Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer all for multiple likes. The Ace Company has established standards as follows: Direct Material Direct Labor Variable Overhead 3 lbs. per unit @

Please answer all for multiple likes.

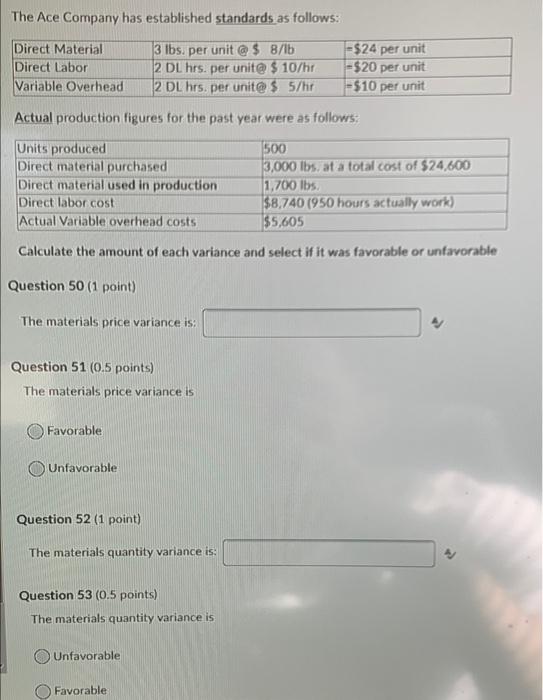

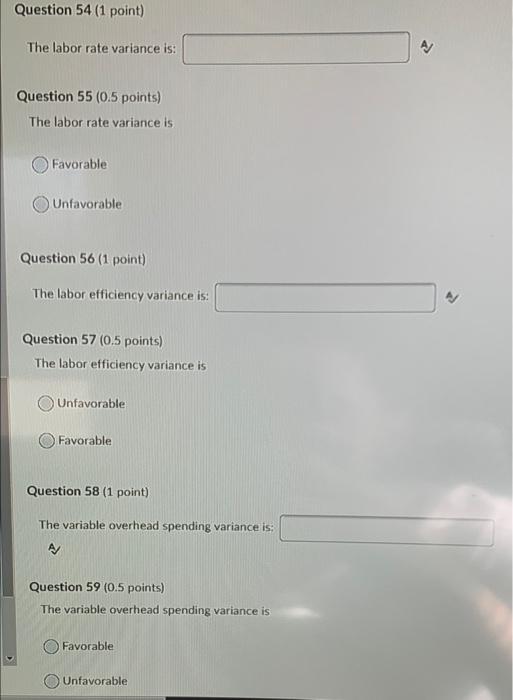

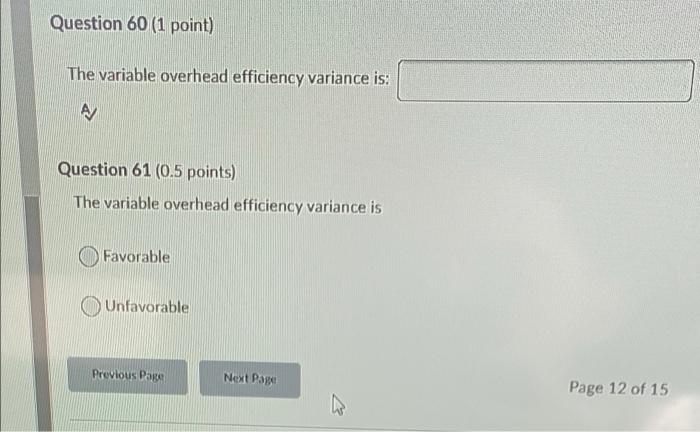

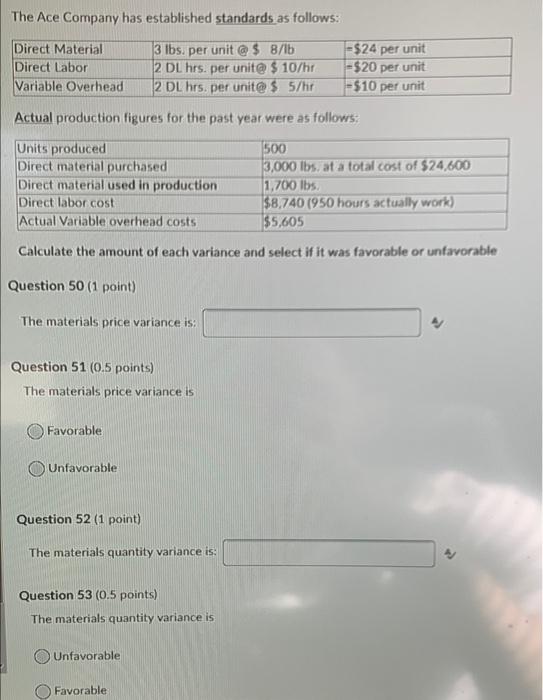

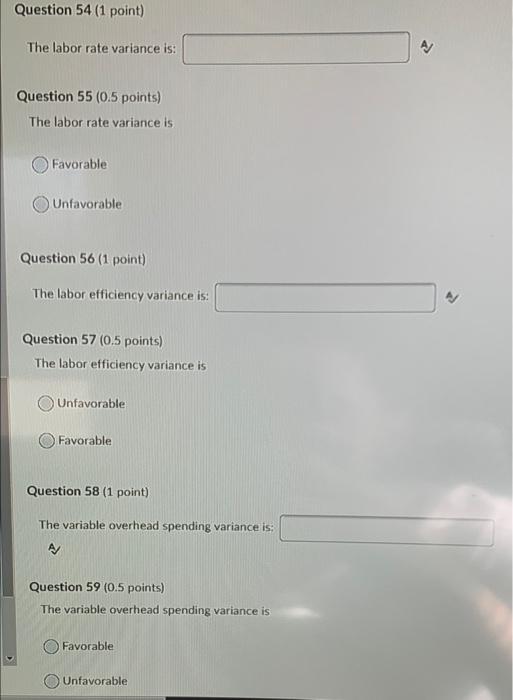

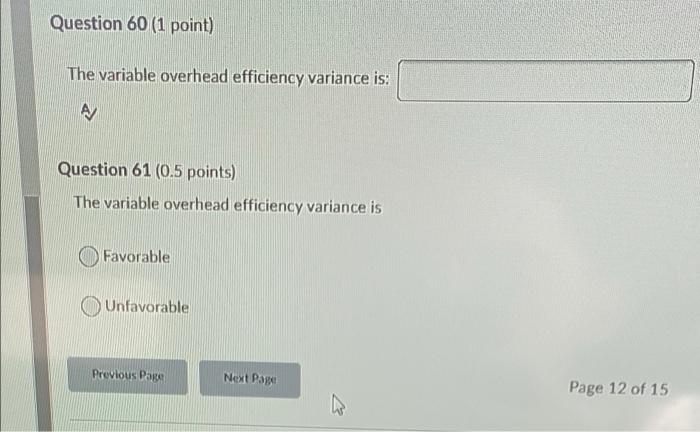

The Ace Company has established standards as follows: Direct Material Direct Labor Variable Overhead 3 lbs. per unit @ $ 8/lb 2 DL hrs. per unit@ $ 10/hr 2 DL hrs. per unit@ $5/hr =$24 per unit =$20 per unit = $10 per unit Actual production figures for the past year were as follows: Units produced Direct material purchased Direct material used in production Direct labor cost Actual Variable overhead costs 500 3,000 lbs at a total cost of $24.600 1.700 lbs $8,740 (950 hours actually work) $5,605 Calculate the amount of each variance and select if it was favorable or unfavorable Question 50 (1 point) The materials price variance is: Question 51 (0.5 points) The materials price variance is Favorable Unfavorable Question 52 (1 point) The materials quantity variance is: Question 53 (0.5 points) The materials quantity variance is Unfavorable Favorable Question 54 (1 point) The labor rate variance is: AM Question 55 (0.5 points) The labor rate variance is Favorable Unfavorable Question 56 (1 point) The labor efficiency variance is: Question 57 (0.5 points) The labor efficiency variance is Unfavorable Favorable Question 58 (1 point) The variable overhead spending variance is: Question 59 (0.5 points) The variable overhead spending variance is Favorable Unfavorable Question 60 (1 point) The variable overhead efficiency variance is: A Question 61 (0.5 points) The variable overhead efficiency variance is Favorable Unfavorable Previous Page Next Page Page 12 of 15

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started