Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer all five questions O Wh . DOC bude Com od . 2. www. w . 3 CN MacBook SO OP v 2 3

please answer all five questions

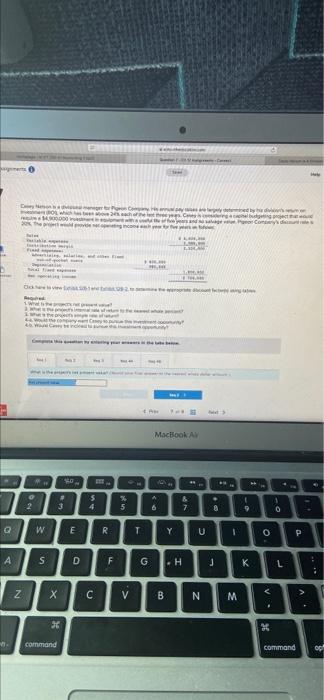

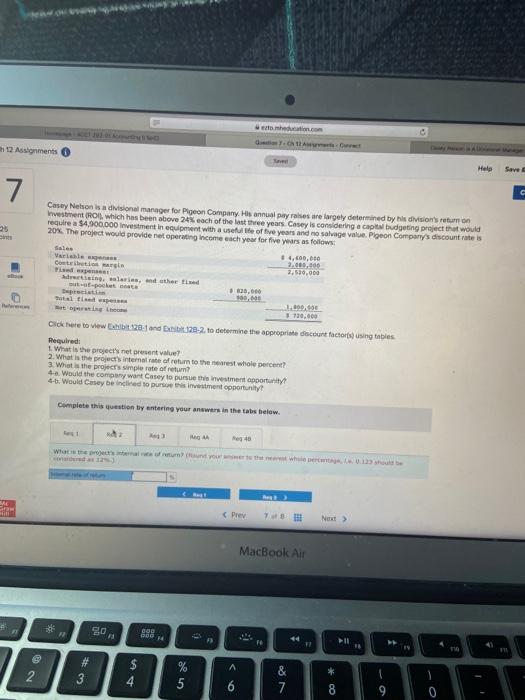

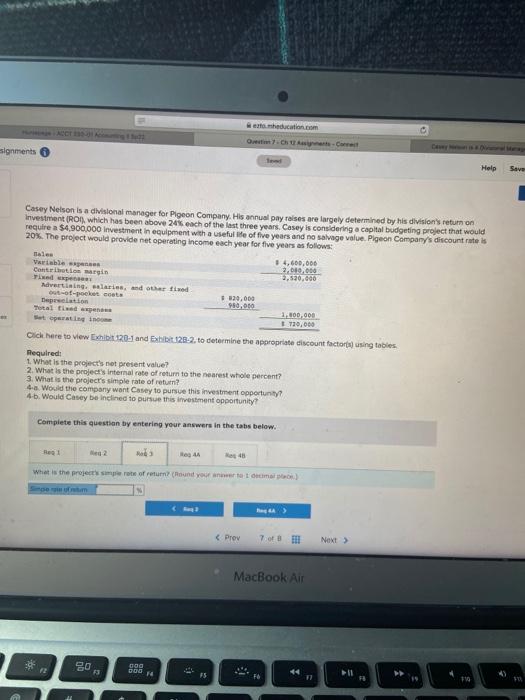

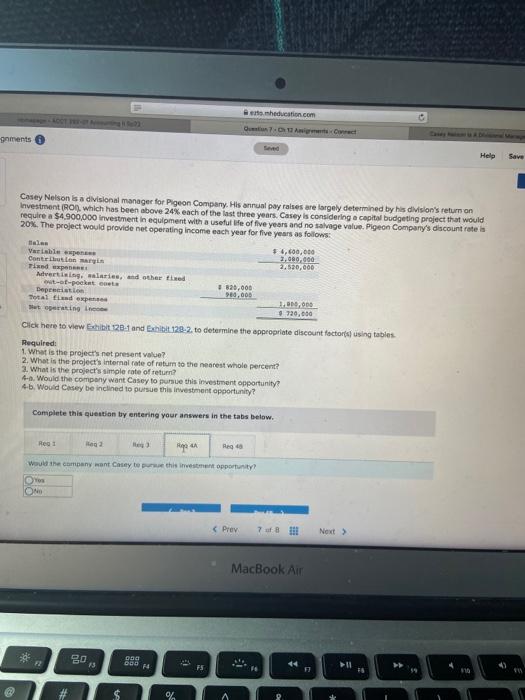

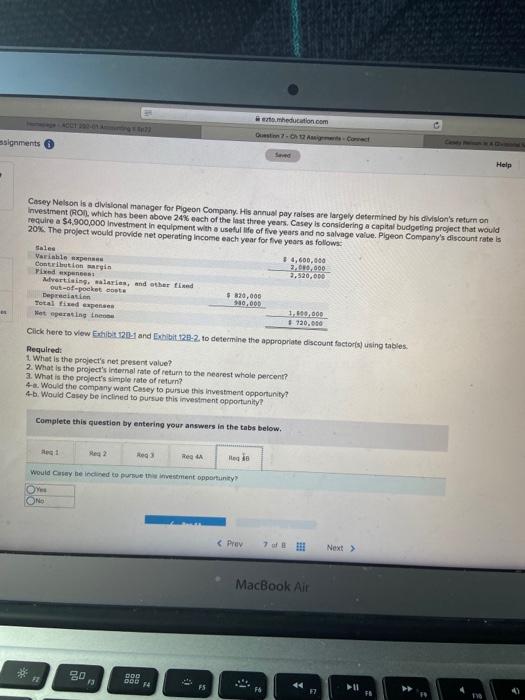

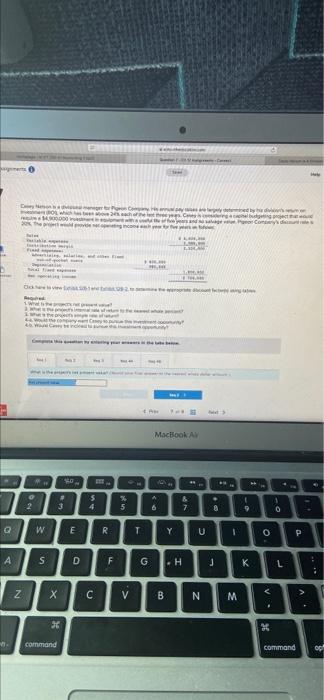

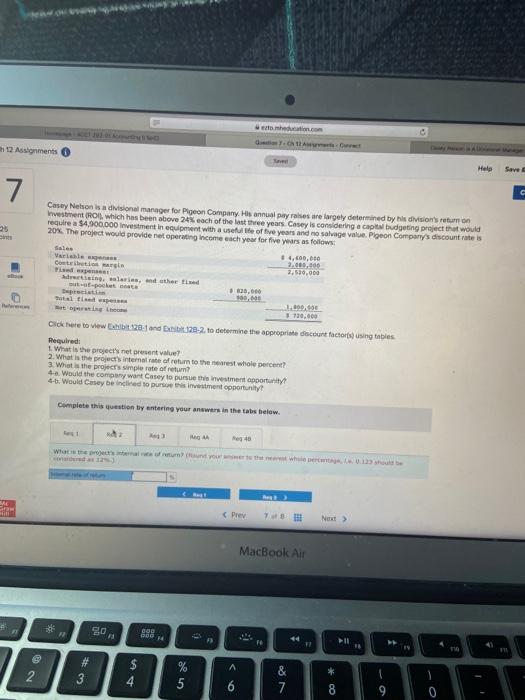

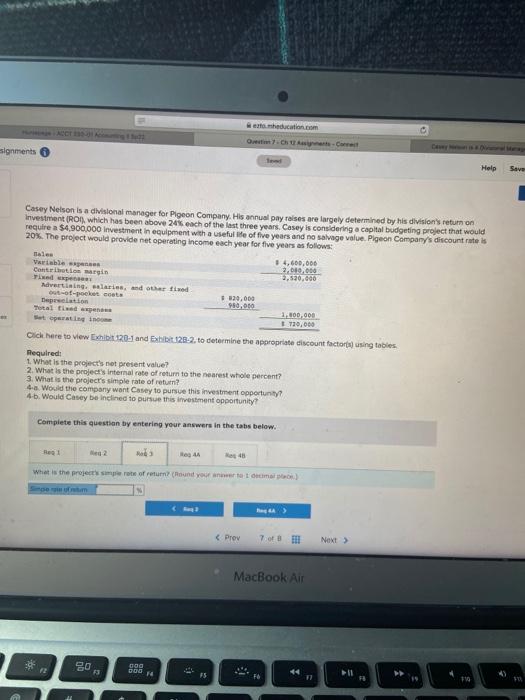

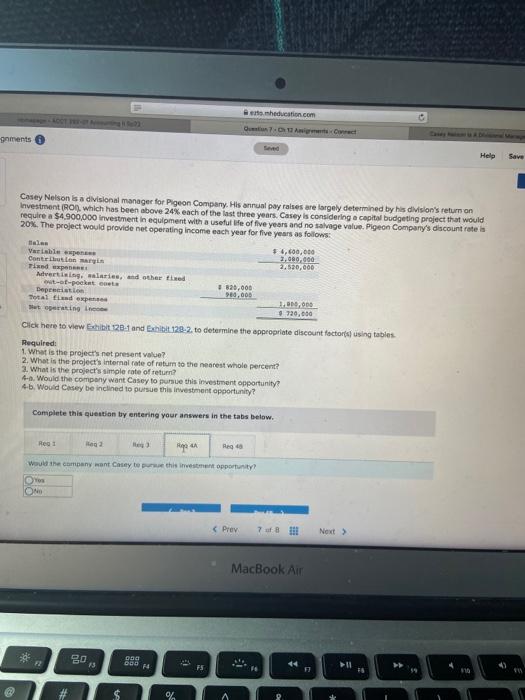

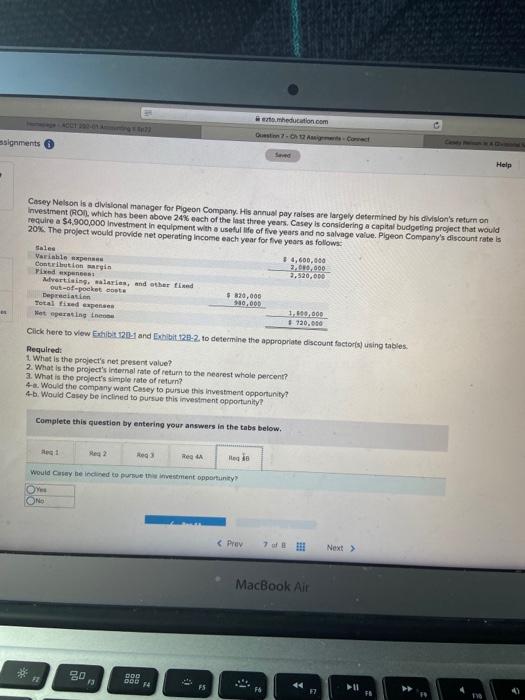

O Wh . DOC bude Com od . 2. www. w . 3 CN MacBook SO OP v 2 3 5 4 % 5 6 7 . 8 G . 1 0 Q w E R T Y U O P S D F G .H L 1 : 1 N v A V B N M . M command Command och sohein.com 12 Assignments Melo Save 7. C 25 Casey Nelson is a divisional manager for Pigeon Company. His au pays we targely determined by his vision's return Investment RO which has been above 24% each of the last three years Casey is considering a capital budgeting project that would require a $4.900.000 investment in equipment with a useful fe of five years and no salvage Value Peon Company's discount rates 20%. The project would provide net operating income each year for five years as follows 4,600,010 are 2.000.000 Contowania 2,530,000 dering, salaries, and other time -pocket 120,000 ela 100.000 the taxe 120X10 3720,000 Click here to view D 120-1 and 120-2. to determine the appropriate court factors using tables Required: 1. What is the project's net presente 2. What is the projects internal rate of return to the nearest whole percent? 