Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PLEASE ANSWER ALL 7 QUESTIONS.Thank you!! 1. P received land as a gift with a fair market value of $5,000. The land was purchased by

PLEASE ANSWER ALL 7 QUESTIONS.Thank you!!

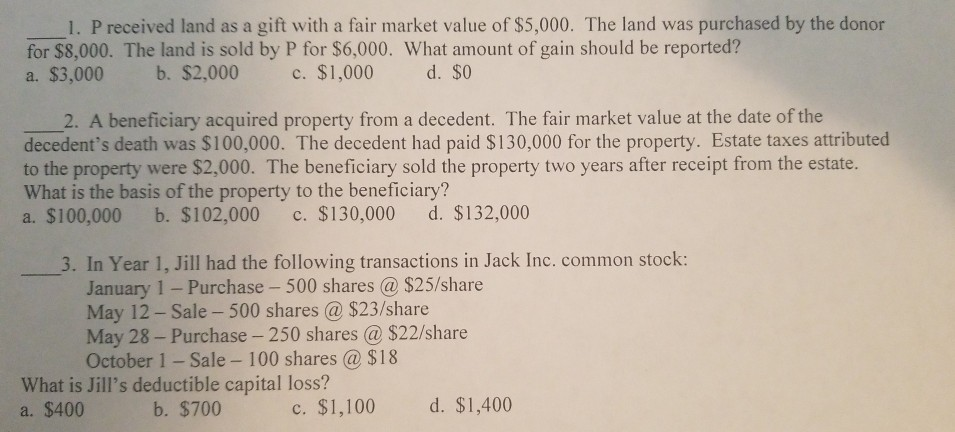

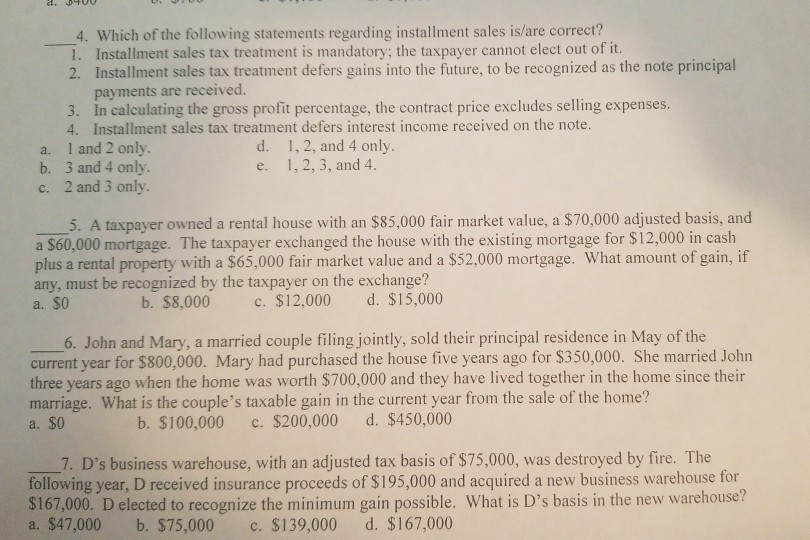

1. P received land as a gift with a fair market value of $5,000. The land was purchased by the donor for $8,000. The land is sold by P for $6,000. What amount of gain should be reported? d. $0 b. $2,000 c. $1,000 a. $3,000 2. A beneficiary acquired property from a decedent. The fair market value at the date of the decedent's death was $100,000. The decedent had paid $130,000 for the property. Estate taxes attributed to the property were $2,000. The beneficiary sold the property two years after receipt from the estate What is the basis of the property to the beneficiary? a. $100,000 b. $102,000 d. $132,000 c. $130,000 3. In Year 1, Jill had the following transactions in Jack Inc.common stock: January 1 Purchase - 500 shares @ $25/share May 12- Sale - 500 shares@ $23/share May 28- Purchase - 250 shares @ $22/share October 1- Sale- 100 shares @ $18 What is Jill's deductible capital loss? b. $700 d. $1,400 c. $1,100 a. $400 4. Which of the following statements regarding installment sales is/are correct? 1. Installment sales tax treatment is mandatory; the taxpayer cannot elect out of it. 2. Installment sales tax treatment defers gains into the future, to be recognized payments are received. 3. In calculating the gross profit percentage, the contract price excludes selling expenses. 4. Installment sales tax treatment defers interest income received on the note. a. 1 and 2 only. b. 3 and 4 only. c. 2 and 3 only. as the note principal 1,2, and 4 only. 1, 2, 3, and 4. d. e. 5. A taxpayer owned a rental house with an $85,000 fair market value, a $70,000 adjusted basis, and $60,000 mortgage. The taxpayer exchanged the house with the existing mortgage for $12,000 in cash plus a rental property with a $65,000 fair market value and a $52,000 mortgage. What amount of gain, if any, must be recognized by the taxpayer on the exchange? a. $0 a d. $15,000 $12,000 b. $8,000 C. 6. John and Mary current year for $800,000. Mary had purchased the house five years ago for $350,000. She married John three years ago when the home was worth $700,000 and they have lived together in the home since their marriage. What is the couple's taxable gain in the current year from the sale of the home? a. $0 a married couple filing jointly, sold their principal residence in May of the d. $450,000 c. $200,000 b. $100,000 7. D's business warehouse, with an following year, D received insurance proceeds of $195,000 and acquired a new business warehouse for $167,000. D elected to recognize the minimum gain possible. What is D's basis in the new warehouse? $47,000 adjusted tax basis of $75,000, was destroyed by fire. The d. $167,000 b. $75,000 c. $139,000 aStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started