Answered step by step

Verified Expert Solution

Question

1 Approved Answer

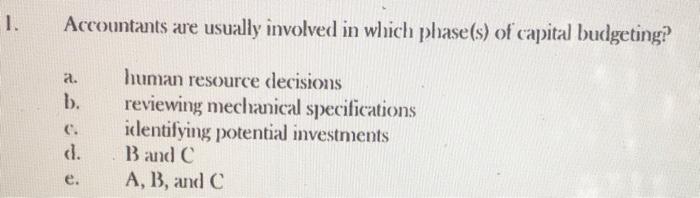

please answer 1-8. please show work. will rate! 1. 2 &3. 4. 5 & 6. 7. 8. Accountants are usually involved in which phase(s) of

please answer 1-8. please show work. will rate!

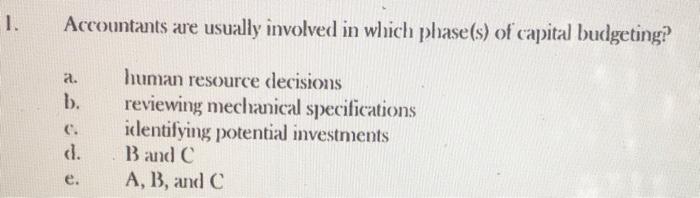

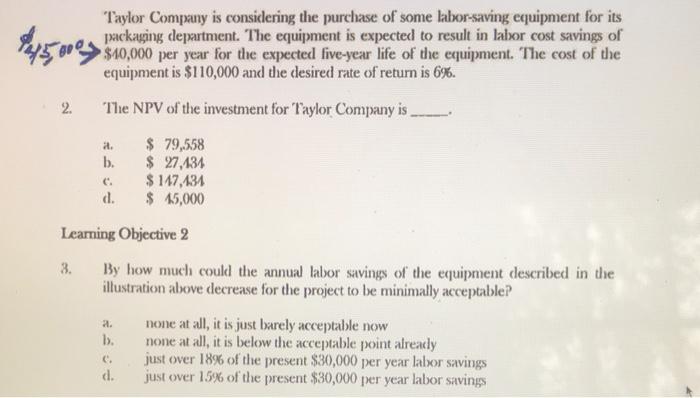

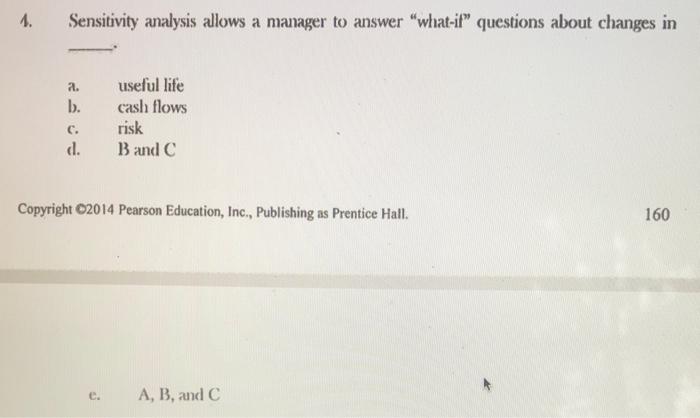

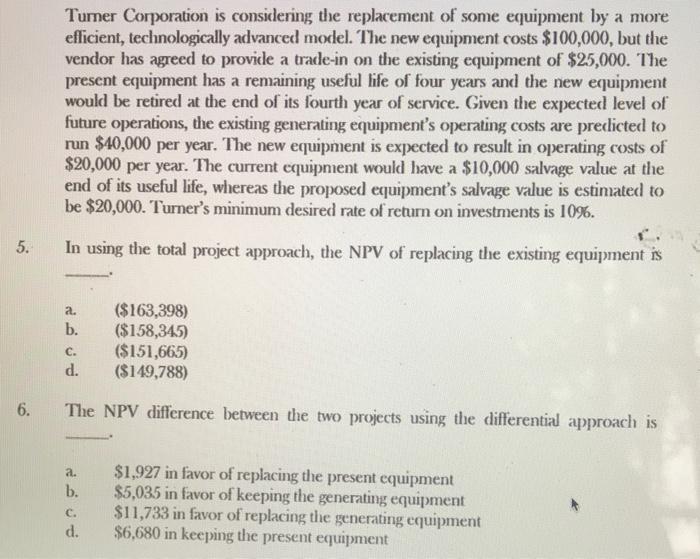

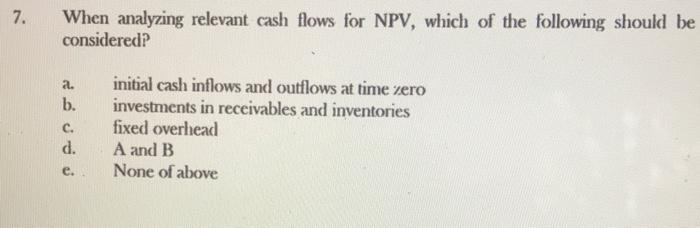

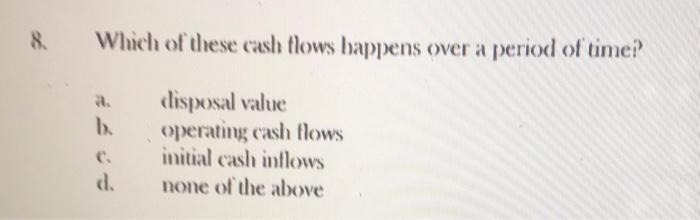

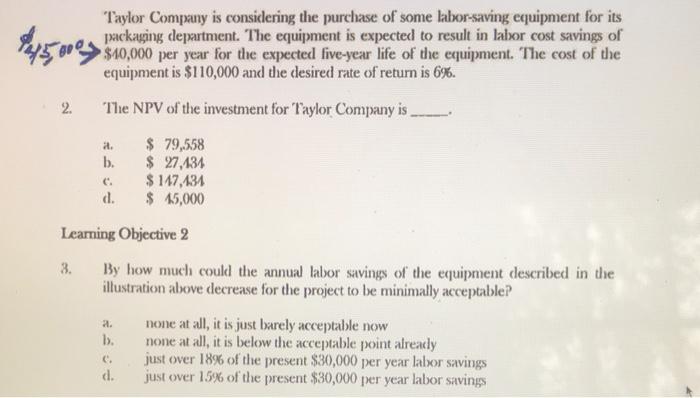

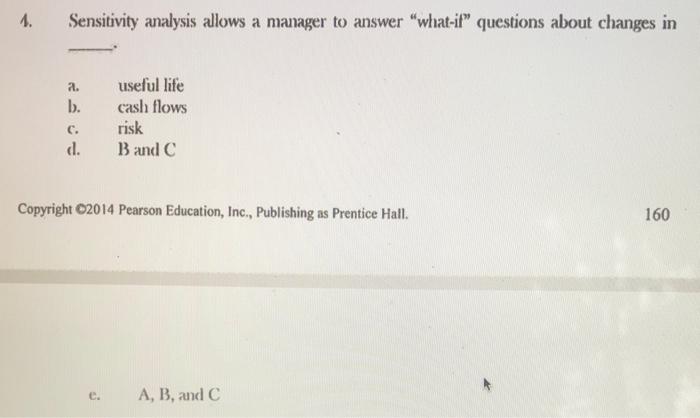

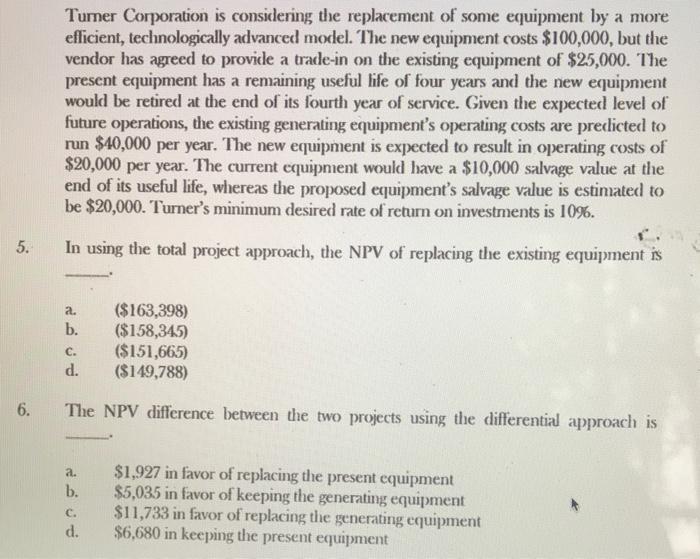

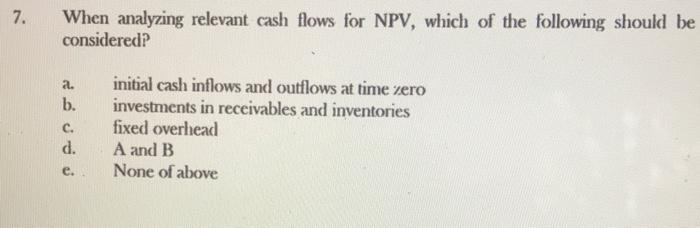

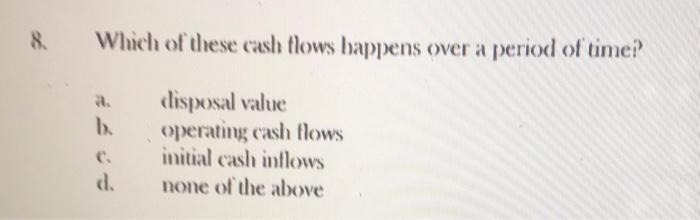

Accountants are usually involved in which phase(s) of capital budgeting? a. human resource decisions b. reviewing mechanical specifications c. illentifying potential investments d. B and C e. A,B, and C Taylor Company is considering the purchase of some labor-saving equipment for its packaging department. The equipment is expected to result in labor cost savings of $10,000 per year for the expected five-year life of the equipment. The cost of the equipment is $110,000 and the desired rate of return is 6%. 