Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer 2 and 3 all sections. Thanks! AaBbCcDdEe Normal 6 GEORGIA CORPORATION makes custom wood tables and utilizes a job-order costing system. The following

Please answer 2 and 3 all sections.

Thanks!

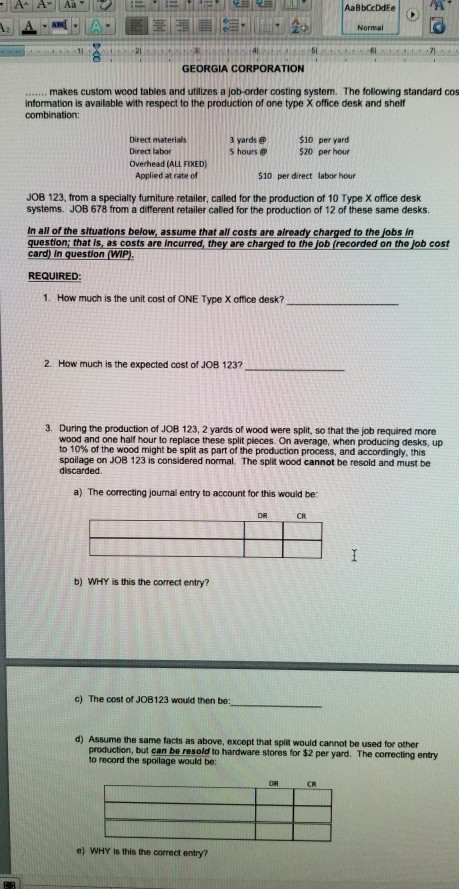

AaBbCcDdEe Normal 6 GEORGIA CORPORATION makes custom wood tables and utilizes a job-order costing system. The following standard cos information is available with respect to the production of one type X office desk and shelf combination: Direct materials Direct labor Overhead (ALL FIXED 3 yards$10 per yard 5 hours @ $20 per hour Applied at rate of $10 per direct labor hour JOB 123, from a specialty furniture retailer, called for the production of 10 Type X office desk systems. JOB 678 from a different retailer caled for the production of 12 of these same desks. In all of the situations below, assume that all costs are already charged to the jobs in question; that is, as costs are incurred, they are charged to the job (recorded on the job cost card) in question (WIP) REQUIRED 1. How much is the unit cost of ONE Type X office desk? 2. How much is the expected cost of JOB 123? 3. During the production of JOB 123, 2 yards of wood were split, so that the job required more wood and one haif hour to replace these split pieces. On average, when producing desks, up to 10% of the wood might be split as part of the production process, and accordingly, this spoilage on JOB 123 is considered normal. The split wood cannot be resold and must be discarded. a) The correcting journal entry to account for this would be: CR b) WHY is this the correct entry? c) The cost of JOB123 would then be: d) Assume the same facts as above, except that split would cannot be used for other production, but can be resold to hardware stores for $2 per yard. The correcting entry to record the spollage would be: CR e) WHY is this the correct entryStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started