PLEASE ANSWER ALL AND READ ALL OF THE INSTRUCTIONS- AND FILL OUT ALL FORMS, NOT JUST THE ANSWER

Your new clients are a married couple, Simon and Kaylee Tam. Their social security numbers are 123-45- 6789 and 987-65-4321, respectively. Simon is a doctor and Kaylee is a mechanic. Simon is 32 years old, Kaylee is 30 years old, and neither are blind.

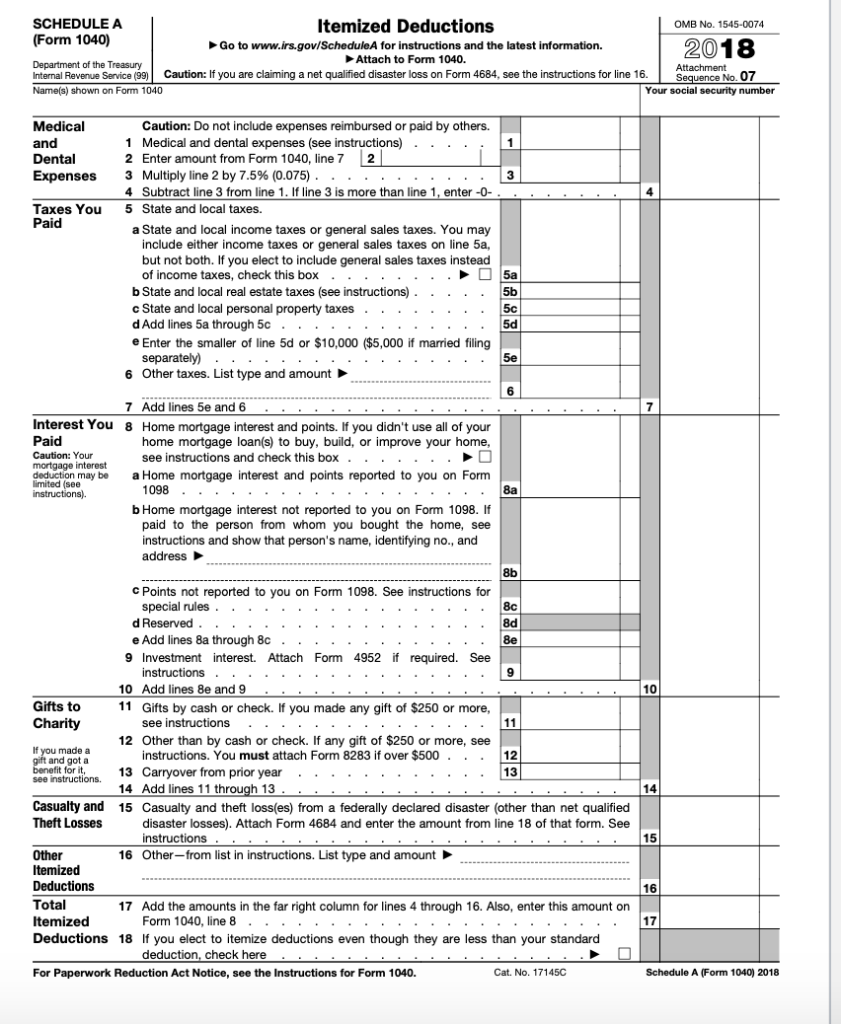

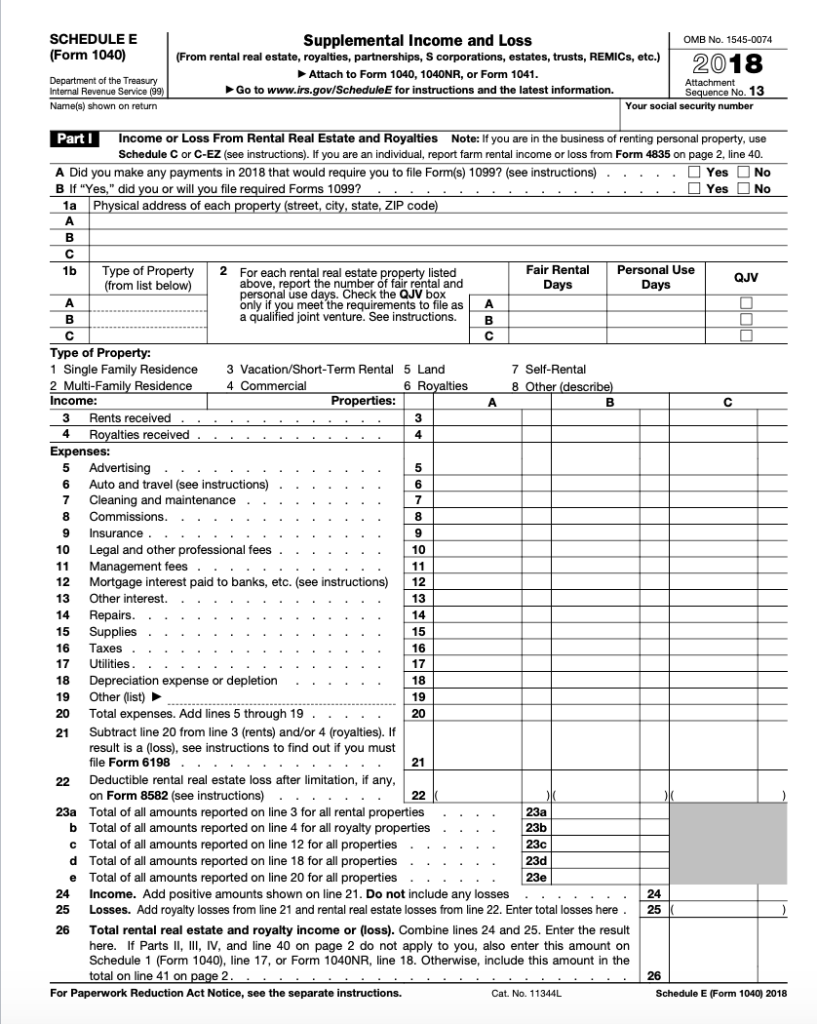

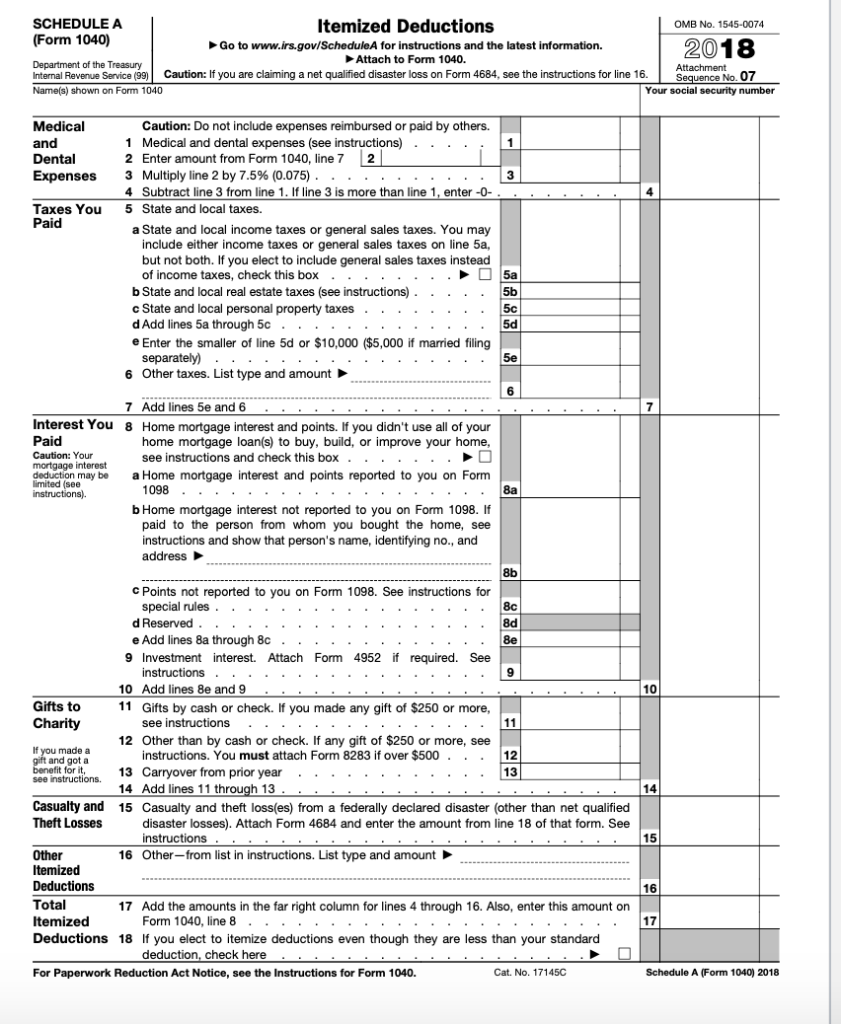

Their primary home address is 1996 Serenity Lane, Peoria, AZ 85383, on which they have a mortgage taken on June 18, 2016. They paid $6,291 in real estate taxes. The Tams also purchased a vacation home in Florida in 2017, which they rented out for 45 days in 2018. The full address is 1059 Ocean Drive, Jacksonville Beach, FL 33250.

They made contributions by check to the United Way Charity in the amount of $400 during the year in 4 checks for $100 each. They did not receive a receipt. They also donated $350 worth of clothes and home goods to the local Goodwill store. No single donation was worth over $250. They also made a contribution to the governors re-election campaign of $1,000.

If a refund is due, the Tams would like a check mailed to them.

The Tams have provided the following documents for your review. Please also see Kaylee Tams Poker Diary saved as a tab in the Blank Excel Workpapers file.

Create a pivot table to calculate Kaylee Tams total poker winnings and total poker losses. Save the pivot table in the Excel Workpapers file that you submit.Report the poker winnings and losses as appropriate in the Tams tax return.

