Question: Please answer all 3 if possible Question 12 Ipes You currently have $20,000.01 in a bank account that pays you 5 percent interest annually. You

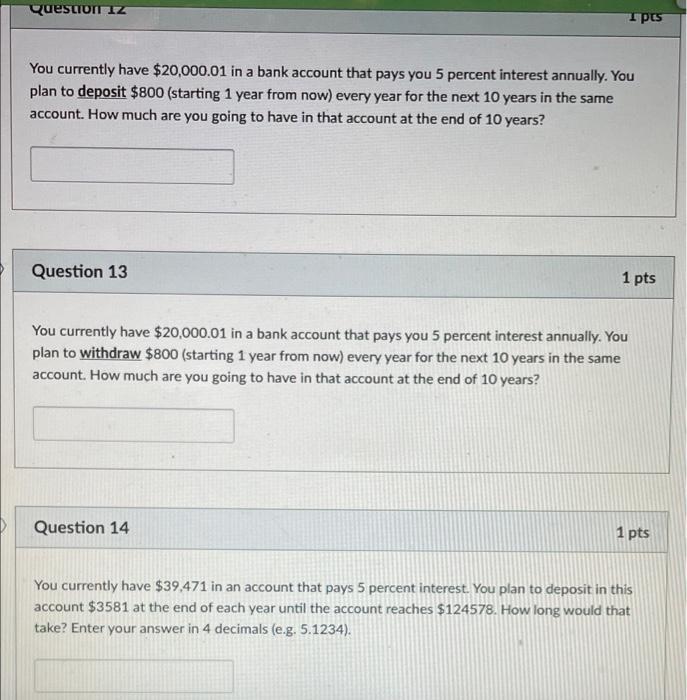

Question 12 Ipes You currently have $20,000.01 in a bank account that pays you 5 percent interest annually. You plan to deposit $800 (starting 1 year from now) every year for the next 10 years in the same account. How much are you going to have in that account at the end of 10 years? Question 13 1 pts You currently have $20,000.01 in a bank account that pays you 5 percent interest annually. You plan to withdraw $800 (starting 1 year from now) every year for the next 10 years in the same account. How much are you going to have in that account at the end of 10 years? Question 14 1 pts You currently have $39,471 in an account that pays 5 percent interest. You plan to deposit in this account $3581 at the end of each year until the account reaches $124578. How long would that take? Enter your answer in 4 decimals (e.g. 5.1234). Question 12 Ipes You currently have $20,000.01 in a bank account that pays you 5 percent interest annually. You plan to deposit $800 (starting 1 year from now) every year for the next 10 years in the same account. How much are you going to have in that account at the end of 10 years? Question 13 1 pts You currently have $20,000.01 in a bank account that pays you 5 percent interest annually. You plan to withdraw $800 (starting 1 year from now) every year for the next 10 years in the same account. How much are you going to have in that account at the end of 10 years? Question 14 1 pts You currently have $39,471 in an account that pays 5 percent interest. You plan to deposit in this account $3581 at the end of each year until the account reaches $124578. How long would that take? Enter your answer in 4 decimals (e.g. 5.1234)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts