Answered step by step

Verified Expert Solution

Question

1 Approved Answer

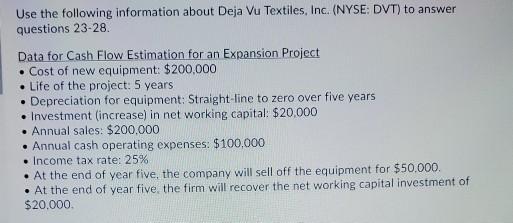

please answer all questions as stated in directions Use the following information about Deja Vu Textiles, Inc. (NYSE: DVT) to answer questions 23-28. Data for

please answer all questions as stated in directions

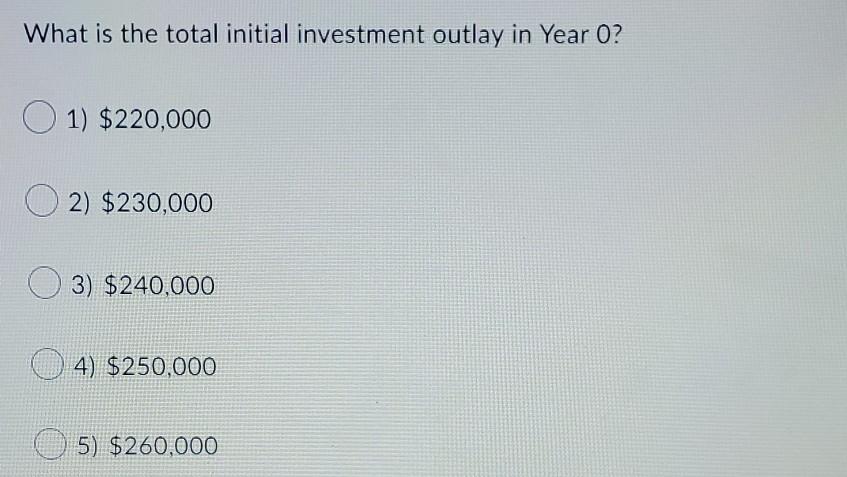

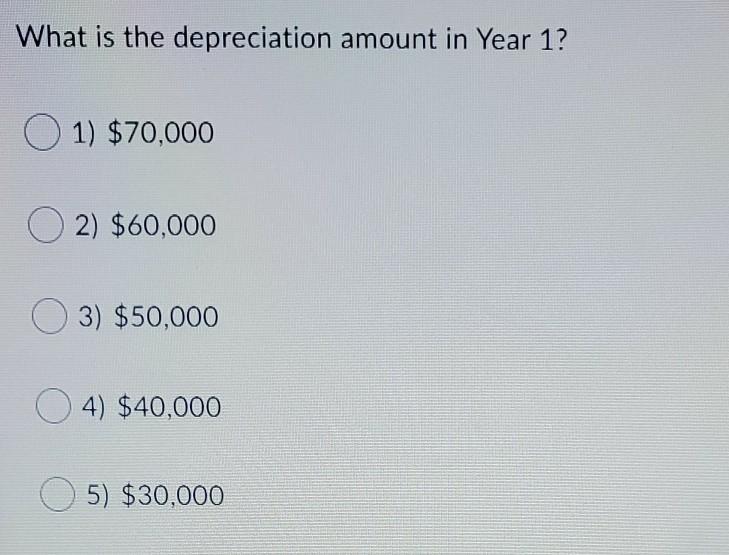

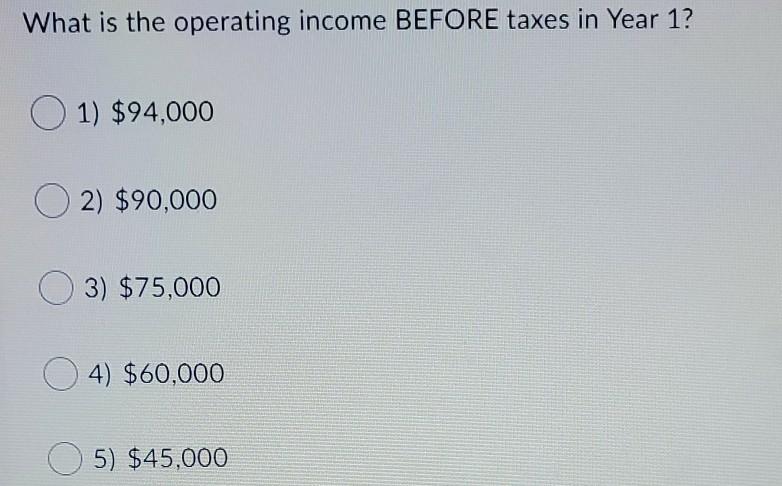

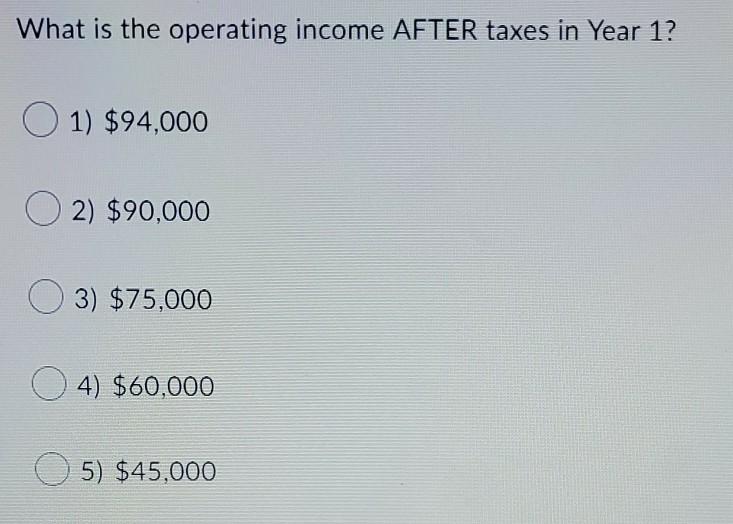

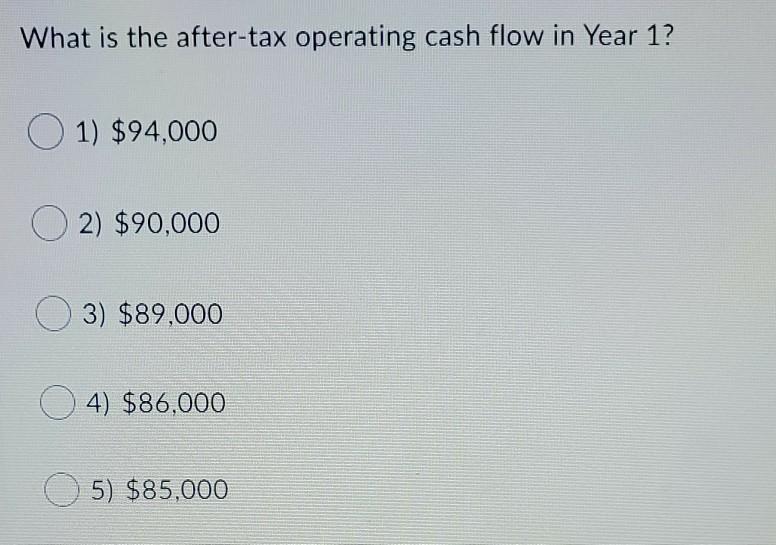

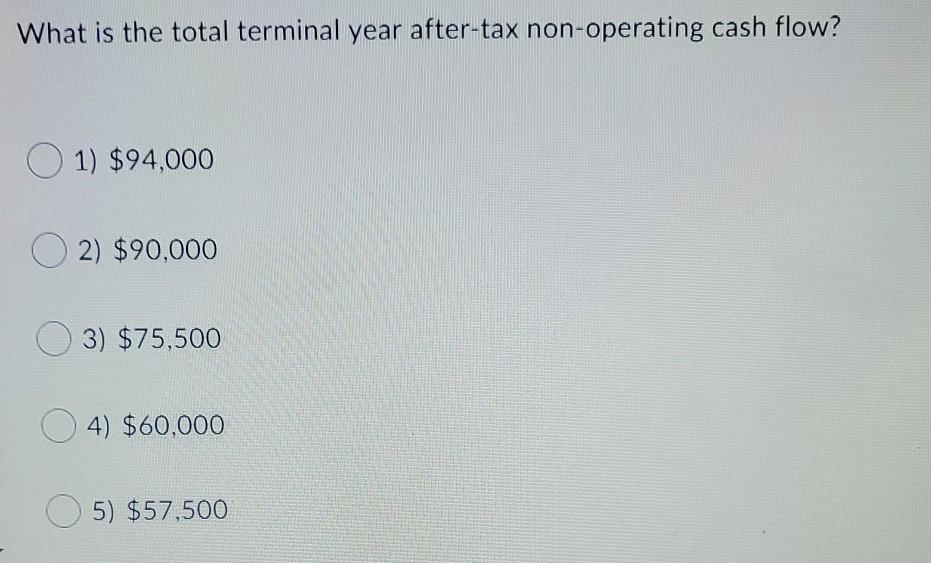

Use the following information about Deja Vu Textiles, Inc. (NYSE: DVT) to answer questions 23-28. Data for Cash Flow Estimation for an Expansion Project . Cost of new equipment: $200,000 Life of the project: 5 years Depreciation for equipment: Straight line to zero over five years Investment (increase) in net working capital: $20,000 Annual sales: $200,000 Annual cash operating expenses: $100,000 Income tax rate: 25% At the end of year five, the company will sell off the equipment for $50.000, At the end of year five, the firm will recover the networking capital investment of $20,000 What is the total initial investment outlay in Year O? 1) $220,000 2) $230,000 3) $240,000 4) $250,000 5) $260,000 What is the depreciation amount in Year 1? 1) $70,000 O2) $60,000 3) $50,000 O4) $40,000 5) $30,000 What is the operating income BEFORE taxes in Year 1? 01) $94,000 2) $90,000 3) $75,000 4) $60,000 5) $45,000 What is the operating income AFTER taxes in Year 1? 01) $94,000 2) $90,000 03) $75,000 4) $60,000 5) $45,000 What is the after-tax operating cash flow in Year 1? 1) $94,000 2) $90,000 3) $89,000 4) $86,000 5) $85,000 What is the total terminal year after-tax non-operating cash flow? 01) $ 94,000 2) $90,000 3) $75,500 4) $60,000 4 5) $57,500Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started