Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer All of them Use the following to answer questions 13 - 17 KMC Corp.'s management is considering either a 100% stock dividend or

please answer All of them

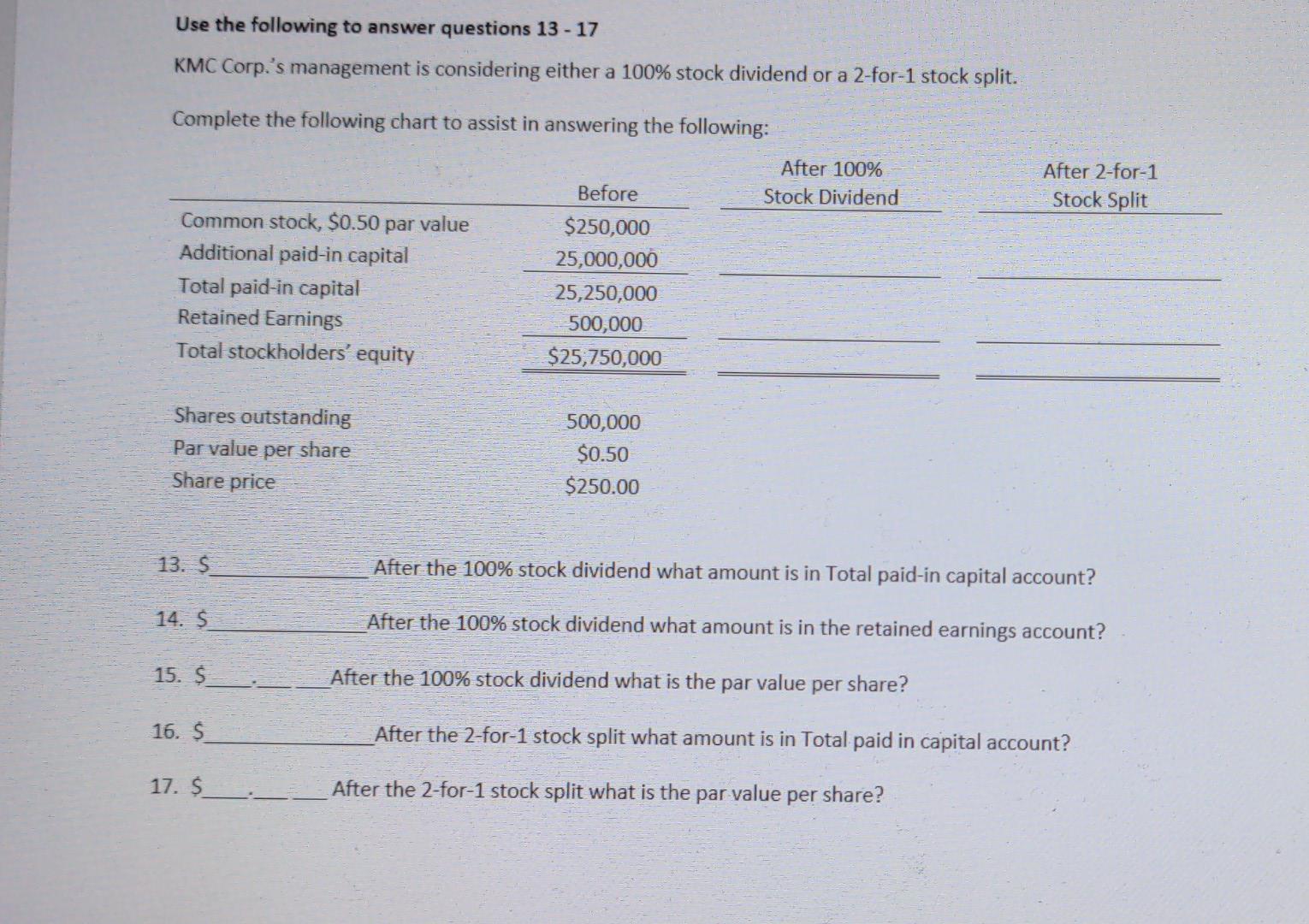

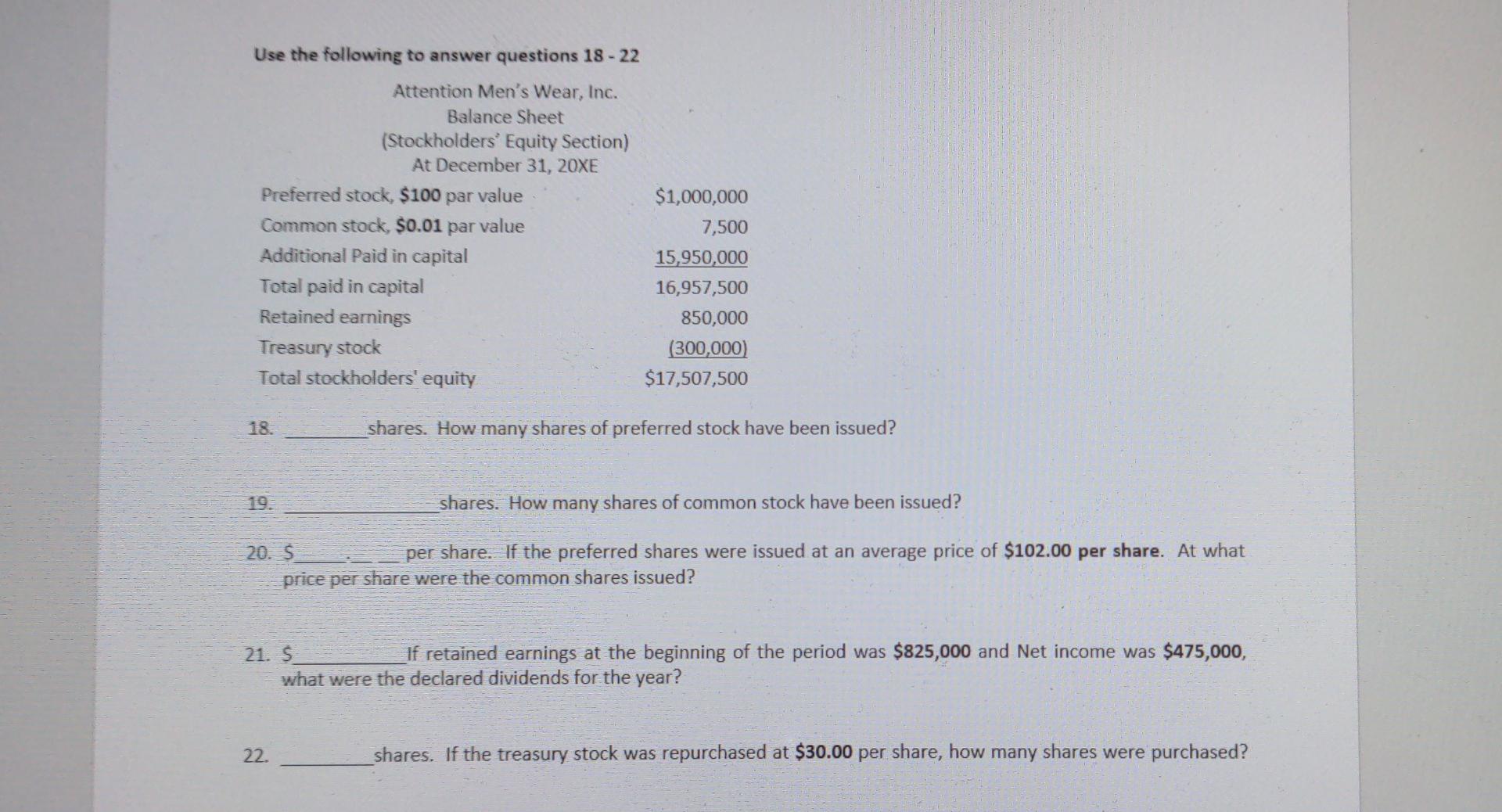

Use the following to answer questions 13 - 17 KMC Corp.'s management is considering either a 100% stock dividend or a 2-for-1 stock split. Complete the following chart to assist in answering the following: After 100% Stock Dividend After 2-for-1 Stock Split Common stock, $0.50 par value Additional paid-in capital Total paid-in capital Retained Earnings Total stockholders' equity Before $250,000 25,000,000 25,250,000 500,000 $25,750,000 Shares outstanding Par value per share Share price 500,000 $0.50 $250.00 13. $ After the 100% stock dividend what amount is in Total paid-in capital account? 14. s After the 100% stock dividend what amount is in the retained earnings account? 15. $ After the 100% stock dividend what is the par value per share? 16. $ After the 2-for-1 stock split what amount is in Total paid in capital account? 17. $ After the 2-for-1 stock split what is the par value per share? Use the following to answer questions 18 - 22 Attention Men's Wear, Inc. Balance Sheet (Stockholders' Equity Section) At December 31, 20XE Preferred stock, $100 par value $1,000,000 Common stock, $0.01 par value 7,500 Additional Paid in capital 15,950,000 Total paid in capital 16,957,500 Retained earnings 850,000 Treasury stock (300,000) Total stockholders' equity $17,507,500 18. shares. How many shares of preferred stock have been issued? 19. shares. How many shares of common stock have been issued? 20. $ per share. If the preferred shares were issued at an average price of $102.00 per share. At what price per share were the common shares issued? 