Please answer all parts of this question to complete it and answer in a similar format I will be sure to thumbs up and thank you in advance.

PART 2

PART 4

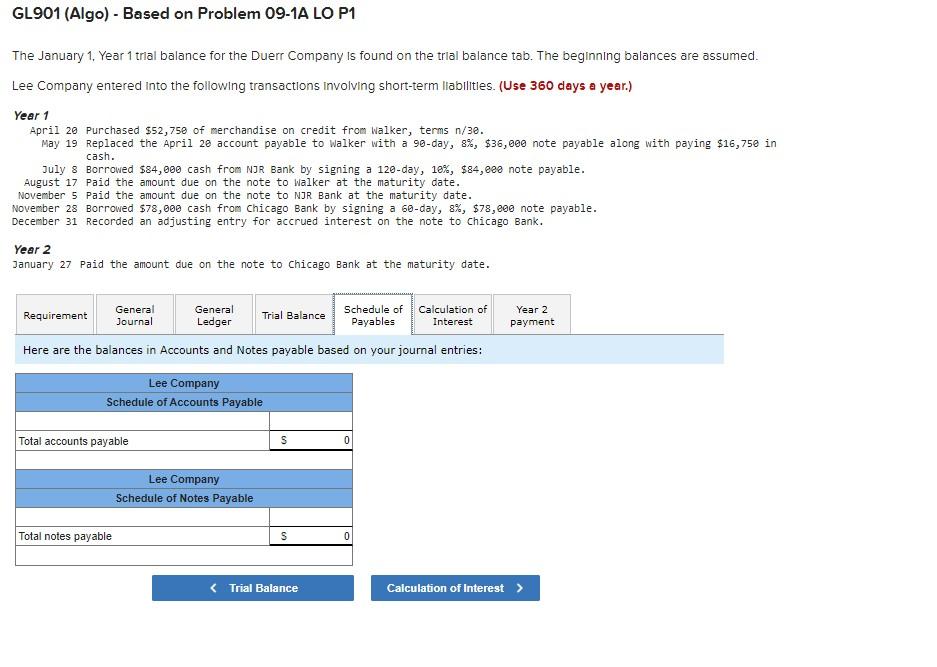

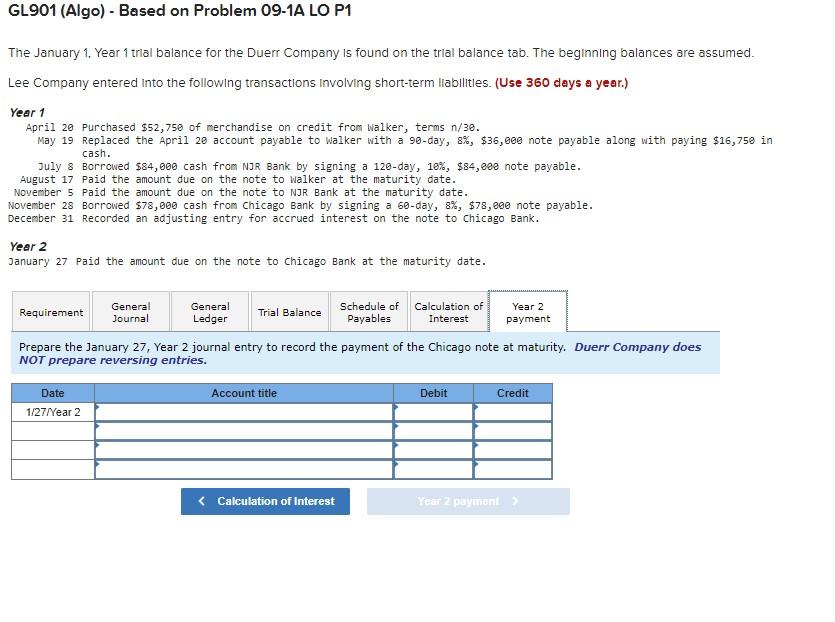

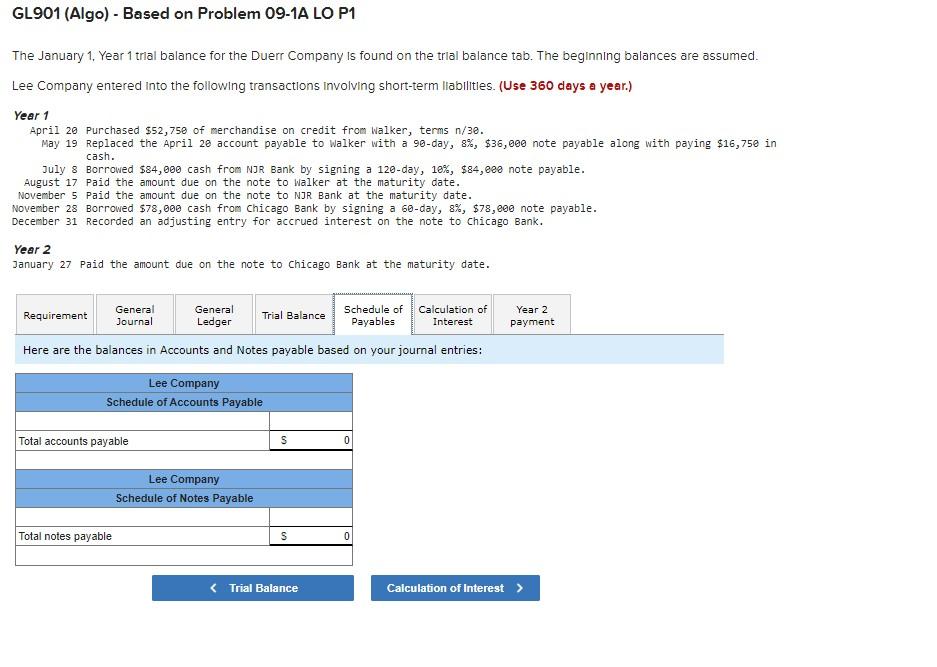

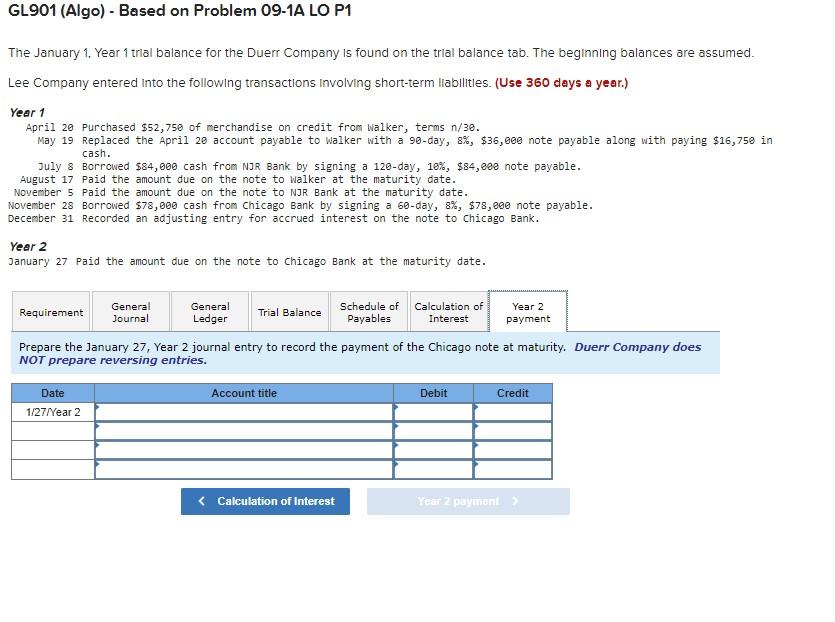

GL901 (Algo) - Based on Problem 09-1A LO P1 The January 1, Year 1 trial balance for the Duerr Company is found on the trial balance tab. The beginning balances are assumed. Lee Company entered into the following transactions involving short-term liabilities. (Use 360 days a year.) Year 1 April 20 Purchased $52,758 of merchandise on credit from Walker, terms n/3e. May 19 Replaced the April 2e account payable to walker with a 90-day, 8%, $36,000 note payable along with paying $16,75e in cash. July 8 Borrowed $84,000 cash from NJR Bank by signing a 120-day, 10%, $84, eee note payable. August 17 Paid the amount due on the note to walker at the maturity date. November 5 Paid the amount due on the note to NJR Bank at the maturity date. November 28 Borrowed $78,000 cash from Chicago Bank by signing a 60-day, 8%, $78,890 note payable. December 31 Recorded an adjusting entry for accrued interest on the note to Chicago Bank. Year 2 January 27 Paid the amount due on the note to Chicago Bank at the maturity date. Interest Year 2 payment Requirement General General Journal Ledger Trial Balance Schedule of Calculation of Payables