please answer all of these question by using word or excel thank you!

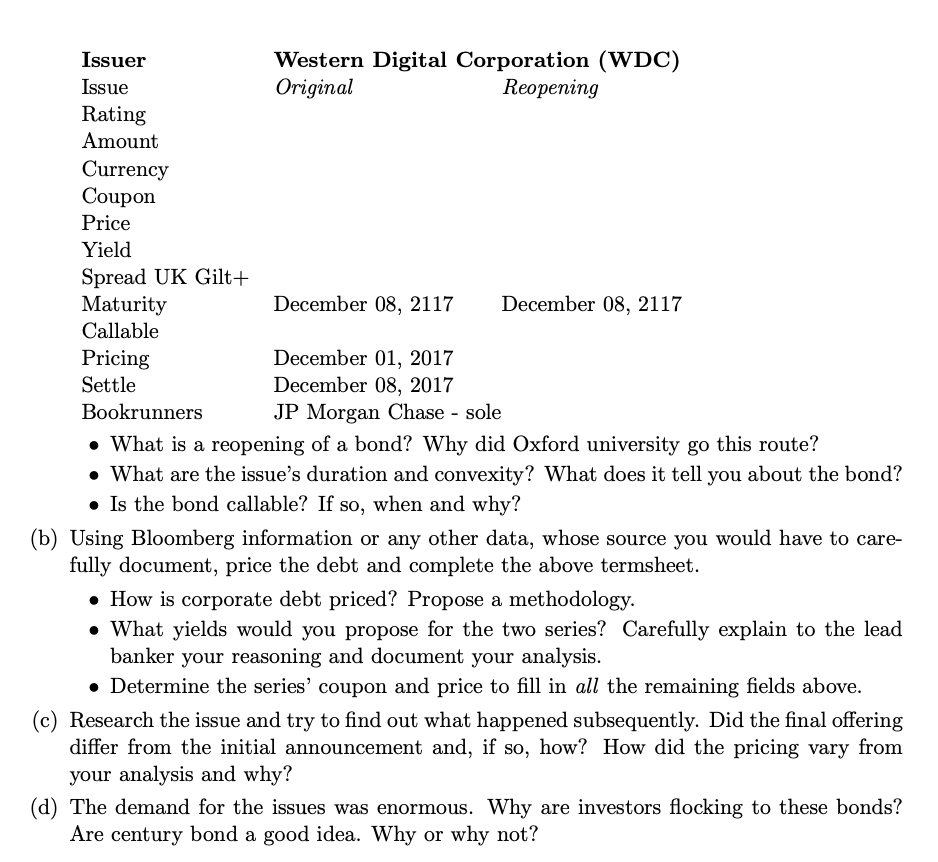

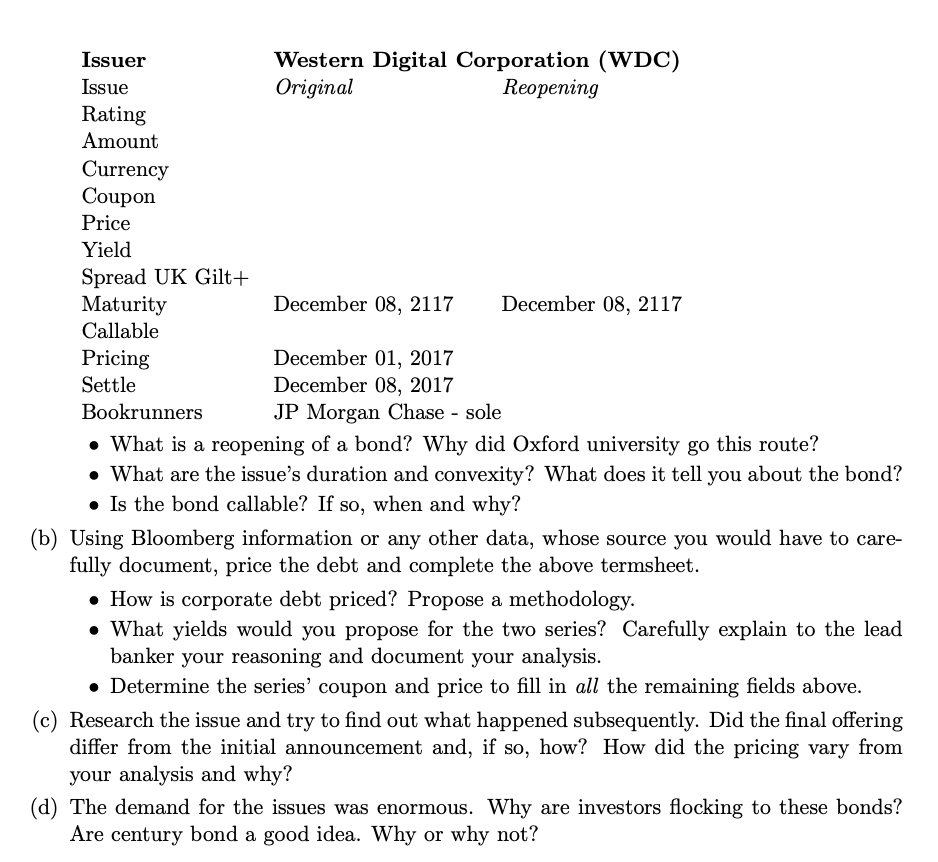

5. Century Bonds. As a financial analyst working for a prominent hedge fund, you follow the emerging new market segment of socalled century bonds. Recently, there has been a fair amount of activity in this segment since Austria and Oxford University established a fashionable new trend in global bond markets. Especially the Oxford issue attracted your attention in no small matter because the issuer and their lead manager recently reopened the issue. Here is recent press coverage of the announcement of the bond offering: Oxford university raises 750m with 100-year bond Oxford university has raised three times as much money as initially expected from its first ever bond, as strong investor demand allowed the triple-A rated institution to borrow at more attractive levels. The 100-year-bond, which was launched earlier this week, was increased in size to 750m from 250m, and attracted close to 3bn in potential investment. The ultra- long dated deal came with an annual coupon of just 2.5 per cent lower than the rate implied by initial pricing expectations, and just 85 basis points above a UK government bond maturing in 2068. The issue makes Oxford the latest in a series of UK universities to enter the bond markets. Last year, Cardiff borrowed 300m in 40-year debt at just 3.1 per cent, while Bristol borrowed 200m from a US investor in May this year. "Looking around the world we could see that other universities had entered the bond market," said Louise Richardson, vice-chancellor. The time seemed opportune now, given the prevailing conditions and given the scale of our ambitions". Government funding for universities has been reduced over recent years, making them more dependent on student tuition and external financing. Last year UK higher education and schools raised $1.8bn in bonds the highest level on record, according to data from Dealogic. Oxford, which dates from the 11th century, plans to use the proceeds for long-term strategic projects and to further the academic mission of the university. Universities, which are often seen as strong credits, have been able to borrow at extremely attractive rates on the back of low interest rates globally. Central bank activity has also generated demand across financial markets for long-dated securities. JPMorgan was the sole bookrunner on the deal. (FT, December 01, 2017) Oxford university plans more 100-year debt in 'anything goes' bond market Oxford university is planning to increase the size of its 100-year bond, riding a wave of cheap borrowing that swept across Europe last year and has gained even more momentum this month. The university has hired banks to gauge appetite among investors for reopening" the bond, which was launched in 2017. If a deal goes ahead, it will join an unusually lively rush of bond issues to kick off 2020, reflecting efforts by companies and other institutions to cash in on rock-bottom borrowing costs. The year is definitely off to a very busy start, doing its best to break records," said Armin Peter, global head of the debt syndicate at UBS. The university raised 750m from its first ever bond in 2017, as strong investor demand allowed the triple A-rated institution to borrow at attractive levels. The ultra-long 100- year-bond attracted close to 3bn in orders at the time and secured a 2.54 per cent yield. Reopening the bond would allow Oxford to issue more at