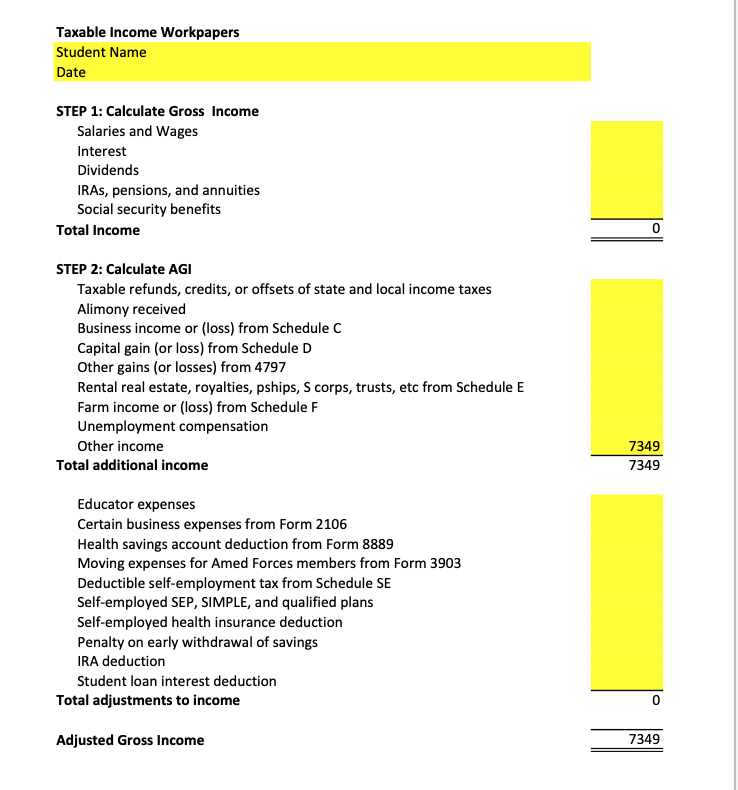

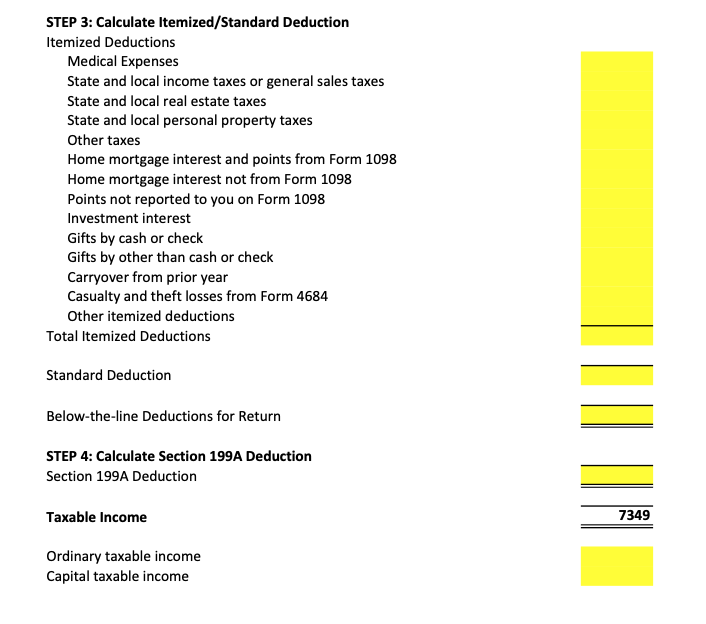

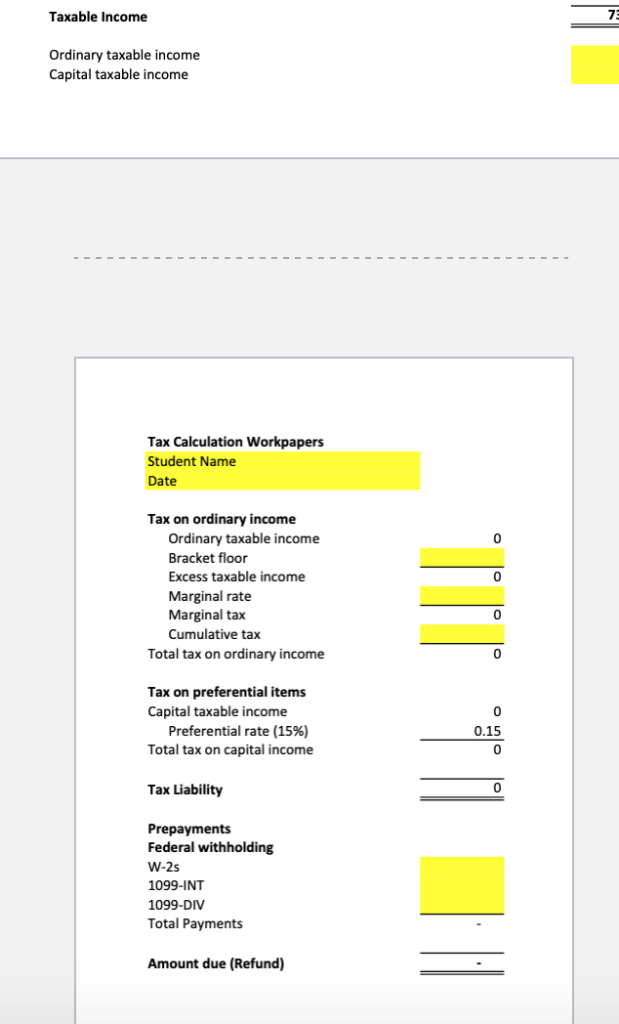

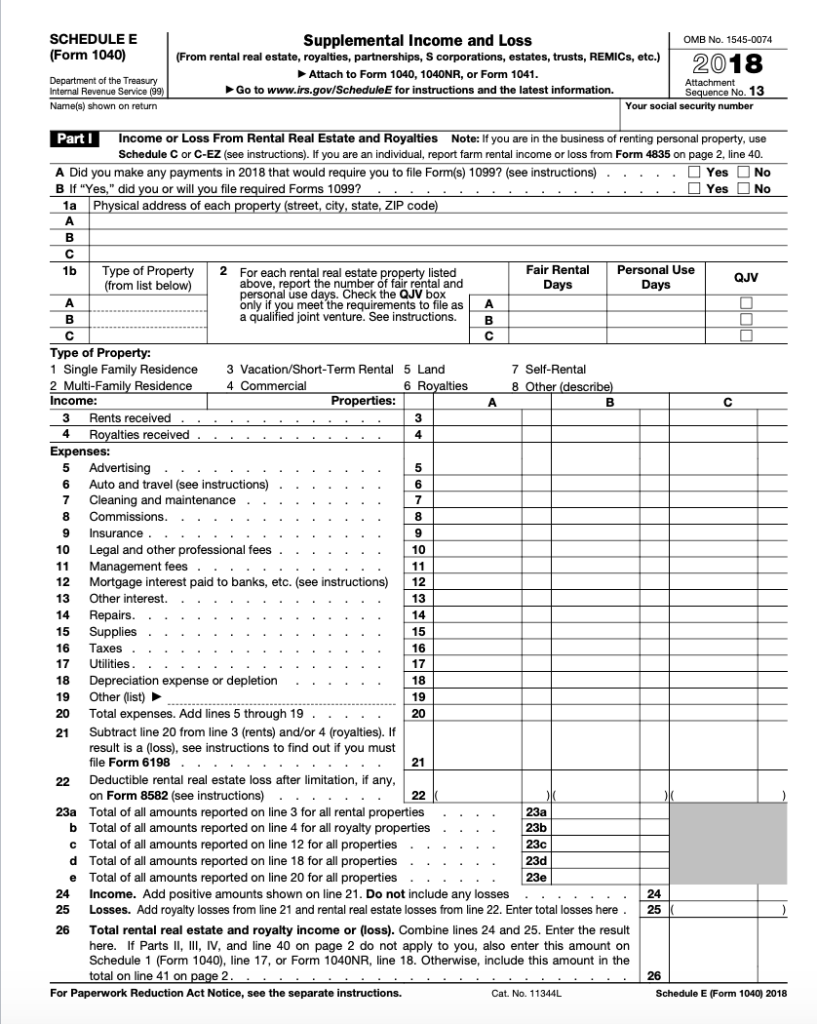

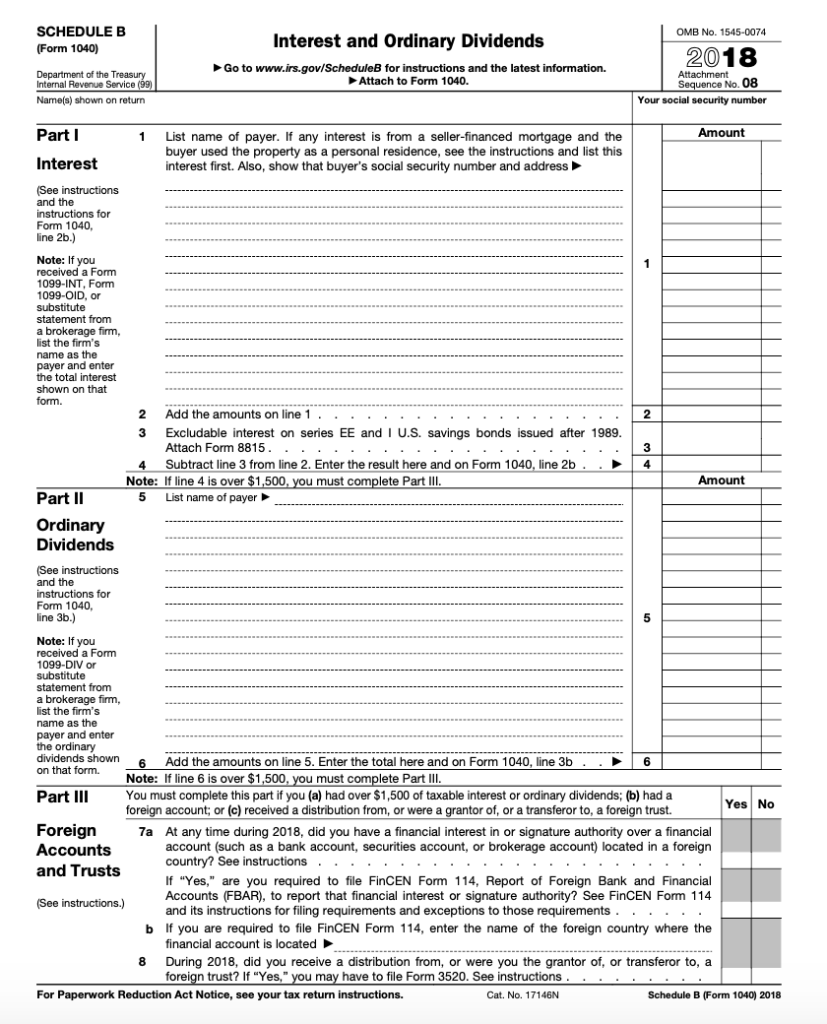

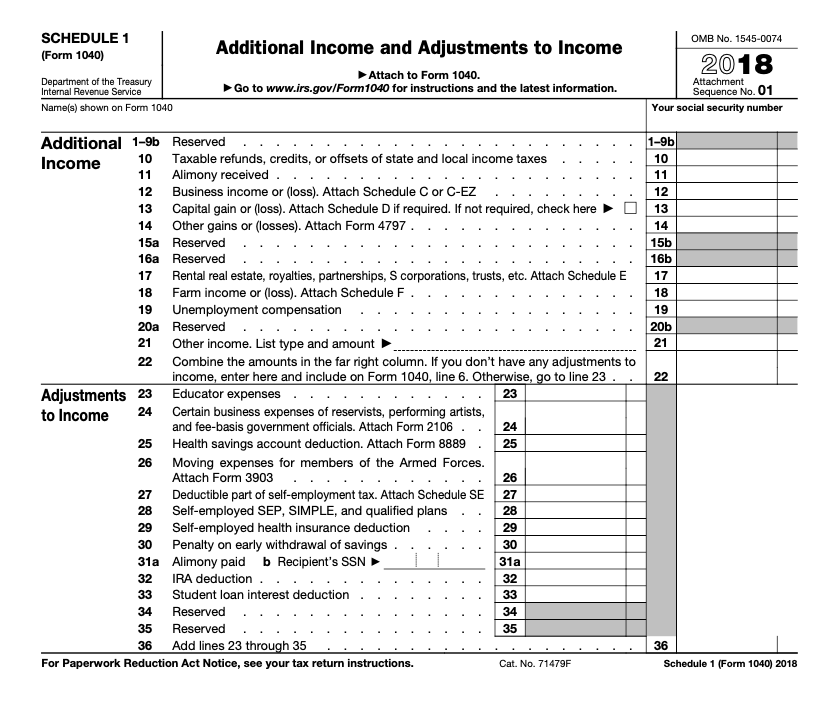

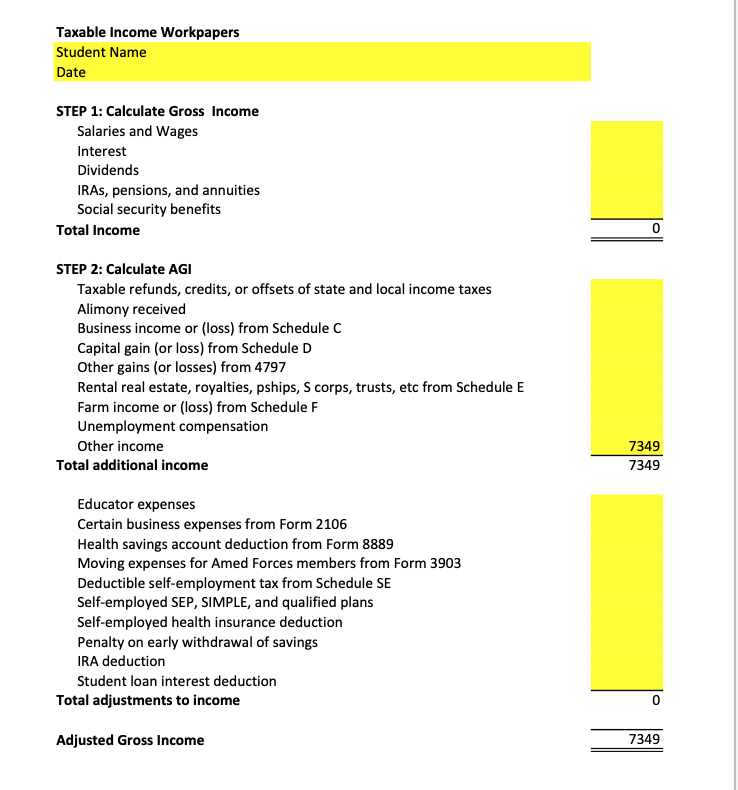

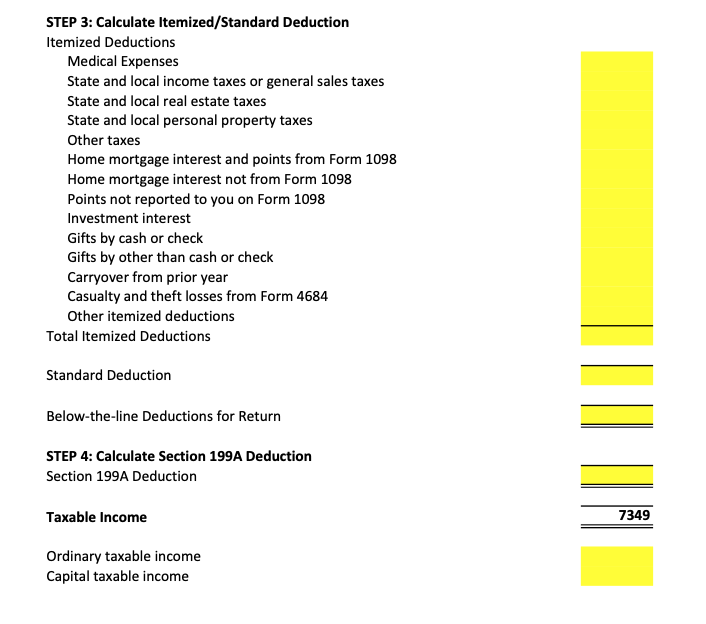

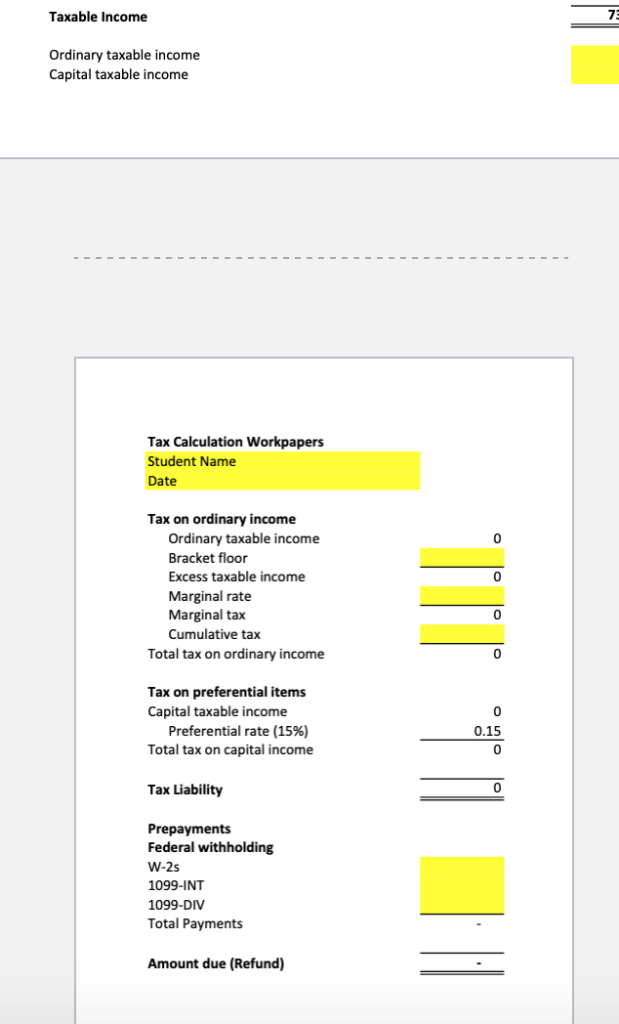

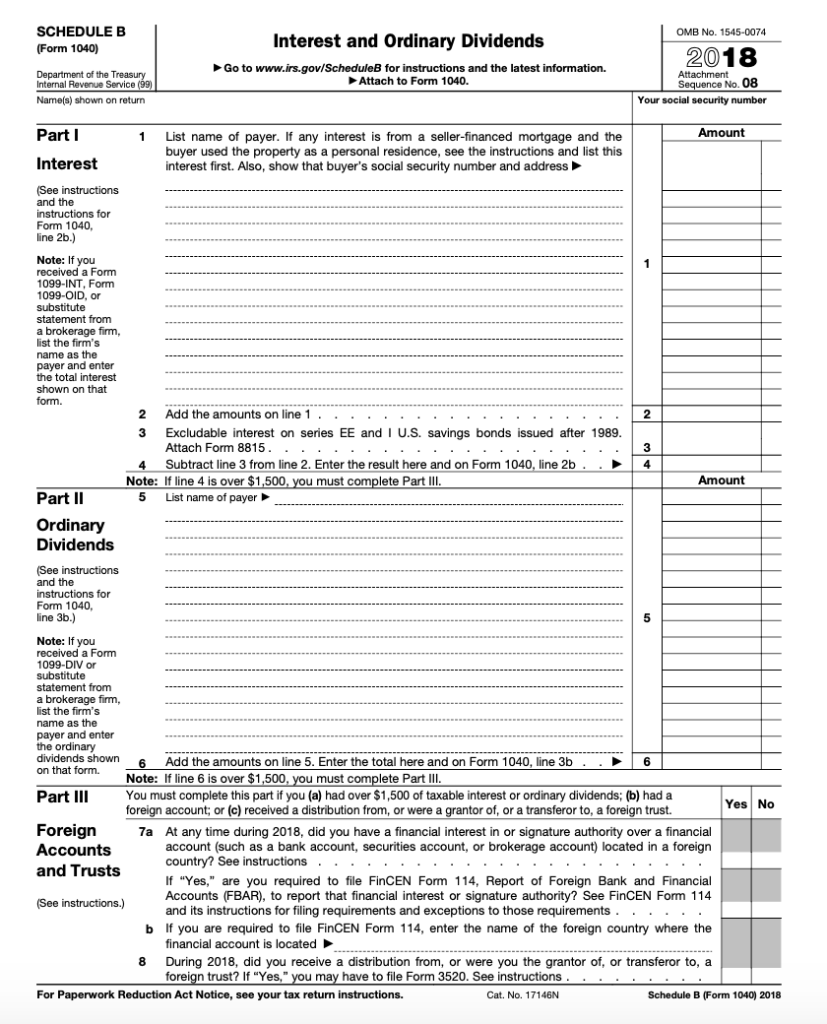

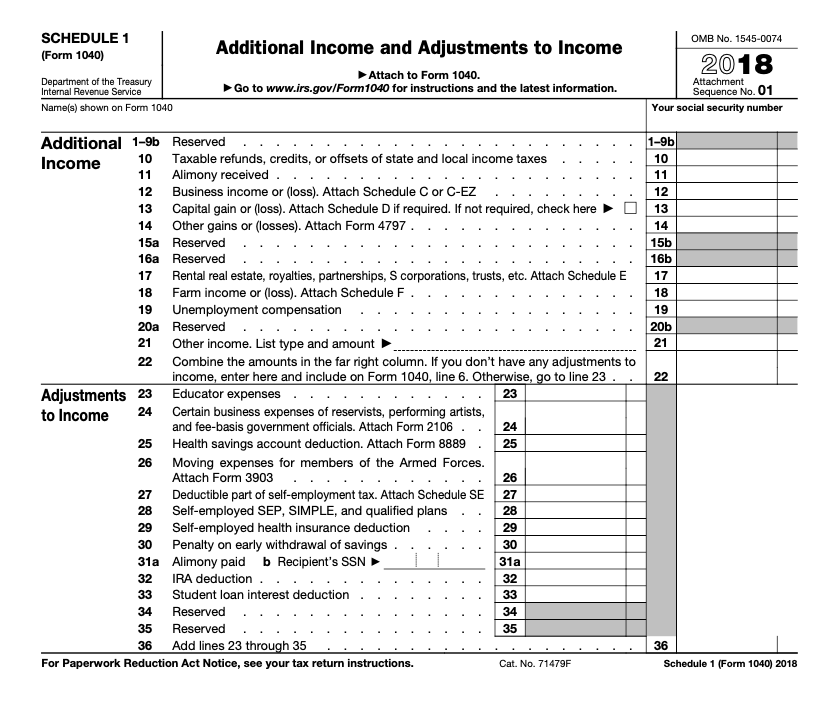

Taxable Income Workpapers Student Name Date STEP 1: Calculate Gross Income Salaries and Wages Interest Dividends IRAs, pensions, and annuities Social security benefits 0 Total Income STEP 2: Calculate AGI Taxable refunds, credits, or offsets of state and local income taxe:s Alimony received Business income or (loss) from Schedule C Capital gain (or loss) from Schedule D Other gains (or losses) from 4797 Rental real estate, royalties, pships, S corps, trusts, etc from Schedule E Farm income or (loss) from Schedule F Unemployment compensation Other income 7349 7349 Total additional income Educator expenses Certain business expenses from Form 2106 Health savings account deduction from Form 8889 Moving expenses for Amed Forces members from Form 3903 Deductible self-employment tax from Schedule SE Self-employed SEP, SIMPLE, and qualified plans Self-employed health insurance deduction Penalty on early withdrawal of savings IRA deduction Student loan interest deduction Total adjustments to income 0 7349 Adjusted Gross Income STEP 3: Calculate Itemized/Standard Deduction Itemized Deductions Medical Expenses State and local income taxes or general sales taxes State and local real estate taxes State and local personal property taxes Other taxes Home mortgage interest and points from Form 1098 Home mortgage interest not from Form 1098 Points not reported to you on Form 1098 Investment interest Gifts by cash or check Gifts by other than cash or check Carryover from prior year Casualty and theft losses from Form 4684 Other itemized deductions Total Itemized Deductions Standard Deduction Below-the-line Deductions for Return STEP 4: Calculate Section 199A Deduction Section 199A Deduction 7349 Taxable Income Ordinary taxable income Capital taxable income Taxable Income Ordinary taxable income Capital taxable income Tax Calculation Workpapers Student Name Date Tax on ordinary income Ordinary taxable income 0 Bracket floor Excess taxable income 0 Marginal rate Marginal tax 0 Cumulative tax Total tax on ordinary income 0 Tax on preferential items Capital taxable income 0 0.15 0 Preferential rate (15%) Total tax on capital income 0 Tax Liability Prepayments Federal withholding W-2s 1099-INT 1099-DI Total Payments Amount due (Refund) SCHEDULE E (Form 1040 Department of the Treasury Supplemental Income and Loss (From rental real estate, royalties, partnerships, S corporations, estates, trusts, REMICs, etc.) Attach to Form 1040, 1040NR, or Form 1041 Go to www.rs.gov/ScheduleE for instructions and the latest information. OMB No. 1545-0074 uence No. 13 Internal Revenue Service Name(s) shown on return Your social security number Part l Income or Loss From Rental Real Estate and Royalties Note: If you are in the business of renting personal property, use Schedule C or C-EZ (see instructions)-lf you are an individual, report farm rental income or loss from Form 4835 on page 2, line 40. A Did you make any payments in 2018 that would require you to file Form(s) 1099? (see instructions)....Yes No B If "Yes," did you or will you file required Forms 1099? YesNo 1a state, ZIP cod address of each 1b Type of Property 2 For each rental real estate property listed Fair Rental Days Personal Use Days QJV above, report the number of fair rental and personal use days. Check the QJV box only if you meet the requirements to file as A a qualified joint venture. See instructions.B (from list below) Type of Property: Single Family Residence 3 Vacation/Short-Term Rental 5 Land 2 Multi-Family Residence Income: 7 Self-Rental 4 Commercial 6 Royalties her (descri Properties 3 Rents received alties received Expenses: 5 Advertising 6 Auto and travel (see instructions) . . 