Answered step by step

Verified Expert Solution

Question

1 Approved Answer

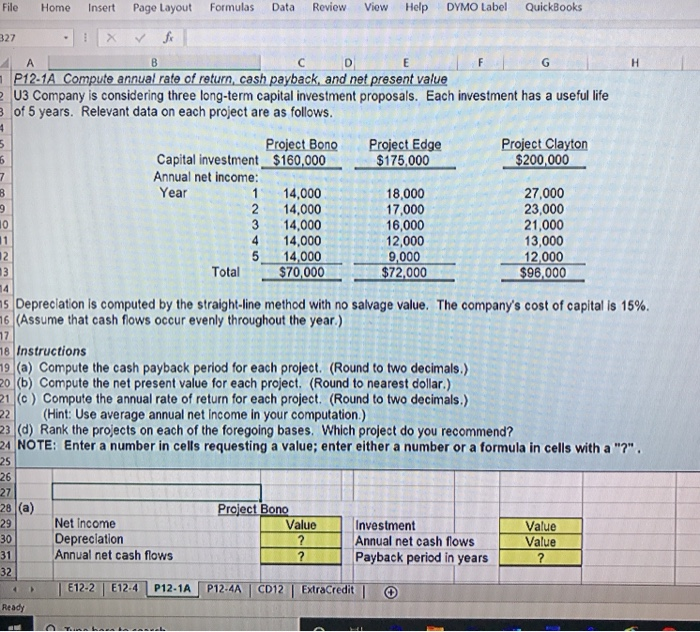

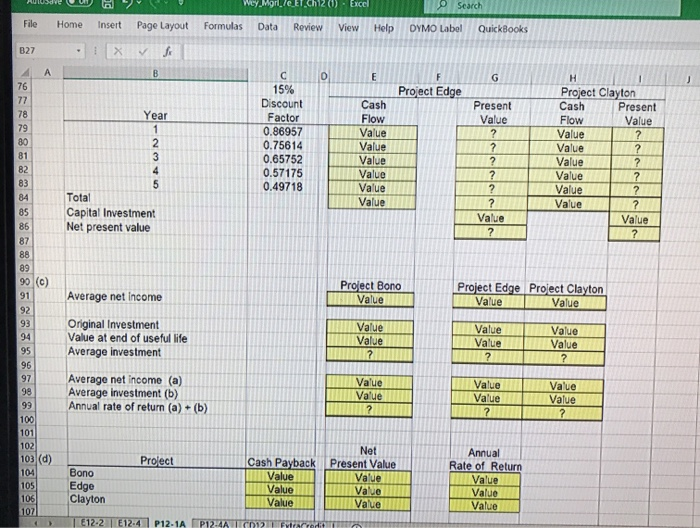

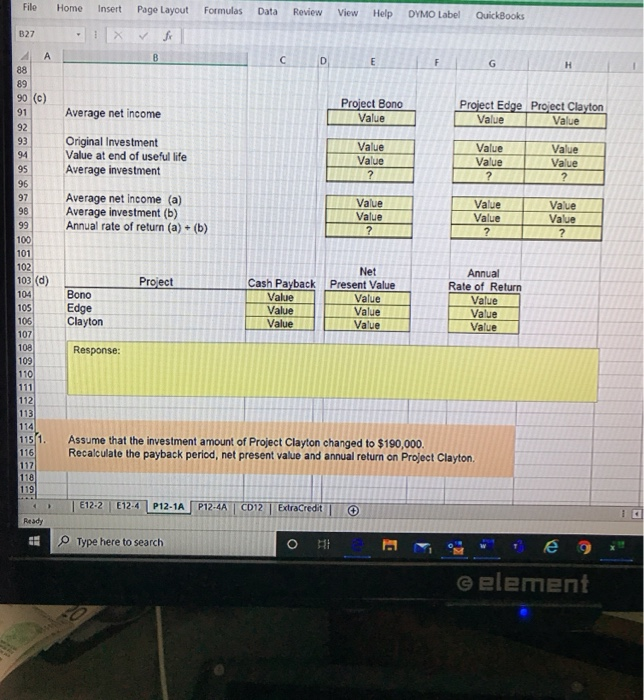

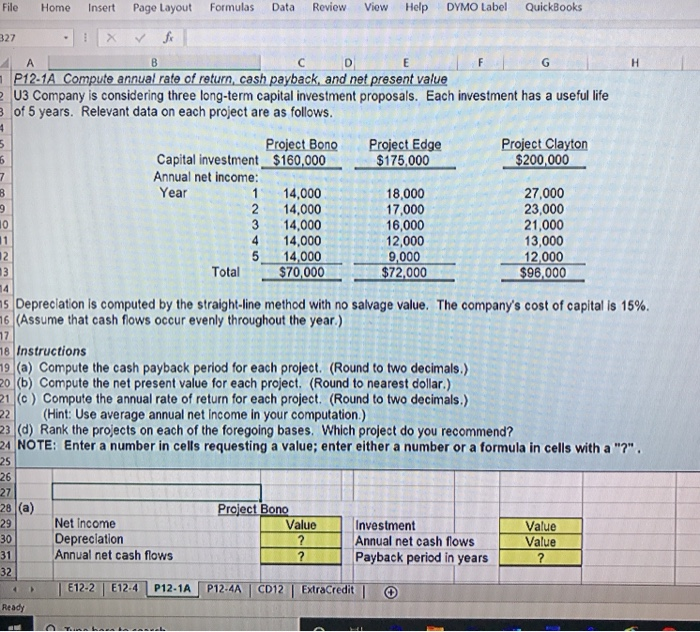

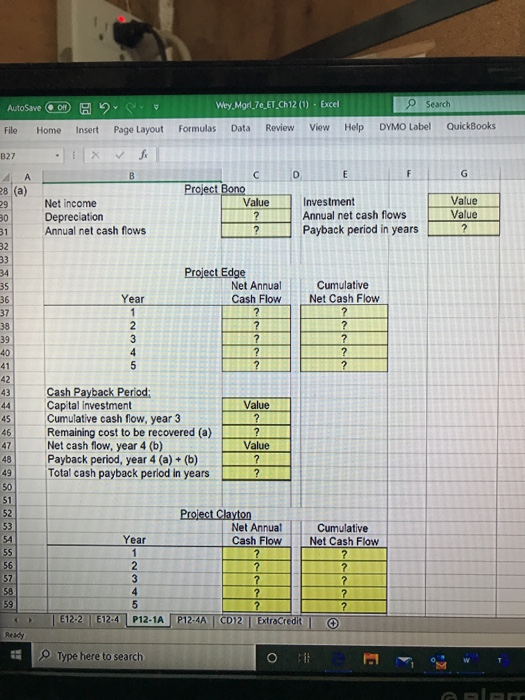

please answer all parts and 1 File Home Insert Page Layout Formulas Data Review View Help DYMO Label QuickBooks 327 - 1X fo C D