the original face value, maturity and coupon rate but at the current market price. It is an unusual display of confidence for borrowers to issue bonds with such long maturities. "How many insurance companies and pension funds actually have 100-year liabilities? said Luke Reeve, a debt advisory partner at EY. It's a 'look at us, look at how long we can go?." Upbeat market conditions suggest the university may have little difficulty finding new buyers. The euro bond market wrapped up last week with close to 80bn of new issuance, the highest weekly total on record, according to analysis by UBS. That marks a contrast from the same period last year, when, after a late-2018 sell-off, only the "better-rated transactions and big, trusted issuers were able to raise money easily, Mr Peter said. This year, more or less anything goes, he added. Last year offers of euro-denominated non-government bonds were covered 1.4 times on average by orders. So far this year, the rate is over two times. Borrowers have also been able to issue debt at significantly cheaper costs than initially indicated to potential buyers. Meanwhile, government bond markets continue to flourish. On Tuesday Spain attracted a record 53bn of bids for its new 10-year bond, the largest ever order book in euro debt markets. The 10bn of new debt sold at a yield of roughly 0.5 per cent, bankers working on the deal said, and followed record-breaking demand for an Irish debt sale last week. Despite ultra-low borrowing costs, eurozone governments are planning their lowest volumes of annual bond issuance since the financial crisis. That is serving to heighten demand for the deals that hit the market now. "It's quite difficult for investors these days to get bonds in large volumes, so a syndication like Spain's is quite attractive, said Rabobank strategist Lyn Graham-Taylor. It's an opportunity that might not come around again later in the year. Investors have been willing to absorb the heavy flow of new debt in January despite broader weakness in eurozone government debt markets, which pushed German 10-year yields to a nine-month high of minus 0.16 per cent on Monday. (FT, January 14, 2020) (a) Using Bloomberg and the Prospectus (Offering Circular) available from the London Stock Exchange, analyze the terms of the originall offering and the reoffering. Here is an extract of the term sheet which you have to complete: Issuer Western Digital Corporation (WDC) Issue Original Reopening Rating Amount Currency Coupon Price Yield Spread UK Gilt+ Maturity December 08, 2117 December 08, 2117 Callable Pricing December 01, 2017 Settle December 08, 2017 Bookrunners JP Morgan Chase - sole What is a reopening of a bond? Why did Oxford university go this route? What are the issue's duration and convexity? What does it tell you about the bond? Is the bond callable? If so, when and why? (b) Using Bloomberg information or any other data, whose source you would have to care- fully document, price the debt and complete the above termsheet. How is corporate debt priced? Propose a methodology. What yields would you propose for the two series? Carefully explain to the lead banker your reasoning and document your analysis. Determine the series' coupon and price to fill in all the remaining fields above. (c) Research the issue and try to find out what happened subsequently. Did the final offering differ from the initial announcement and, if so, how? How did the pricing vary from your analysis and why? (d) The demand for the issues was enormous. Why are