5 9 Insurance 0 Legal and other professional fees. .. . . ..10 12 13 Other interest. 14 15 Mortgage interest paid to banks, etc. (see instructions) 12 13 Repairs. , 14 Supplies . . ..15 . 17 Utilities. 18 Depreciation expense or depletion 19 Other (list) 20 21 17 .. . .18 19 Total expenses. Add lines 5 through 19 Subtract line 20 from line 3 (rents) and/or 4 (royalties). If result is a (loss), see instructions to find out if you must 20 . Deductible rental real estate loss after limitation, if any on Form 8582 (see instructions) .. Total of all amounts reported on line 3 for all rental properties 22 .. 22 23a 23a 23b ....23c 23d ...23e .. .. b Total of all amounts reported on line 4 for all royalty properties c Total of all amounts reported on line 12 for all properties . . d Total of all amounts reported on line 18 for all properties . . e Total of all amounts reported on line 20 for all properties Income. Add positive amounts shown on line 21. Do not include any losses... 24 25 Losses. Add royalty losses fom line 21 and rental real estate losses from line 22. Enter total losses here. 26 Total rental real estate and royalty income or (loss). Combine lines 24 and 25. Enter the result 24 25 here. If Parts,I, IV, and line 40 on page 2 do not apply to you, also enter this amount on Schedule 1 (Form 1040), ine 17, or Form 1040NR, line 18. Otherwise, include this amount in the total on line 41 on For Paperwork Reduction Act Notice, see the separate instructions. Cat. No. 11344L Schedule E (Form 1040) 2018 SCHEDULE B Form 1040) Department of the Treasury OMB No. 1545-0074 Interest and Ordinary Dividends 2018 No. 08 Go to www.irs.gov/ScheduleB for instructions and the latest information. Attach to Form 1040. Internal Revenue Service Your social security number Name(s) shown on return Amount Part l 1 List name of payer. If any interest is from a seller-financed mortgage and the buyer used the property as a personal residence, see the instructions and list this interest first. Also, show that buyer's social security number and address Interest See instructions and the instructions for Form 1040, line 2b.) Note: If you received a Form 1099-INT, Form 1099-OID, or substitute statement from a brokerage firm, ist the firms name as the payer and enter the total interest shown on that form. 3 Excludable interest on series EE and I U.S. savings bonds issued after 1989. 4 Subtract line 3 from line 2. Enter the result here and on Form 1040, line 2b 5 List name of payer Note: If line 4 is over $1,500 Amount must complete Part III Part II Ordinary Dividends See instructions and the instructions for Form 1040, ine 3b.) 5 Note: If you received a Formm 1099-DIV or substitute statement from a brokerage firm, ist the firm's name as the payer and enter he ordinary dividends shown Add the amounts on line 5. Enter the total here and on Form 1040, line 3b Note: If line 6 is over $1,500, you must complete Part II PartIIYou must complete this part if you (a) had over $1,500 of taxable interest or ordinary dividends; (b) had a Yes No foreign account; or (c) received