Answered step by step

Verified Expert Solution

Question

1 Approved Answer

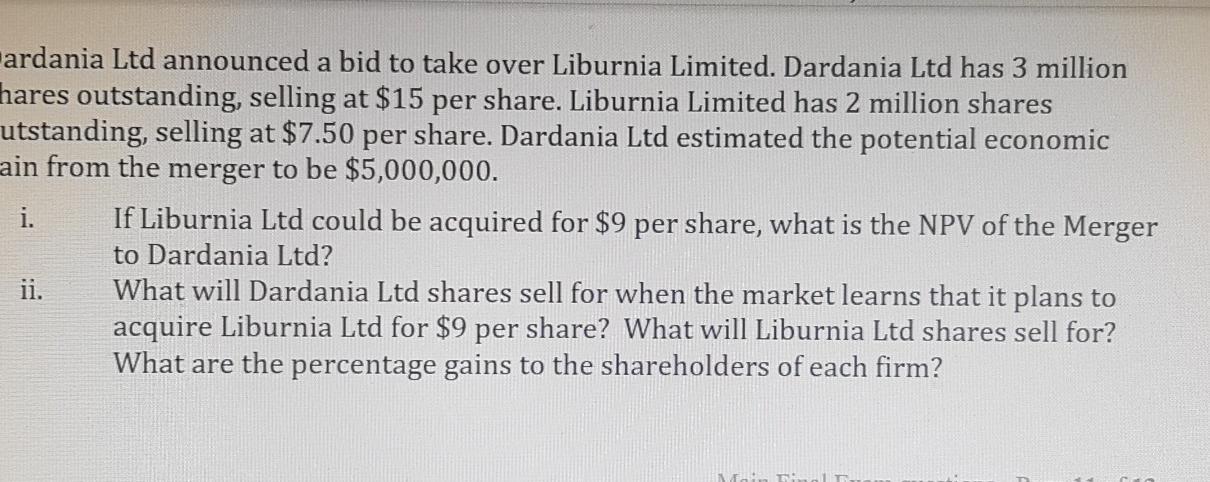

ardania Ltd announced a bid to take over Liburnia Limited. Dardania Ltd has 3 million a hares outstanding, selling at $15 per share. Liburnia Limited

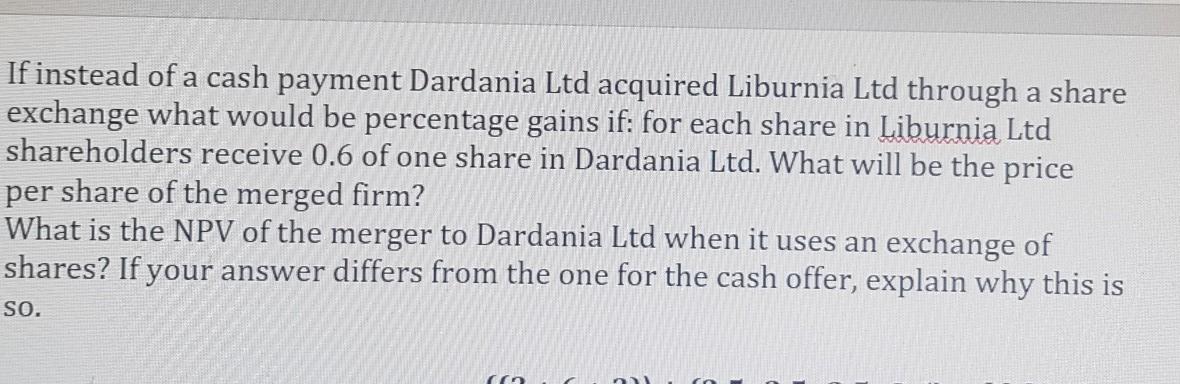

ardania Ltd announced a bid to take over Liburnia Limited. Dardania Ltd has 3 million a hares outstanding, selling at $15 per share. Liburnia Limited has 2 million shares utstanding, selling at $7.50 per share. Dardania Ltd estimated the potential economic ain from the merger to be $5,000,000. If Liburnia Ltd could be acquired for $9 per share, what is the NPV of the Merger to Dardania Ltd? ii. What will Dardania Ltd shares sell for when the market learns that it plans to acquire Liburnia Ltd for $9 per share? What will Liburnia Ltd shares sell for? What are the percentage gains to the shareholders of each firm? If instead of a cash payment Dardania Ltd acquired Liburnia Ltd through a share exchange what would be percentage gains if: for each share in Liburnia Ltd shareholders receive 0.6 of one share in Dardania Ltd. What will be the price per share of the merged firm? What is the NPV of the merger to Dardania Ltd when it uses an exchange of shares? If your answer differs from the one for the cash offer, explain why this is So

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started