Please answer A-G

Please answer A-G

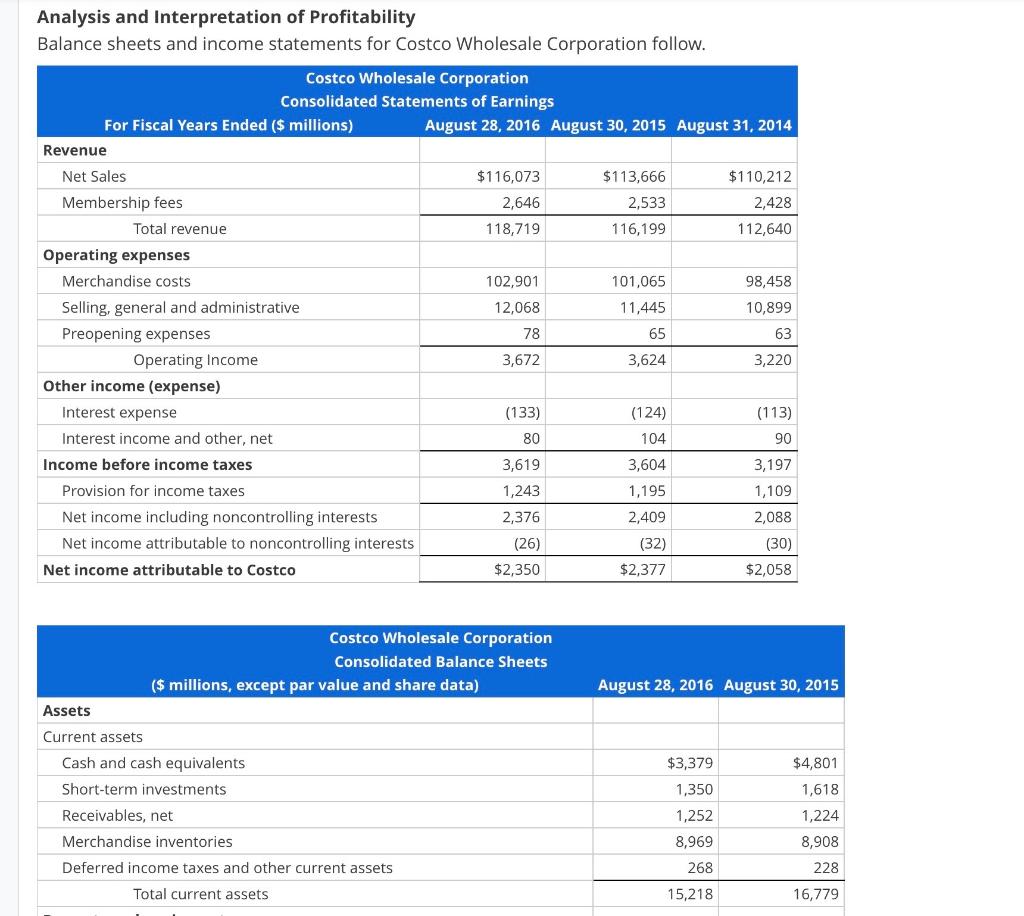

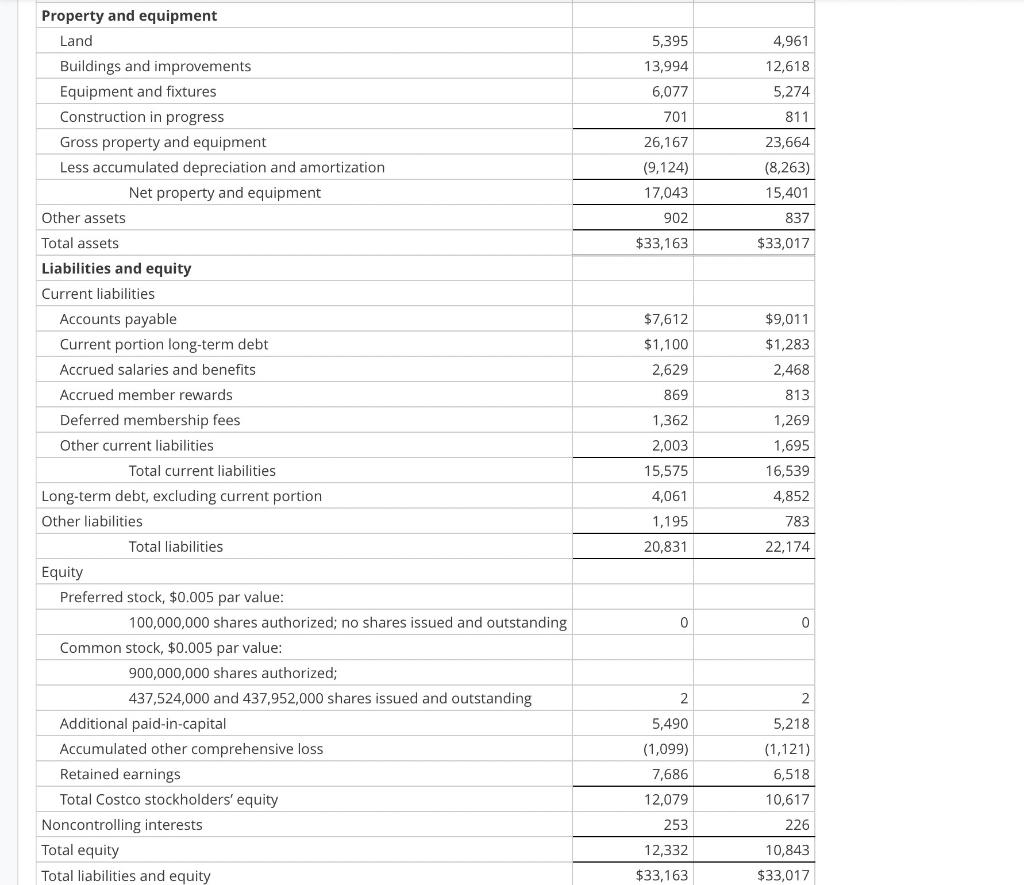

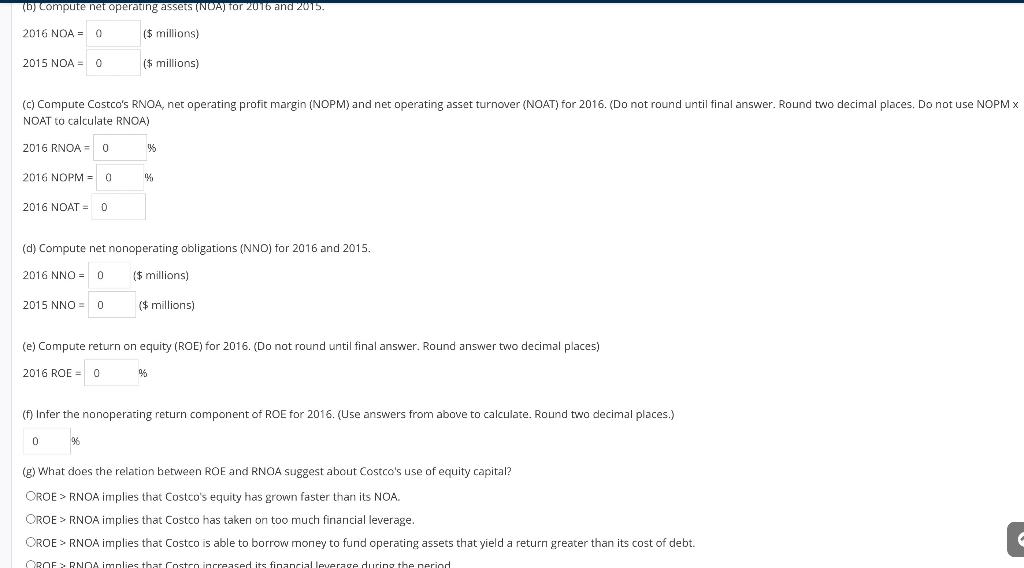

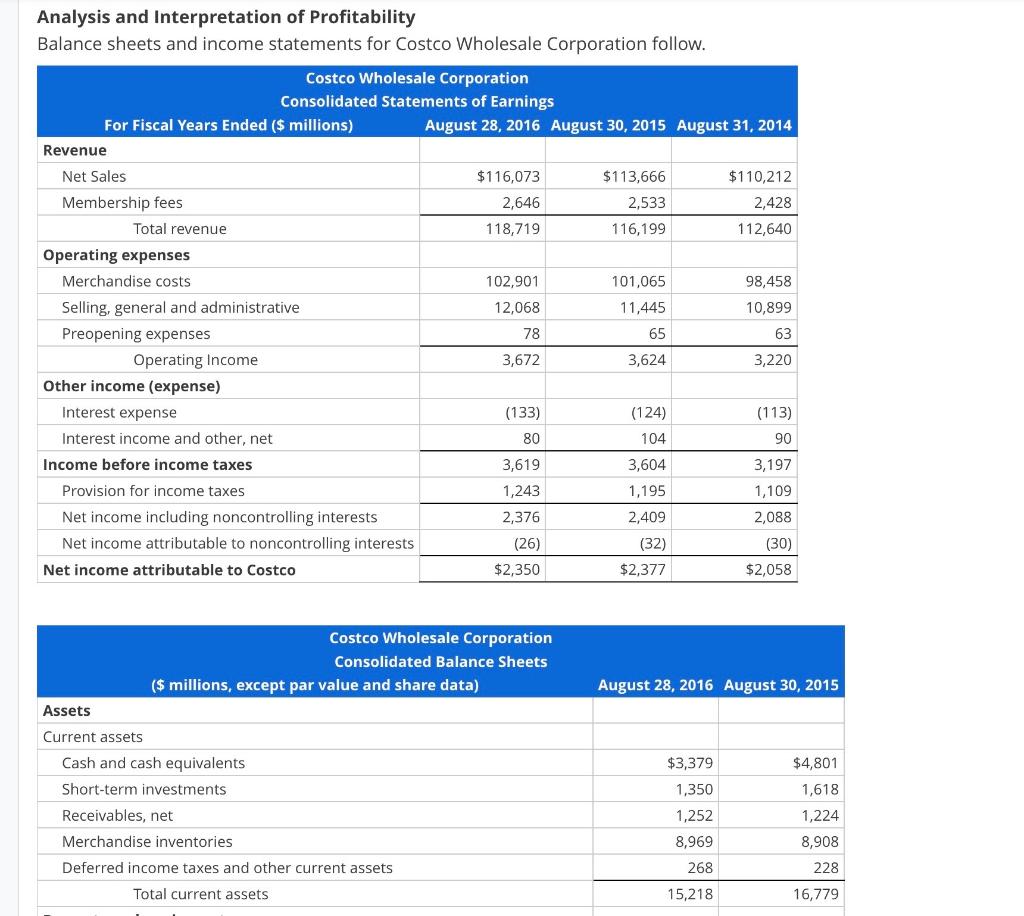

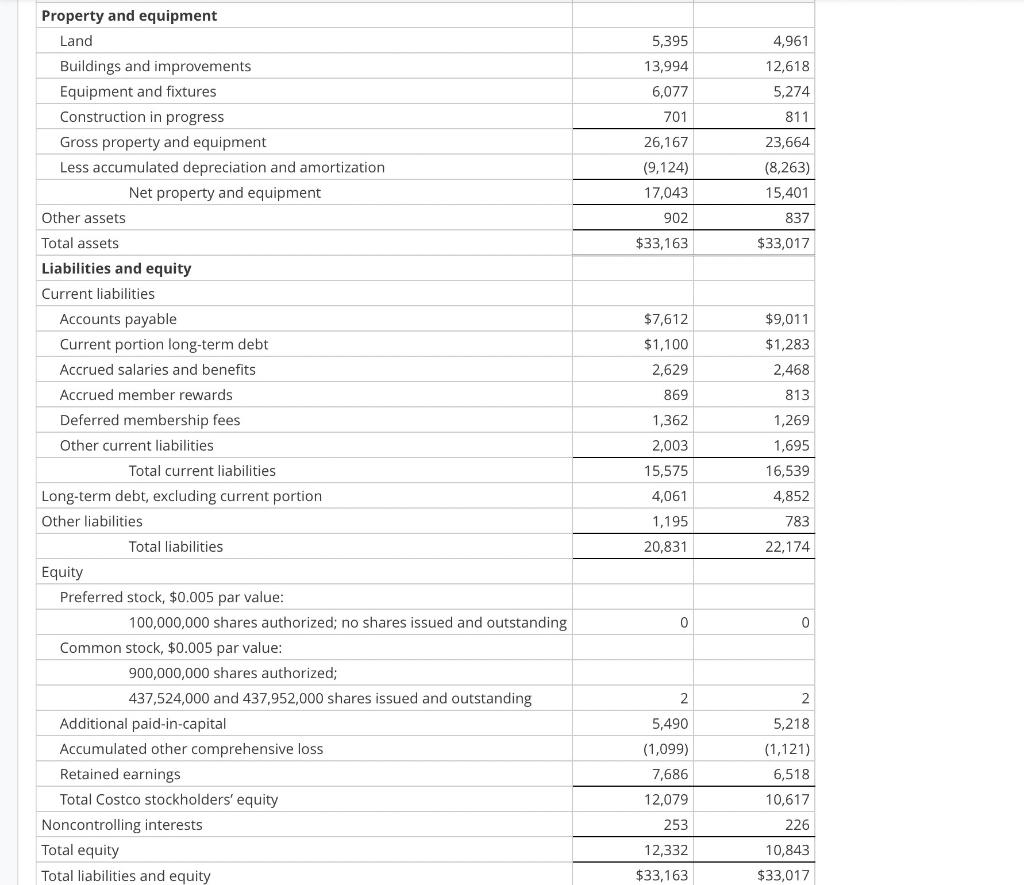

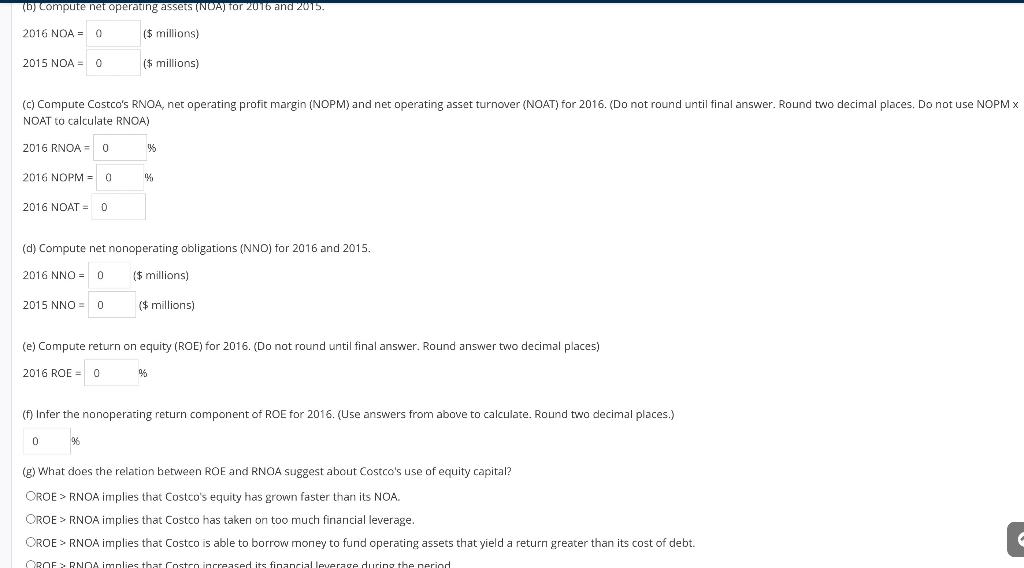

Analysis and Interpretation of Profitability Balance sheets and income statements for Costco Wholesale Corporation follow. (b) Compute net operating assets (NOA) tor 2016 and 2015. 2016NOA=2015NOA=($millions)($millions) (c) Compute Costco's RNOA, net operating profit margin (NOPM) and net operating asset turnover (NOAT) for 2016. (Do not round until final answer. Round two decimal