Please answer all parts (a)-(c) and label them! I will upvote if all of them are answered.

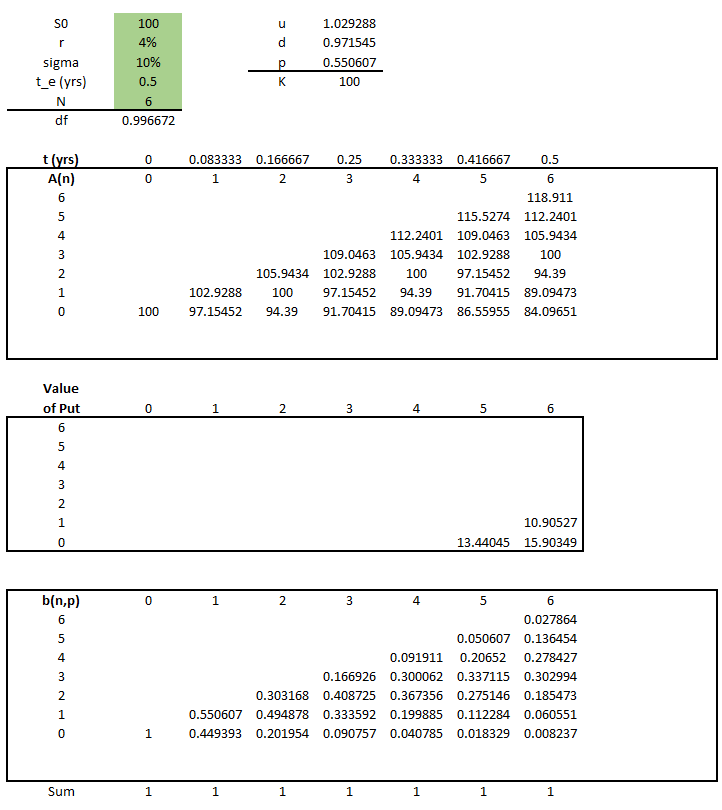

Excel spreadsheet:

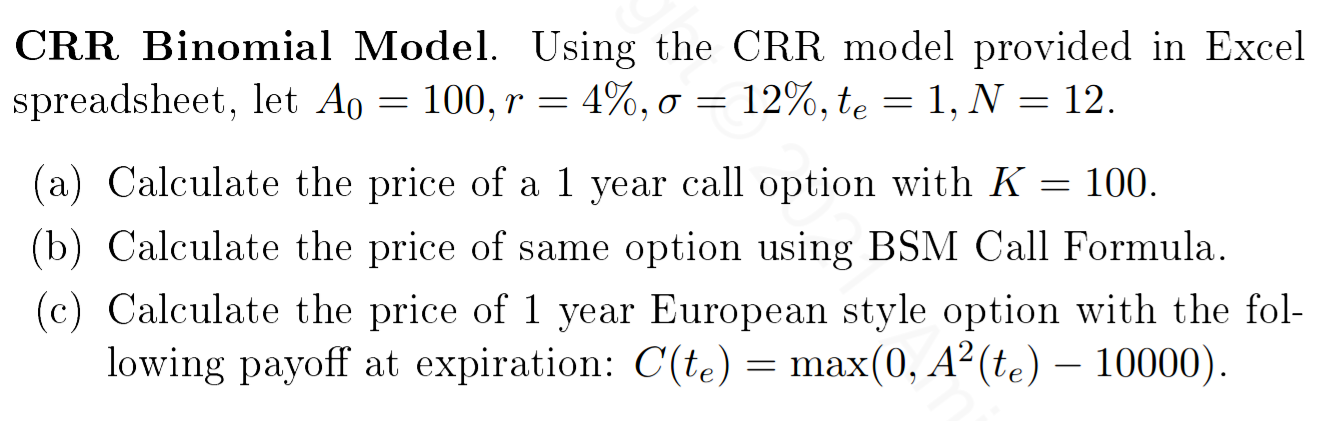

Excel spreadsheet:

