Question: please answer all 1-45 and I will upvote immediately! thank you so much! TRUE/FALSE - Write ' T if the statement is true and '

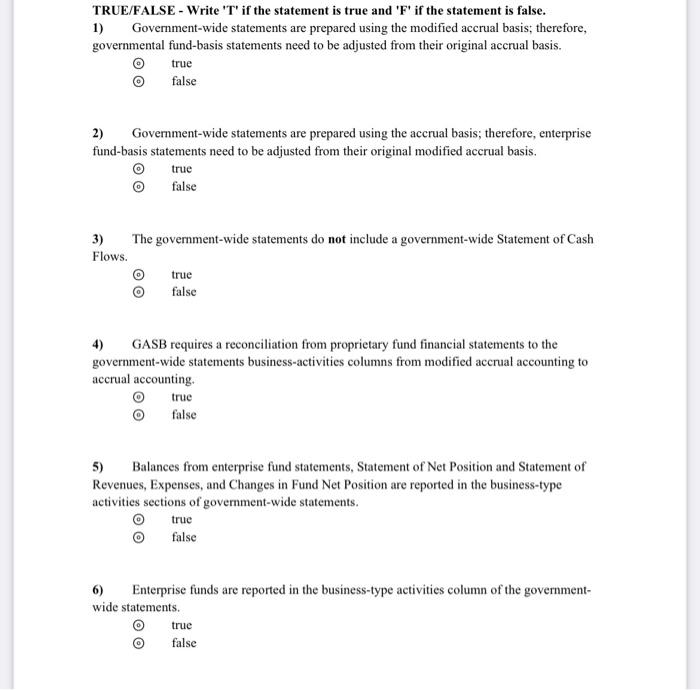

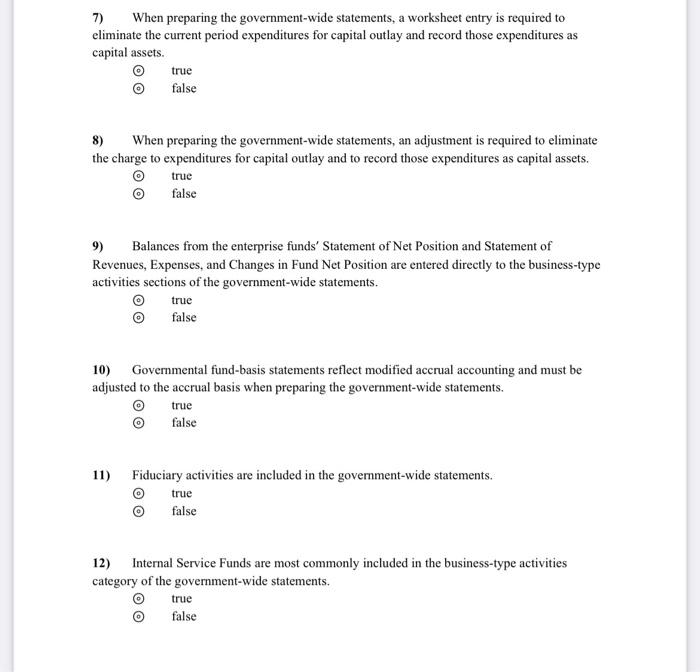

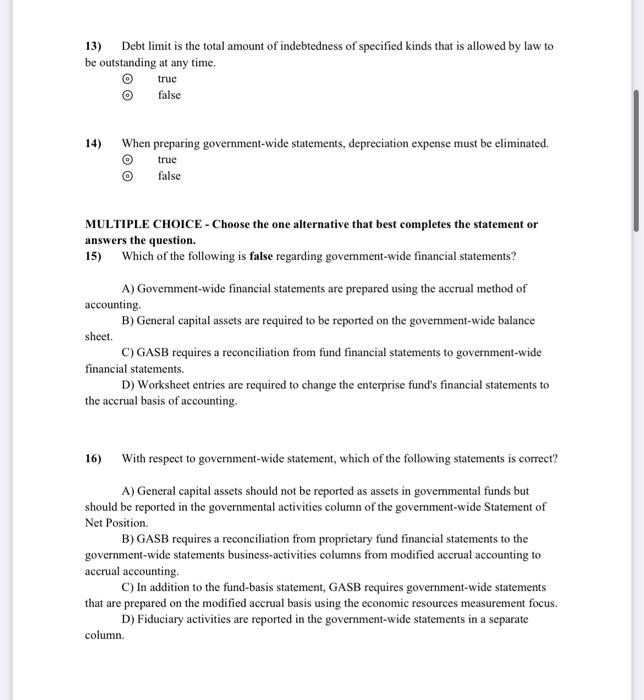

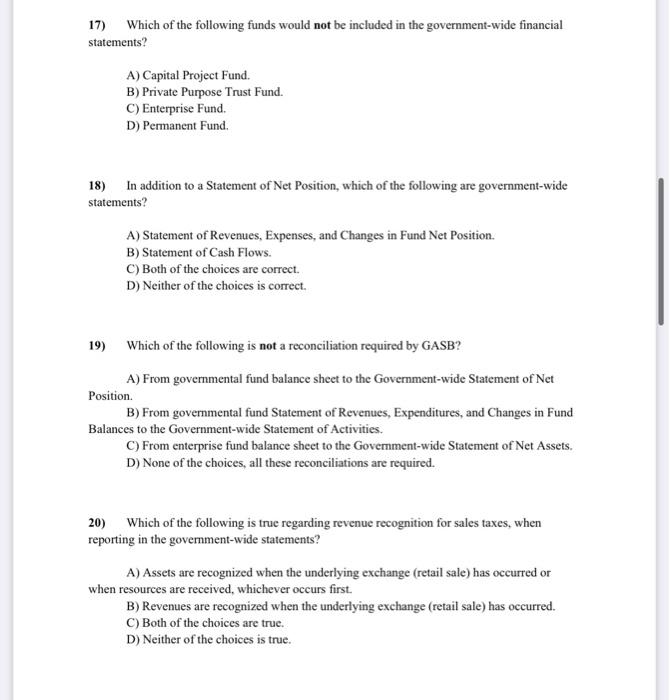

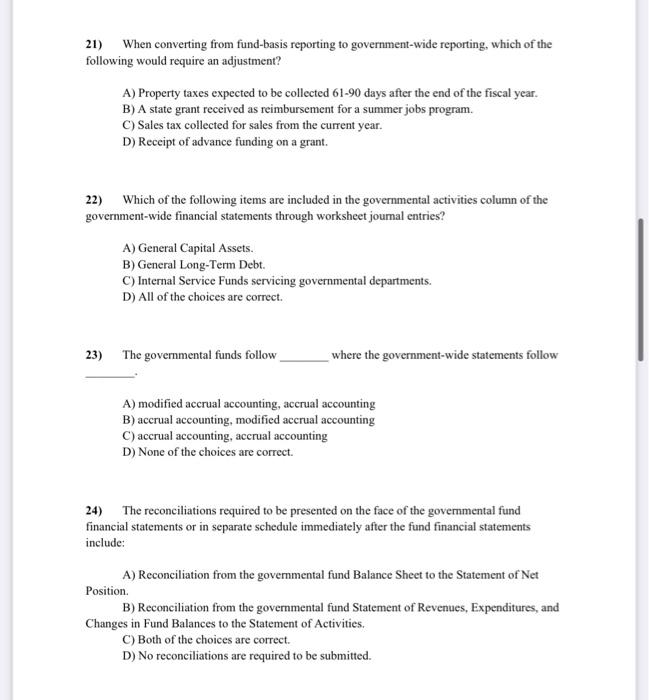

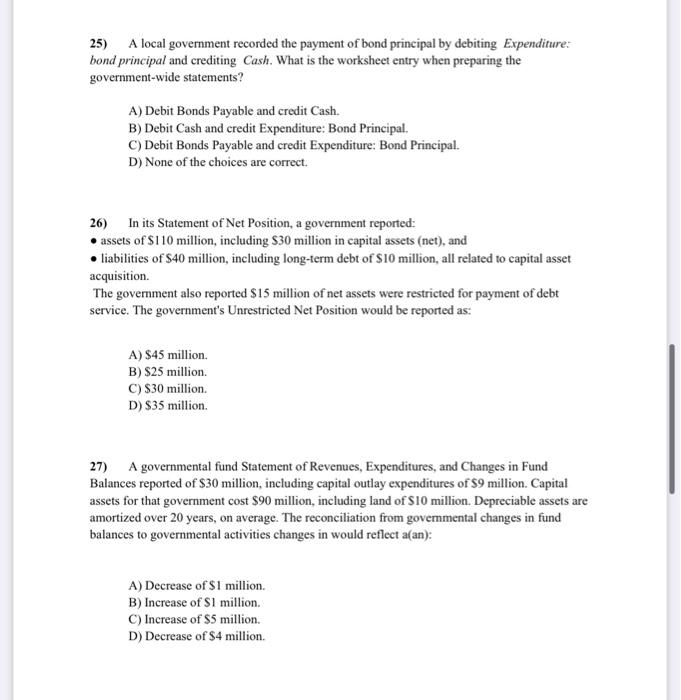

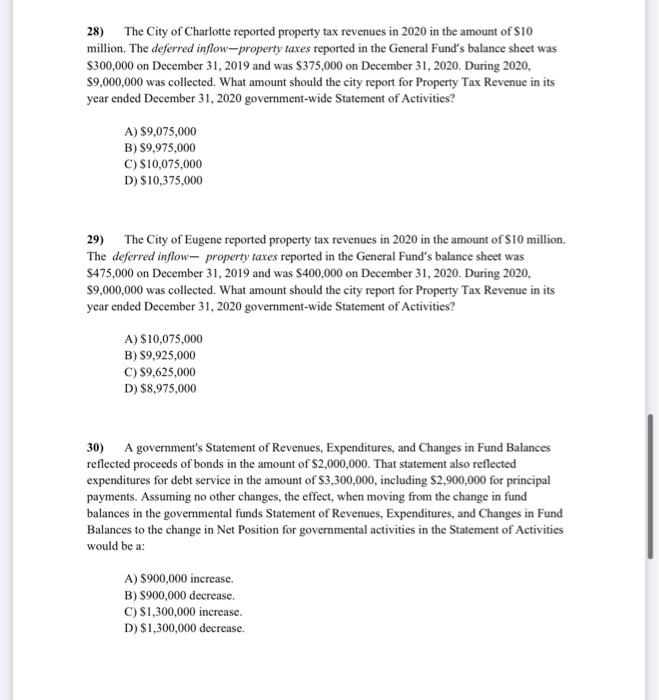

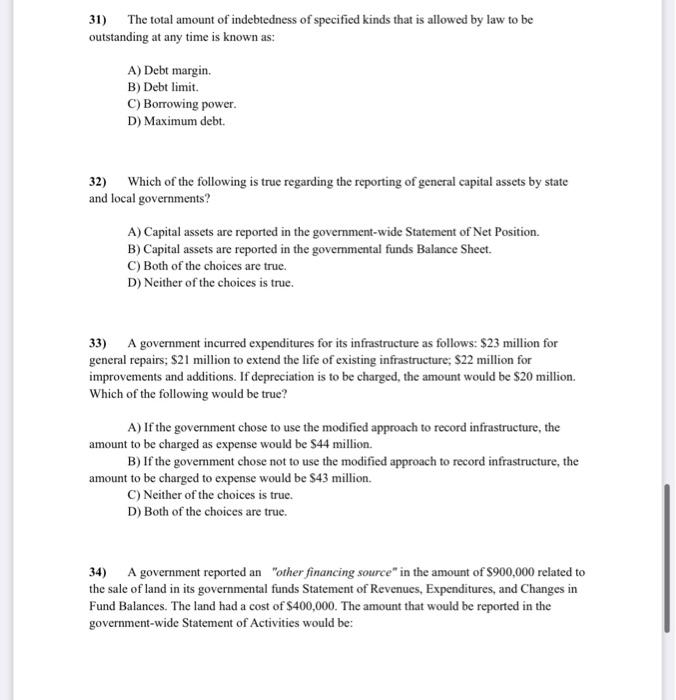

TRUE/FALSE - Write ' T if the statement is true and ' F if the statement is false. 1) Government-wide statements are prepared using the modified accrual basis; therefore, governmental fund-basis statements need to be adjusted from their original accrual basis. true false 2) Government-wide statements are prepared using the accrual basis; therefore, enterprise fund-basis statements need to be adjusted from their original modified accrual basis. true false 3) The government-wide statements do not include a government-wide Statement of Cash Flows. true false 4) GASB requires a reconciliation from proprietary fund financial statements to the government-wide statements business-activities columns from modified accrual accounting to accrual accounting. true false 5) Balances from enterprise fund statements, Statement of Net Position and Statement of Revenues, Expenses, and Changes in Fund Net Position are reported in the business-type activities sections of government-wide statements. true false 6) Enterprise funds are reported in the business-type activities column of the governmentwide statements. true false 7) When preparing the government-wide statements, a worksheet entry is required to eliminate the current period expenditures for capital outlay and record those expenditures as capital assets. true false 8) When preparing the government-wide statements, an adjustment is required to eliminate the charge to expenditures for capital outlay and to record those expenditures as capital assets. true false 9) Balances from the enterprise funds' Statement of Net Position and Statement of Revenues, Expenses, and Changes in Fund Net Position are entered directly to the business-type activities sections of the government-wide statements. true false 10) Governmental fund-basis statements reflect modified accrual accounting and must be adjusted to the accrual basis when preparing the government-wide statements. true false 11) Fiduciary activities are included in the government-wide statements. true false 12) Internal Service Funds are most commonly included in the business-type activities category of the government-wide statements. true false 13) Debt limit is the total amount of indebtedness of specified kinds that is allowed by law to be outstanding at any time. true false 14) When preparing government-wide statements, depreciation expense must be eliminated. true false MULTIPLE CHOICE - Choose the one alternative that best completes the statement or answers the question. 