Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer A & B (Cash conversion cycle) Historical data for the firm's sales, accounts receivable, Inventories, and accounts payable for the Crimson Mig Company

please answer A & B

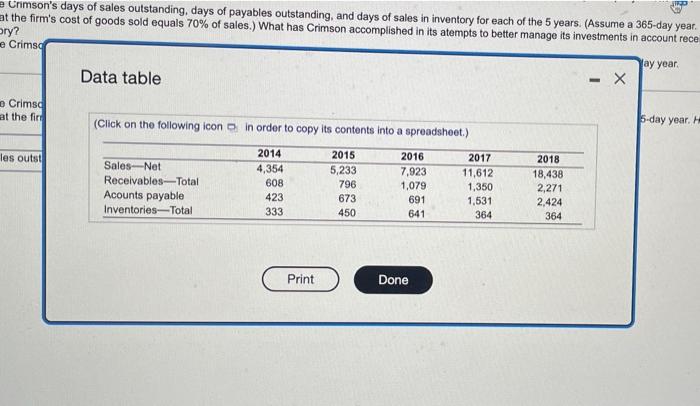

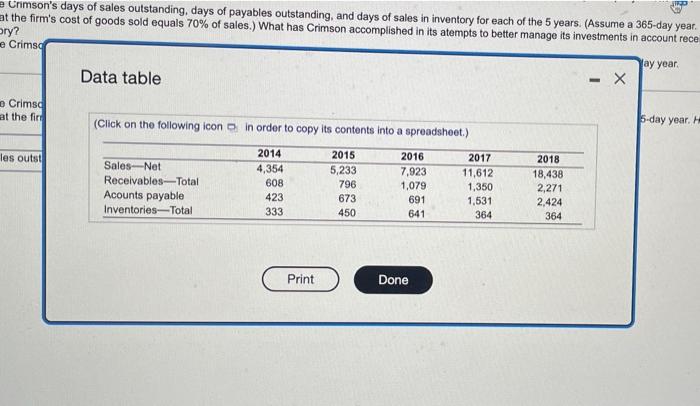

(Cash conversion cycle) Historical data for the firm's sales, accounts receivable, Inventories, and accounts payable for the Crimson Mig Company follow I a. Calculate Crimson's days of sales outstanding, days of payables outstanding, and days of sales in inventory for each of the 5 years. (Assume a 365-day year. Hint Assume that the firm's cost of goods sold equals 70% of sales.) What has Crimson accomplished in its atempts to better manage its investments in account receivable and inventory? b. Calculate Crimson's cash conversion cycle for each of the 5 years. Evaluate the firm's overall management of its working capital. Assume a 365-day year. a. Calculate Crimson's days of sales outstanding, days of payables outstanding, and days of sales in inventory for each of the 5 years. Assume a 365-day year. Hint: Assume that the firm's cost of goods sold equals 70% of sales. (Round to two decimal places.) 2015 2016 Days of sales outstanding (DSO) 2014 2017 2018 = Urmson's days of sales outstanding days of payables outstanding, and days of sales in inventory for each of the 5 years. (Assume a 365-day year. at the firm's cost of goods sold equals 70% of sales.) What has Crimson accomplished in its atempts to better manage its investments in account rece ory? e Crims lay year - X Data table Crimsd at the fire (Click on the following icon in order to copy its contents into a spreadsheet.) 5-day year. les outst Sales Net Receivables-Total Acounts payable Inventories-Total 2014 4,354 608 423 333 2015 5,233 796 673 450 2016 7,923 1,079 691 641 2017 11,612 1,350 1,531 364 2018 18,438 2,271 2,424 364 Print Done

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started