a distribution from, or were a grantor of, or a transferor to, a foreign trust. Foreign Accounts and Trusts 7a At any time during 2018, did you have a financial interest in or signature authority over a financial account (such as a bank account, securities account, or brokerage account) located in a foreign If "Yes," are you required to file FinCEN Form 114, Report of Foreign Bank and Financial Accounts (FBAR), to report that financial interest or signature authority? See FinCEN Form 114 and its instructions for filing requirements and exceptions to those requirements . See instructions.) b If you are required to file FinCEN Form 114, enter the name of the foreign country where the financial account is located 8 During 2018, did you receive a distribution from, or were you the grantor of, or transferor to, a foreign trust? If "Yes, have to file Form 3520. See instructions Cat. No. 17146N For Paperwork Reduction Act Notice, see your tax return instructions. Schedule B (Form 1040) 2018 SCHEDULE A (Form 1040) Itemized Deductions OMB No. 1545-0074 2018 Go to www.irs.govlScheduleA for instructions and the latest information. Attach to Form 1040. Department of the Treasury Internal Revenue Service 99Caution: If you are claiming a net qualified disaster loss on Form 4684, see the instructions for line 16 Name(s) shown on Form 1040 No.07 Your social security number Medical and Dental Caution: Do not include expenses reimbursed or paid by others. Medical and dental expenses (see instructions)... ..1 Enter amount from Form 1040, line 7 2 1 2 4 5 State and local taxes. Subtract line 3 from line 1. If line 3 is more than line 1, enter -0- Taxes You Paid a State and local income taxes or general sales taxes. You may include either income taxes or general sales taxes on line 5a, but not both. If you elect to include general sales taxes instead of income taxes, check this box .. 5a 5b c State and local personal property taxes....... 5c d Add lines 5a through5c . .. . 5d b State and local real estate taxes (see instructions). . .. . e Enter the smaller of line 5d or $10,000 ($5,000 if married filing 6 Other taxes. List type and amount 7 Add lines 5e and 6 separately)... . . . 5e - . 6 Interest You 8 Home mortgage interest and points. If you didn't use all of your home mortgage loan(s) to buy, build, or improve your home, see instructions and check this box . . Paid Caution: Your mortgage interest deduction may be a Home mortgage interest and points reported to you on Form mited (see b Home mortgage interest not reported to you on Form 1098. If paid to the person from whom you bought the home, see instructions and show that person's name, identifying no., and address 8b C Points not reported to you on Form 1098. See instructions for special rules. . 8c e Add lines 8a through 8c. 9 Investment interest. Attach Form 4952 ...- 8e if required. See 10 Add lines 8e and 9 11 Gifts by cash or check. If you made any gift of $250 or more, Gifts to Charity If you made a benefit for it 12 Other than by cash or check. If any gift of $250 or more, see instructions. You must attach Form 8283 if over $500...12 13 Carryover from prior year.... 13 see instructions.14 Add lines 14 Casualty and 15 Casualty and theft loss(es) from a federally declared disaster (other than net qualified Theft Losses disaster losses). Attach Form 4684 and enter the amount from line 18 of that form. See instructions Other-from list in instructions. List type and amount Other Itemized Deductions Total Itemized Deductions 18 If you elect to itemize deductions even though they are less than your standard 16 16 