15) Which of the following is false regarding government-wide financial statements? A) Government-wide financial statements are prepared using the accrual method of accounting. B) General capital assets are required to be reported on the government-wide balance sheet. C) GASB requires a reconciliation from fund financial statements to government-wide financial statements. D) Worksheet entries are required to change the enterprise fund's financial statements to the accrual basis of accounting. 16) With respect to government-wide statement, which of the following statements is correct? A) General capital assets should not be reported as assets in governmental funds but should be reported in the governmental activities column of the government-wide Statement of Net Position. B) GASB requires a reconciliation from proprietary fund financial statements to the government-wide statements business-activities columns from modified accrual accounting to accrual accounting. C) In addition to the fund-basis statement, GASB requires government-wide statements that are prepared on the modified accrual basis using the economic resources measurement focus. D) Fiduciary activities are reported in the government-wide statements in a separate column. 17) Which of the following funds would not be included in the government-wide financial statements? A) Capital Project Fund. B) Private Purpose Trust Fund. C) Enterprise Fund. D) Permanent Fund. 18) In addition to a Statement of Net Position, which of the following are government-wide statements? A) Statement of Revenues, Expenses, and Changes in Fund Net Position. B) Statement of Cash Flows. C) Both of the choices are correct. D) Neither of the choices is correct. 19) Which of the following is not a reconciliation required by GASB? A) From governmental fund balance sheet to the Government-wide Statement of Net Position. B) From governmental fund Statement of Revenues, Expenditures, and Changes in Fund Balances to the Government-wide Statement of Activities. C) From enterprise fund balance sheet to the Government-wide Statement of Net Assets. D) None of the choices, all these reconciliations are required. 