Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer all or don't answer at all. thank you 21. Assume that the reserve requirements ratio is 15%. An initial injection of $150 million

Please answer all or don't answer at all. thank you

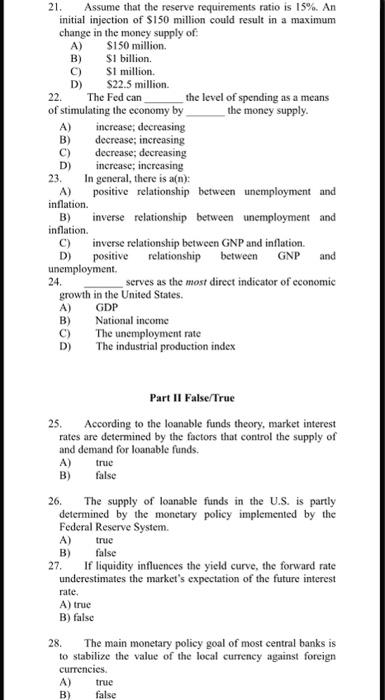

21. Assume that the reserve requirements ratio is 15%. An initial injection of $150 million could result in a maximum change in the money supply of: A) $150 million. B) $1 billion. C) S1 million. D) $22.5 million. 22. The Fed can the level of spending as a means of stimulating the economy by the money supply. A) increase; decreasing B) decrease; increasing C) decrease; decreasing D) increase; increasing 23. In general, there is a(n): A) positive relationship between unemployment and inflation. B) inverse relationship between unemployment and inflation. C) inverse relationship between GNP and inflation. D) positive relationship between GNP and unemployment. 24. serves as the most direct indieator of economic growth in the United States. A) GDP B) National income C) The unemployment rate D) The industrial production index Part II False/True 25. According to the loanable funds theory, market interest rates are determined by the factors that control the supply of and demand for loanable funds. A) true B) false 26. The supply of loanable funds in the U.S. is partly determined by the monetary policy implemented by the Federal Reserve System. A) true B) false 27. If liquidity influences the yield curve, the forward rate underestimates the market's expectation of the future interest rate. A) true B) false 28. The main monetary policy goal of most central banks is to stabilize the value of the local currency against forcign currencies. A) true B) false

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started