21. $ If retained earnings at the beginning of the period was $825,000 and Net income was $475,000, what were the declared dividends for the year? 22. shares. If the treasury stock was repurchased at $30.00 per share, how many shares were purchased? Use the following to answer questions 13 - 17 KMC Corp.'s management is considering either a 100% stock dividend or a 2-for-1 stock split. Complete the following chart to assist in answering the following: After 100% Stock Dividend After 2-for-1 Stock Split Common stock, $0.50 par value Additional paid-in capital Total paid-in capital Retained Earnings Total stockholders' equity Before $250,000 25,000,000 25,250,000 500,000 $25,750,000 Shares outstanding Par value per share Share price 500,000 $0.50 $250.00 13. $ After the 100% stock dividend what amount is in Total paid-in capital account? 14. s After the 100% stock dividend what amount is in the retained earnings account? 15. $ After the 100% stock dividend what is the par value per share? 16. $ After the 2-for-1 stock split what amount is in Total paid in capital account? 17. $ After the 2-for-1 stock split what is the par value per share? Use the following to answer questions 18 - 22 Attention Men's Wear, Inc. Balance Sheet (Stockholders' Equity Section) At December 31, 20XE Preferred stock, $100 par value $1,000,000 Common stock, $0.01 par value 7,500 Additional Paid in capital 15,950,000 Total paid in capital 16,957,500 Retained earnings 850,000 Treasury stock (300,000) Total stockholders' equity $17,507,500 18. shares. How many shares of preferred stock have been issued? 19. shares. How many shares of common stock have been issued? 20. $ per share. If the preferred shares were issued at an average price of $102.00 per share. At what price per share were the common shares issued? 21. $ If retained earnings at the beginning of the period was $825,000 and Net income was $475,000, what were the declared dividends for the year? 22. shares. If the treasury stock was repurchased at $30.00 per share, how many shares were purchasedStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started