20) Which of the following is true regarding revenue recognition for sales taxes, when reporting in the government-wide statements? A) Assets are recognized when the underlying exchange (retail sale) has occurred or when resources are received, whichever occurs first. B) Revenues are recognized when the underlying exchange (retail sale) has occurred. C) Both of the choices are true. D) Neither of the choices is true. 21) When converting from fund-basis reporting to government-wide reporting, which of the following would require an adjustment? A) Property taxes expected to be collected 61-90 days after the end of the fiscal year. B) A state grant received as reimbursement for a summer jobs program. C) Sales tax collected for sales from the current year. D) Receipt of advance funding on a grant. 22) Which of the following items are included in the governmental activities column of the government-wide financial statements through worksheet journal entries? A) General Capital Assets. B) General Long-Term Debt. C) Internal Service Funds servicing governmental departments. D) All of the choices are correct. 23) The governmental funds follow where the government-wide statements follow A) modified accrual accounting, accrual accounting B) accrual accounting, modified accrual accounting C) accrual accounting, accrual accounting D) None of the choices are correct. 24) The reconciliations required to be presented on the face of the govermmental fund financial statements or in separate schedule immediately after the fund financial statements include: A) Reconciliation from the governmental fund Balance Sheet to the Statement of Net Position. B) Reconciliation from the governmental fund Statement of Revenues, Expenditures, and Changes in Fund Balances to the Statement of Activities. C) Both of the choices are correct. D) No reconciliations are required to be submitted. 25) A local government recorded the payment of bond principal by debiting Expenditure: bond principal and crediting Cash. What is the worksheet entry when preparing the government-wide statements? A) Debit Bonds Payable and credit Cash. B) Debit Cash and credit Expenditure: Bond Principal. C) Debit Bonds Payable and credit Expenditure: Bond Principal. D) None of the choices are correct. 26) In its Statement of Net Position, a government reported: - assets of \$110 million, including \$30 million in capital assets (net), and - liabilities of $40 million, including long-term debt of $10 million, all related to capital asset acquisition. The government also reported $15 million of net assets were restricted for payment of debt service. The government's Unrestricted Net Position would be reported as: A) $45 million. B) $25 million. C) $30 million. D) $35 million. 