Answered step by step

Verified Expert Solution

Question

1 Approved Answer

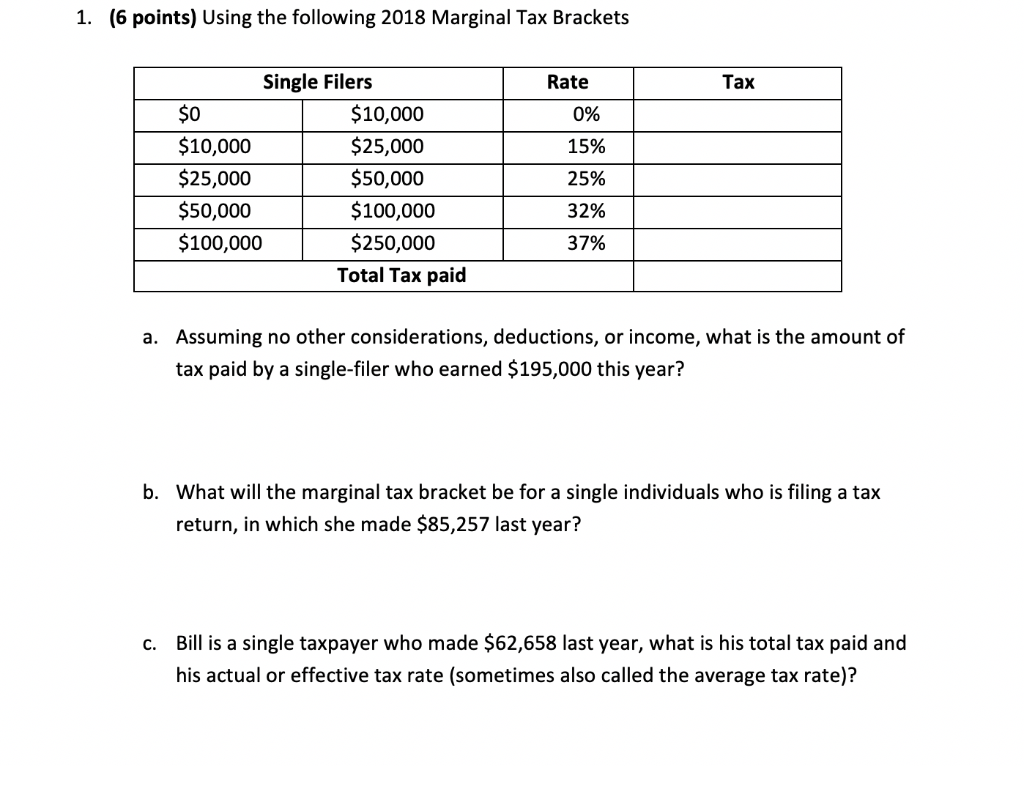

Please answer all parts in detail and show your work! Thank you!! 1. (6 points) Using the following 2018 Marginal Tax Brackets Single Filers Rate

Please answer all parts in detail and show your work! Thank you!!

1. (6 points) Using the following 2018 Marginal Tax Brackets Single Filers Rate Tax 0 $10,000 $25,000 $50,000 $100,000 $10,000 $25,000 $50,000 $100,000 $250,000 Total Tax paid 0% 15% 25% 32% 37% Assuming no other considerations, deductions, or income, what is the amount of tax paid by a single-filer who earned $195,000 this year? a. b. What will the marginal tax bracket be for a single individuals who is filing a tax return, in which she made $85,257 last year? Bill is a single taxpayer who made $62,658 last year, what is his total tax paid and his actual or effective tax rate (sometimes also called the average tax rate)? cStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started