investors flocking to these bonds? Are century bond a good idea. Why or why not? 5. Century Bonds. As a financial analyst working for a prominent hedge fund, you follow the emerging new market segment of socalled century bonds. Recently, there has been a fair amount of activity in this segment since Austria and Oxford University established a fashionable new trend in global bond markets. Especially the Oxford issue attracted your attention in no small matter because the issuer and their lead manager recently reopened the issue. Here is recent press coverage of the announcement of the bond offering: Oxford university raises 750m with 100-year bond Oxford university has raised three times as much money as initially expected from its first ever bond, as strong investor demand allowed the triple-A rated institution to borrow at more attractive levels. The 100-year-bond, which was launched earlier this week, was increased in size to 750m from 250m, and attracted close to 3bn in potential investment. The ultra- long dated deal came with an annual coupon of just 2.5 per cent lower than the rate implied by initial pricing expectations, and just 85 basis points above a UK government bond maturing in 2068. The issue makes Oxford the latest in a series of UK universities to enter the bond markets. Last year, Cardiff borrowed 300m in 40-year debt at just 3.1 per cent, while Bristol borrowed 200m from a US investor in May this year. "Looking around the world we could see that other universities had entered the bond market," said Louise Richardson, vice-chancellor. The time seemed opportune now, given the prevailing conditions and given the scale of our ambitions". Government funding for universities has been reduced over recent years, making them more dependent on student tuition and external financing. Last year UK higher education and schools raised $1.8bn in bonds the highest level on record, according to data from Dealogic. Oxford, which dates from the 11th century, plans to use the proceeds for long-term strategic projects and to further the academic mission of the university. Universities, which are often seen as strong credits, have been able to borrow at extremely attractive rates on the back of low interest rates globally. Central bank activity has also generated demand across financial markets for long-dated securities. JPMorgan was the sole bookrunner on the deal. (FT, December 01, 2017) Oxford university plans more 100-year debt in 'anything goes' bond market Oxford university is planning to increase the size of its 100-year bond, riding a wave of cheap borrowing that swept across Europe last year and has gained even more momentum this month. The university has hired banks to gauge appetite among investors for reopening" the bond, which was launched in 2017. If a deal goes ahead, it will join an unusually lively rush of bond issues to kick off 2020, reflecting efforts by companies and other institutions to cash in on rock-bottom borrowing costs. The year is definitely off to a very busy start, doing its best to break records," said Armin Peter, global head of the debt syndicate at UBS. The university raised 750m from its first ever bond in 2017, as strong investor demand allowed the triple A-rated institution to borrow at attractive levels. The ultra-long 100- year-bond attracted close to 3bn in orders at the time and secured a 2.54 per cent yield. Reopening the bond would allow Oxford to issue more at the original face value, maturity and coupon rate but at the current market