please answer all 3 will thumbs up

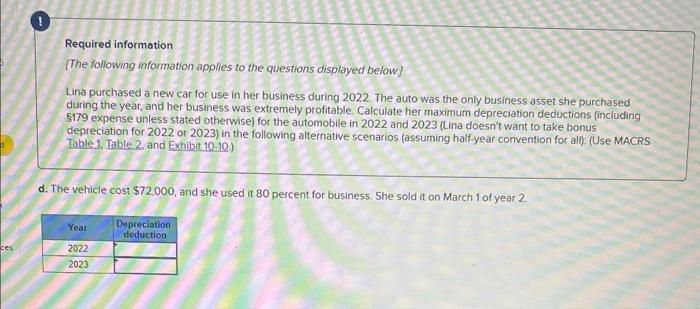

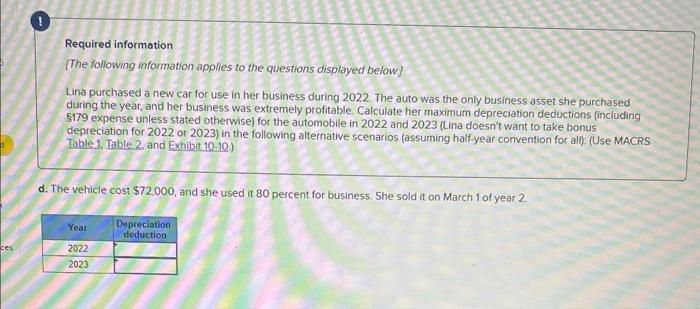

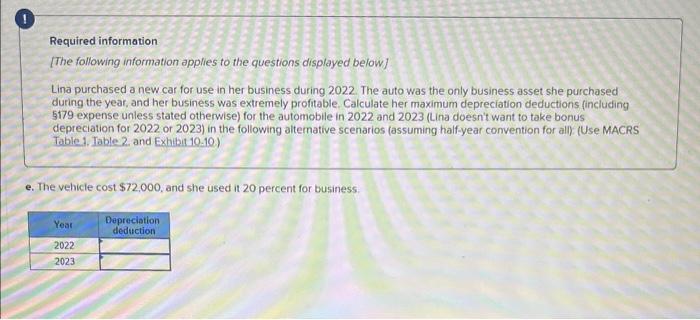

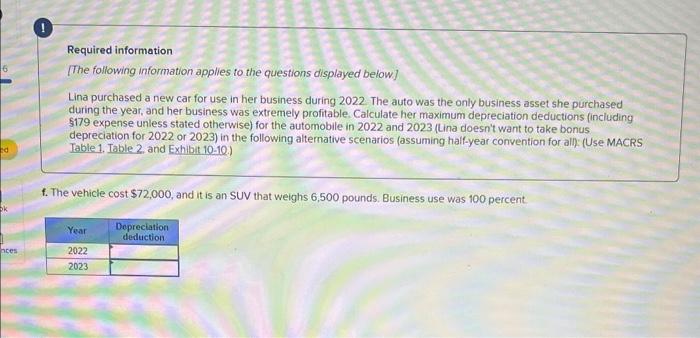

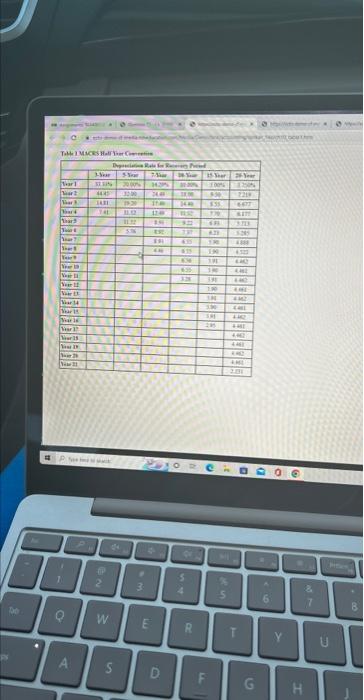

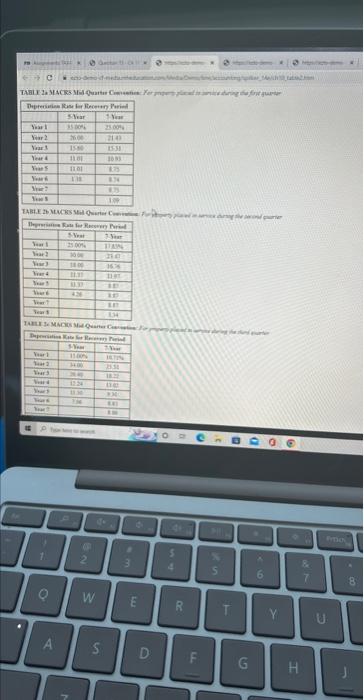

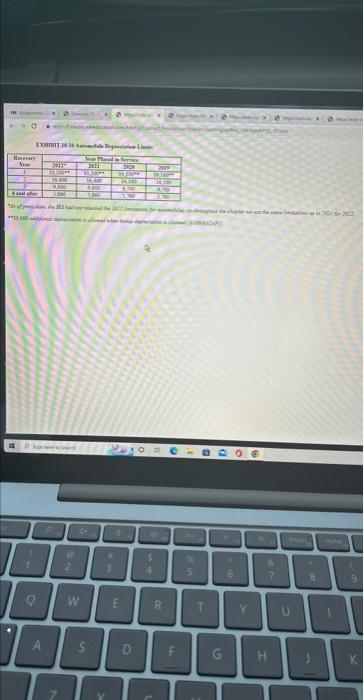

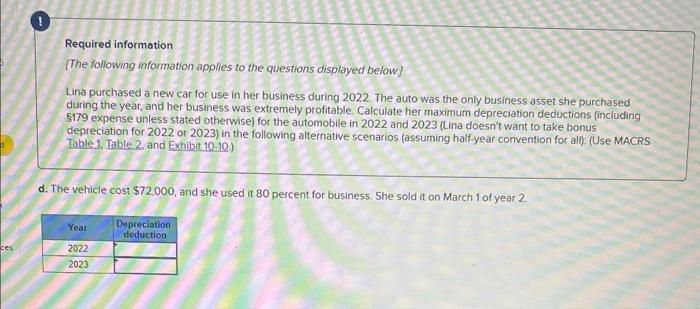

Required information [The following information applies to the questions displayed below] Lina purchased a new car for use in her business during 2022 . The auto was the only business asset she purchased during the year, and her business was extremely profitable. Calculate her maximum depreciation deductions (including $179 expense unless stated otherwise) for the automobile in 2022 and 2023 (Lina doesn't want to take bonus depreciation for 2022 or 2023 ) in the foilowing alternative scenarios (assuming half-year convention for all) (Use MACRS Table 1. Table 2 and Exhibit 10-10). d. The vehicle cost $72,000, and she used it 80 percent for business. She sold it on March 1 of year 2 . Required information [The following information applies to the questions displayed below] Lina purchased a new car for use in her business during 2022 . The auto was the only business asset she purchased during the year, and her business was extremely profitable. Calculate her maximum depreciation deductions fincluding 5179 expense unless stated otherwise) for the automobile in 2022 and 2023 (Lina doesn't want to take bonus depreciation for 2022 or 2023) in the following altemative scenarios (assuming half-year convention for all): (Use MACRS Table 1. Table 2. and Exhibit 10-10) e. The vehicle cost $72,000, and she used it 20 percent for business: Required information [The following information applies to the questions displayed below] Lina purchased a new car for use in her business during 2022 . The auto was the only business asset she purchased during the year, and her business was extremely profitable. Calculate her maximum depreciation deductions (including $179 expense unless stated otherwise) for the automobile in 2022 and 2023 (Lina doesn't want to take bonus depreciation for 2022 or 2023 ) in the following alternative scenarios (assuming half-year convention for all): (Use MACRS Table 1. Table 2. and Exhibit 10-10.) f. The vehicle cost $72,000, and it is an SUV that weighs 6,500 pounds, Business use was 100 percent, Required information [The following information applies to the questions displayed below] Lina purchased a new car for use in her business during 2022 . The auto was the only business asset she purchased during the year, and her business was extremely profitable. Calculate her maximum depreciation deductions (including $179 expense unless stated otherwise) for the automobile in 2022 and 2023 (Lina doesn't want to take bonus depreciation for 2022 or 2023 ) in the foilowing alternative scenarios (assuming half-year convention for all) (Use MACRS Table 1. Table 2 and Exhibit 10-10). d. The vehicle cost $72,000, and she used it 80 percent for business. She sold it on March 1 of year 2 . Required information [The following information applies to the questions displayed below] Lina purchased a new car for use in her business during 2022 . The auto was the only business asset she purchased during the year, and her business was extremely profitable. Calculate her maximum depreciation deductions fincluding 5179 expense unless stated otherwise) for the automobile in 2022 and 2023 (Lina doesn't want to take bonus depreciation for 2022 or 2023) in the following altemative scenarios (assuming half-year convention for all): (Use MACRS Table 1. Table 2. and Exhibit 10-10) e. The vehicle cost $72,000, and she used it 20 percent for business: Required information [The following information applies to the questions displayed below] Lina purchased a new car for use in her business during 2022 . The auto was the only business asset she purchased during the year, and her business was extremely profitable. Calculate her maximum depreciation deductions (including $179 expense unless stated otherwise) for the automobile in 2022 and 2023 (Lina doesn't want to take bonus depreciation for 2022 or 2023 ) in the following alternative scenarios (assuming half-year convention for all): (Use MACRS Table 1. Table 2. and Exhibit 10-10.) f. The vehicle cost $72,000, and it is an SUV that weighs 6,500 pounds, Business use was 100 percent