27) A governmental fund Statement of Revenues, Expenditures, and Changes in Fund Balances reported of $30 million, including capital outlay expenditures of $9 million. Capital assets for that government cost $90 million, including land of $10 million. Depreciable assets are amortized over 20 years, on average. The reconciliation from govemmental changes in fund balances to governmental activities changes in would reflect a(an): A) Decrease of $1 million. B) Increase of $1 million. C) Increase of $5 million. D) Decrease of $4 million. 28) The City of Charlotte reported property tax revenues in 2020 in the amount of $10 million. The deferred inflow-property taxes reported in the General Fund's balance sheet was $300,000 on December 31,2019 and was $375,000 on December 31, 2020. During 2020 , $9,000,000 was collected. What amount should the city report for Property Tax Revenue in its year ended December 31, 2020 government-wide Statement of Activities? A) $9,075,000 B) $9,975,000 C) $10,075,000 D) $10,375,000 29) The City of Eugene reported property tax revenues in 2020 in the amount of $10 million. The deferred inflow- property taxes reported in the General Fund's balance sheet was $475,000 on December 31,2019 and was $400,000 on December 31,2020 . During 2020 , $9,000,000 was collected. What amount should the city report for Property Tax Revenue in its year ended December 31, 2020 government-wide Statement of Activities? A) $10,075,000 B) $9,925,000 C) $9,625,000 D) $8,975,000 30) A government's Statement of Revenues, Expenditures, and Changes in Fund Balances reflected proceeds of bonds in the amount of $2,000,000. That statement also reflected expenditures for debt service in the amount of $3,300,000, including $2,900,000 for principal payments. Assuming no other changes, the effect, when moving from the change in fund balances in the governmental funds Statement of Revenues, Expenditures, and Changes in Fund Balances to the change in Net Position for governmental activities in the Statement of Activities would be a: A) $900,000 increase. B) $900,000 decrease. C) $1,300,000 increase. D) $1,300,000 decrease. 31) The total amount of indebtedness of specified kinds that is allowed by law to be outstanding at any time is known as: A) Debt margin. B) Debt limit. C) Borrowing power. D) Maximum debt. 32) Which of the following is true regarding the reporting of general capital assets by state and local governments? A) Capital assets are reported in the government-wide Statement of Net Position. B) Capital assets are reported in the governmental funds Balance Sheet. C) Both of the choices are true. D) Neither of the choices is true. 33) A government incurred expenditures for its infrastructure as follows: $23 million for general repairs; $21 million to extend the life of existing infrastructure; $22 million for improvements and additions. If depreciation is to be charged, the amount would be $20 million. Which of the following would be true? A) If the government chose to use the modified approach to record infrastructure, the amount to be charged as expense would be $44 million. B) If the government chose not to use the modified approach to record infrastructure, the amount to be charged to expense would be $43 million. C) Neither of the choices is true. D) Both of the choices are true. 34) A government reported an "other financing source" in the amount of $900,000 related to the sale of land in its governmental funds Statement of Revenues, Expenditures, and Changes in Fund Balances. The land had a cost of $400,000. The amount that would be reported in the government-wide Statement of Activities would be: 34) A government reported an "other financing source" in the amount of $900,000 related to the sale of land in its goveramental funds Statement of Revenues, Expenditures, and Changes in Fund Balances. The land had a cost of $400,000. The amount that would be reported in the government-wide Statement of Activities would be: Version 1 8 A) a gain of 51,300,000. B) a gain of $900,000. C) a gain of $500,000. D) a gain of $400,000. 35) A government recorded transfers out of the General Fund to the debt service fund in the amount of $300,000 and to the enterprise fund in the amount of $450,000. The amount that would be shown as a transfer in the governmental activities column of the Statement of Activities would be: A) $750,000. B) $450,000. C) $300,000. D) $0. 36) The City of Casper levied property taxes for 2020 in the amount of $9,000,000. By the end of the year, $7,200,000 had been collected. It was estimated that $500,000 would be collected during the next 60 days of 2020 and that $240,000 would be collected after that and the remainder would be uncollectible. The City has a policy of recognizing the full amount possible for property taxes. Which of the following statements is true? A) The arnount reported for property tax revenue in the government-wide Statement of Activities would be 57,700,000. B) The amount reported for property tax revenue in the governmental fund Statement of Revenues, Expenditures, and Changes in Fund Balances would be $7,940,000. C) Both of the choices are true. D) None of the choices are true. 37) A government's Statement of Revenues, Expenditures, and Changes in Fund Balances reported proceeds of bonds in the amount of $2,000,000. It also reported expenditures for bond principal in the amount of $500,000. The last interest payment was on the last day of the fiscal year. The reconciliation from the govemmental funds changes in fund balances to the governmental activities change in Net Position would reflect a(an): Version 1 9 A) Increase of $1,500,000. B) Decrease of $1,500,000. C) Increase of $500,000. D) Decrease of $500,000. 