Answered step by step

Verified Expert Solution

Question

1 Approved Answer

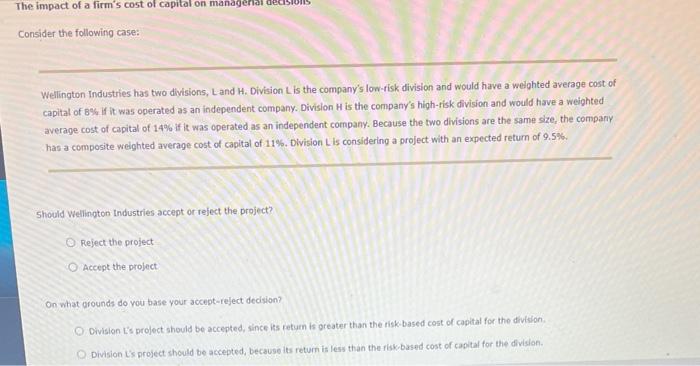

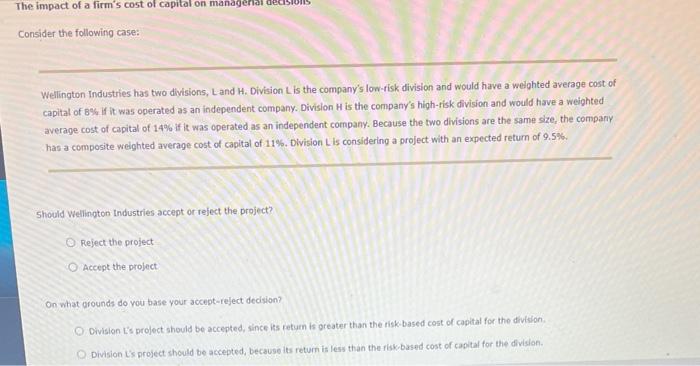

PLEASE ANSWER ALL QUESTION CH 10 Consider the following case: Wellington Industries has two divisions, L and H. Division L is the company's low-fisk division

PLEASE ANSWER ALL QUESTION

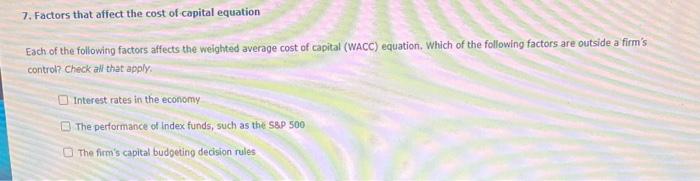

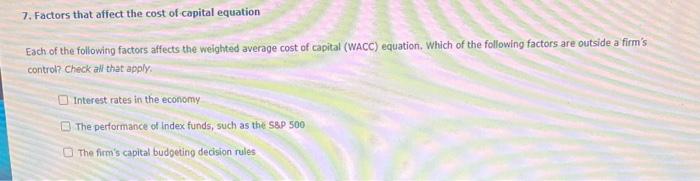

Consider the following case: Wellington Industries has two divisions, L and H. Division L is the company's low-fisk division and would have a welghted average cost of capital of B% if it was operated as an independent company. Division H is the company's high-risk division and would have a weighted average cost of capital of 14% if it was operated as an independent company. Because the two divisions are the same size, the company has a composite weighted average cost of capital of 11%. Division L is considering a project with an expected retum of 9.5%. 5hould wellington Industries accept or reject the project? Reject the project Accept the project: On what grounds do vou base your accept-reject decision? 7. Factors that affect the cost of-capital equation Each of the following factors affects the weighted average cost of capital (WACC) equation. Which of the following factors are outside a firm's control? check all that apply. Interest rates in the economy The performance of index funds, such as the S8P 500 The firm's capital budgeting decision rules CH 10

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started