please answer all parts and 1

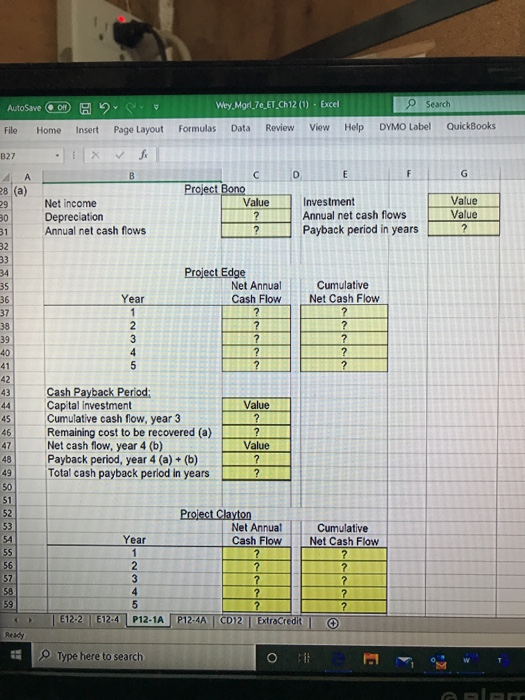

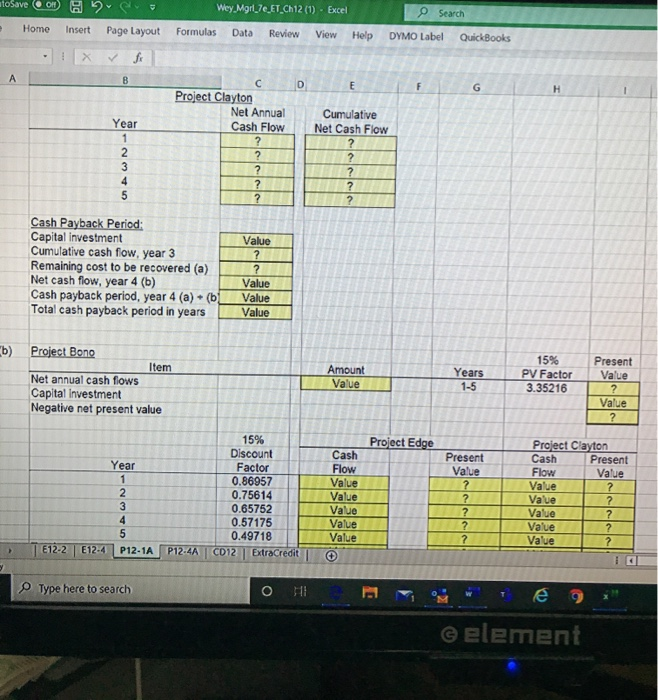

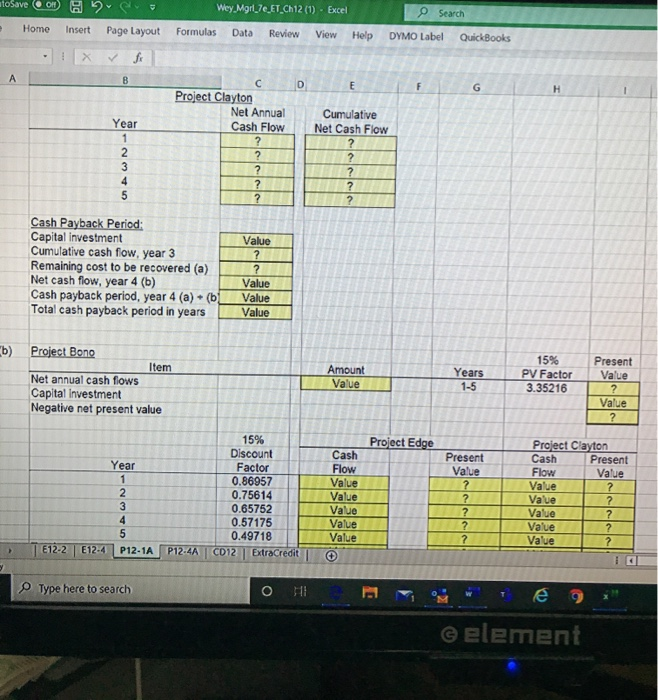

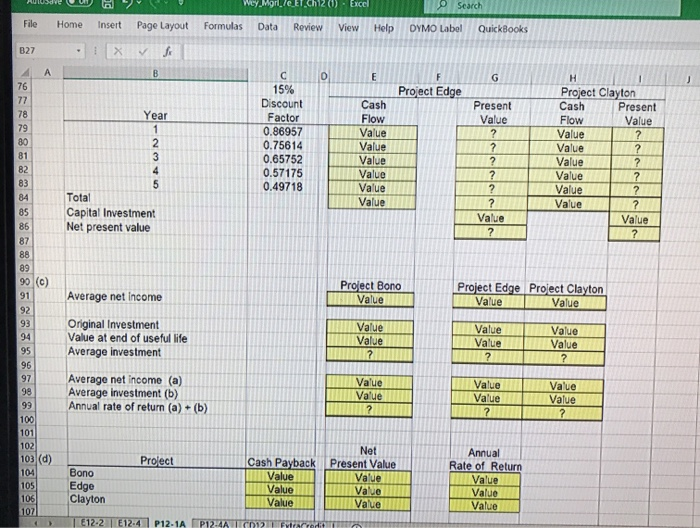

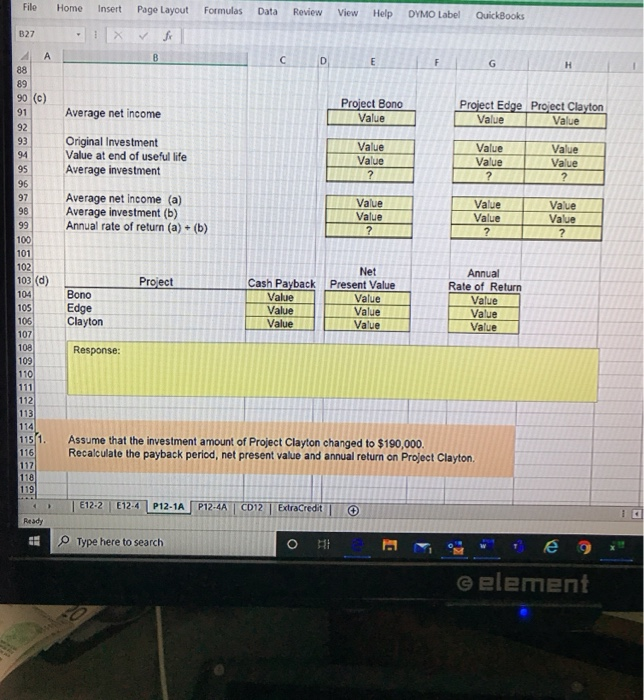

File Home Insert Page Layout Formulas Data Review View Help DYMO Label QuickBooks 327 - 1X fo C D E F G P12.1A Compute annual rate of return, cash payback, and net present value U3 Company is considering three long-term capital investment proposals. Each investment has a useful life 3 of 5 years. Relevant data on each project are as follows. Project Edge $175,000 Project Clayton $200,000 no-NM Project Bono Capital investment $160,000 Annual net income: Year 1 14,000 2 14,000 3 14,000 27,000 18,000 17,000 16,000 12,000 9,000 $72,000 23,000 21,000 4 14.000 13.000 5 Total 14,000 $70,000 12 000 $96,000 5 Depreciation is computed by the straight-line method with no salvage value. The company's cost of capital is 15%. 76 (Assume that cash flows occur evenly throughout the year.) 17 18 Instructions 19 (a) Compute the cash payback period for each project. (Round to two decimals.) (b) Compute the net present value for each project. (Round to nearest dollar.) 1(c) Compute the annual rate of return for each project. (Round to two decimals.) 22 (Hint: Use average annual net income in your computation.) 23. (d) Rank the projects on each of the foregoing bases. Which project do you recommend? 24 NOTE: Enter a number in cells requesting a value; enter either a number or a formula in cells with a "?". 