38) A governmental fund's Statement of Revenues, Expenditures, and Changes in Fund Balances reported expenditures for capital outlay in the amount of $12,000,000. Capital assets for that govemnent cost $160,000,000, including $30,000.000 in land. Depreciable assets are amortized over 20 years, on average. The reconciliation from the govemmental funds changes in fund balances to the governmental activities change in Net Position would reflect a(an): A) Increase of $5.500,000. B) Decrease of $5,500,000. C) increase of S7,100,000, D) Decrease of $7.100.000. 39) When preparing government-wide statements, which of the following is not true? A) Gencral capital assets, gencral long-term debt, and internal service funds are added through worksheet journal entrics. B) Worksheet entries eliminate elements of the modified accrual basis fund statements that do not conform to accrual accounting, such as expenditures for capital assets and principal repayments. C) Entries are necessary to adjust revenues to the accrual basis, record expenses not recognized under the modified accrual basis. D) Entries are necessary to eliminate fiduciary funds. 34) A government reported an "other financing source" in the amount of $900,000 related to the sale of land in its goveramental funds Statement of Revenues, Expenditures, and Changes in Fund Balances. The land had a cost of $400,000. The amount that would be reported in the government-wide Statement of Activities would be: Version 1 8 A) a gain of 51,300,000. B) a gain of $900,000. C) a gain of $500,000. D) a gain of $400,000. 35) A government recorded transfers out of the General Fund to the debt service fund in the amount of $300,000 and to the enterprise fund in the amount of $450,000. The amount that would be shown as a transfer in the governmental activities column of the Statement of Activities would be: A) $750,000. B) $450,000. C) $300,000. D) $0. 36) The City of Casper levied property taxes for 2020 in the amount of $9,000,000. By the end of the year, $7,200,000 had been collected. It was estimated that $500,000 would be collected during the next 60 days of 2020 and that $240,000 would be collected after that and the remainder would be uncollectible. The City has a policy of recognizing the full amount possible for property taxes. Which of the following statements is true? A) The arnount reported for