Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PLEASE ANSWER ALL OF THEM OR DO NOT ANSWER ANY OF THEM! I WILL GIVE THUMBS UP IF ALL OF THEM ARE ANSWERED a. Which

PLEASE ANSWER ALL OF THEM OR DO NOT ANSWER ANY OF THEM! I WILL GIVE THUMBS UP IF ALL OF THEM ARE ANSWERED

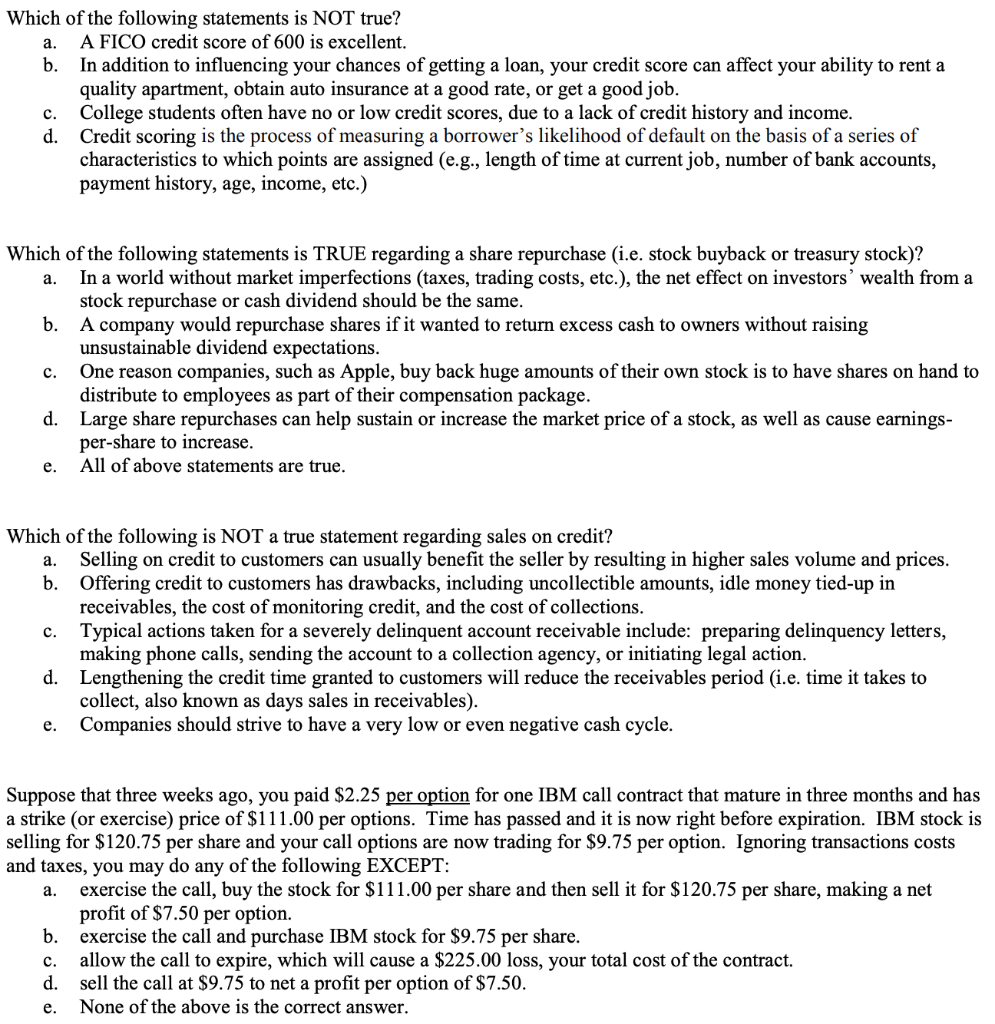

a. Which of the following statements is NOT true? A FICO credit score of 600 is excellent. b. In addition to influencing your chances of getting a loan, your credit score can affect your ability to rent a quality apartment, obtain auto insurance at a good rate, or get a good job. c. College students often have no or low credit scores, due to a lack of credit history and income. d. Credit scoring is the process of measuring a borrower's likelihood of default on the basis of a series of characteristics to which points are assigned (e.g., length of time at current job, number of bank accounts, payment history, age, income, etc.) a. Which of the following statements is TRUE regarding a share repurchase (i.e. stock buyback or treasury stock)? In a world without market imperfections (taxes, trading costs, etc.), the net effect on investors' wealth from a stock repurchase or cash dividend should be the same. b. A company would repurchase shares if it wanted to return excess cash to owners without raising unsustainable dividend expectations. One reason companies, such as Apple, buy back huge amounts of their own stock is to have shares on hand to distribute to employees as part of their compensation package. d. Large share repurchases can help sustain or increase the market price of a stock, as well as cause earnings- per-share to increase. All of above statements are true. c. e. Which of the following is NOT a true statement regarding sales on credit? a. Selling on credit to customers can usually benefit the seller by resulting in higher sales volume and prices. b. Offering credit to customers has drawbacks, including uncollectible amounts, idle money tied-up in receivables, the cost of monitoring credit, and the cost of collections. Typical actions taken for a severely delinquent account receivable include: preparing delinquency letters, making phone calls, sending the account to a collection agency, or initiating legal action. d. Lengthening the credit time granted to customers will reduce the receivables period (i.e. time it takes to collect, also known as days sales in receivables). Companies should strive to have a very low or even negative cash cycle. c. e. a. Suppose that three weeks ago, you paid $2.25 per option for one IBM call contract that mature in three months and has a strike (or exercise) price of $111.00 per options. Time has passed and it is now right before expiration. IBM stock is selling for $120.75 per share and your call options are now trading for $9.75 per option. Ignoring transactions costs and taxes, you may do any of the following EXCEPT: exercise the call, buy the stock for $111.00 per share and then sell it for $120.75 per share, making a net profit of $7.50 per option. b. exercise the call and purchase IBM stock for $9.75 per share. allow the call to expire, which will cause a $225.00 loss, your total cost