Answered step by step

Verified Expert Solution

Question

1 Approved Answer

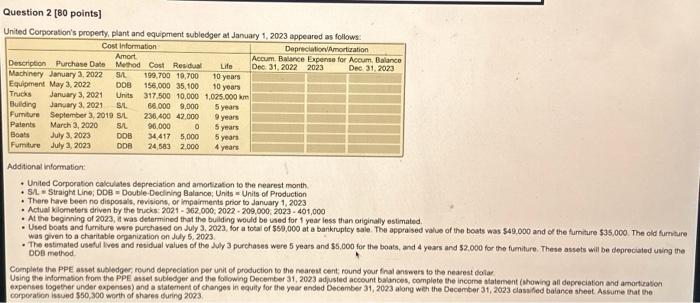

please answer all questions Additional information: - Uniled Corporation calculates depreciation and amortization to the nearest month. - SA = Straight Line; DDB = Double-Declining

please answer all questions

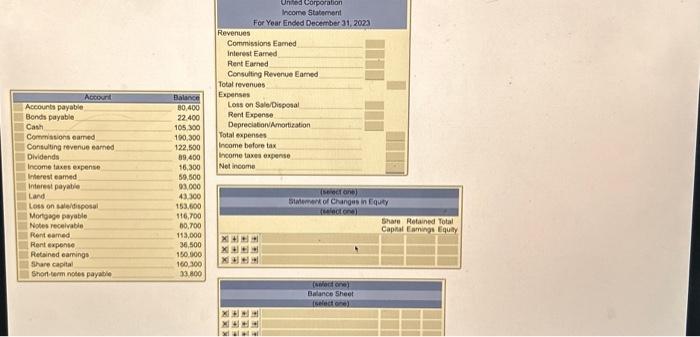

Additional information: - Uniled Corporation calculates depreciation and amortization to the nearest month. - SA = Straight Line; DDB = Double-Declining Balance; Units = Unils of Production - There have been no disposals, revisions, or impairments prior to January 1, 2023 - Actual kilometers driven by the trucks: 2021 - 362,000, 2022 - 209,000, 2023 - 401,000 - At the beginning of 2023 , a was determined that the building would be used for 1 year less than ariginally estimated. - Uled boats and furniture were purchased on July 3,2023, for a total of \$\$0,000 at a bankruptcy sale. The apprased value of the boats was $49,000 and the furniture $35,000. The old furnture Was given to a chantable orpanization on July 5,2023 - The estimated usetul lives and residual values of the July 3 purchases were 5 years and $5,000 for the boats, and 4 years and 52,000 for the fumiture. These assets will be depreciated using the DOB method Complete the PPE asset subledger, round depreciation per unit of production to the nearest cent, round your final answers fo the nearest dolar Using the informason from the PPE assel subledger and the following December 31,2023 adjusted account balances, complote the incorne atatement (Mhowing all depreciation and amorticason expenses topether under expenses) and a staternent of changes in equity for the year ended Decomber 31, 2023 along weh the December 31, 2023 classhed baiance sheet Assume that the corporation lisued $50,300 worth of shares buring 2023 . Uniled Corporatian Income statement For Year Finded Decermber 31,2023 Revenues Commisaions Eamed Interest Earred Rent Earned Consulting Revenue Cartred Total revenues Expenses Lots on SylerDiscosal Rent Expense Depreclabon/Amartization Total expenses Income before tax income taxes expense Net income

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started