Please answer all parts correctly (as best as possible). Also needed quickly.

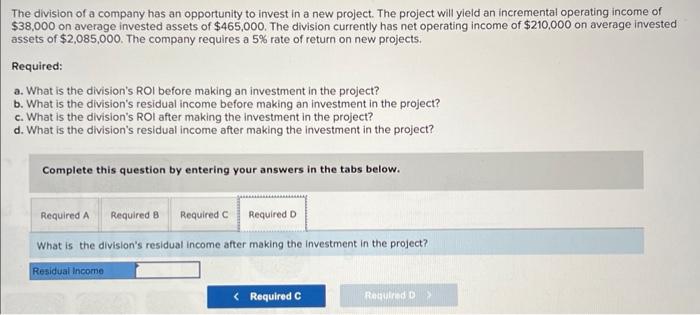

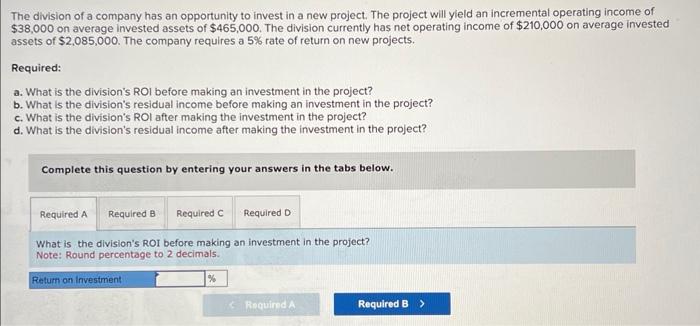

The division of a company has an opportunity to invest in a new project. The project will yield an incremental operating income of $38,000 on average invested assets of $465,000. The division currently has net operating income of $210,000 on average invested assets of $2,085,000. The company requires a 5% rate of return on new projects. Required: a. What is the division's ROI before making an investment in the project? b. What is the division's residual income before making an investment in the project? c. What is the division's ROI after making the investment in the project? d. What is the division's residual income after making the investment in the project? Complete this question by entering your answers in the tabs below. What is the division's ROI before making an investment in the project? Note: Round percentage to 2 decimals. The division of a company has an opportunity to invest in a new project. The project will yield an incremental operating income of $38,000 on average invested assets of $465,000. The division currently has net operating income of $210,000 on average invested assets of $2,085,000. The company requires a 5% rate of return on new projects. Required: a. What is the division's ROI before making an investment in the project? b. What is the division's residual income before making an investment in the project? c. What is the division's ROI after making the investment in the project? d. What is the division's residual income after making the investment in the project? Complete this question by entering your answers in the tabs below. What is the division's residual income before making an investment in the project? The division of a company has an opportunity to invest in a new project. The project will yield an incremental operating income of $38,000 on average invested assets of $465,000. The division currently has net operating income of $210,000 on average invested assets of $2,085,000. The company requires a 5% rate of return on new projects. Required: a. What is the division's ROI before making an investment in the project? b. What is the division's residual income before making an investment in the project? c. What is the division's ROI after making the investment in the project? d. What is the division's residual income after making the investment in the project? Complete this question by entering your answers in the tabs below. What is the division's RoI after making the investment in the project? Note: Round percentage to 2 decimals. The division of a company has an opportunity to invest in a new project. The project will yleld an incremental operating income of $38,000 on average invested assets of $465,000. The division currently has net operating income of $210,000 on average invested assets of $2,085,000. The company requires a 5% rate of return on new projects. Required: a. What is the division's ROI before making an investment in the project? b. What is the division's residual income before making an investment in the project? c. What is the division's ROI after making the investment in the project? d. What is the division's residual income after making the investment in the project? Complete this question by entering your answers in the tabs below. What is the division's residual income after making the investment in the project