property tax revenue in the government-wide Statement of Activities would be 57,700,000. B) The amount reported for property tax revenue in the governmental fund Statement of Revenues, Expenditures, and Changes in Fund Balances would be $7,940,000. C) Both of the choices are true. D) None of the choices are true. 37) A government's Statement of Revenues, Expenditures, and Changes in Fund Balances reported proceeds of bonds in the amount of $2,000,000. It also reported expenditures for bond principal in the amount of $500,000. The last interest payment was on the last day of the fiscal year. The reconciliation from the govemmental funds changes in fund balances to the governmental activities change in Net Position would reflect a(an): Version 1 9 A) Increase of $1,500,000. B) Decrease of $1,500,000. C) Increase of $500,000. D) Decrease of $500,000. 38) A governmental fund's Statement of Revenues, Expenditures, and Changes in Fund Balances reported expenditures for capital outlay in the amount of $12,000,000. Capital assets for that govemnent cost $160,000,000, including $30,000.000 in land. Depreciable assets are amortized over 20 years, on average. The reconciliation from the govemmental funds changes in fund balances to the governmental activities change in Net Position would reflect a(an): A) Increase of $5.500,000. B) Decrease of $5,500,000. C) increase of S7,100,000, D) Decrease of $7.100.000. 39) When preparing government-wide statements, which of the following is not true? A) Gencral capital assets, gencral long-term debt, and internal service funds are added through worksheet journal entrics. B) Worksheet entries eliminate elements of the modified accrual basis fund statements that do not conform to accrual accounting, such as expenditures for capital assets and principal repayments. C) Entries are necessary to adjust revenues to the accrual basis, record expenses not recognized under the modified accrual basis. D) Entries are necessary to eliminate fiduciary funds. 40) With respect to the content of goverement-wide statements, which of the following is correct? Version 1 10 A) Intermal service funds are typically reported in the govemmental activities sections of the government-wide statements, while fidociary activities are not incloded in the govemmentwide statements. B) Fiduciary activities are included the govemment-wide statements and intemal service fonds are not included in the government-wide statements. C) laterfund transictions are not adjusted when proparing the governmentowide statements because they cancel esch other out. D) Interfund transaction are separately stated to show detait but do not affect the ending halances on the statements because revenaes equal expenses. 