Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer all of it. If not, skip please! SHOW ALL YOUR WORK. 1. Recently. More Money 4U offered an annuity that pays 5.7% compounded

Please answer all of it. If not, skip please! SHOW ALL YOUR WORK.

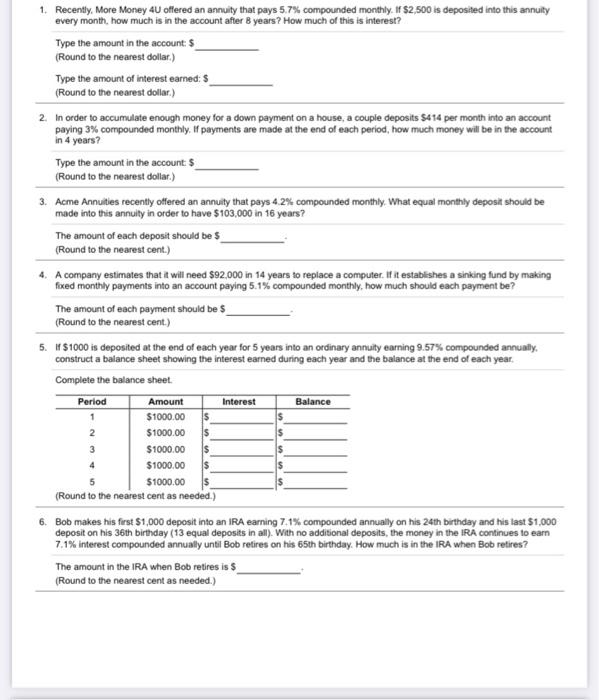

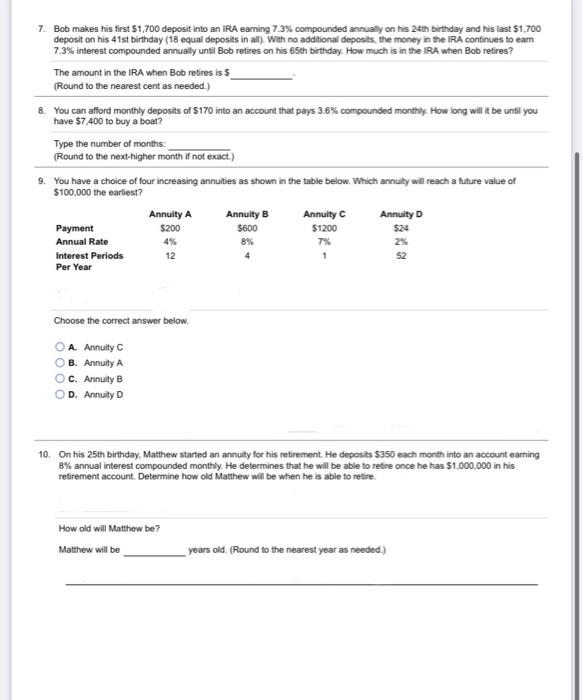

1. Recently. More Money 4U offered an annuity that pays 5.7% compounded monthly. If $2,500 is deposited into this annuty every month, how much is in the account after years? How much of this is interest? Type the amount in the account: $ (Round to the nearest dollar) Type the amount of interest earned: $ (Round to the nearest dollar) 2. In order to accumulate enough money for a down payment on a house, a couple deposits 5414 per month into an account paying 3% compounded monthly. If payments are made at the end of each period, how much money will be in the account in 4 years? Type the amount in the account: $ (Round to the nearest dollar) 3. Acme Annuities recently offered an annuity that pays 4.2% compounded monthly. What equal monthly deposit should be made into this annuity in order to have $103,000 in 16 years? The amount of each deposit should be $ (Round to the nearest cent.) 4. A company estimates that it will need $92,000 in 14 years to replace a computer. If it establishes a sinking fund by making fixed monthly payments into an account paying 5.1% compounded monthly, how much should each payment be? The amount of each payment should be $ (Round to the nearest cent.) 5. 1S1000 is deposited at the end of each year for 5 years into an ordinary annuity earning 9.57% compounded annunity. construct a balance sheet showing the interest earned during each year and the balance at the end of each year. Complete the balance sheet. Period Amount Interest Balance $1000.00 $1000.00 $1000.00 $1000.00 $1000.00 (Round to the nearest cent as needed.) 6. Bob makes his first $1,000 deposit into an IRA earning 7.1% compounded annually on his 24th birthday and his last $1,000 deposit on his 36th birthday (13 equal deposits in all). With no additional deposits, the money in the IRA continues to earn 7.1% interest compounded annually until Bob retires on his 65th birthday. How much is in the IRA when Bob retires? The amount in the IRA when Bob retires is $ (Round to the nearest cent as needed.) 1 2 $ $ $ $ 4 $ 7. Bob makes his first $1,700 deposit into an IRA earning 7.3% compounded annually on his 24th birthday and his last $1,700 deposit on his 41st birthday (18 equal deposits in all). With no additional deposits, the money in the IRA continues to earn 7.3% interest compounded annually until Bob retires on his 65th birthday. How much is in the IRA when Bob retires? The amount in the IRA when Bob retires is $_ (Round to the nearest cent as needed.) 8. You can afford monthly deposits of $170 into an account that pays 3.8% compounded monthly. How long will it be until you have $7.400 to buy a boat? Type the number of months (Round to the next-higher month if not exact) 9. You have a choice of four increasing annuities as shown in the table below. Which annuty will reach a each a future value of $100,000 the earliest? Annuity A Annuity B Annuity C Annuity D Payment $200 3600 $1200 $24 Annual Rate 4% 8% 7% 2% Interest Periods 12 1 52 Per Year 4 Choose the correct answer below. A. Annuity B. Annuity A C. Annuity B D. Annuity D 10. On his 25th birthday, Matthew started an annuity for his retirement. He deposits $350 each month into an account earning 8% annual interest compounded monthly. He determines that he will be able to retire once he has $1,000,000 in his retirement account. Determine how old Matthew will be when he is able to retire. How old will Matthew be? Matthew will be years old. (Round to the nearest year as needed.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started