please answer all

question 1:

question 2:

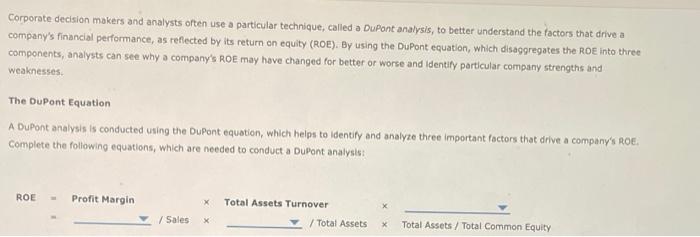

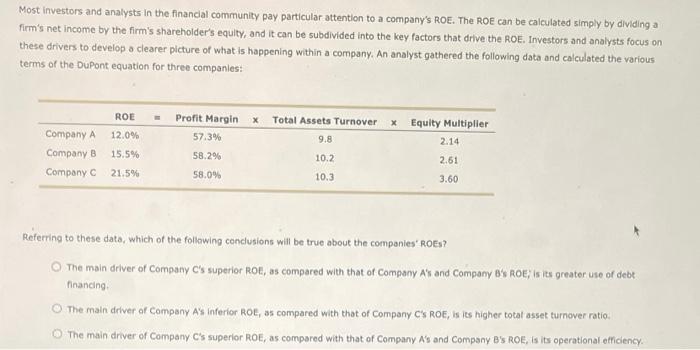

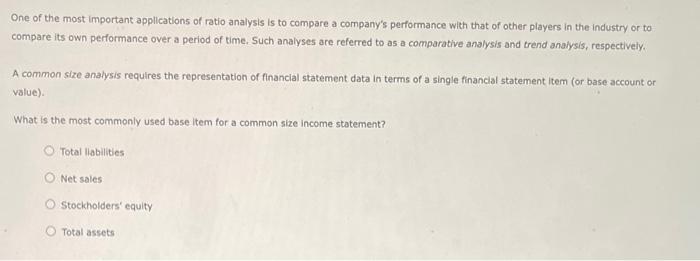

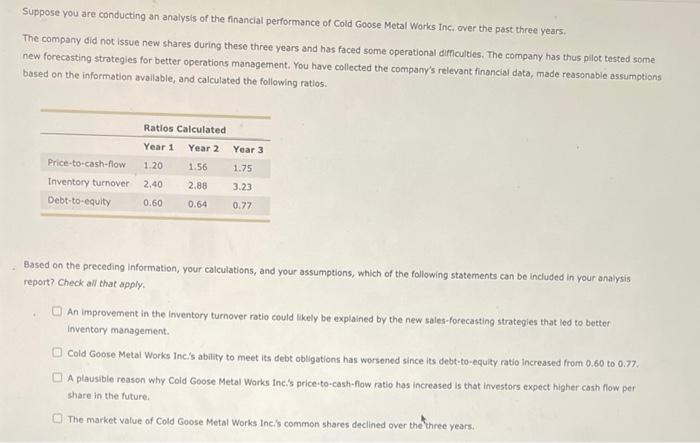

Corporate decision makers and analysts often use a particular technique, called a Dupont analysis, to better understand the factors that drive a company's financial performance, as reflected by its return on equity (ROE). By using the DuPont equation, which disaggregates the ROE into three components, analysts can see why a company's ROE may hove changed for better or worse and identify particular company strengths and weaknesses. The Dupont Equation A DuPont analysis is conducted using the DuPont equation, which helps to idenefy and analyze three important foctors that drive a company's roe: Complete the following equations, which are needed to conduct a Dupont analysis: Most investors and analysts in the financial community pay particular attention to a company's ROE. The ROE can be calculated simply by dividing a firm's net income by the firm's shareholder's equity, and it can be subdivided into the key factors that drive the ROE. Investors and analysts focus on these drivers to develop a clearer picture of what is happening within a company. An analyst gathered the following data and calculated the various terms of the DuPont equation for three companies: Referring to these data, which of the following conclusions will be true about the companies' ROEs? The main driver of Company C's superior ROE, as compared with that of Company A's and Company B's ROE; is its greater use of debt finaneing. The main driver of Company A's inferior ROE, as compared with that of Company C's ROE, is its higher total asset turnover ratio. The main driver of Company C's superior ROE, as compared with that of Company A's and Company B's ROE, is its operational efficiency. One of the most important applications of ratio analysis is to compare a company's performance with that of other players in the industry or to compare its own performance over a period of time. Such analyses are referred to as a comparative analysis and trend anaiysis, respectively. A common size analysis requires the representation of financial statement data in terms of a single financial statement item (or base account or value). What is the most commonly used base item for a common size income statement? Total llabilities Net sales Stockholders' equity Total assets Suppose you are conducting an analysis of the financial performance of Cold Goose Metal Works inc, over the past three years. The company did not issue new shares during these three years and has faced some operational difficulties. The company has thus pilot tosted some new forecasting strategies for better operations management. You have collected the company's relevant financial data, made reasonable assumptions based on the information avaliable, and calculated the following ratios. Based on the preceding information, your calculations, and your assumptions, which of the following statements can be included in your analysis report? Check all that apply. An improvement in the inventory turnover ratio could likely be explained by the new sales-forecasting strategies that led to better inventory management. Cold Goose Metai Works inci's ability to meet its debt obligations has worsened since its debt-to-equity ratio increased from 0.60 to 0.77. A plausible reason why Cold Goose Metal Works inci's price-to-cash-flow ratio has increased is that investors expect higher cash flow per share in the future. The market value of Cold Goose Metal Works incis common shares declined over the three years