41) Which of the following is troe concening infrastructure assets with respect to the governmen-wide statements? A) Capstalization of infrastructure is required. B) Govemments must depreciate infrastructure assets. C) Governments rarely possess infrastructure. D) Capitaluzation of infrastructure is eptional. 42) The Genetal Fund of the City of Plymeuth purchased a police car in the amount of $33,000. Which of the following would be true? B) B. The General Fund Statenent of Revenues, Expenditures, and Changes in Fund Balances would report an expenditure of $33,000. C) C. Boeh A and B choices are true. D) D. Neither A nor B choices is true. 43) Which of the following is not required to convent from the modified accrual basis fo the acerual basis in preparing the government-wide statements? A) Record general capital assets. B) Change experaditues for debt service principal to reduction of liabilities. C) Make adjustments to revenues deferred because of the 60-day rule. D) Accrue interest on enterprise fund bonds. 43) Which of the following is not required to convert from the modified accrual basis to the accrual basis in preparing the government-wide statements? A) Record general capital assets. B) Change expenditures for debt service principal to reduction of liabilities. C) Make adjustments to revenues deferred because of the 60-day rule. D) Accrue interest on enterprise fund bonds. Version 1 11 44) Which of the following situations would be unlikely to result in the recognition of an asset impairment? A) A city warehouse is damaged by fire. B) Recently purchased city-owned voting booths are rendered obsolete by a federal law requiring a new technology. C) Ridership on city buses declines. D) Construction on a municipal sports complex stops when the city's major league baseball team moves to another city. 45) A government reported an "Other Financing Source" in the amount of $600,000 related to the sale of land in its governmental funds Statement of Revenues, Expenditures, and Changes in Fund Balances. The land had a cost of $120,000. The adjustment in the reconciliation when moving from the changes in fund balances in the Statement of Revenues, Expenditures, and Changes in Fund Balances to the change in Net Position in the Statement of Activities would be a(an): A) Increase of $480,000. B) Decrease of $480,000. C) Increase of $120,000. D) Decrease of $120,000

Step by Step Solution

There are 3 Steps involved in it

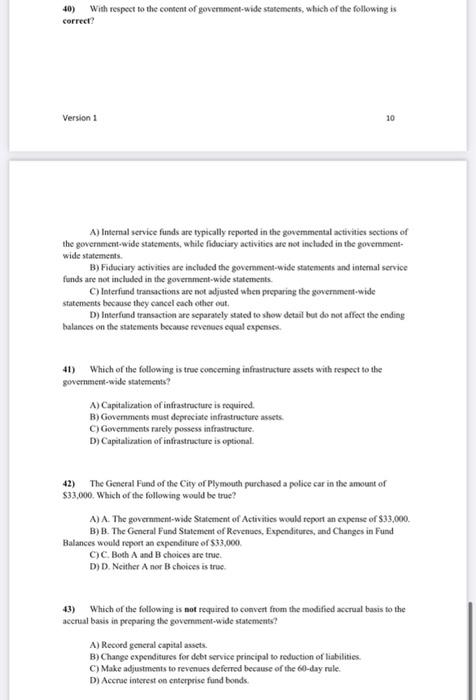

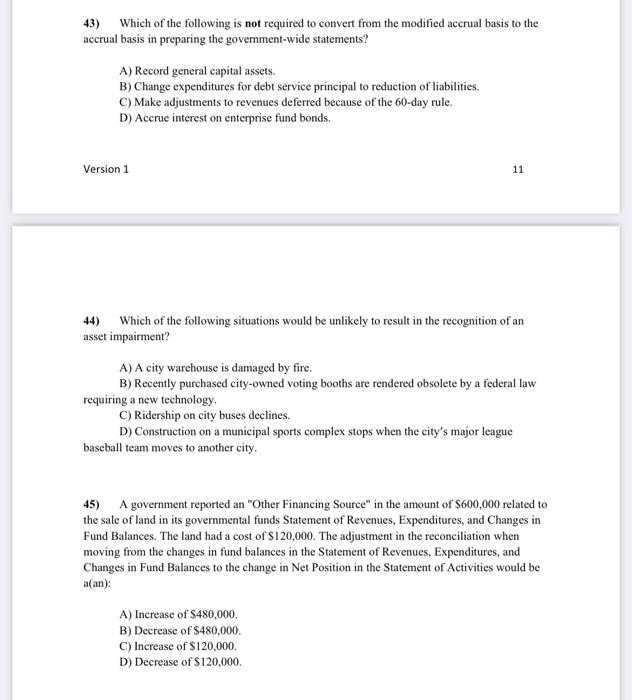

Get step-by-step solutions from verified subject matter experts