25 28 (a) Project Bono Value Net Income Depreciation Annual net cash flows Investment Annual net cash flows Payback period in years Value Value E12-2 E124 P12.1A P12. AACD12 ExtraCredit Ready instant AutoSave 0 File Home 2 Insert Wey.Mgrl_7e_ET_Ch12 (1) - Excel Search Formulas Data Review View HelpDYMO Label QuickBooks Page Layout B27 B 4 A 28 (a) Project Bono Value Net income Depreciation Annual net cash flows Investment Annual net cash flows Payback period in years Value Value Project Edge Net Annual Cash Flow Cumulative Net Cash Flow on AWNS Value Cash Payback Period: Capital investment Cumulative cash flow, year 3 Remaining cost to be recovered (a) Net cash flow, year 4 (b) Payback period, year 4 (a) + (6) Total cash payback period in years Value Project Clayton Net Annual Cash Flow | Year Cumulative Net Cash Flow 12: 2 124P12-1A P12.4A CD12 Extracredit Ready Type here to search Ollow 2 Save OD Home Wey Mgrl_7_ET_Ch12 (1) - Excel Formulas Data Review View Help Le Search DYMO Label QuickBooks Insert Page Layout F G Project Clayton Net Annual Cash Flow Year Cumulative Net Cash Flow Cash Payback Period: Capital Investment Cumulative cash flow, year 3 Remaining cost to be recovered (a) Net cash flow, year 4 (6) Cash payback period, year 4 (a) (_Value Total cash payback period in years Value Value "b) Project Bono Item Net annual cash fows Capital Investment Negative net present value Present Value Amount Valve 15% PV Factor 3.35216 Years 1-5 Value Project Edge Present Value Year 15% Discount Factor 0.86957 0.75614 0.65752 0.57175 0.49718 P12.4AC012 | Extracredit Cash Flow Value Value Value Value Value Project Clayton Cash Present Flow Value Value Valve Value Value Value E12-2 E12.4 P12.1A Type here to search @element Aude BLY Wey. Mgrl_le_ET_ch120) - Excel Search DYMO Label QuickBooks File Home Insert Page