Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer 4 and 5(a,b,c). Thank you! 4. One year ago, a U.S. investor converted dollars to yen and purchased 50 shares of stock in

Please answer 4 and 5(a,b,c). Thank you!

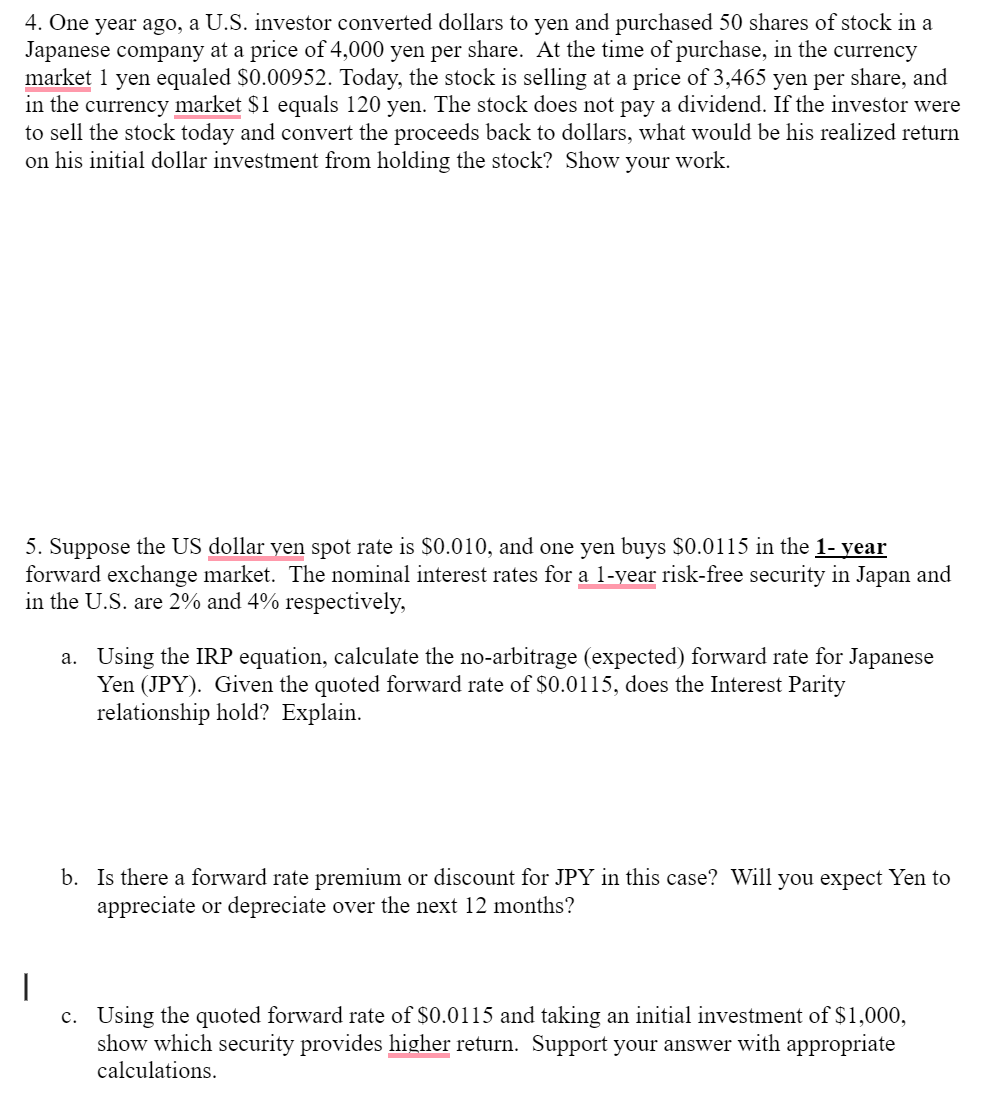

4. One year ago, a U.S. investor converted dollars to yen and purchased 50 shares of stock in a Japanese company at a price of 4,000 yen per share. At the time of purchase, in the currency market 1 yen equaled $0.00952. Today, the stock is selling at a price of 3,465 yen per share, and in the currency market $1 equals 120 yen. The stock does not pay a dividend. If the investor were to sell the stock today and convert the proceeds back to dollars, what would be his realized return on his initial dollar investment from holding the stock? Show your work. 5. Suppose the US dollar yen spot rate is $0.010, and one yen buys $0.0115 in the 1 - year forward exchange market. The nominal interest rates for a 1-year risk-free security in Japan and in the U.S. are 2% and 4% respectively, a. Using the IRP equation, calculate the no-arbitrage (expected) forward rate for Japanese Yen (JPY). Given the quoted forward rate of $0.0115, does the Interest Parity relationship hold? Explain. b. Is there a forward rate premium or discount for JPY in this case? Will you expect Yen to appreciate or depreciate over the next 12 months? c. Using the quoted forward rate of $0.0115 and taking an initial investment of $1,000, show which security provides higher return. Support your answer with appropriate calculationsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started