Here are the balances in Accounts and Notes payable based on your journal entries: Lee Company Schedule of Accounts Payable Total accounts payable S 0 Lee Company Schedule of Notes Payable Total notes payable S 0 Trial Balance Calculation of Interest > GL901 (Algo) - Based on Problem 09-1A LO P1 The January 1, Year 1 trial balance for the Duerr Company is found on the trial balance tab. The beginning balances are assumed. Lee Company entered into the following transactions involving short-term liabilities. (Use 360 days a year.) Year 1 April 20 Purchased $52,750 of merchandise on credit from Walker, terms n/3e. May 19 Replaced the April 2e account payable to walker with a 90-day, 8%, $35,000 note payable along with paying $16,752 in cash. July 8 Borrowed $84,000 cash from NJR Bank by signing a 120-day, 18%, $84, eee note payable. August 17 Paid the amount due on the note to walker at the maturity date. November 5 paid the amount due on the note to NJR Bank at the maturity date. November 28 Borrowed $78,000 cash from Chicago Bank by signing a 60-day, 8%, $78,2ge note payable. December 31 Recorded an adjusting entry for accrued interest on the note to Chicago Bank. Year 2 January 27 Paid the amount due on the note to Chicago Bank at the maturity date. Requirement General General Schedule of Calculation of Year 2 Journal Trial Balance Ledger Payables Interest payment Prepare the January 27, Year 2 journal entry to record the payment