places. Do not use NOPM x NOAT to calculate RNOA) 2016RNOA=2016NOPM=2016NOAT=$3$% (d) Compute net nonoperating obligations (NNO) for 2016 and 2015. 2016NNO=2015NNO=($millions)($millions) (e) Compute return on equity (ROE) for 2016. (Do not round until final answer. Round answer two decimal places) 2016ROE=35 (f) Infer the nonoperating return component of ROE for 2016. (Use answers from above to calculate. Round two decimal places.) as (g) What does the relation between ROE and RNOA suggest about Costco's use of equity capital? OROE > RNOA implies that Costco's equity has grown faster than its NOA. ROE > RNOA implies that Costco has taken on too much financial leverage. OROE > RNOA implies that Costco is able to borrow money to fund operating assets that yield a return greater than its cost of debt. Analysis and Interpretation of Profitability Balance sheets and income statements for Costco Wholesale Corporation follow. (b) Compute net operating assets (NOA) tor 2016 and 2015. 2016NOA=2015NOA=($millions)($millions) (c) Compute Costco's RNOA, net operating profit margin (NOPM) and net operating asset turnover (NOAT) for 2016. (Do not round until final answer. Round two decimal places. Do not use NOPM x NOAT to calculate RNOA) 2016RNOA=2016NOPM=2016NOAT=$3$% (d) Compute net nonoperating obligations (NNO) for 2016 and 2015. 2016NNO=2015NNO=($millions)($millions) (e) Compute return on equity (ROE) for 2016. (Do not round until final answer. Round answer two decimal places) 2016ROE=35 (f) Infer the nonoperating return component of ROE for 2016. (Use answers from above to calculate. Round two decimal places.) as (g) What does the relation between ROE and RNOA suggest about Costco's use of equity capital? OROE > RNOA implies that Costco's equity has grown faster than its NOA. ROE > RNOA implies that Costco has taken on too much financial leverage. OROE > RNOA implies that Costco is able to borrow money to fund operating assets that yield a return greater than its cost of debt

Please answer A-G

Please answer A-G