Please answer (a), (b), (c), (d), (e) and (f)

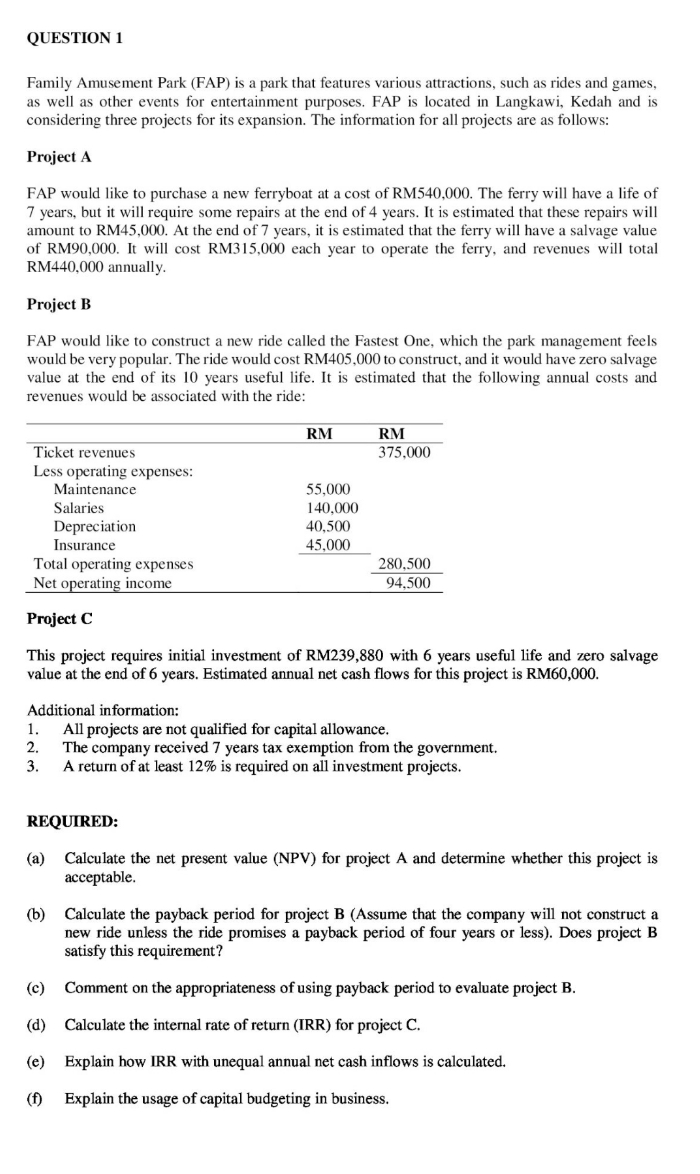

QUESTION 1 Family Amusement Park (FAP) is a park that features various attractions, such as rides and games, as well as other events for entertainment purposes. FAP is located in Langkawi, Kedah and is considering three projects for its expansion. The information for all projects are as follows: Project A FAP would like to purchase a new ferryboat at a cost of RM540,000. The ferry will have a life of 7 years, but it will require some repairs at the end of 4 years. It is estimated that these repairs will amount to RM45,000. At the end of 7 years, it is estimated that the ferry will have a salvage value of RM90,000. It will cost RM315,000 each year to operate the ferry, and revenues will total RM440,000 annually. Project B FAP would like to construct a new ride called the Fastest One, which the park management feels would be very popular. The ride would cost RM405,000 to construct, and it would have zero salvage value at the end of its 10 years useful life. It is estimated that the following annual costs and revenues would be associated with the ride: RM RM Ticket revenues 375,000 Less operating expenses: Maintenance 55,000 Salaries 140,000 Depreciation 40,500 Insurance 45,000 Total operating expenses 280.500 Net operating income 94,500 Project C This project requires initial investment of RM239,880 with 6 years useful life and zero salvage value at the end of 6 years. Estimated annual net cash flows for this project is RM60,000. Additional information: 1. All projects are not qualified for capital allowance. 2. The company received 7 years tax exemption from the government. 3. A return of at least 12% is required on all investment projects. REQUIRED: (a) Calculate the net present value (NPV) for project A and determine whether this project is acceptable. (b) Calculate the payback period for project B (Assume that the company will not construct a new ride unless the ride promises a payback period of four years or less). Does project B satisfy this requirement? (c) Comment on the appropriateness of using payback period to evaluate project B. (d) Calculate the internal rate of return (IRR) for project C. (e) Explain how IRR with unequal annual net cash inflows is calculated. (f) Explain the usage of capital budgeting in business