PLEASE ANSWER

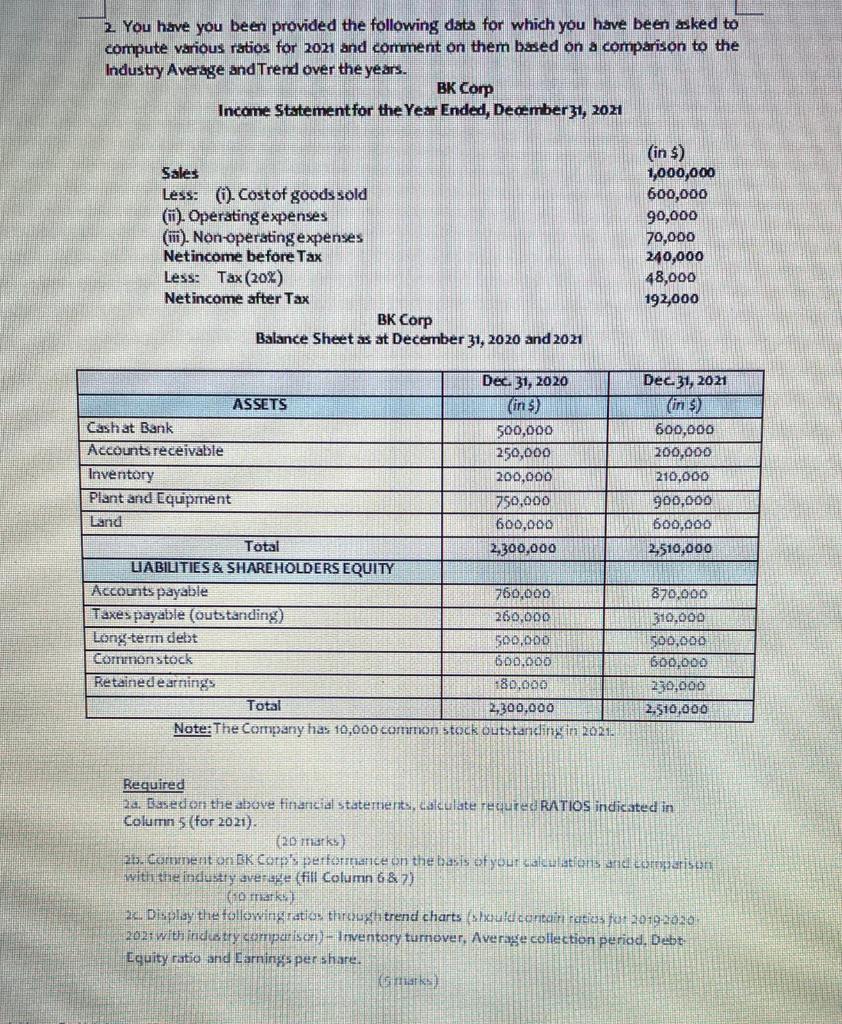

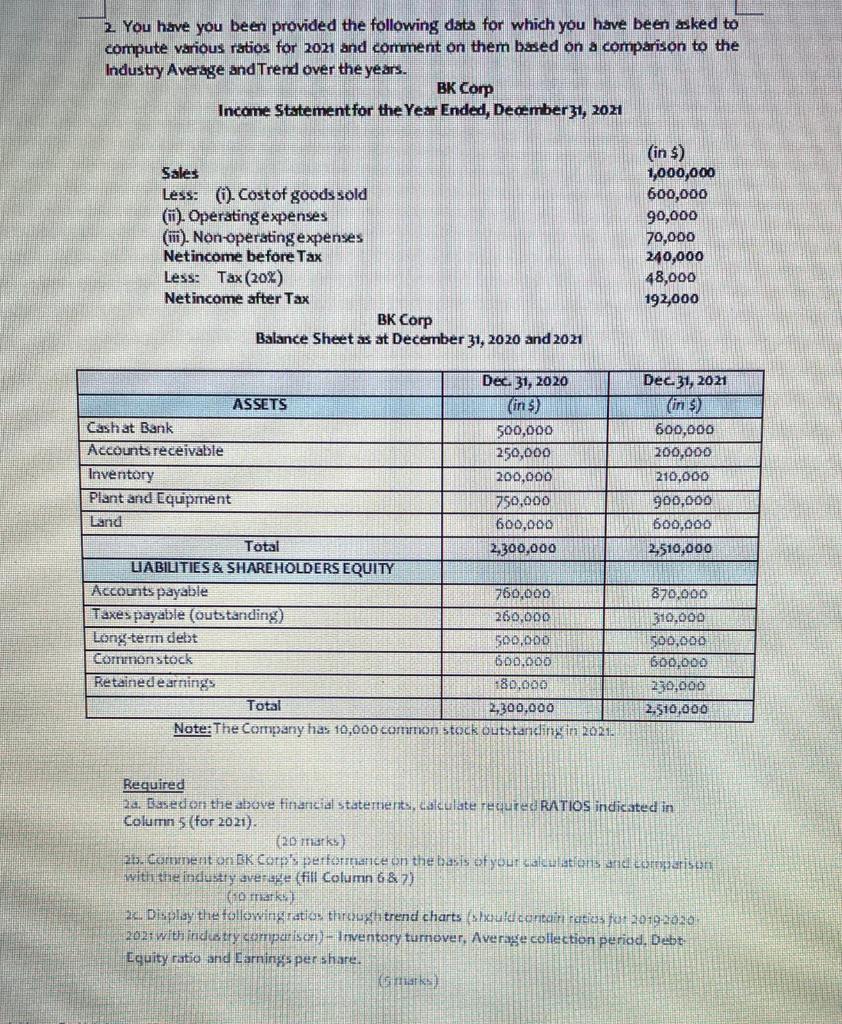

2. You have you been provided the following data for which you have been asked to compute various ratios for 2021 and comment on them based on a comparison to the Industry Average and Trend over the years. BK Corp Income Statement for the Year Ended, December 31, 2011 Sales Less: 6). Costof goods sold (ii). Operating expenses (iii). Non-operating expenses Netincome before Tax Less: Tax (20%) Netincome after Tax BK Corp Balance Sheet as at December 31, 2020 and 2021 (in $) 1,000,000 600,000 90,000 70,000 240,000 48,000 192,000 Dec. 31, 2020 ASSETS in ) Cashat Bank 500,000 Accounts receivable 250,000 Inventory 200,000 Plant and Equipment 750,000 Land 600,000 Total 2300,000 LABILITIES & SHAREHOLDERS EQUITY Accounts payable 760,000 Taxes payable (outstanding) 260.000 Long-term debt 500,000 Comunon stock ,000 Retained earnings 80.000 Total 2,300,000 Note: The Company has 10,000 common stock outstanding in 2021 Dec 31, 2021 (in 3) 600,000 200,000 210.000 900,000 600,000 2,510,000 870,000 310.000 500,000 600,000 230,000 2,510,000 Required 20. Based on the above financial Statements, caldulate recured RATIOS indicated in Column 5 (for 2021). (20 marks) 23. Comment on BK Corp's performance on the basis of your calculations and comparison with the industry average (fill Column 6 & 2) (10 matky 20. Display the following ratio throuxa trend charts should contain ratios 10192020- 2021 with industry comparison) - Inventory turnover, Average collection