please answer all parts to the question for a good review

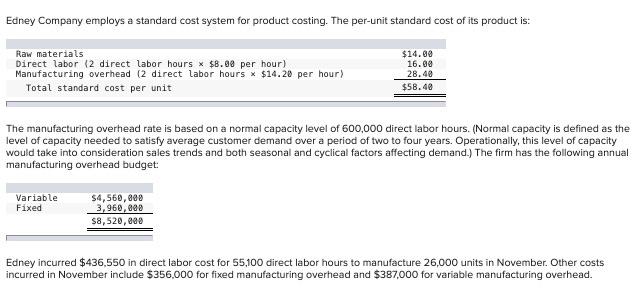

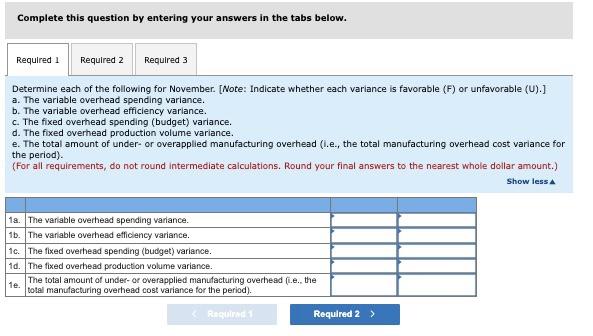

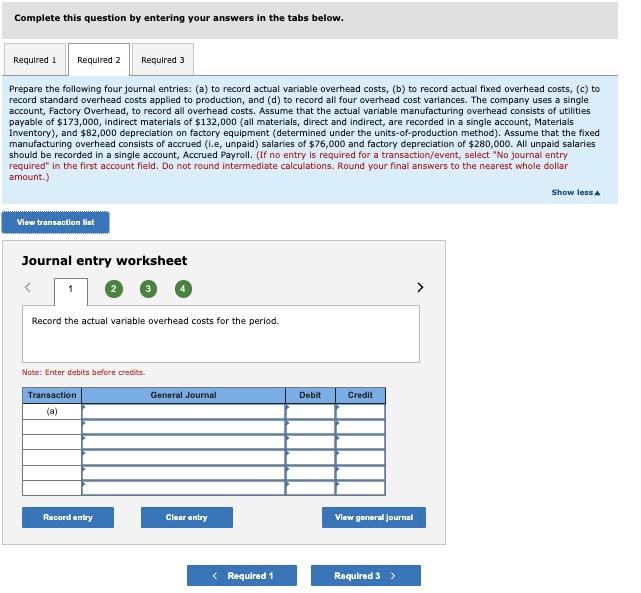

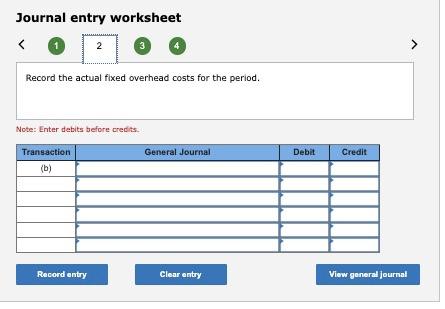

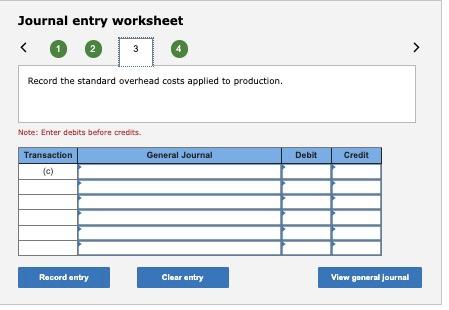

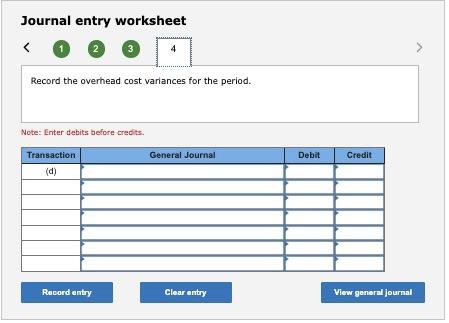

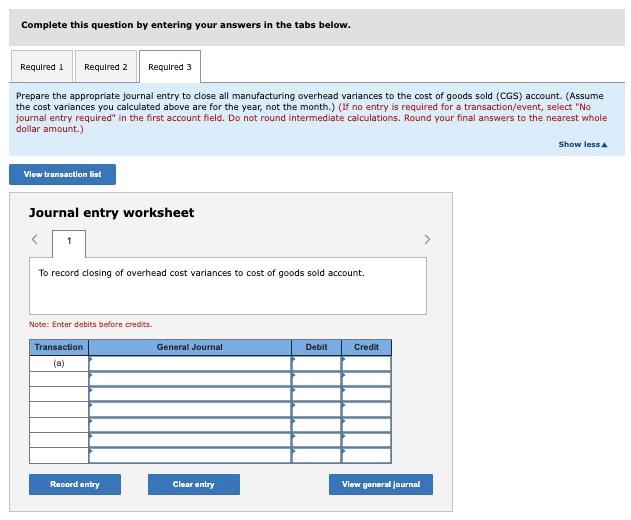

Edney Company employs a standard cost system for product costing. The per-unit standard cost of its product is: The manufacturing overhead rate is based on a normal capacity level of 600,000 direct labor hours. (Normal capacity is defined as the level of capacity needed to satisfy average customer demand over a period of two to four years. Operationally, this level of capacity would take into consideration sales trends and both seasonal and cyclical factors affecting demand.) The firm has the following annual manufacturing overhead budget: Edney incurred $436,550 in direct labor cost for 55,100 direct labor hours to manufacture 26,000 units in November. Other costs incurred in November include $356,000 for fixed manufacturing overhead and $387,000 for variable manufacturing overhead. Complete this question by entering your answers in the tabs below. Determine each of the following for November. [Note: Indicate whether each variance is favorable (F) or unfavorable (U).] a. The variable overhead spending variance. b. The variable overhead efficiency variance. c. The fixed overhead spending (budget) variance. d. The fixed overhead production volume variance. e. The total amount of under- or overapplied manufacturing overhead (i.e., the total manufacturing overhead cost variance for the period). (For all requirements, do not round intermediate calculations. Round your final answers to the nearest whole dollar amount.) Show less Complete this question by entering your answers in the tabs below. Prepare the following four journal entries: (a) to record actual varlable overhead