Please answer all and I will give thumbs up

Please answer all and I will give thumbs up

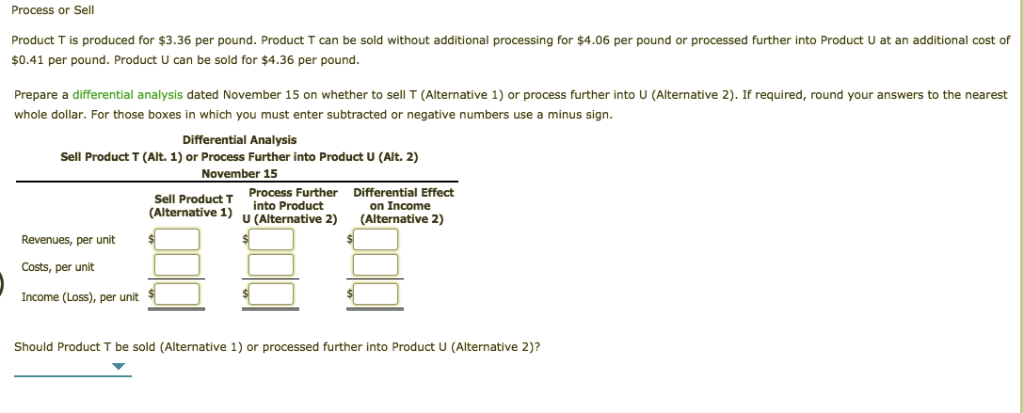

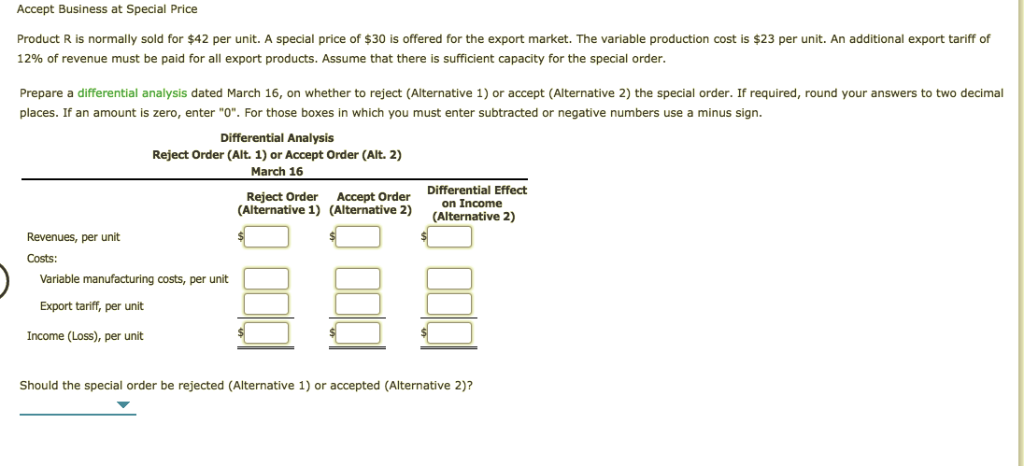

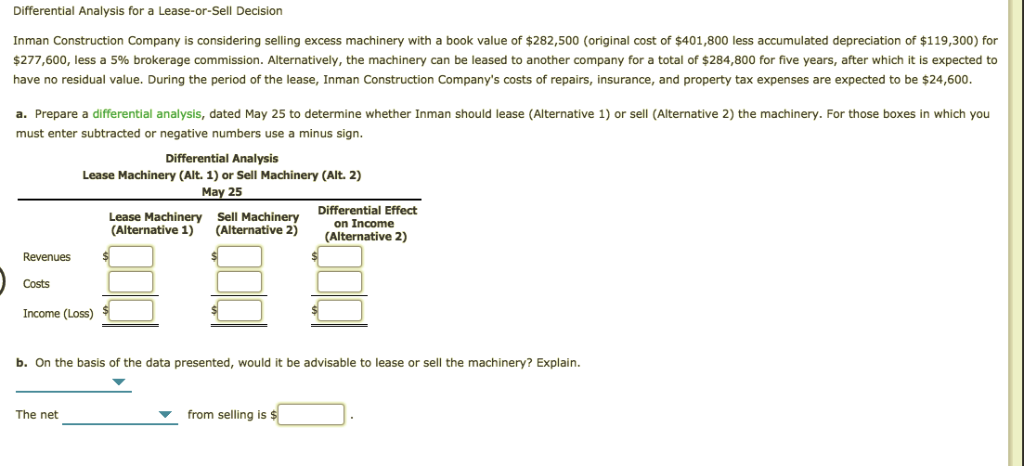

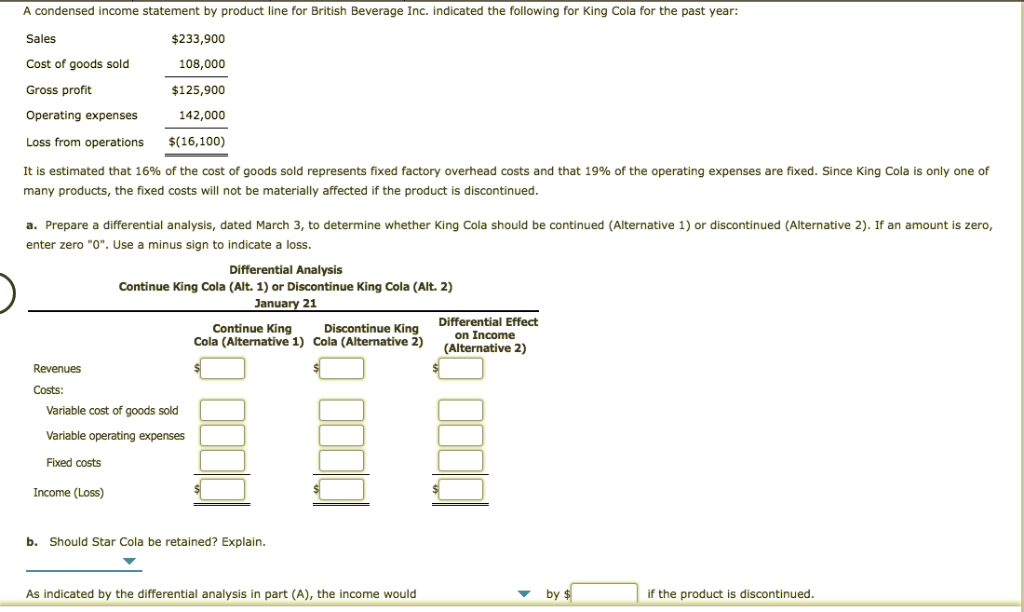

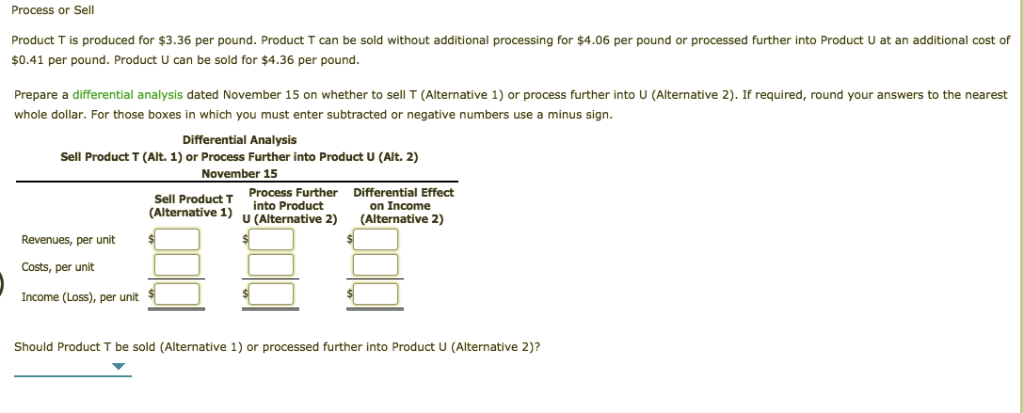

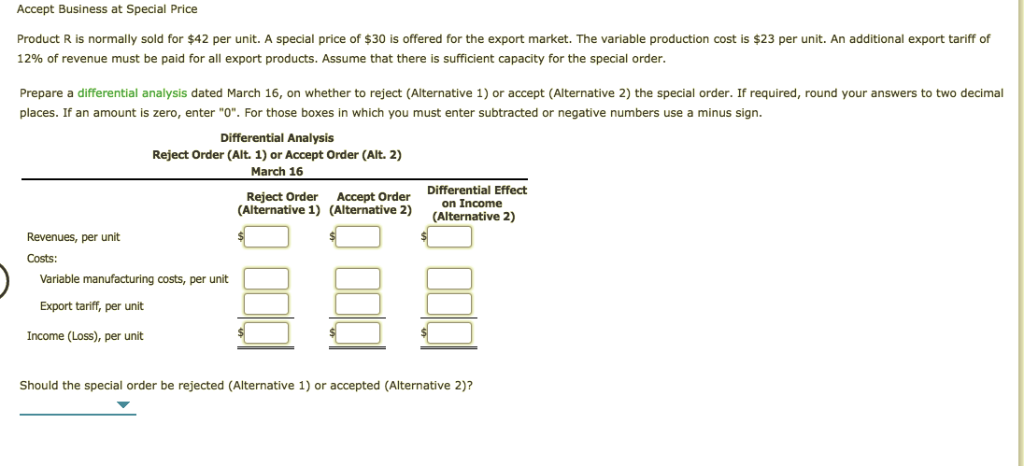

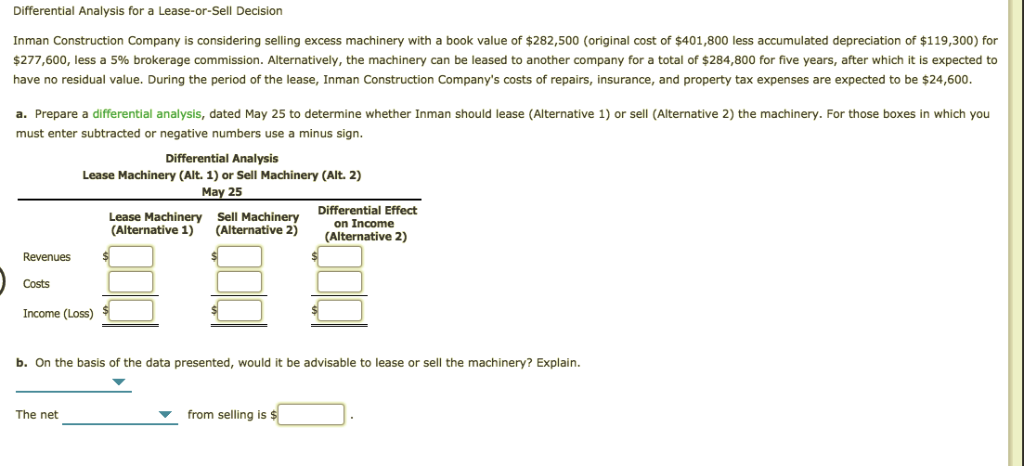

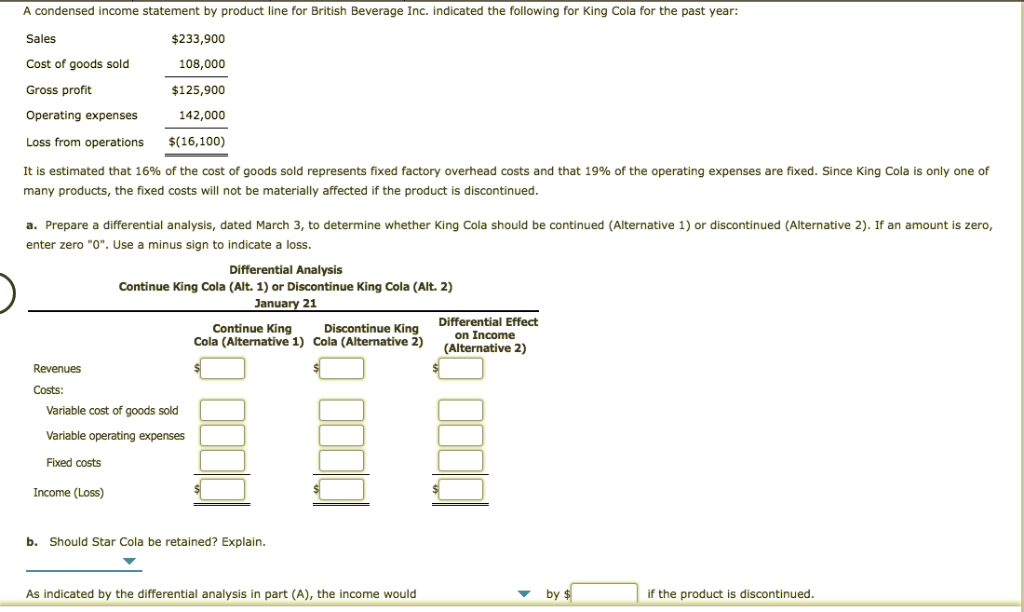

Process or Sell Product T is produced for $3.36 per pound. Product T can be sold without additional processing for $4.06 per pound or processed further into Product U at an additional cost of $0.41 per pound. Product U can be sold for $4.36 per pound. Prepare a differential analysis dated November 15 on whether to sell T (Alternative 1) or process further into U (Alternative 2). If required, round your answers to the nearest whole dollar. For those boxes in which you must enter subtracted or negative numbers use a minus sign. Differential Analysis Sell Product T (Alt. 1) or Process Further into Product U (Alt. 2) November 15 Sell Product T Process Further Differential Effect into Product on Income (Alternative 1) e) U (Alternative 2) (Alternative 2) Revenues, per