Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer all parts, will give a good rating Mr. Ito, an unmarried individual, made a gift of real estate to his son. Assume the

Please answer all parts, will give a good rating

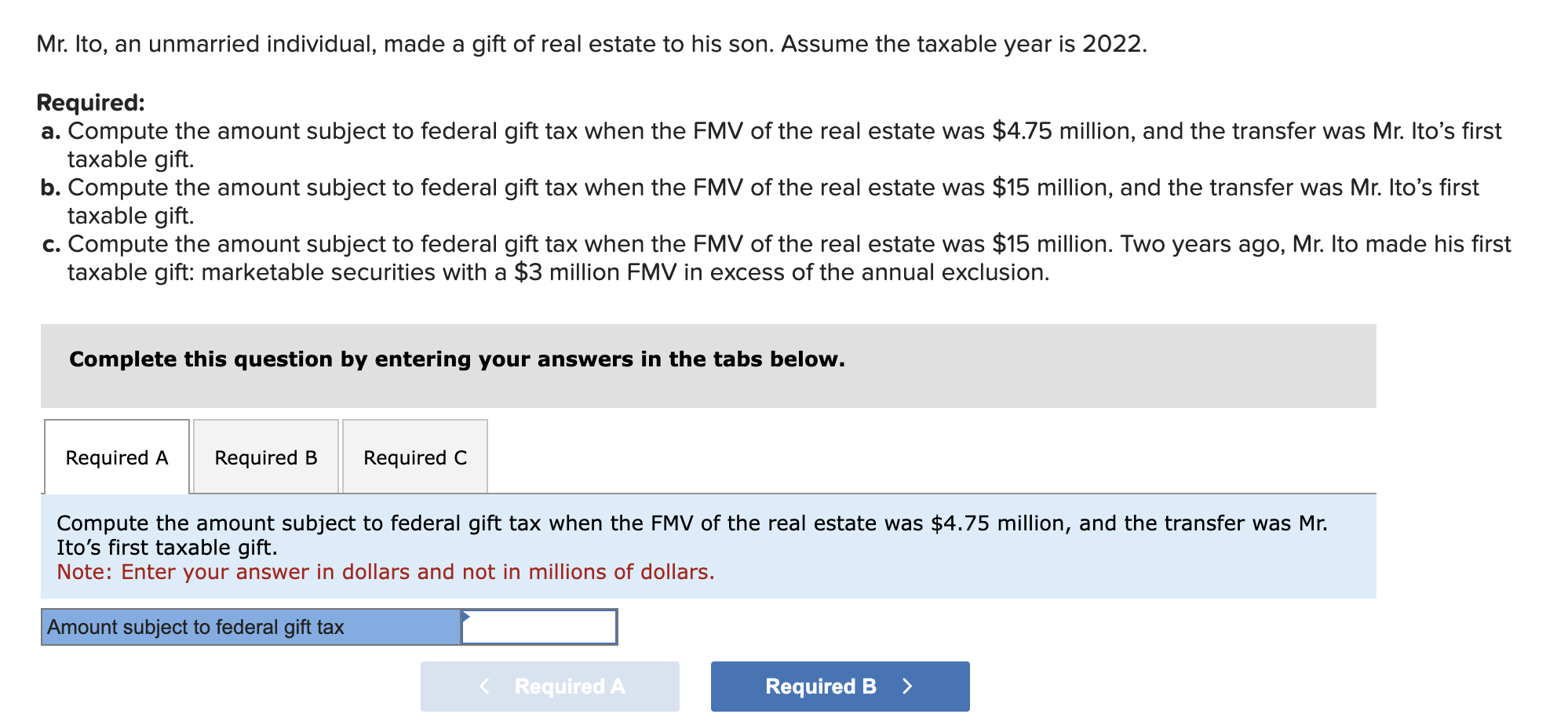

Mr. Ito, an unmarried individual, made a gift of real estate to his son. Assume the taxable year is 2022 . Required: a. Compute the amount subject to federal gift tax when the FMV of the real estate was $4.75 million, and the transfer was Mr. Ito's first taxable gift. b. Compute the amount subject to federal gift tax when the FMV of the real estate was $15 million, and the transfer was Mr. Ito's first taxable gift. c. Compute the amount subject to federal gift tax when the FMV of the real estate was $15 million. Two years ago, Mr. Ito made his first taxable gift: marketable securities with a $3 million FMV in excess of the annual exclusion. Complete this question by entering your answers in the tabs below. Compute the amount subject to federal gift tax when the FMV of the real estate was $4.75 million, and the transfer was Mr. Ito's first taxable gift. Note: Enter your answer in dollars and not in millions of dollars. Mr. Ito, an unmarried individual, made a gift of real estate to his son. Assume the taxable year is 2022 . Required: a. Compute the amount subject to federal gift tax when the FMV of the real estate was $4.75 million, and the transfer was Mr. Ito's first taxable gift. b. Compute the amount subject to federal gift tax when the FMV of the real estate was $15 million, and the transfer was Mr. Ito's first taxable gift. c. Compute the amount subject to federal gift tax when the FMV of the real estate was $15 million. Two years ago, Mr. Ito made his first taxable gift: marketable securities with a $3 million FMV in excess of the annual exclusion. Complete this question by entering your answers in the tabs below. Compute the amount subject to federal gift tax when the FMV of the real estate was $4.75 million, and the transfer was Mr. Ito's first taxable gift. Note: Enter your answer in dollars and not in millions of dollarsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started