17 Add the amounts in the far right column for lines 4 through 16Also, enter this amount on Form 1040, line 8 17 .. deduction, check here For Paperwork Reduction Act Notice, see the Instructions for Form 1040. Cat. No. 17145C Schedule A (Form 1040) 2018 SCHEDULE 1 (Form 1040) Department of the Treasury OMB No. 1545-0074 Additional Income and Adjustments to Income 2018 Attach to Form 1040. Go to www.irs.govlForm1040 for instructions and the latest information. uence No. 01 Internal Revenue Service Name(s) shown on Form 1040 Your social security number Additional 1-9b Reserved .. . 1-9b Income 10 Taxable refunds, credits, or offsets of state and local income taxes . . ...10 12 Business income or (loss). Attach Schedule C orC-EZ . . 12 13 Capital gain or (loss). Attach Schedule D if required. If not required, check here13 14 Other gains or (losses). Attach Form 4797.... 14 15a Reserved .. 15b 16a Reserved 16b 17 Rental real estate, royalties, partnerships, S corporations, trusts, etc. Attach Schedule E 17 18 Farm income or (loss). Attach Schedule F... 18 19 Unemployment compensation 19 20a Reserved .. 20b 21 Other income. List type and amount 22 Combine the amounts in the far right column. If you don't have any adjustments to 21 income, enter here and include on Form 1040, line 6. Otherwise, go to line 23 24 Certain business expenses of reservists, performing artists, and fee-basis government officials. Attach Form 2106. . Health savings account deduction. Attach Form 8889 . Moving expenses for members of the Armed Forces Attach Form 3903 to Income 25 26 .. 26 27 Deductible part of self-employment tax. Attach Schedule SE 27 28 Self-employed SEP, SIMPLE, and qualified plans.. 28 29 Self-employed health insurance deduction . ...29 30 Penalty on early withdrawal of savings ...30 31a Alimony paid b Recipient's SSN 31a 33 Student loan interest deduction 33 5 36 Reserved Add lines 23 through 35 135 36 For Paperwork Reduction Act Notice, see your tax return instructions. Cat. No. 71479F Schedule 1 (Form 1040) 2018 Taxable Income Workpapers Student Name Date STEP 1: Calculate Gross Income Salaries and Wages Interest Dividends IRAs, pensions, and annuities Social security benefits 0 Total Income STEP 2: Calculate AGI Taxable refunds, credits, or offsets of state and local income taxe:s Alimony received Business income or (loss) from Schedule C Capital gain (or loss) from Schedule D Other gains (or losses) from 4797 Rental real estate, royalties, pships, S corps, trusts, etc from Schedule E Farm income or (loss) from Schedule F Unemployment compensation Other income 7349 7349 Total additional income Educator expenses Certain business expenses from Form 2106 Health savings account deduction from Form 8889 Moving expenses for Amed Forces members from Form 3903 Deductible self-employment tax from Schedule SE Self-employed SEP, SIMPLE, and qualified plans Self-employed health insurance deduction Penalty on early withdrawal of savings IRA deduction Student loan interest deduction Total adjustments to income 0 7349 Adjusted Gross Income STEP 3: Calculate Itemized/Standard Deduction Itemized Deductions Medical Expenses State and local income taxes or general sales taxes State and local real estate taxes State and local personal property taxes Other taxes Home mortgage interest and points from Form 1098 Home mortgage interest not from Form 1098 Points not reported to you on Form 1098 Investment interest Gifts by cash or check Gifts by other than cash or check Carryover from prior year Casualty and theft losses from Form 4684 Other itemized deductions Total Itemized Deductions