Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer 1-6 true or flase Determine if the statements below are True or False. If False, correct the statement. (You do not need to

please answer 1-6 true or flase

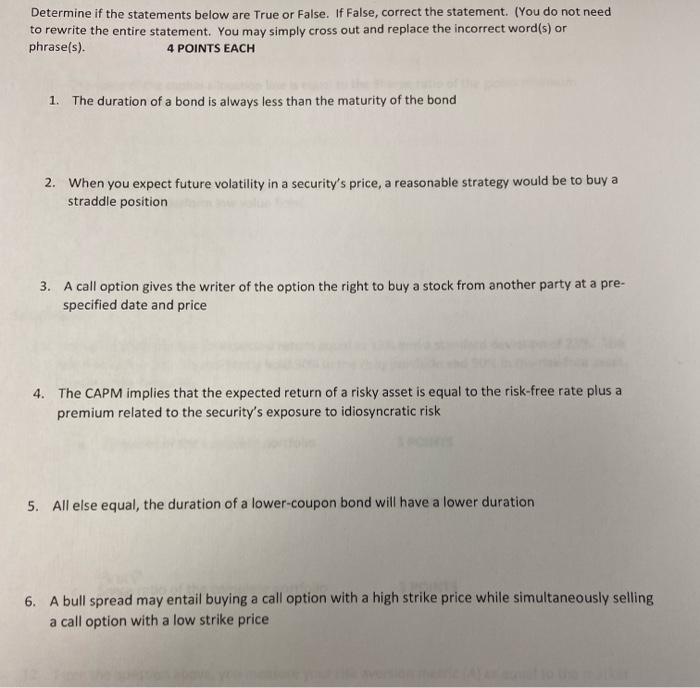

Determine if the statements below are True or False. If False, correct the statement. (You do not need to rewrite the entire statement. You may simply cross out and replace the incorrect word(s) or phrase(s). 4 POINTS EACH 1. The duration of a bond is always less than the maturity of the bond 2. When you expect future volatility in a security's price, a reasonable strategy would be to buy a straddle position 3. A call option gives the writer of the option the right to buy a stock from another party at a pre- specified date and price 4. The CAPM implies that the expected return of a risky asset is equal to the risk-free rate plus a premium related to the security's exposure to idiosyncratic risk 5. All else equal, the duration of a lower-coupon bond will have a lower duration 6. A bull spread may entail buying a call option with a high strike price while simultaneously selling a call option with a low strike price

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started