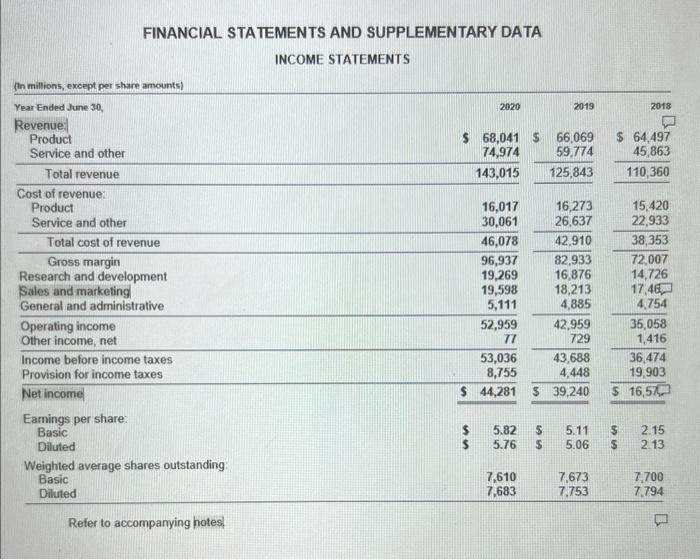

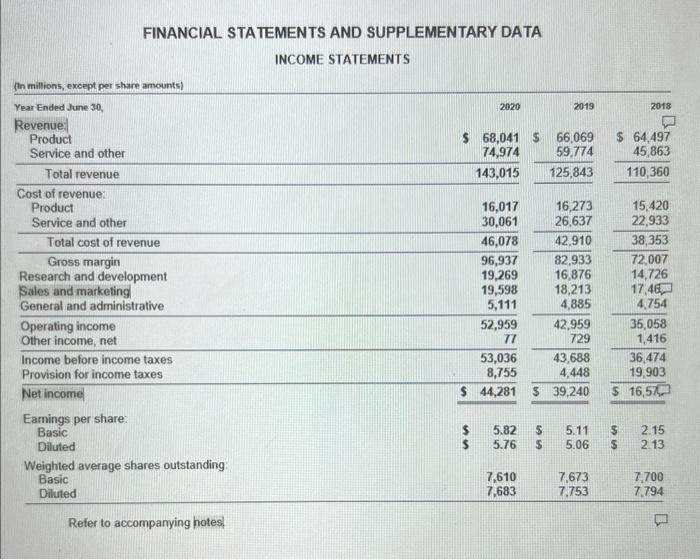

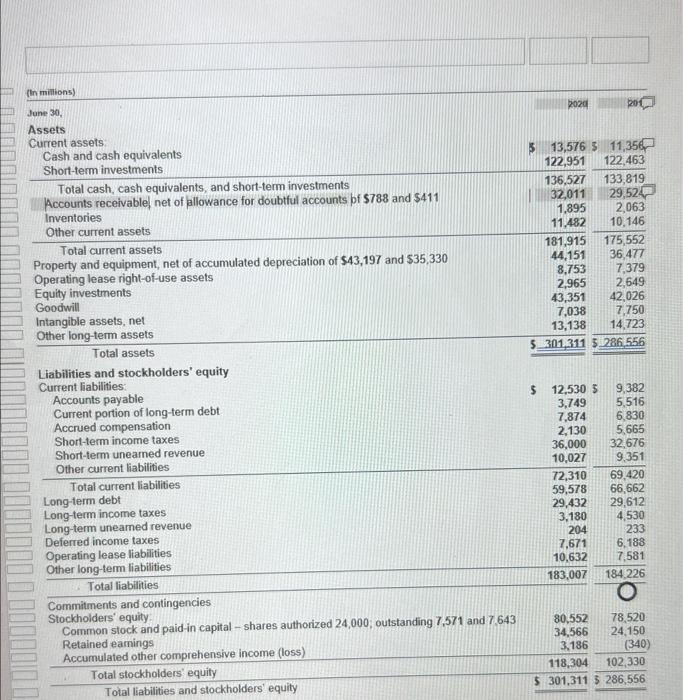

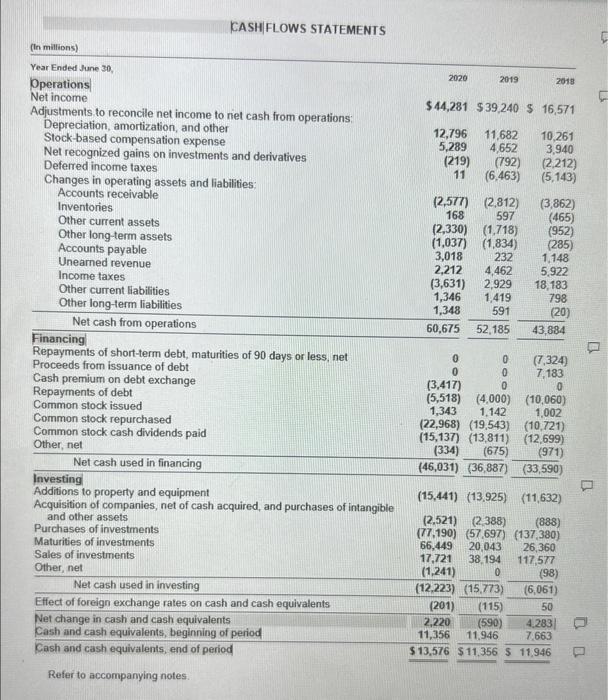

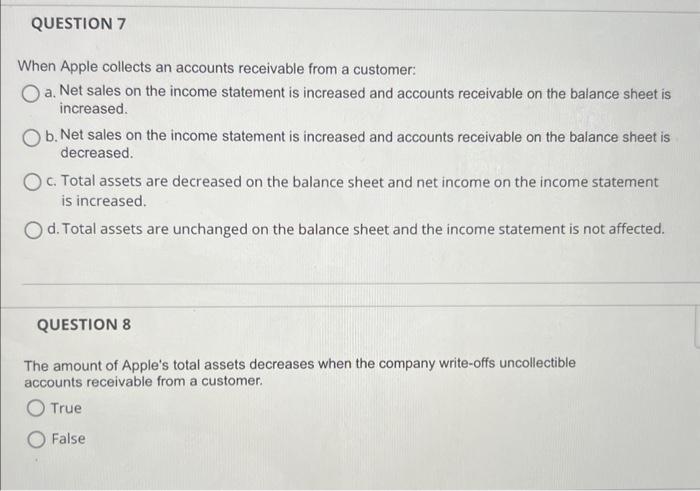

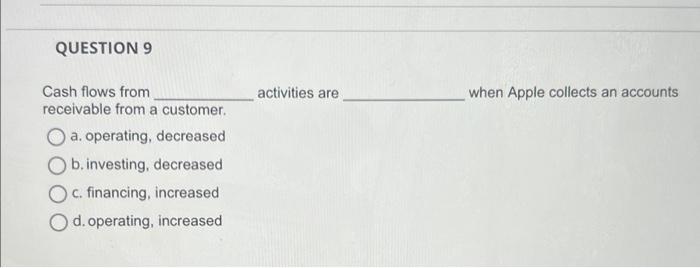

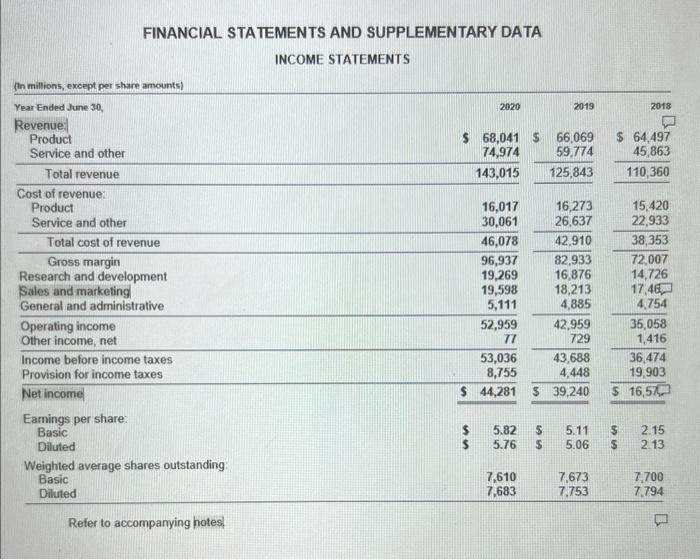

FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA (In minitions) June 30, Assets Current assets: Cash and cash equivalents Short-tem investments Total cash, cash equivalents, and short-term investments Total cash, cash equivalents, and short-term investments Accounts receivable, net of fallowance for doubtful accounts bf $788 and $411 Inventories Other current assets Tolal current assets Property and equipment, net of accumulated depreciation of $43,197 and $35,330 Operating lease right-of-use assets Equity investments Goodwill Intangible assets, net TotalassetsOtherlong-termassets Liabilities and stockholders' equity Current liabilities: Accounts payable Current portion of long-term debt Accrued compensation Short-tem income taxes Short-term unearned revenue Other current liabilities Total current liabilities Long-term debt Long-term income taxes Long-term uneamed revenue Deferred income taxes Deferred income taxes Operating lease liabilities: TotalliabilitiesOtherlong-temliabilities Commitments and contingencies Stockholders' equity: \begin{tabular}{l} Common stock and paid-in capital - shares authorized 24,000; outstanding 7,571 and 7,643 \\ Retained eamings \\ Accumulated other comprehensive income (loss) \\ \hline Total stockholders' equity \\ Total liabilities and stockholders' equity \\ \hline (340) \end{tabular} CASH|FLOWS