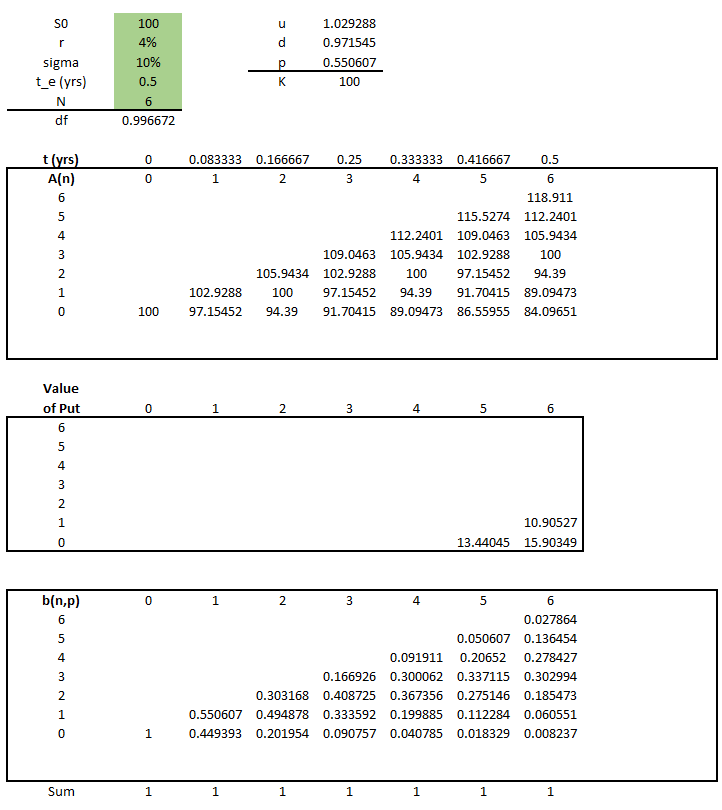

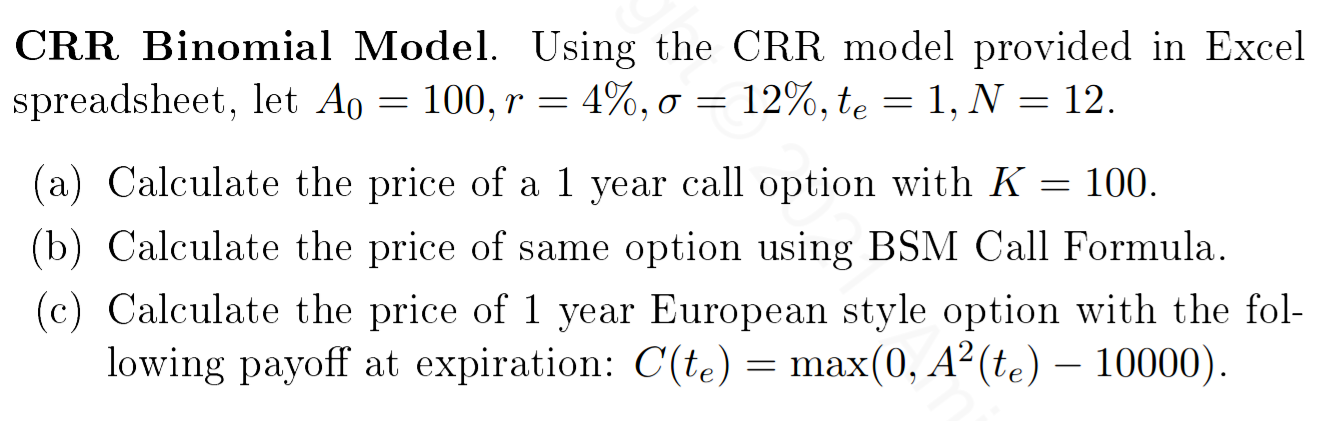

CRR Binomial Model. Using the CRR model provided in Excel spreadsheet, let Ao = 100, r = 4%,0 = 12%, te = 1, N = 12. (a) Calculate the price of a 1 year call option with K = 100. (b) Calculate the price of same option using BSM Call Formula. (c) Calculate the price of 1 year European style option with the fol- lowing payoff at expiration: C(te) = max(0, A(te) 10000). SO r 100 4% 10% 0.5 6 0.996672 1.029288 0.971545 0.550607 100 sigma t_e (yrs) N df p 0 0 0.083333 1 0.166667 2 0.25 3 0.333333 4 tyrs) A(n) 6 5 4 3 0.416667 0.5 5 6 118.911 115.5274 112.2401 109.0463 105.9434 102.9288 100 97.15452 94.39 91.70415 89.09473 86.55955 84.09651 NO 112.2401 109.0463 105.9434 102.9288 100 97.15452 94.39 91.70415 89.09473 105.9434 100 94.39 102.9288 97.15452 100 Value of Put 6 0 1 2 3 4 5 6 5 4 3 2 1 10.90527 15.90349 0 13.44045 0 1 2 b(n,p) 6 3 5 6 0.027864 0.050607 0.136454 0.091911 0.20652 0.278427 0.166926 0.300062 0.337115 0.302994 0.408725 0.367356 0.275146 0.185473 0.333592 0.199885 0.112284 0.060551 0.090757 0.040785 0.018329 0.008237 2 1 0.303168 0.550607 0.494878 0.449393 0.201954 1 Sum 1 1 1 1 1 1 1 CRR Binomial Model. Using the CRR model provided in Excel spreadsheet, let Ao = 100, r = 4%,0 = 12%, te = 1, N = 12. (a) Calculate the price of a 1 year call option with K = 100. (b) Calculate the price of same option using BSM Call Formula. (c) Calculate the price of 1 year European style option with the fol- lowing payoff at expiration: C(te) = max(0, A(te) 10000). SO r 100 4% 10% 0.5 6 0.996672 1.029288 0.971545 0.550607 100 sigma t_e (yrs) N df p 0 0 0.083333 1 0.166667 2 0.25 3 0.333333 4 tyrs) A(n) 6 5 4 3 0.416667 0.5 5 6 118.911 115.5274 112.2401 109.0463 105.9434 102.9288 100 97.15452 94.39 91.70415 89.09473 86.55955 84.09651 NO 112.2401 109.0463 105.9434 102.9288 100 97.15452 94.39 91.70415 89.09473 105.9434 100 94.39 102.9288 97.15452 100 Value of Put 6 0 1 2 3 4 5 6 5 4 3 2 1 10.90527 15.90349 0 13.44045 0 1 2 b(n,p) 6 3 5 6 0.027864 0.050607 0.136454 0.091911 0.20652 0.278427 0.166926 0.300062 0.337115 0.302994 0.408725 0.367356 0.275146 0.185473 0.333592 0.199885 0.112284 0.060551 0.090757 0.040785 0.018329 0.008237 2 1 0.303168 0.550607 0.494878 0.449393 0.201954 1 Sum 1 1 1 1 1 1 1

Excel spreadsheet:

Excel spreadsheet: