Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer all parts of question! i have a lot of incorrect answers!! Assume that you are the CFO at Porter Memorial Hospital. The CEO

please answer all parts of question! i have a lot of incorrect answers!!

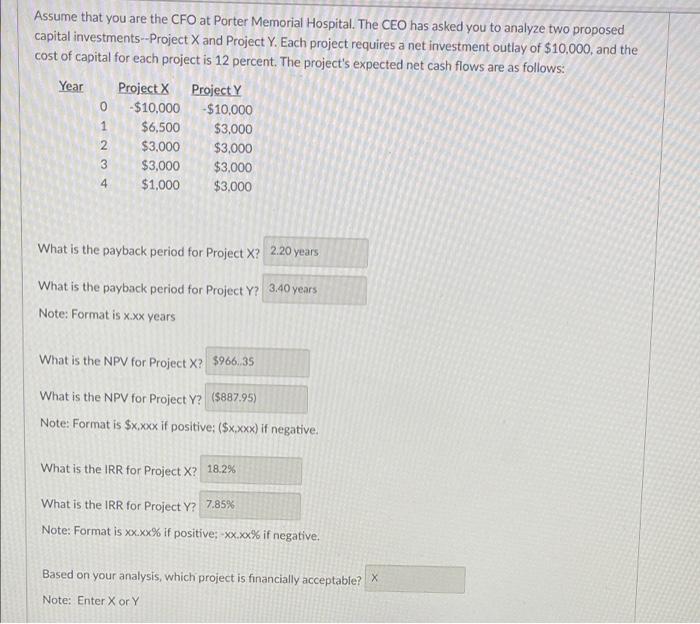

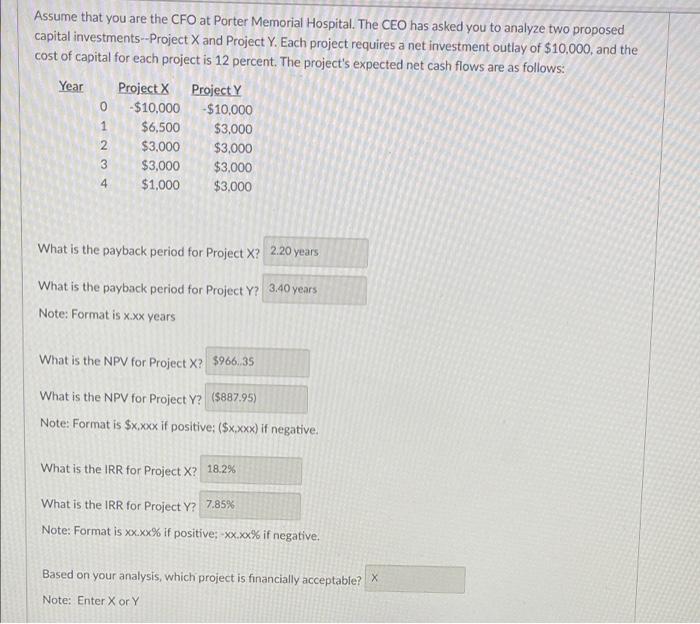

Assume that you are the CFO at Porter Memorial Hospital. The CEO has asked you to analyze two proposed capital investments--Project X and Project Y. Each project requires a net investment outlay of $10,000, and the cost of capital for each project is 12 percent. The project's expected net cash flows are as follows: Year 01234 Project X Project Y -$10,000 -$10,000 $6,500 $3,000 $3,000 $1,000 $3,000 $3,000 $3,000 $3,000 What is the payback period for Project X? 2.20 years What is the payback period for Project Y? 3.40 years Note: Format is x.xx years What is the NPV for Project X? $966..35 What is the NPV for Project Y? ($887.95) Note: Format is $x,xxx if positive; ($x,xxx) if negative. What is the IRR for Project X? 18.2% What is the IRR for Project Y? Note: Format is xx.xx% if positive; -xx.xx% if negative. 7.85% Based on your analysis, which project is financially acceptable? X Note: Enter X or Y

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started