Standard Deduction Below-the-line Deductions for Return STEP 4: Calculate Section 199A Deduction Section 199A Deduction 7349 Taxable Income Ordinary taxable income Capital taxable income Taxable Income Ordinary taxable income Capital taxable income Tax Calculation Workpapers Student Name Date Tax on ordinary income Ordinary taxable income 0 Bracket floor Excess taxable income 0 Marginal rate Marginal tax 0 Cumulative tax Total tax on ordinary income 0 Tax on preferential items Capital taxable income 0 0.15 0 Preferential rate (15%) Total tax on capital income 0 Tax Liability Prepayments Federal withholding W-2s 1099-INT 1099-DI Total Payments Amount due (Refund) SCHEDULE E (Form 1040 Department of the Treasury Supplemental Income and Loss (From rental real estate, royalties, partnerships, S corporations, estates, trusts, REMICs, etc.) Attach to Form 1040, 1040NR, or Form 1041 Go to www.rs.gov/ScheduleE for instructions and the latest information. OMB No. 1545-0074 uence No. 13 Internal Revenue Service Name(s) shown on return Your social security number Part l Income or Loss From Rental Real Estate and Royalties Note: If you are in the business of renting personal property, use Schedule C or C-EZ (see instructions)-lf you are an individual, report farm rental income or loss from Form 4835 on page 2, line 40. A Did you make any payments in 2018 that would require you to file Form(s) 1099? (see instructions)....Yes No B If "Yes," did you or will you file required Forms 1099? YesNo 1a state, ZIP cod address of each 1b Type of Property 2 For each rental real estate property listed Fair Rental Days Personal Use Days QJV above, report the number of fair rental and personal use days. Check the QJV box only if you meet the requirements to file as A a qualified joint venture. See instructions.B (from list below) Type of Property: Single Family Residence 3 Vacation/Short-Term Rental 5 Land 2 Multi-Family Residence Income: 7 Self-Rental 4 Commercial 6 Royalties her (descri Properties 3 Rents received alties received Expenses: 5 Advertising 6 Auto and travel (see instructions) . . 5 9 Insurance 0 Legal and other professional fees. .. . . ..10 12 13 Other interest. 14 15 Mortgage interest paid to banks, etc. (see instructions) 12 13 Repairs. , 14 Supplies . . ..15 . 17 Utilities. 18 Depreciation expense or depletion 19 Other (list) 20 21 17 .. . .18 19 Total expenses. Add lines 5 through 19 Subtract line 20 from line 3 (rents) and/or 4 (royalties). If result is a (loss), see instructions to find out if you must 20 . Deductible rental real estate loss after limitation, if any on Form 8582 (see instructions) .. Total of all amounts reported on line 3 for all rental properties 22 .. 22 23a 23a 23b ....23c 23d ...23e .. .. b Total of all amounts reported on line 4 for all royalty properties c Total of all amounts reported on line 12 for all properties . . d Total of all amounts reported on line 18 for all properties . . e Total of all amounts reported on line 20 for all properties Income. Add positive amounts shown on line 21. Do not include any losses... 24 25 Losses. Add royalty losses fom line 21 and rental real estate losses from line 22. Enter total losses here. 26 Total rental real estate and royalty income or (loss). Combine lines 24 and 25. Enter the result 24 25 here. If Parts,I, IV, and line 40 on page 2 do not apply to you, also enter this amount on Schedule 1 (Form 1040), ine 17, or Form 1040NR, line 18. Otherwise, include this amount in the total on line 41 on For Paperwork Reduction Act Notice, see the separate instructions. Cat. No. 11344L Schedule E (Form 1040) 2018 SCHEDULE B Form 1040) Department of the Treasury OMB No. 1545-0074 Interest and Ordinary Dividends 2018 No. 08 Go to www.irs.gov/ScheduleB for instructions and the latest information. Attach to Form 1040. Internal Revenue Service Your social security number Name(s) shown on return Amount Part l 1 List name of payer. If any interest is from a seller-financed mortgage and the buyer used the property as a personal residence, see the instructions and list this interest first. Also, show that buyer's social security number and address Interest See instructions and the instructions for Form 1040, line 2b.) Note: If you received a Form 1099-INT, Form 1099-OID, or substitute statement from a brokerage firm, ist the firms name as the payer and enter the total interest shown on that form. 3 Excludable interest on series EE and I U.S. savings bonds issued after 1989. 4 Subtract line 3 from line 2. Enter the result here and on Form 1040, line 2b 5 List name of payer Note: If line 4 is over $1,500 Amount must complete Part III Part II Ordinary Dividends See instructions and the instructions for Form 1040, ine 3b.) 5 Note: If you received a Formm 1099-DIV or substitute statement from a brokerage firm, ist the firm's name as the payer and enter he ordinary dividends shown Add the amounts on line 5. Enter the total here and on Form 1040, line 3b Note: If line 6 is over $1,500, you must complete Part II PartIIYou must complete this part if you (a) had over $1,500 of taxable interest or ordinary dividends; (b) had a Yes No foreign account; or (c) received a distribution from, or were a grantor of, or a transferor to, a foreign trust. Foreign Accounts and Trusts 7a At any time during 2018, did you have a financial interest in or signature authority over a financial account (such as a bank account, securities account, or brokerage account) located in a foreign If "Yes," are you required to file FinCEN Form 114, Report of Foreign Bank and Financial Accounts (FBAR), to report that financial interest or signature authority? See FinCEN Form 114 and its instructions for filing requirements and exceptions to those requirements . See instructions.) b If you are required to file FinCEN Form 114, enter the name of the foreign country where the financial account is located 8 During 2018, did you receive a distribution from, or were you the grantor of, or transferor to, a foreign trust? If "Yes, have to file Form 3520. See instructions Cat. No. 17146N For Paperwork Reduction Act Notice, see your tax return instructions. Schedule B (Form 1040) 2018 SCHEDULE A (Form 1040) Itemized Deductions OMB No. 1545-0074 2018 Go to www.irs.govlScheduleA for instructions and the latest information. Attach to Form 1040. Department of the Treasury Internal Revenue Service 99Caution: If you are claiming a net qualified disaster loss on Form 4684, see the instructions for line 16 Name(s) shown on Form 1040 No.07 Your social security number Medical and Dental Caution: Do not include expenses reimbursed or paid by others. Medical and dental expenses (see instructions)... ..1 Enter amount from Form 1040, line 7 2 1 2 4 5 State and local taxes. Subtract line 3 from line 1. If line 3 is more than line 1, enter -0- Taxes You Paid a State and local income taxes or general sales taxes. You may include either income taxes or general sales taxes on line 5a, but not both. If you elect to include general sales taxes instead of income taxes, check this box .. 5a 5b c State and local personal property taxes....... 5c d Add lines 5a through5c . .. . 