please answer ALL or none

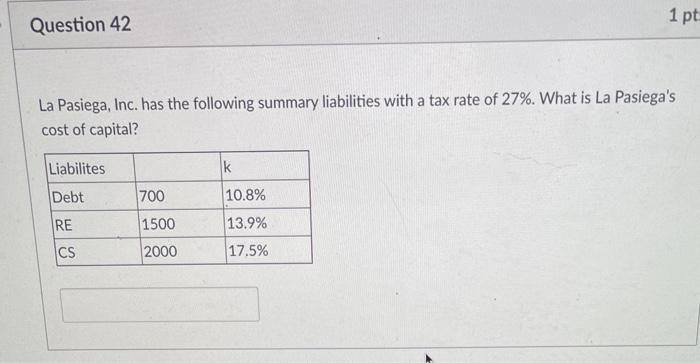

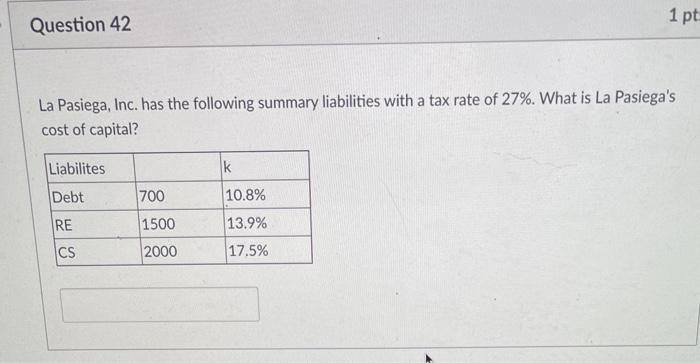

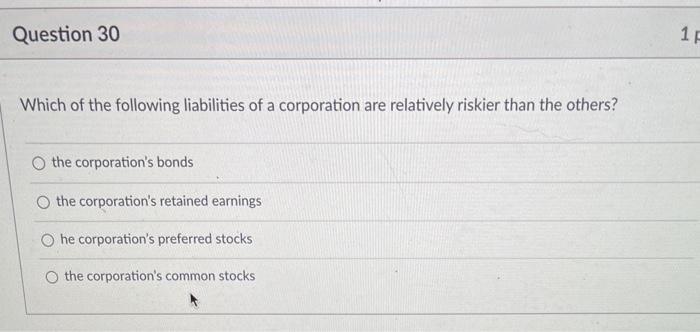

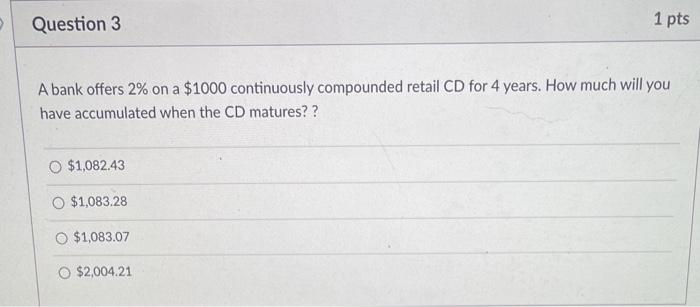

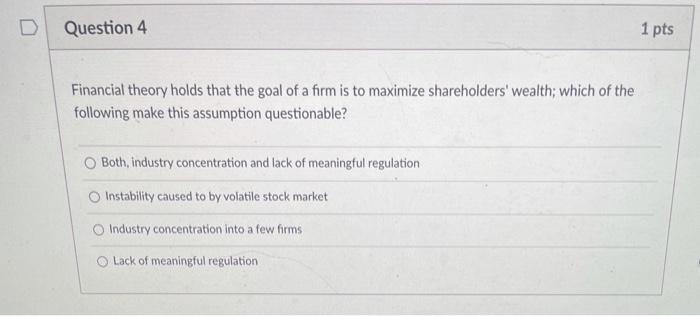

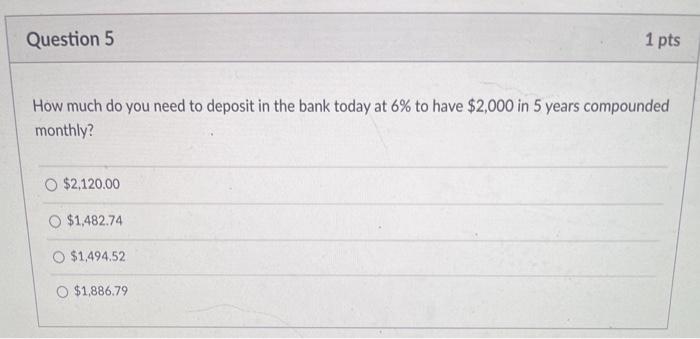

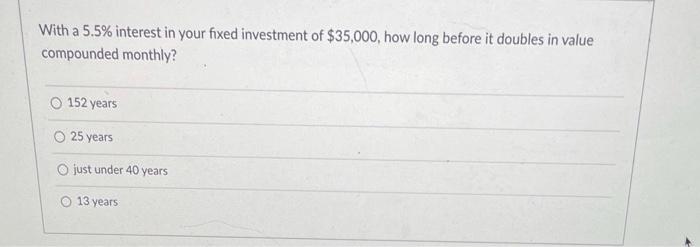

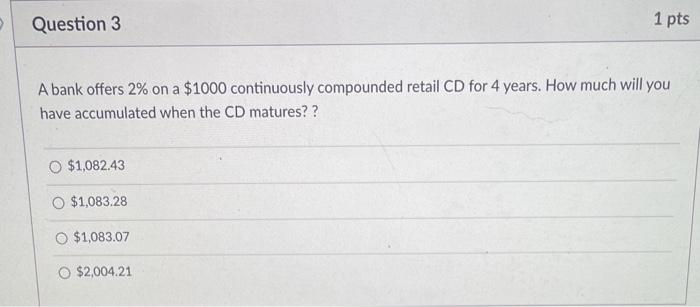

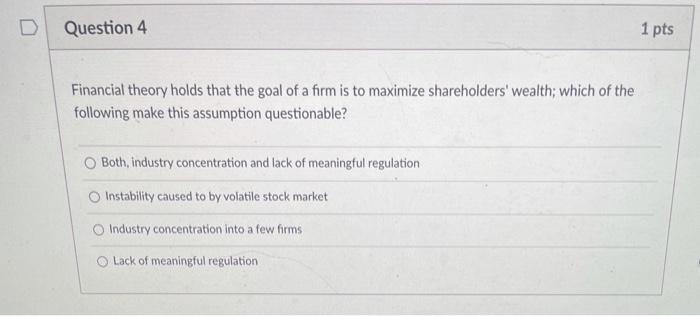

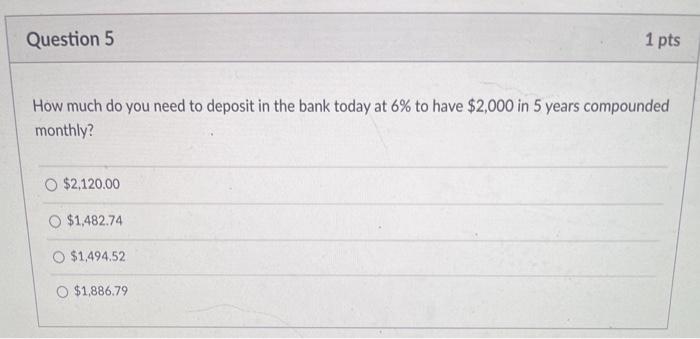

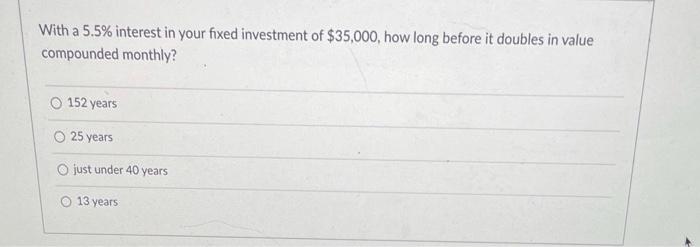

1 pt Question 42 La Pasiega, Inc. has the following summary liabilities with a tax rate of 27%. What is La Pasiega's cost of capital? Liabilites k Debt 700 10.8% RE 1500 13.9% CS 2000 17.5% Question 30 17 Which of the following liabilities of a corporation are relatively riskier than the others? O the corporation's bonds the corporation's retained earnings he corporation's preferred stocks the corporation's common stocks Question 3 1 pts A bank offers 2% on a $1000 continuously compounded retail CD for 4 years. How much will you have accumulated when the CD matures?? $1,082.43 $1,083.28 $1,083.07 $2,004.21 D Question 4 1 pts Financial theory holds that the goal of a firm is to maximize shareholders' wealth; which of the following make this assumption questionable? Both, industry concentration and lack of meaningful regulation Instability caused to by volatile stock market Industry concentration into a few firms Lack of meaningful regulation Question 5 1 pts How much do you need to deposit in the bank today at 6% to have $2,000 in 5 years compounded monthly? $2,120.00 $1.482.74 $1,494.52 O $1,886.79 With a 5.5% interest in your fixed investment of $35,000, how long before it doubles in value compounded monthly? 152 years 25 years O just under 40 years 13 years 1 pt Question 42 La Pasiega, Inc. has the following summary liabilities with a tax rate of 27%. What is La Pasiega's cost of capital? Liabilites k Debt 700 10.8% RE 1500 13.9% CS 2000 17.5% Question 30 17 Which of the following liabilities of a corporation are relatively riskier than the others? O the corporation's bonds the corporation's retained earnings he corporation's preferred stocks the corporation's common stocks Question 3 1 pts A bank offers 2% on a $1000 continuously compounded retail CD for 4 years. How much will you have accumulated when the CD matures?? $1,082.43 $1,083.28 $1,083.07 $2,004.21 D Question 4 1 pts Financial theory holds that the goal of a firm is to maximize shareholders' wealth; which of the following make this assumption questionable? Both, industry concentration and lack of meaningful regulation Instability caused to by volatile stock market Industry concentration into a few firms Lack of meaningful regulation Question 5 1 pts How much do you need to deposit in the bank today at 6% to have $2,000 in 5 years compounded monthly? $2,120.00 $1.482.74 $1,494.52 O $1,886.79 With a 5.5% interest in your fixed investment of $35,000, how long before it doubles in value compounded monthly? 152 years 25 years O just under 40 years 13 years