Please answer 1-5 thank you!

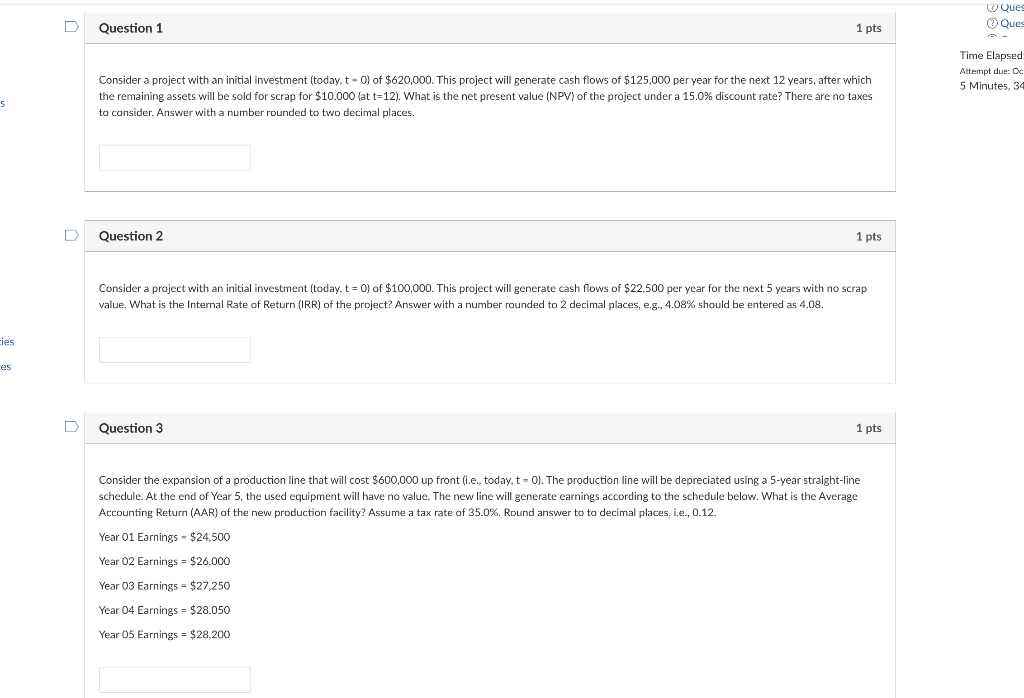

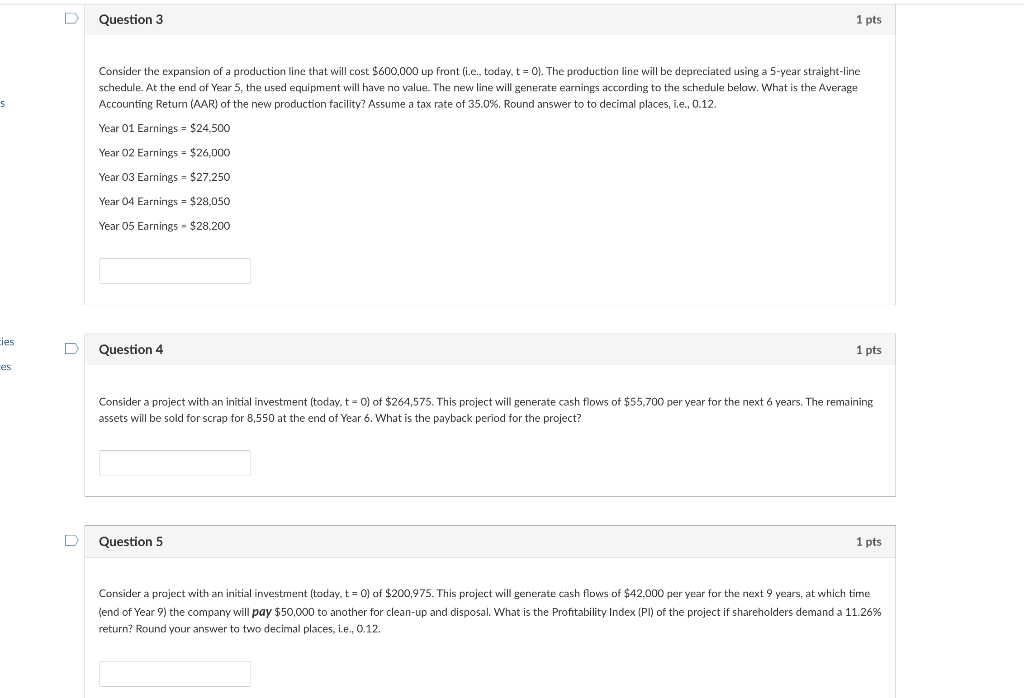

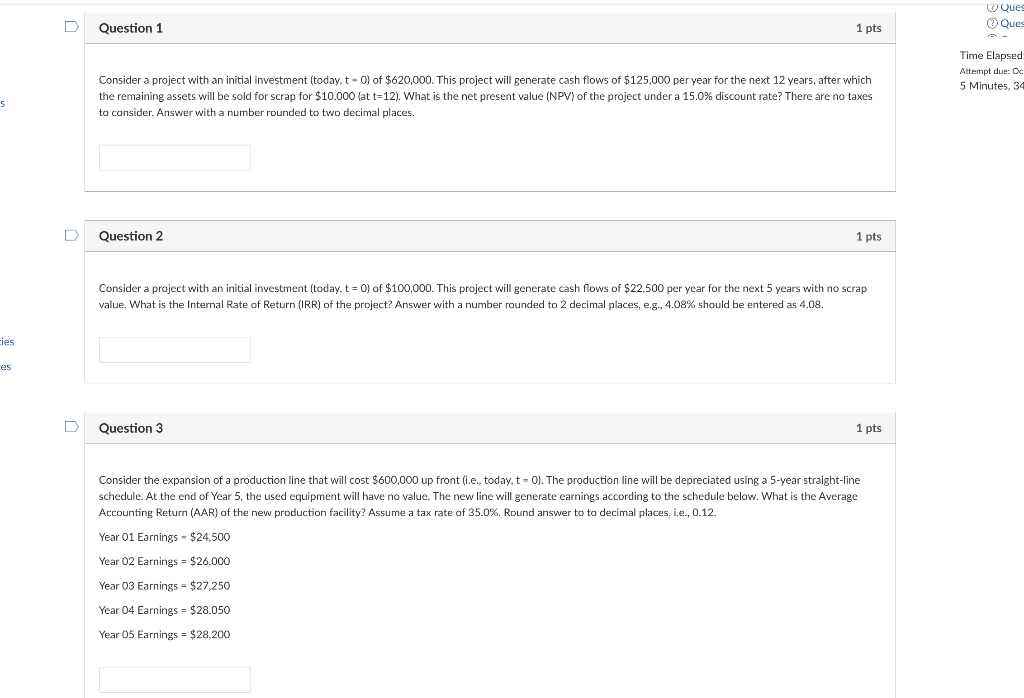

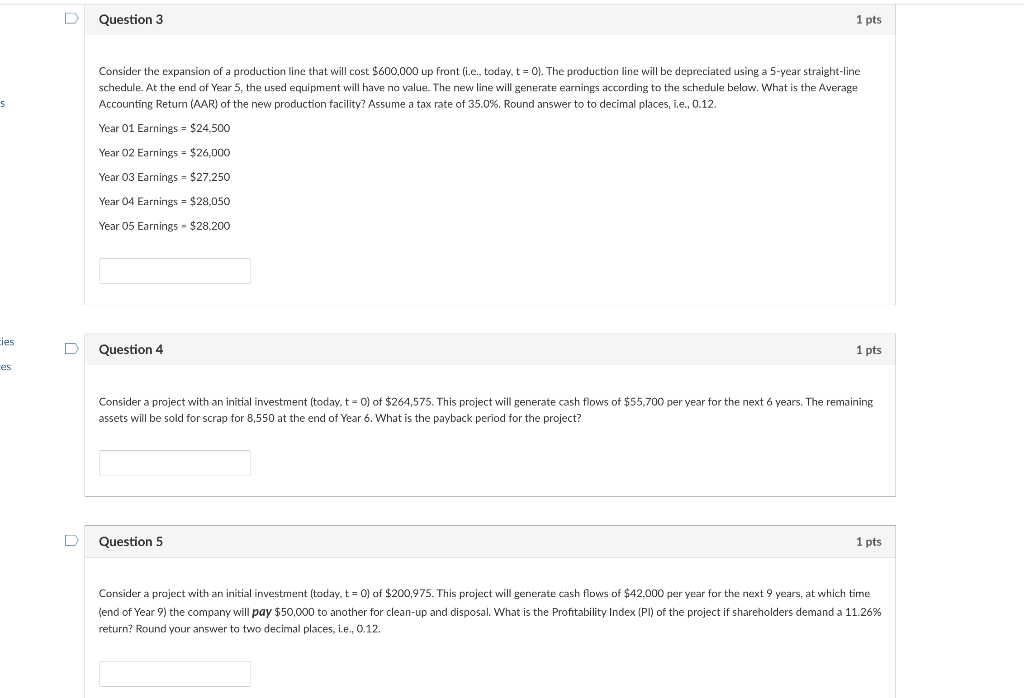

Consider a project with an initial investment (today, t=0 ) of $620,000. This project will generate cash flows of $125,000 per year for the next 12 years, after which Time Elapsed the remaining assets will be sold for scrap for $10,000 (at t=12 ). What is the net present value (NPV) of the project under a 15.0% discount rate? There are no taxes to consider. Answer with a number rounded to two decimal places. Question 2 Consider a project with an initial investment (today, t=0 ) of $100,000. This project will generate cash flows of $22,500 per year for the next 5 years with no scrap value. What is the Internal Rate of Return (IRR) of the project? Answer with a number rounded to 2 decimal places, e.g. 4.08% should be entered as 