please answer 17-9,17-10, ans 17-11. first picture is just there to reference the chart

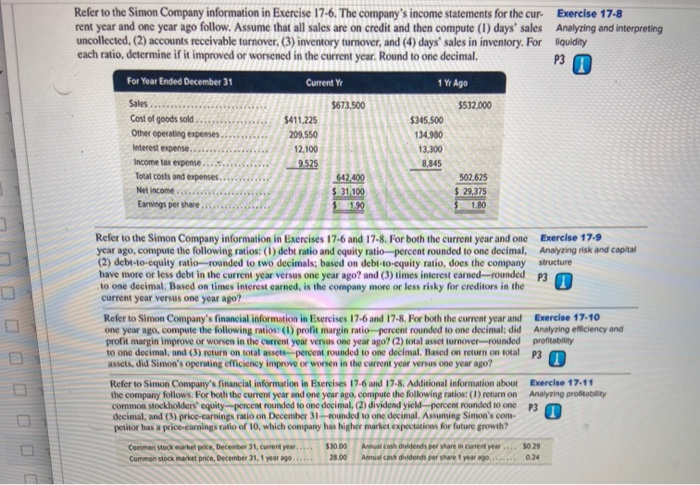

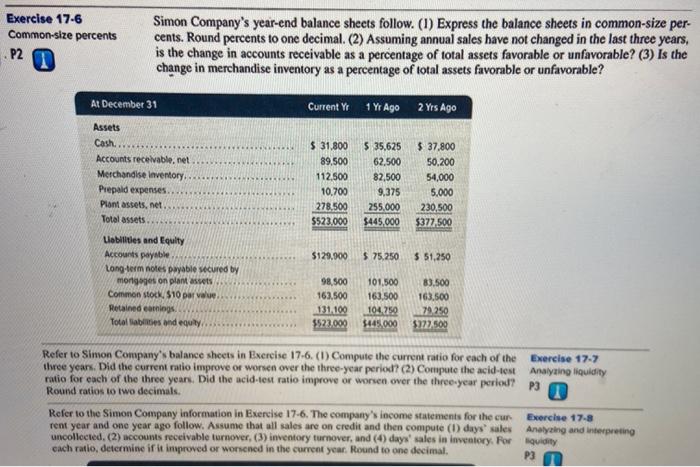

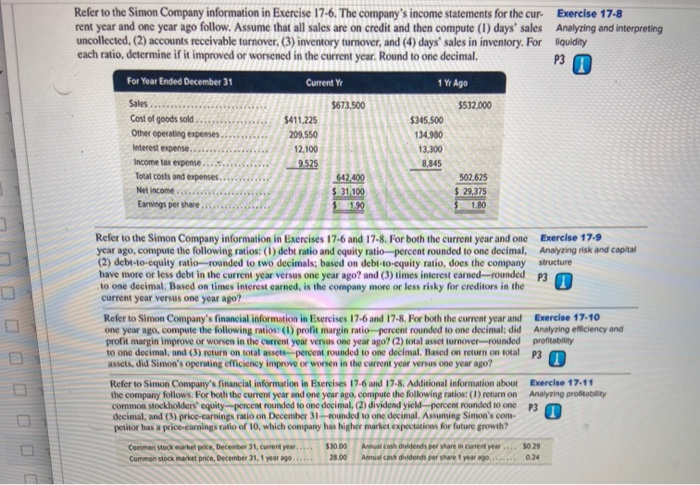

Exercise 17-6 Common-size percents P2 Simon Company's year-end balance sheets follow. (1) Express the balance sheets in common-size per- cents. Round percents to one decimal. (2) Assuming annual sales have not changed in the last three years, is the change in accounts receivable as a percentage of total assets favorable or unfavorable? (3) Is the change in merchandise inventory as a percentage of total assets favorable or unfavorable? At December 31 Current Y 1 Yr Ago 2 Yrs Ago Assets Cash..... Accounts receivable, net Merchandise Inventory.... Prepaid expenses..... Plant assets, net... Total assets ... . Liabilities and Equity Accounts payable Long-term notes payable secured mortgages on plant assets Common stock. $10 per value Retained earnings Total Babies and equity . $ 31,800 89.500 112.500 10.700 278,500 $523.000 $ 35,625 62.500 82,500 9,375 255,000 $445.000 $ 37,800 50,200 54,000 5,000 230,500 $377.500 $129,000 $75.250 5 51.250 98,500 101,500 163,500 104.750 $445.000 83.500 163.500 79.250 $22.500 131.100 552.000 Refer to Simon Company's balance sheets in Exercise 17.6. (1) Compute the current ratio for each of the three years. Did the current ratio improve or worsen over the three-year period? (2) Compute the acid-test ratio for each of the three years. Did the acid-test ratio improve or worsen over the three-year period Round ratios to two decimals. Exercise 17-7 Analyzing liquidity P3 Refer to the Simon Company Information in Exercise 17-6. The company's income statements for the e rent year and one year ago follow. Assume that all sales are on credit and then compute (1) days' sales uncollected, (2) accounts receivable turnover, (3) inventory turnover, and (4) days' sales in inventory for cach ratio, determine if it improved or worsened in the current year. Round to one decimal x ercise 17-8 Analyzing and interpreting it Refer to the Simon Company information in Exercise 17-6. The company's income statements for the cur. rent year and one year ago follow. Assume that all sales are on credit and then compute (1) days' sales uncollected. (2) accounts receivable turnover, (3) inventory turnover, and (4) days' sales in inventory. For cach ratio, determine if it improved or worsened in the current year. Round to one decimal. Exercise 17-8 Analyzing and interpreting liquidity P3 For Year Ended December 31 Current YT 1 Ago Sales $673,500 $532,000 $411,225 209.550 12.100 $345.500 134.980 13.300 Cost of goods sold Other operating expenses........... Interest expense....... Income tax expense .............. Total costs and expenses............ Net income Earnings per share ....... ..... 9525 8.845 642 502,625 $ 29,375 00000 Refer to the Simon Company information in Exercises 17-6 and 17-8. For both the current year and one Exercise 17.9 year ago, compute the following ratios: (1) debt ratio and equity ratio percent rounded to one decimal, Analyzing risk and capital (2) debt-to-equity ratio-rounded to two decimals; based on debt-to-equity ratio, does the company structure have more or less debt in the current year versus one year ago? and (3) times interest earned-rounded P3 to one decimal. Based on times interest earned, is the company more or less risky for creditors in the current year versus one year ago? Refer to Simon Company's financial information in Exercises 17-6 and 17-8. For both the current year and Exercise 17-10 one year ago, compute the following ratios (1) profit margin ratio percent rounded to one decimal; did Analyring efficiency and profit margin improve or worsen in the current year versus one year ago? (2) total asset turnover-rounded profitability to one decimal, and (3) return on total assets percent rounded to one decimal. Based on return on total P3 assets, did Simon's operating efficiency improve or worsen in the current year versus one year ago? Refer to Simon Company's financial information in Exercises 17-6 and 17-8. Additional information about Exercise 17.11 the company follows. For both the current year and one year ago, compute the following ratios (1) return on Analyting profitability common stockholders' equity-percent rounded to one decimal. (2) dividend yield percent rounded to one P3 decimal, and (3) price earnings ratio on December 31-rounded to one decimal. Assuming Simon's com petitor has a price.camnings ratio of 10, which company has higher market expectations for future growth? Common stock market price, December 31, current year..... Common stock market price, December 31, 1 year ago..... 510.00 28.00 cash dividend per share in current year.... 50.29 Auch dividends per there year ago...... 0.24

please answer 17-9,17-10, ans 17-11. first picture is just there to reference the chart

please answer 17-9,17-10, ans 17-11. first picture is just there to reference the chart