STATEMENTS ( ln millions) Year Ended thane 30, Pperations| Net income Adjustments to reconcile net income to net cash from operations: Depreciation, amortization, and other Stock-based compensation expense Net recognized gains on investments and derivatives Deferred income taxes. Changes in operating assets and liabilities: Accounts receivable Inventories Other current assets Other long-term assets Accounts payable Unearned reven Other cument liabilities Other long-term liabilities $44,28112,7965,289(219)11$39,24011,6824,652(792)(6,463)$16,57110,2613,940(2,212)(5,143) Net cash from operations Repayments of short-term debt, maturiting oceeds from issuance of debt ash premium on debt exchange Rpayments of debt ommon stock issued ommon stock repurchased (2,577)(2,812)(3,862) 168(2,330)597(1,718)(465)(952) (2,330)(1,037)(1,718)(1,834)(952)(285) When Apple collects an accounts receivable from a customer: a. Net sales on the income statement is increased and accounts receivable on the balance sheet is increased. b. Net sales on the income statement is increased and accounts receivable on the balance sheet is decreased. c. Total assets are decreased on the balance sheet and net income on the income statement is increased. d. Total assets are unchanged on the balance sheet and the income statement is not affected. QUESTION 8 The amount of Apple's total assets decreases when the company write-offs uncollectible accounts receivable from a customer. True False Cash flows from activities are when Apple collects an accounts receivable from a customer. a. operating, decreased b. investing, decreased c. financing, increased d. operating, increased