please answer all for upvote

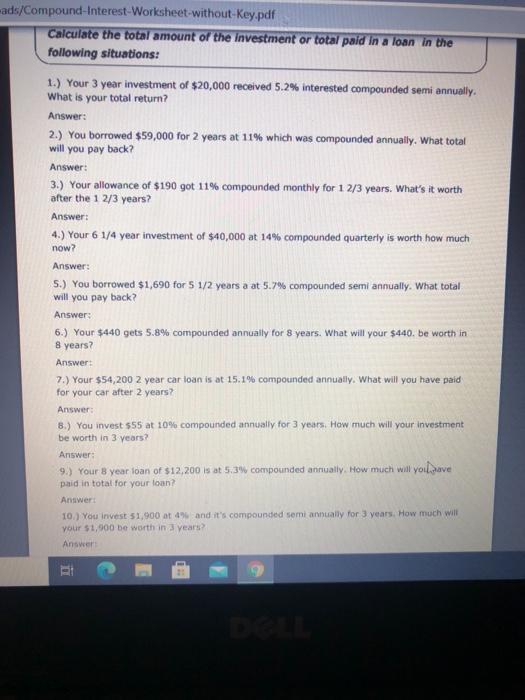

-ads/Compound-Interest-Worksheet-without-Key.pdf Calculate the total amount of the investment or total paid in a loan in the following situations: 1.) Your 3 year investment of $20,000 received 5.2% interested compounded semi annually. What is your total return? Answer: 2.) You borrowed $59,000 for 2 years at 11% which was compounded annually. What total will you pay back? Answer: 3.) Your allowance of $190 got 11% compounded monthly for 1 2/3 years. What's it worth after the 1 2/3 years? Answer: 4.) Your 6 1/4 year investment of $40,000 at 14% compounded quarterly is worth how much now? Answer: S.) You borrowed $1,690 for 5 1/2 years a at 5.7% compounded semi annually. What total will you pay back? Answer: 6.) Your $440 gets 5.8% compounded annually for 8 years. What will your $440. be worth in 8 years? Answer: 7.) Your $54,200 2 year car loan is at 15.1% compounded annually. What will you have paid for your car after 2 years? Answer: 8.) You invest $55 at 10% compounded annually for 3 years. How much will your investment be worth in 3 years? Answer: 9.) Your 8 year loan of $12,200 is at 5.3 compounded annually. How much will you have paid in total for your loan? Answer: 10.) You invest 51.900 at 4% and it's compounded semiannually for 3 years. How much will your $1,900 be worth in 3 years Answer BE -ads/Compound-Interest-Worksheet-without-Key.pdf Calculate the total amount of the investment or total paid in a loan in the following situations: 1.) Your 3 year investment of $20,000 received 5.2% interested compounded semi annually. What is your total return? Answer: 2.) You borrowed $59,000 for 2 years at 11% which was compounded annually. What total will you pay back? Answer: 3.) Your allowance of $190 got 11% compounded monthly for 1 2/3 years. What's it worth after the 1 2/3 years? Answer: 4.) Your 6 1/4 year investment of $40,000 at 14% compounded quarterly is worth how much now? Answer: S.) You borrowed $1,690 for 5 1/2 years a at 5.7% compounded semi annually. What total will you pay back? Answer: 6.) Your $440 gets 5.8% compounded annually for 8 years. What will your $440. be worth in 8 years? Answer: 7.) Your $54,200 2 year car loan is at 15.1% compounded annually. What will you have paid for your car after 2 years? Answer: 8.) You invest $55 at 10% compounded annually for 3 years. How much will your investment be worth in 3 years? Answer: 9.) Your 8 year loan of $12,200 is at 5.3 compounded annually. How much will you have paid in total for your loan? Answer: 10.) You invest 51.900 at 4% and it's compounded semiannually for 3 years. How much will your $1,900 be worth in 3 years Answer BE