unit Costs, per unit Income (Loss), per units Should Product T be sold (Alternative 1) or processed further into Product u (Alternative 2)? Accept Business at Special Price Product R is normally sold for $42 per unit. A special price of $30 is offered for the export market. The variable production cost is $23 per unit. An additional export tariff of 12% of revenue must be paid for all export products. Assume that there is sufficient capacity for the special order. Prepare a differential analysis dated March 16, on whether to reject (Alternative 1) or accept (Alternative 2) the special order. If required, round your answers to two decimal places. If an amount is zero, enter "0". For those boxes in which you must enter subtracted or negative numbers use a minus sign. Differential Analysis Reject Order (Alt. 1) or Accept Order (Alt. 2) March 16 Differential Effect Reject Order Accept Order DI on Income (Alternative 1) (Alternative 2) (Alternative 2) Revenues, per unit Costs: Variable manufacturing costs, per unit Export tariff, per unit Income (Loss), per unit Should the special order be rejected (Alternative 1) or accepted (Alternative 2)? Differential Analysis for a Lease-or-Sell Decision Inman Construction Company is considering selling excess machinery with a book value of $282,500 (original cost of $401,800 less accumulated depreciation of $119,300) for $277,600, less a 5% brokerage commission. Alternatively, the machinery can be leased to another company for a total of $284,800 for five years, after which it is expected to have no residual value. During the period of the lease, Inman Construction Company's costs of repairs, insurance, and property tax expenses are expected to be $24,600. a. Prepare a differential analysis, dated May 25 to determine whether Inman should lease (Alternative 1) or sell (Alternative 2) the machinery. For those boxes in which you must enter subtracted or negative numbers use a minus sign. Differential Analysis Lease Machinery (Alt. 1) or Sell Machinery (Alt. 2) May 25 Differential Effect Lease Machinery Sell Machinery on Income (Alternative 1) (Alternative 2) (Alternative 2) Revenues $ Costs Income (Loss) $ b. On the basis of the data presented, would it be advisable to lease or sell the machinery? Explain. The net from selling is $ . A condensed income statement by product line for British Beverage Inc. indicated the following for King Cola for the past year: Sales $233,900 108,000 Cost of goods sold Gross profit Operating expenses $125,900 142,000 $(16,100) Loss from operations It is estimated that 16% of the cost of goods sold represents fixed factory overhead costs and that 19% of the operating expenses are fixed. Since King Cola is only one of many products, the fixed costs will not be materially affected if the product is discontinued. a. Prepare a differential analysis, dated March 3, to determine whether King Cola should be continued (Alternative 1) or discontinued (Alternative 2). If an amount is zero, enter zero "O". Use a minus sign to indicate a loss. Differential Analysis Continue King Cola (Alt. 1) or Discontinue King Cola (Alt. 2) January 21 Continue King Discontinue King Differential Effect on Income Cola (Alternative 1) Cola (Alternative 2) (Alternative 2) Revenues Costs: Variable cost of goods sold Variable operating expenses Fixed costs Income (Loss) b. Should Star Cola be retained? Explain. As indicated by the differential analysis in part (A), the income would by $ if the product is discontinued

Please answer all and I will give thumbs up

Please answer all and I will give thumbs up