5d b State and local real estate taxes (see instructions). . .. . e Enter the smaller of line 5d or $10,000 ($5,000 if married filing 6 Other taxes. List type and amount 7 Add lines 5e and 6 separately)... . . . 5e - . 6 Interest You 8 Home mortgage interest and points. If you didn't use all of your home mortgage loan(s) to buy, build, or improve your home, see instructions and check this box . . Paid Caution: Your mortgage interest deduction may be a Home mortgage interest and points reported to you on Form mited (see b Home mortgage interest not reported to you on Form 1098. If paid to the person from whom you bought the home, see instructions and show that person's name, identifying no., and address 8b C Points not reported to you on Form 1098. See instructions for special rules. . 8c e Add lines 8a through 8c. 9 Investment interest. Attach Form 4952 ...- 8e if required. See 10 Add lines 8e and 9 11 Gifts by cash or check. If you made any gift of $250 or more, Gifts to Charity If you made a benefit for it 12 Other than by cash or check. If any gift of $250 or more, see instructions. You must attach Form 8283 if over $500...12 13 Carryover from prior year.... 13 see instructions.14 Add lines 14 Casualty and 15 Casualty and theft loss(es) from a federally declared disaster (other than net qualified Theft Losses disaster losses). Attach Form 4684 and enter the amount from line 18 of that form. See instructions Other-from list in instructions. List type and amount Other Itemized Deductions Total Itemized Deductions 18 If you elect to itemize deductions even though they are less than your standard 16 16 17 Add the amounts in the far right column for lines 4 through 16Also, enter this amount on Form 1040, line 8 17 .. deduction, check here For Paperwork Reduction Act Notice, see the Instructions for Form 1040. Cat. No. 17145C Schedule A (Form 1040) 2018 SCHEDULE 1 (Form 1040) Department of the Treasury OMB No. 1545-0074 Additional Income and Adjustments to Income 2018 Attach to Form 1040. Go to www.irs.govlForm1040 for instructions and the latest information. uence No. 01 Internal Revenue Service Name(s) shown on Form 1040 Your social security number Additional 1-9b Reserved .. . 1-9b Income 10 Taxable refunds, credits, or offsets of state and local income taxes . . ...10 12 Business income or (loss). Attach Schedule C orC-EZ . . 12 13 Capital gain or (loss). Attach Schedule D if required. If not required, check here13 14 Other gains or (losses). Attach Form 4797.... 14 15a Reserved .. 15b 16a Reserved 16b 17 Rental real estate, royalties, partnerships, S corporations, trusts, etc. Attach Schedule E 17 18 Farm income or (loss). Attach Schedule F... 18 19 Unemployment compensation 19 20a Reserved .. 20b 21 Other income. List type and amount 22 Combine the amounts in the far right column. If you don't have any adjustments to 21 income, enter here and include on Form 1040, line 6. Otherwise, go to line 23 24 Certain business expenses of reservists, performing artists, and fee-basis government officials. Attach Form 2106. . Health savings account deduction. Attach Form 8889 . Moving expenses for members of the Armed Forces Attach Form 3903 to Income 25 26 .. 26 27 Deductible part of self-employment tax. Attach Schedule SE 27 28 Self-employed SEP, SIMPLE, and qualified plans.. 28 29 Self-employed health insurance deduction . ...29 30 Penalty on early withdrawal of savings ...30 31a Alimony paid b Recipient's SSN 31a 33 Student loan interest deduction 33 5 36 Reserved Add lines 23 through 35 135 36 For Paperwork Reduction Act Notice, see your tax return instructions. Cat. No. 71479F Schedule 1 (Form 1040) 2018