costs, (b) to record actual fixed overhead costs, (c) to record standard overhead costs applied to production, and (d) to record all four overhead cost variances. The company uses a single account, Factory Overhead, to record all overhead costs. Assume that the actual variable manufacturing overhead consists of utilities payable of $173,000, indirect materials of $132,000 (all materials, direct and indirect, are recorded in a single account, Materials Inventory), and $82,000 depreciation on factory equipment (determined under the units-of-production method). Assume that the fixed manufacturing overhead consists of accrued (i.e, unpaid) salaries of $76,000 and factory depreciation of $280,000. All unpaid salaries should be recorded in a single account, Accrued Payroll. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Do not round intermedlate calculations. Round your final answers to the nearest whole dollar amount.) Journal entry worksheet (2) 3 (4) Record the actual variable overhead costs for the period. Note: Enter debits before credits. Journal entry worksheet Record the actual fixed overhead costs for the period. Note: Enter debits before credits. Journal entry worksheet Record the standard overhead costs applied to production. Note: Enter debits before credits. Journal entry worksheet 1 Record the overhead cost variances for the period. Note: Enter debits before credits. Complete this question by entering your answers in the tabs below. Prepare the appropriate journal entry to close all manufacturing overhead variances to the cost of goods sold (CGS) account. (Assume the cost variances you calculated above are for the year, not the month.) (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Do not round intermediate calculations. Round your final answers to the nearest whole dollar amount) Journal entry worksheet To record closing of overhead cost variances to cost of goods sold account. Note: Enter debits before credits