period. Debt Equity ratio and Larnings pershare. tak 2. You have you been provided the following data for which you have been asked to compute various ratios for 2021 and comment on them based on a comparison to the Industry Average and Trend over the years. BK Corp Income Statement for the Year Ended, December 31, 2011 Sales Less: 6). Costof goods sold (ii). Operating expenses (iii). Non-operating expenses Netincome before Tax Less: Tax (20%) Netincome after Tax BK Corp Balance Sheet as at December 31, 2020 and 2021 (in $) 1,000,000 600,000 90,000 70,000 240,000 48,000 192,000 Dec. 31, 2020 ASSETS in ) Cashat Bank 500,000 Accounts receivable 250,000 Inventory 200,000 Plant and Equipment 750,000 Land 600,000 Total 2300,000 LABILITIES & SHAREHOLDERS EQUITY Accounts payable 760,000 Taxes payable (outstanding) 260.000 Long-term debt 500,000 Comunon stock ,000 Retained earnings 80.000 Total 2,300,000 Note: The Company has 10,000 common stock outstanding in 2021 Dec 31, 2021 (in 3) 600,000 200,000 210.000 900,000 600,000 2,510,000 870,000 310.000 500,000 600,000 230,000 2,510,000 Required 20. Based on the above financial Statements, caldulate recured RATIOS indicated in Column 5 (for 2021). (20 marks) 23. Comment on BK Corp's performance on the basis of your calculations and comparison with the industry average (fill Column 6 & 2) (10 matky 20. Display the following ratio throuxa trend charts should contain ratios 10192020- 2021 with industry comparison) - Inventory turnover, Average collection period. Debt Equity ratio and Larnings pershare. tak