2. The NPV of the investment for laylor Company is a. $79,558 b. $27,131 c. $117,134 d. $15,000 Learning Objective 2 3. By how much could the annual labor savings of the equipment described in the illustration above decrease for the project to be minimally acceptable? a. none at all, it is just barely acceptable now b. none at all, it is below the acceptable point already c. just over 18% of the present $30,000 per year labor savings d. just over 15% of the present $30,000 per year labor savings 1. Sensitivity analysis allows a manager to answer "what-if" questions about changes in a. useful life b. cash flows c. risk l. B and C Copyright 02014 Pearson Education, Inc., Publishing as Prentice Hall. 160 Turner Corporation is considering the replacement of some equipment by a more efficient, technologically advanced model. The new equipment costs $100,000, but the vendor has agreed to provicle a trade-in on the existing equipment of $25,000. The present equipment has a remaining useful life of four years and the new equipment would be retired at the end of its fourth year of service. Given the expected level of future operations, the existing generating equipment's operating costs are preclicted to run $40,000 per year. The new equipment is expected to result in operating costs of $20,000 per year. The current equipment would have a $10,000 salvage value at the end of its useful life, whereas the proposed equipment's salvage value is estimated to be $20,000. Turner's minimum desired rate of return on investments is 10%. 5. In using the total project approach, the NPV of replacing the existing equipment is a. ($163,398) b. ($158,345) c. ($151,665) d. ($149,788) 6. The NPV difference between the two projects using the differential approach is a. \$1,927 in favor of replacing the present equipment b. $5,035 in favor of keeping the generating equipment c. $11,733 in favor of replacing the generating equipment d. $6,680 in keeping the present equipment 7. When analyzing relevant cash flows for NPV, which of the following should be considered? a. initial cash inflows and outflows at time sero b. investments in receivables and inventories c. fixed overhead d. A and B e. None of above 8. Which of these cash flows happens over a period of time?' a. disposal value b. operating cash flows c. initial cash inflows d. none of the above 1.

2 &3.

4.

5 & 6.

7.

8.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started