Layout Formulas Data Review View Help Project Edge Present Value 15% Discount Factor 0.86957 0.75614 0.65752 0.57175 0.49718 AWN- Cash Flow Value Value Value Value Value Value Project Clayton Cash Present Flow Value Value Value Value Value Value Value Value Total Capital Investment Net present value (0) Average net income Project Bono Value Project Edge Project Clayton Value V alue Original Investment Value at end of useful life Average investment Value Value 7 Value Value ? Value Value ? Average net income (a) Average investment (b) Annual rate of return (a) (b) Value Value Value Value ? Value Value Project 103 (d) 104 106 107 Bono Edge Clayton Cash Payback Value 11 Value Value Net Present Value Value Value Annual Rate of Return Value Value Value 12: 2 12.4 P12-1A P124A CMT fyrir Formulas Data Review View Help DYMO Label File Home Insert B27 . 1 X AA Page Layout Bo QuickBooks 90 (c) Average net income Project Bono Value Project Edge Project Clayton Value Value Original Investment Value at end of useful life Average investment Value Value Value Value ? Value Value ? Average net income (a) Average investment (b) Annual rate of return (a) Value Value Value Value Value Value (b) 103 (d) Project Cash Payback Value 1 Bono Edge Clayton Net Present Value Value Value Value Annual Rate of Return Value Value Value Value Value Response: 109 110 111 113 114 Assume that the investment amount of Project Clayton changed to $190,000. Recalculate the payback period, net present value and annual return on Project Clayton. 1151. 116 112 118 119 E12- 2 012-4 P12-1A P12-4ACD12 | ExtraCredit Ready Type here to search @element

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started