Answered step by step

Verified Expert Solution

Question

1 Approved Answer

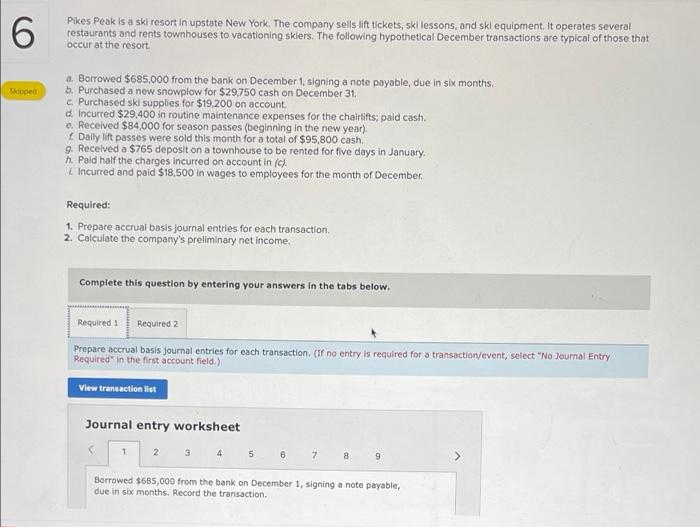

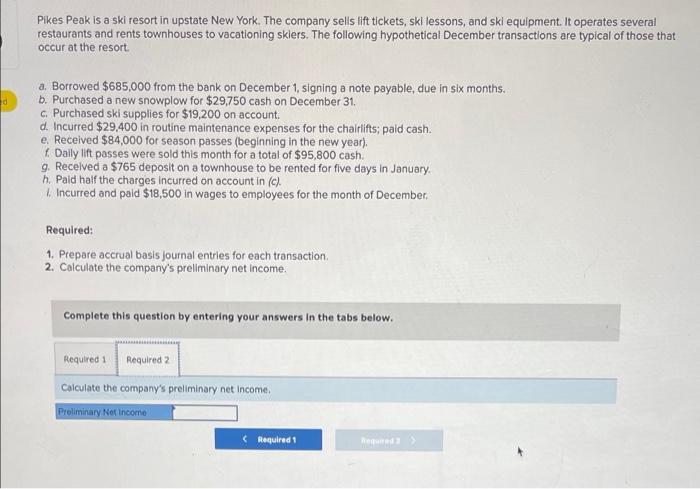

please answer A-I on the journal entry part 2 6 Pikes Peak is a ski resort in upstate New York. The company sells lift tickets,

please answer A-I on the journal entry

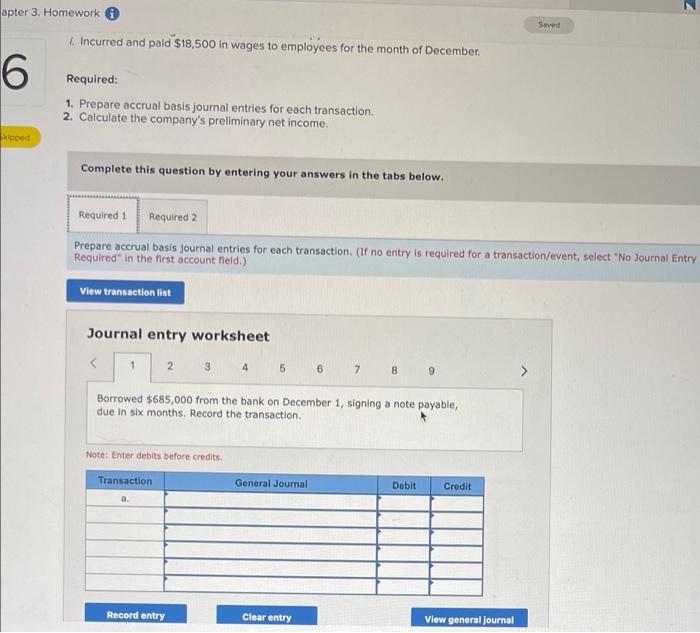

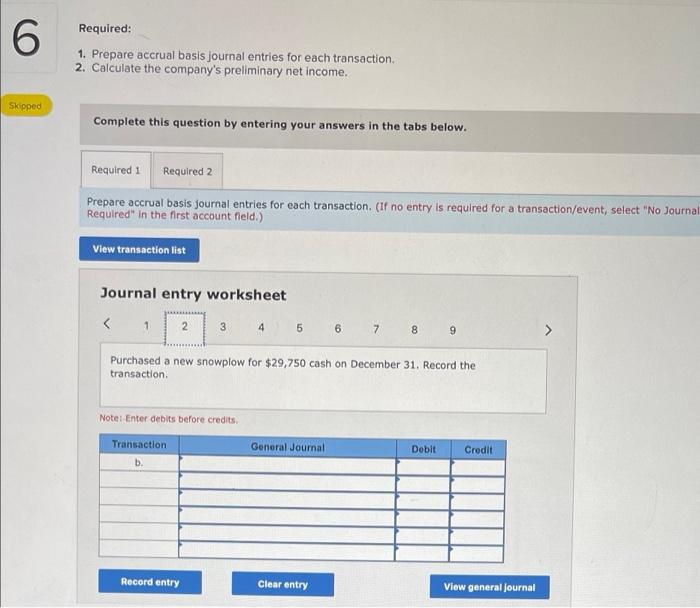

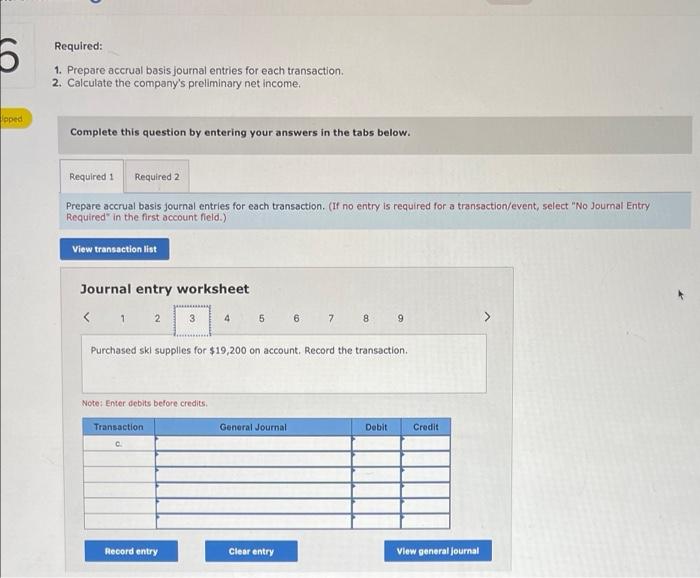

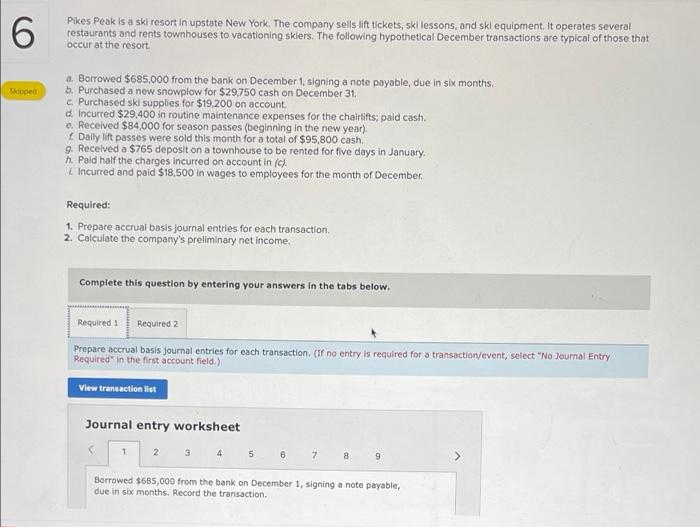

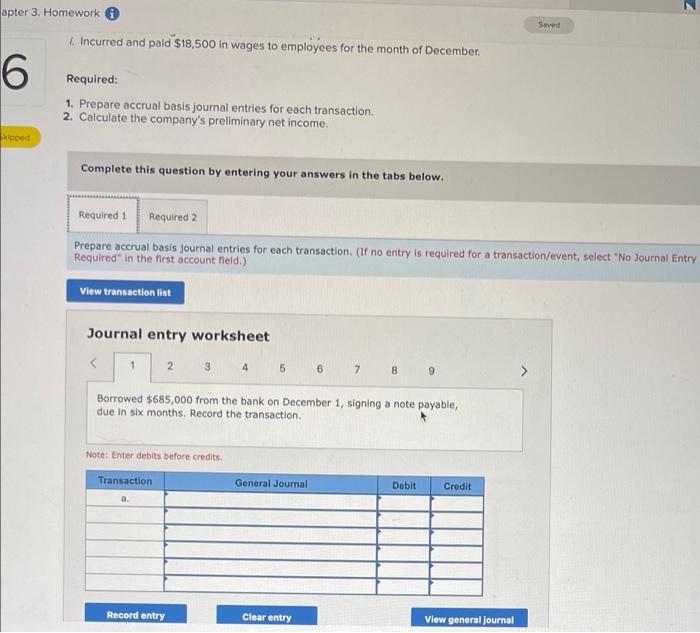

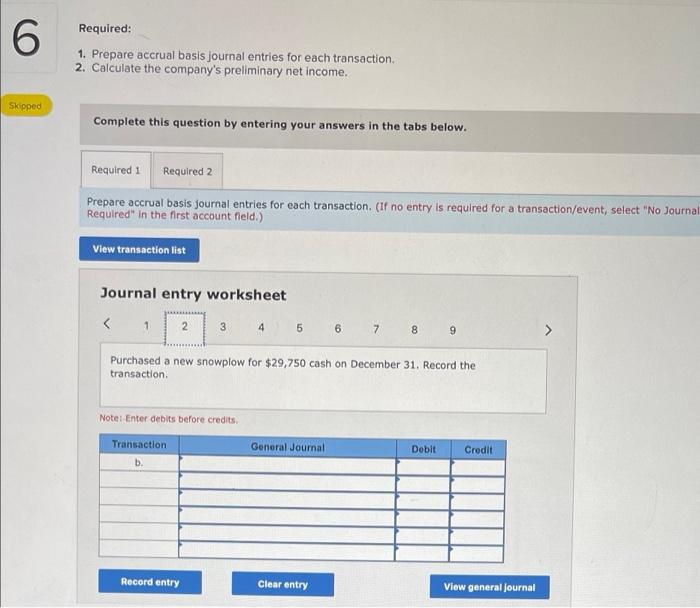

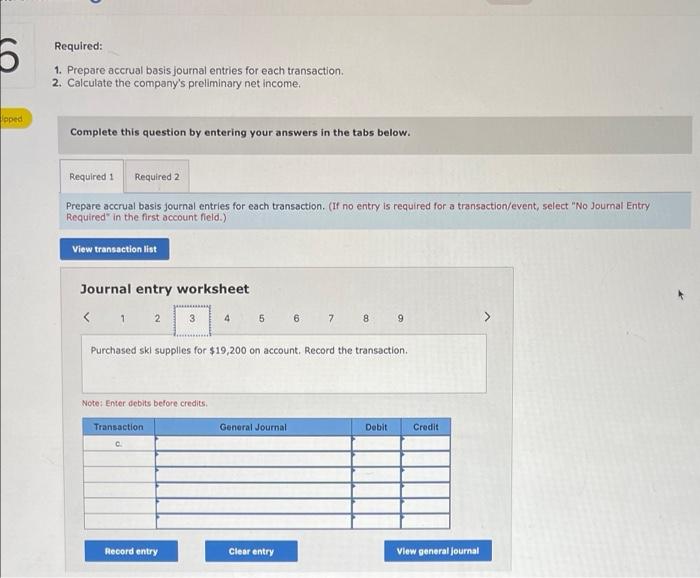

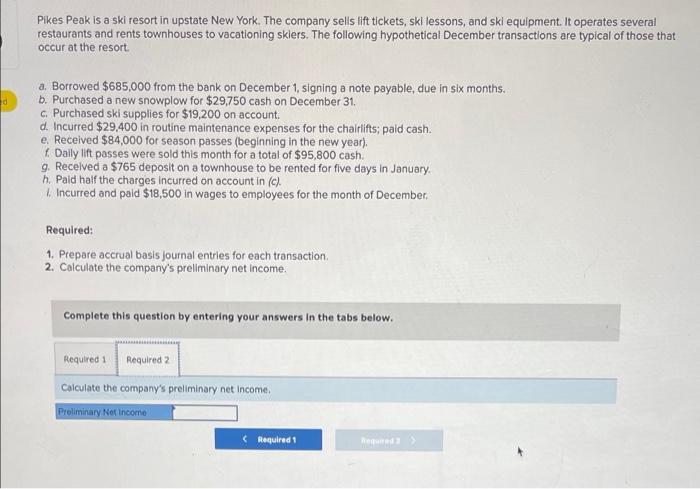

6 Pikes Peak is a ski resort in upstate New York. The company sells lift tickets, ski lessons, and skl equipment. It operates several restaurants and rents townhouses to vacationing skers. The following hypothetical December transactions are typical of those that occur at the resort Skipped 4. Borrowed $685,000 from the bank on December 1, signing a note payable, due in six months b. Purchased a new snowplow for $29,750 cash on December 31 c Purchased ski supplies for $19,200 on account. & Incurred $29.400 in routine maintenance expenses for the chairlifts; paid cash. e. Received $84,000 for season passes (beginning in the new year) Daily lift passes were sold this month for a total of $95,800 cash 9. Received a $765 deposit on a townhouse to be rented for five days in January h. Pald half the charges incurred on account in (c) Lincurred and paid $18,500 in wages to employees for the month of December Required: 1. Prepare accrual basis journal entries for each transaction. 2. Calculate the company's preliminary net income. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare accrual basis journal entries for each transaction. (If no entry is required for a transaction/event, select "No Journal Entry Required in the first account field.) View transaction list Journal entry worksheet 1 2 3 5 8 9 Borrowed $685,000 from the bank on December 1, signing a note payable, due in six months. Record the transaction. apter 3. Homework Saved Incurred and paid $18,500 in wages to employees for the month of December. 6 Required: 1. Prepare accrual basis journal entries for each transaction. 2. Calculate the company's preliminary net income. oped Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare accrual basis journal entries for each transaction. (If no entry is required for a transaction/event, select "No Journal Entry Required in the first account field.) View transaction list Journal entry worksheet 1 2 3 4 5 6 7 8 9 Borrowed $685,000 from the bank on December 1, signing a note payable, due in six months. Record the transaction. Note: Enter debits before credits. Transaction General Journal Dobit Credit a. Record entry Clear entry View general Journal 6 Required: 1. Prepare accrual basis journal entries for each transaction 2. Calculate the company's preliminary net income. Skipped Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare accrual basis journal entries for each transaction. (If no entry is required for a transaction/event, select "No Journal Required in the first account field.) View transaction list Journal entry worksheet

part 2

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started