of the contract. d. sell the call at $9.75 to net a profit per option of $7.50. None of the above is the correct answer. c. e. a. Which of the following statements is NOT true? A FICO credit score of 600 is excellent. b. In addition to influencing your chances of getting a loan, your credit score can affect your ability to rent a quality apartment, obtain auto insurance at a good rate, or get a good job. c. College students often have no or low credit scores, due to a lack of credit history and income. d. Credit scoring is the process of measuring a borrower's likelihood of default on the basis of a series of characteristics to which points are assigned (e.g., length of time at current job, number of bank accounts, payment history, age, income, etc.) a. Which of the following statements is TRUE regarding a share repurchase (i.e. stock buyback or treasury stock)? In a world without market imperfections (taxes, trading costs, etc.), the net effect on investors' wealth from a stock repurchase or cash dividend should be the same. b. A company would repurchase shares if it wanted to return excess cash to owners without raising unsustainable dividend expectations. One reason companies, such as Apple, buy back huge amounts of their own stock is to have shares on hand to distribute to employees as part of their compensation package. d. Large share repurchases can help sustain or increase the market price of a stock, as well as cause earnings- per-share to increase. All of above statements are true. c. e. Which of the following is NOT a true statement regarding sales on credit? a. Selling on credit to customers can usually benefit the seller by resulting in higher sales volume and prices. b. Offering credit to customers has drawbacks, including uncollectible amounts, idle money tied-up in receivables, the cost of monitoring credit, and the cost of collections. Typical actions taken for a severely delinquent account receivable include: preparing delinquency letters, making phone calls, sending the account to a collection agency, or initiating legal action. d. Lengthening the credit time granted to customers will reduce the receivables period (i.e. time it takes to collect, also known as days sales in receivables). Companies should strive to have a very low or even negative cash cycle. c. e. a. Suppose that three weeks ago, you paid $2.25 per option for one IBM call contract that mature in three months and has a strike (or exercise) price of $111.00 per options. Time has passed and it is now right before expiration. IBM stock is selling for $120.75 per share and your call options are now trading for $9.75 per option. Ignoring transactions costs and taxes, you may do any of the following EXCEPT: exercise the call, buy the stock for $111.00 per share and then sell it for $120.75 per share, making a net profit of $7.50 per option. b. exercise the call and purchase IBM stock for $9.75 per share. allow the call to expire, which will cause a $225.00 loss, your total cost of the contract. d. sell the call at $9.75 to net a profit per option of $7.50. None of the above is the correct answer. c. eStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started