price. It is an unusual display of confidence for borrowers to issue bonds with such long maturities. "How many insurance companies and pension funds actually have 100-year liabilities? said Luke Reeve, a debt advisory partner at EY. It's a 'look at us, look at how long we can go?." Upbeat market conditions suggest the university may have little difficulty finding new buyers. The euro bond market wrapped up last week with close to 80bn of new issuance, the highest weekly total on record, according to analysis by UBS. That marks a contrast from the same period last year, when, after a late-2018 sell-off, only the "better-rated transactions and big, trusted issuers were able to raise money easily, Mr Peter said. This year, more or less anything goes, he added. Last year offers of euro-denominated non-government bonds were covered 1.4 times on average by orders. So far this year, the rate is over two times. Borrowers have also been able to issue debt at significantly cheaper costs than initially indicated to potential buyers. Meanwhile, government bond markets continue to flourish. On Tuesday Spain attracted a record 53bn of bids for its new 10-year bond, the largest ever order book in euro debt markets. The 10bn of new debt sold at a yield of roughly 0.5 per cent, bankers working on the deal said, and followed record-breaking demand for an Irish debt sale last week. Despite ultra-low borrowing costs, eurozone governments are planning their lowest volumes of annual bond issuance since the financial crisis. That is serving to heighten demand for the deals that hit the market now. "It's quite difficult for investors these days to get bonds in large volumes, so a syndication like Spain's is quite attractive, said Rabobank strategist Lyn Graham-Taylor. It's an opportunity that might not come around again later in the year. Investors have been willing to absorb the heavy flow of new debt in January despite broader weakness in eurozone government debt markets, which pushed German 10-year yields to a nine-month high of minus 0.16 per cent on Monday. (FT, January 14, 2020) (a) Using Bloomberg and the Prospectus (Offering Circular) available from the London Stock Exchange, analyze the terms of the originall offering and the reoffering. Here is an extract of the term sheet which you have to complete: Issuer Western Digital Corporation (WDC) Issue Original Reopening Rating Amount Currency Coupon Price Yield Spread UK Gilt+ Maturity December 08, 2117 December 08, 2117 Callable Pricing December 01, 2017 Settle December 08, 2017 Bookrunners JP Morgan Chase - sole What is a reopening of a bond? Why did Oxford university go this route? What are the issue's duration and convexity? What does it tell you about the bond? Is the bond callable? If so, when and why? (b) Using Bloomberg information or any other data, whose source you would have to care- fully document, price the debt and complete the above termsheet. How is corporate debt priced? Propose a methodology. What yields would you propose for the two series? Carefully explain to the lead banker your reasoning and document your analysis. Determine the series' coupon and price to fill in all the remaining fields above. (c) Research the issue and try to find out what happened subsequently. Did the final offering differ from the initial announcement and, if so, how? How did the pricing vary from your analysis and why? (d) The demand for the issues was enormous. Why are investors flocking to these bonds? Are century bond a good idea. Why or why not