please answer all parts and show work. i will not connect elsewhere

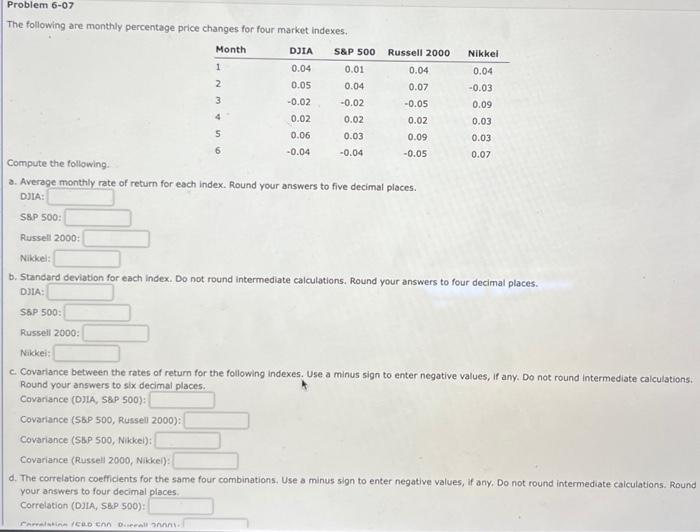

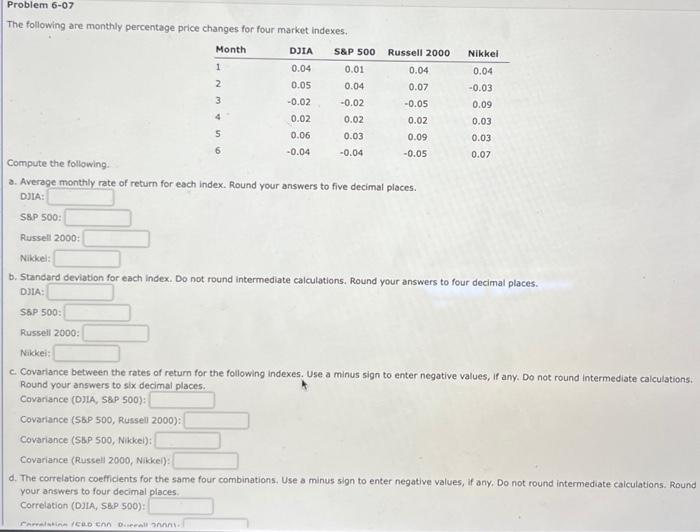

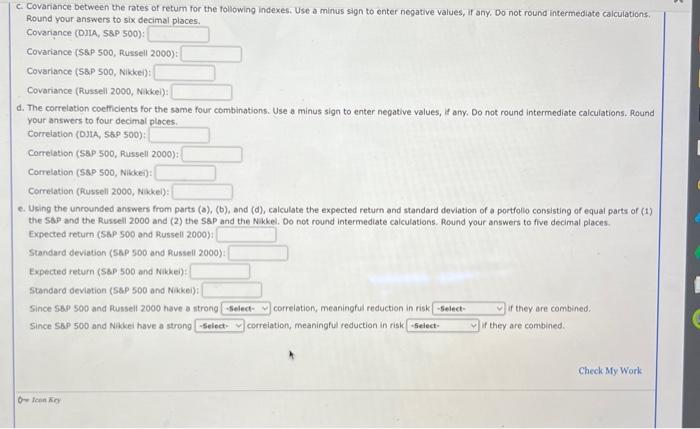

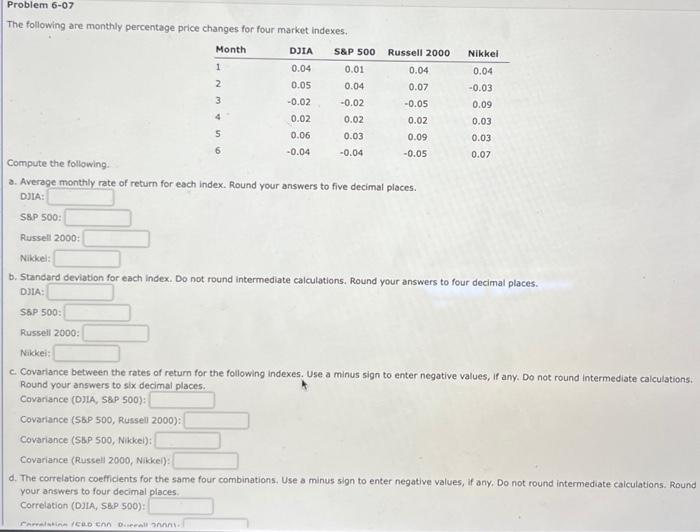

The following are monthly percentage price changes for four market indexes. Compute the following: a. Average monthly rate of return for each index. Round your answers to five decimal places. DulA: S8P 500: Russell 2000 : Nikkel: b. Standard deviation for each index. Do not round intermediate calculations, Round your answers to four decimal places. DutA: S6P 500: Russell 2000: Nakkei: c. Covariance between the rates of retum for the following indexes. Use a minus sign to enter negative values, if any. Do not round intermediate calculations. Round your answers to six decimal places. Covariance (DJIA, SBP 500): Covariance (SBP 500, Russell 2000): Covariance (SBP 500, Nikkel): Covariance (Russell 2000, Nikkel): d. The correlation coefficients for the same four combinations. Use a minus sign to enter negative values, if any, Do not round intermediate calculations. Round your answers to four decimal places. Correlation (D)IA, SBP 500): c. Covariance between the rates of retum for the following indexes, Use a minus sign to enter negative values, if any, Do not round intermediate calculations. Round your answers to six decimal places. Covariance (DJIA, SAP 500): Covariance ( $8P.500, Russell 2000): Covariance (SBP 500, Nikkei): Covariance (Russell 2000, Nikkel): d. The correlation coefficients for the same four combinations. Use a minus sign to enter negative values, if any. Do not round intermediate calculations. Round your answers to four decimal places. Correlation (DJIA, SSP 500): Correlation (SAP 500, Russell 2000): Correlation (SAP 500 , Nikkei): Correlation (Russell 2000, Nikkel): e. Using the unrounded answers from parts (a),(b), and (d), calculate the expected return and standard deviation of a portfollo consisting of equal parts of ( 1 ) the SAP and the Russeli 2000 and (2) the S8P and the Nikkel. Do not round intermediate calculations. Round your answers to five decimal places. Expected return (\$8P. 500 and Russell 2000): Standard deviation (SAP 500 and Russell 2000): Expected return (Ssp 500 and Nikkei): Standard deviation (S\$P 500 and Nakei): Since SBP 500 and Pussell 2000 have a strong correlotion, meaningful reduction in risk If they are combined. since 563 . 500 and Nikkei have a streng correlation, meaningful reduction in risk if they are combined