3. What is the project's simple rate of retur? 4. Would the company want Casey to pursue this vestment oportunity 4-6. Would Casey be inclined to pursue investment opportunity Complete this question by entering your answers in the tabs below 40 What is the return > E (Prey Next > MacBook Air * LO 6 13 00 FO A 2 3 $ 4 A 4 % 5 & 7 * CO N 8 theducation.com Orchestrert signments Help Casey Nelson is a divisional manager for Pigeon Company. His annual pay raises are largely determined by his division's return on Investment (Ron, which has been above 20% each of the last three years Casey is considering a capital budgeting project that would require a $4.900,000 investment in equipment with a useful life of five years and no salvage value. Pigeon Company's discount rates 20%. The project would provide net operating income each year for five years as follows Bales Variables # 4,600,000 Contration margin 2.000.000 de *-7.530,666 Advertising, waaries, and other two -of-pocket 220,000 Depreciation 980,000 2.100.000 Stoperating in 770,000 Click here to view Ext 120-1 and 120-2. to determine the appropriate discount factorta) using tables Required: 1. What is the project's not present value? 2. What is the project's Internal rate of return to the nearest whole percent? 3. What is the project's simple rate of return? 4. Would the company want Casey to pursue this investment opportunity 4-6. Would Casey be inclined to pursue this investment opportunity? Complete this question by entering your answers in the tabs below. Reg mos HA 45 What is the project prote of return (Round your noticima MacBook Air * 30 72 13 090 000 25 Il 10 seducation.com 7. At gaments Help Save Casey Nelson is a divisional manager for Pigeon Company. His annual pay rates are largely determined by his division's return on Investment (Ron, which has been above 24% each of the last three years, Casey is considering a capital budgeting project that would require a $4.900,000 investment in equipment with a useful fe of five years and no salvage value. Pigeon Company's discount rate is 20%. The project would provide net operating income each year for five years as follows # 4,600,000 Varia pera) 2.000.000 Contanari 2,520,000 Tiedep Advertising, waris, and other time -of-pockets 820.000 Depentition 900.000 To the expens 10.000 Set operating $ 120.000 Click here to view Sibt 281 and Exit 122-2. to determine the appropriate discount factors using tables Required: 1. What is the project's not present value? 2. What is the project's Internal rate of return to the nearest whole percent? 3. What is the project's simple rate of return? 4-6. Would the company want Casey to pursue this investment opportunity? 