Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer 1-6 please and thank you! 1) Which of the following statements is true regarding QBO ? (5pts) a. QBO can only be accessed

please answer 1-6 please and thank you!

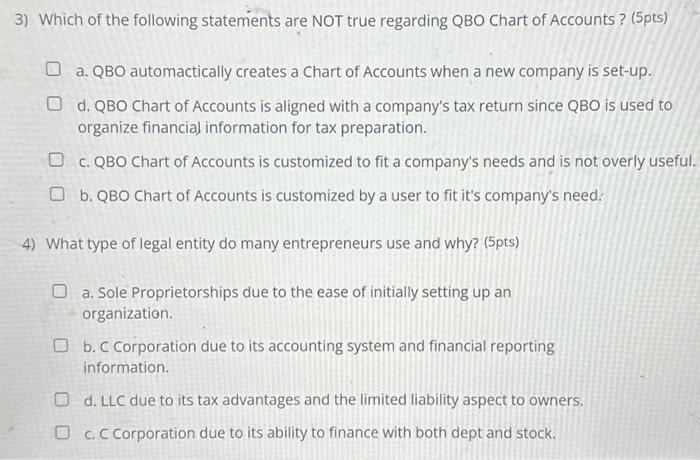

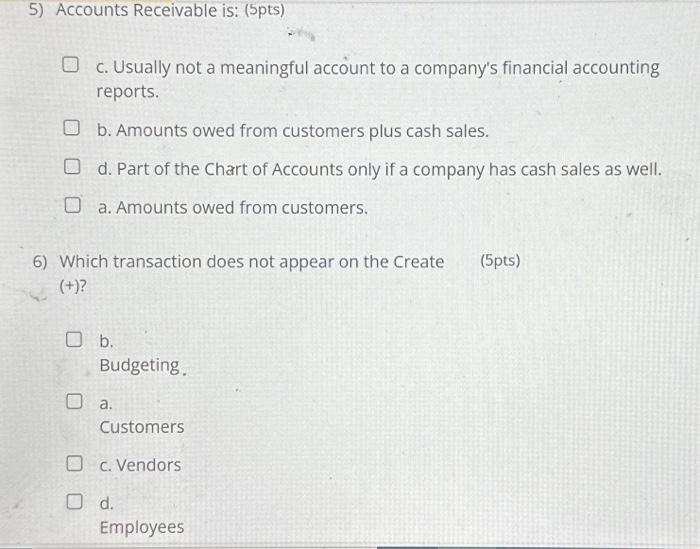

1) Which of the following statements is true regarding QBO ? (5pts) a. QBO can only be accessed by using installed software on a computer or desktop. b. QBO is updated annually to ensure the content screens are familiar to users. c. QBO does not require a user to have integrated knowledge of accounting, financial systems or technlogy. d. QBO is cloud-based and uses a web browser to access information vs. installed software. 2) Why is it important to align QBO with a company's legal entity and tax information during initial set-up? b. QBO only allows one type of legal entity to be input for a corporation - the C corporation. a. The IRS (Internal Revenue Service) regularly d. A company can use more than one legal entity at a time; it is important for QBO to track what type of legal entity a company is using for different transactions/ c. Legal entitv dictates what tax form a companv uses and the tax form affects the 3) Which of the following statements are NOT true regarding QBO Chart of Accounts ? (5pts) a. QBO automactically creates a Chart of Accounts when a new company is set-up. d. QBO Chart of Accounts is aligned with a company's tax return since QBO is used to organize financial information for tax preparation. c. QBO Chart of Accounts is customized to fit a company's needs and is not overly useful. b. QBO Chart of Accounts is customized by a user to fit it's company's need: 4) What type of legal entity do many entrepreneurs use and why? (5pts) a. Sole Proprietorships due to the ease of initially setting up an organization. b. C Corporation due to its accounting system and financial reporting information. d. LLC due to its tax advantages and the limited liability aspect to owners. c. C Corporation due to its ability to finance with both dept and stock. 5) Accounts Receivable is: (5pts) c. Usually not a meaningful account to a company's financial accounting reports. b. Amounts owed from customers plus cash sales. d. Part of the Chart of Accounts only if a company has cash sales as well. a. Amounts owed from customers. 6) Which transaction does not appear on the Create (5pts) (+) ? b. Budgeting. a. Customers c. Vendors d. Employees

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started