of the Chicago note at maturity. Duerr Company does NOT prepare reversing entries. Account title Debit Credit Date 1/27/Year 2 GL901 (Algo) - Based on Problem 09-1A LO P1 The January 1, Year 1 trial balance for the Duerr Company is found on the trial balance tab. The beginning balances are assumed. Lee Company entered into the following transactions involving short-term liabilities. (Use 360 days a year.) Year 1 April 20 Purchased $52,750 of merchandise on credit from Walker, terms n/3e. May 19 Replaced the April 2e account payable to walker with a 90-day, 8%, $35,000 note payable along with paying $16,752 in cash. July 8 Borrowed $84,000 cash from NJR Bank by signing a 120-day, 18%, $84, eee note payable. August 17 Paid the amount due on the note to walker at the maturity date. November 5 paid the amount due on the note to NJR Bank at the maturity date. November 28 Borrowed $78,000 cash from Chicago Bank by signing a 60-day, 8%, $78,2ge note payable. December 31 Recorded an adjusting entry for accrued interest on the note to Chicago Bank. Year 2 January 27 Paid the amount due on the note to Chicago Bank at the maturity date. Requirement General General Schedule of Calculation of Year 2 Journal Trial Balance Ledger Payables Interest payment Prepare the January 27, Year 2 journal entry to record the payment of the Chicago note at maturity. Duerr Company does NOT prepare reversing entries. Account title Debit Credit Date 1/27/Year 2