4-6. Would Casey be inclined to pursue this investment opportunity? Complete this question by entering your answers in the tabs below. Reg1 2 Rya Reco would the company want Casey to this investment opportunity MacBook Air BO 13 Dad 007 FS 11 $ % to medication.com signments Help Casey Nelson is a divisional manager for Pigeon Company. His annual pay raises are largely determined by his division's return on Investment (RON which has been above 24% each of the last three years. Casey is considering a capital budgeting project that would require a $4.900,000 Investment in equipment with a useful fe of five years and no salvage value. Pigeon Company's discount rate is 20%. The project would provide net operating income each year for five years as follows: Sales # 4,600,000 Vaishte 3.00,000 Contration is 3,520,000 Videos Avertising. salaries, and other find out-of-pocket sota $ 80.000 Depreciation 910.000 Total fized expenses 1.100.000 Het eersing L 120.000 Click here to view Ent 120-1 and 28-2. to determine the appropriate discount factors using tables Required 1 What is the project's net present value? 2. What is the project's internal rate of return to the nearest whole percent? 3. What is the project's simple rate of return? 4. Would the company want Casey to pursue his investment opportunity? 4-5. Would Casey be inclined to pursue this investment opportunity! Complete this question by entering your answers in the tabs below. Rea 2 Rog Rege Would y tended to put investment opportunity? NO MacBook Air BO 13 DOO DOO 17

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started