4.08. Question 3 Consider the expansion of a production line that will cost $600,000 up front (i.e., today, t=0 ). The production line will be depreciated using a 5 -year straight-line schedule. At the end of Year 5 , the used equipment will have no value. The new line will generate earnings according to the schedule below. What is the Average Accounting Return (AAR) of the new production facility? Assume a tax rate of 35.0%. Round answer to to decimal places, i.e., 0.12. Year 01 Earnings - $24,500 Year 02 Earnings =$26,000 Year 03 Earnings =$27,250 Year 04 Earnings =$28.050 Year 05 Earnings =$28,200 Consider the expansion of a production line that will cost $600,000 up front (i.e., today, t=0 ). The production line will be depreciated using a 5-year straight-line schedule. At the end of Year 5 , the used equipment will have no value. The new line will generate earnings according to the schedule below. What is the Average Accounting Return (AAR) of the new production facility? Assume a tax rate of 35.0%. Round answer to to decimal places, i.e., 0.12. Year 01 Earnings =$24,500 Year 02 Earnings =$26,000 Year 03 Earnings =$27,250 Year 04 Earnings =$28,050 Year O5 Earnings - \$28,200 Question 4 Consider a project with an initial investment (today, t=0 ) of $264,575. This project will generate cash flows of $55,700 per year for the next 6 years. The remaining assets will be sold for scrap for 8,550 at the end of Year 6 . What is the payback period for the project? Question 5 Consider a project with an initial investment (today, t=0 ) of $200,975. This project will generate cash flows of $42,000 per year for the next 9 years, at which time (end of Year 9 ) the company will pay $50,000 to another for clean-up and disposal. What is the Profitability Index (PI) of the project if shareholders demand a 11.26% return? Round your answer to two decimal places, i.e., 0.12